Finance

How Much Is An Insurance License?

Published: November 10, 2023

Find out the cost of obtaining an insurance license and dive into the world of finance with this comprehensive guide. Learn everything you need to know about the expenses involved in obtaining an insurance license.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Overview

An insurance license is a necessary credential for individuals looking to work in the insurance industry. It grants them the legal authority to sell different types of insurance policies to individuals and businesses. Whether you aspire to become an insurance agent, adjuster, broker, or underwriter, obtaining an insurance license is a crucial step to kickstart your career in the field.

However, the cost of acquiring an insurance license can vary depending on several factors. This article will explore the different elements that can influence the overall expense of obtaining an insurance license, allowing you to plan your budget accordingly.

There are various components to consider when calculating the cost of acquiring an insurance license. These include state licensing fees, pre-licensing education costs, exam fees, continuing education expenses, background check fees, license application fees, license renewal fees, and potential costs for errors and omissions (E&O) insurance.

Understanding these factors can assist you in estimating the total expenditure required to obtain and maintain your insurance license. With this knowledge in hand, you can make informed decisions and plan your financial resources accordingly. Let’s delve deeper into each of these aspects to gain a comprehensive understanding of the costs associated with acquiring an insurance license.

Factors Affecting Insurance License Costs

Several factors can influence the overall cost of acquiring an insurance license. Understanding these factors will help you estimate the expenses associated with obtaining and maintaining your license. Here are the key factors that can affect insurance license costs:

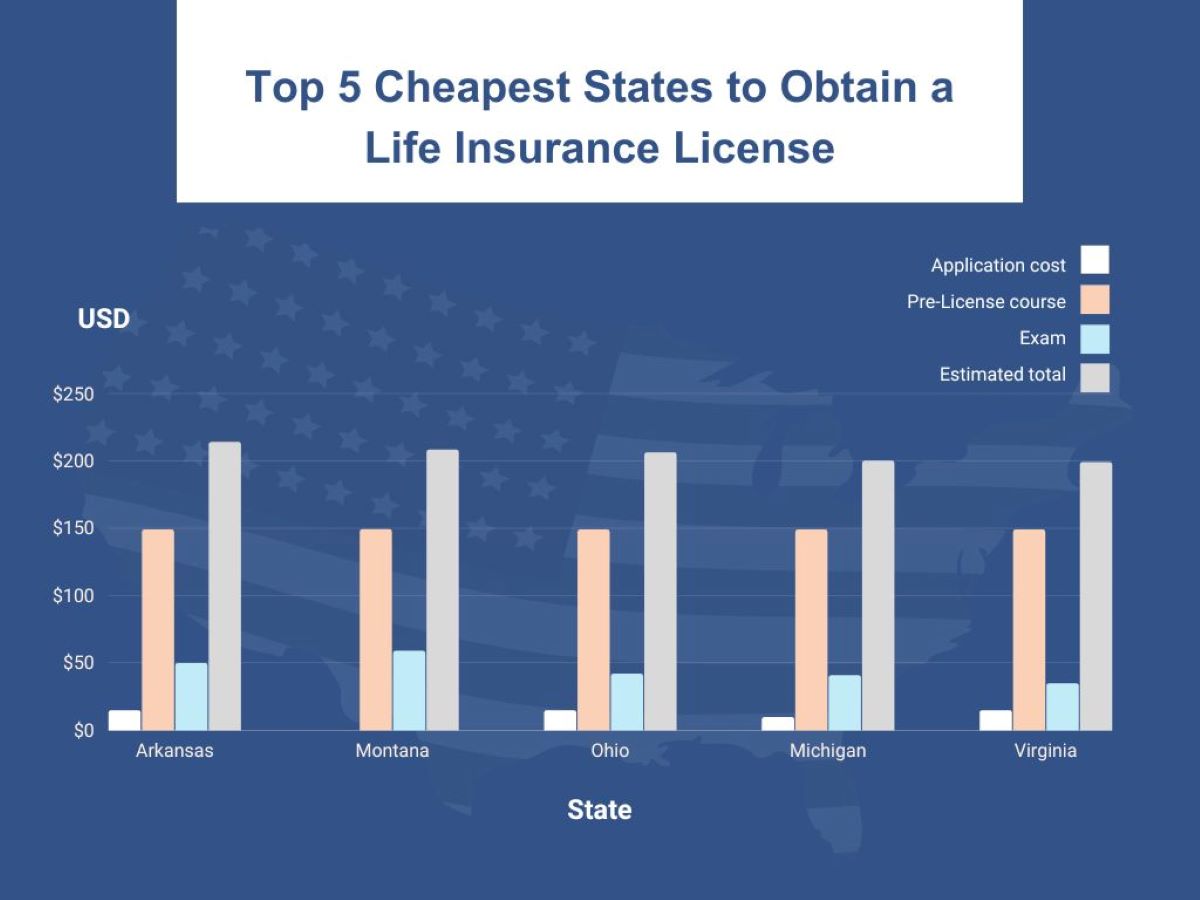

- State Licensing Requirements: Each state has its own set of licensing requirements and fees. The licensing fees can vary significantly from one state to another. It is essential to research and understand the specific requirements of the state in which you intend to obtain your insurance license.

- Pre-licensing Education: Most states impose a mandatory pre-licensing education requirement. This involves completing a certain number of hours of coursework or training, which can incur additional costs. The fees for pre-licensing education can vary based on the type of insurance you wish to specialize in and the provider you choose.

- Exam Fees: To obtain an insurance license, you will need to pass a state-administered licensing exam. These exams typically have associated fees that vary by state. It is essential to factor in these fees when considering the overall cost of obtaining your license.

- Continuing Education: Once you acquire your insurance license, most states require you to complete continuing education courses to maintain your license. These courses have associated fees, and the number of hours and frequency of completion may vary depending on your state’s requirements.

- Background Check: Some states require applicants to undergo a background check as part of the licensing process. This check ensures that applicants meet the state’s suitability requirements. The fees associated with background checks can vary depending on the state.

- License Application Fees: When applying for an insurance license, you may need to pay an application fee. The fee can vary depending on the state and the type of license you are seeking. It is important to consider these fees when calculating the overall cost of obtaining your license.

- License Renewal Fees: Insurance licenses are typically valid for a certain period and must be renewed periodically. Renewal fees vary by state and license type. It is crucial to factor in these recurring fees when considering the long-term costs of maintaining your insurance license.

- Errors and Omissions (E&O) Insurance: Depending on your role in the insurance industry, you may be required to carry errors and omissions insurance. E&O insurance helps protect against claims by clients alleging inadequate work or negligence. The cost of E&O insurance can vary based on the coverage limits and the provider you choose.

It is important to note that the costs associated with acquiring an insurance license may vary widely depending on the state and the specific requirements of the license you are seeking. Therefore, it is crucial to research and understand the costs specific to your situation and location before embarking on the licensure process.

State Licensing Fees

State licensing fees are a significant factor to consider when calculating the overall cost of acquiring an insurance license. Each state has its own fees for the initial licensing as well as for license renewals. These fees can vary widely depending on the state and the type of license you are applying for.

State licensing fees typically cover the administrative costs associated with processing the license application and maintaining the licensing database. These fees contribute to the regulation and oversight of the insurance industry within the state.

The exact amount of state licensing fees can vary widely. Some states have relatively low fees, while others may have higher fees. For example, the licensing fee for an insurance producer in one state may be $50, while in another state, it could be $200 or more.

In addition to the upfront licensing fees, most states require license renewals at regular intervals, typically every 1-2 years. Renewal fees, although often lower than the initial licensing fees, can still add to the overall cost of maintaining your insurance license.

It is important to research and be aware of the specific licensing fees in the state where you plan to obtain your insurance license. This information can usually be found on the state’s insurance department website or by contacting the relevant licensing authority.

Keep in mind that state licensing fees are subject to change, so it is crucial to verify the most up-to-date fee schedule before proceeding with your license application. Additionally, some states may offer fee waivers or reduced fees for certain categories, such as veterans or low-income individuals. Be sure to check if you qualify for any fee exemptions or discounts.

Considering the state licensing fees is essential when budgeting for your insurance license. Understanding these costs upfront can help you plan your finances more effectively and avoid any surprises during the licensing process.

Pre-licensing Education Costs

Most states require individuals seeking an insurance license to complete a certain number of pre-licensing education hours before they can qualify for the licensing exam. Pre-licensing education provides aspiring insurance professionals with the necessary knowledge and understanding of insurance principles, laws, and regulations.

The cost of pre-licensing education can vary depending on several factors, including the type of insurance license you are pursuing and the provider you choose for your coursework or training. Some states may have specific requirements regarding the number of hours and the specific topics that must be covered in the pre-licensing education curriculum.

Insurance pre-licensing courses are typically offered by approved education providers, which can include community colleges, online platforms, or specialized insurance schools. The cost of these courses can range from as low as $100 to several hundred dollars, depending on various factors such as the duration, delivery method, and comprehensiveness of the course.

Some states may require individuals to complete a specific number of classroom hours, while others may allow for online self-study. Online courses tend to be more flexible and affordable, as they eliminate the need for physical attendance and offer self-paced learning options.

It is essential to research the approved pre-licensing education providers in your state and compare their offerings and prices. Look for reputable providers that offer comprehensive and up-to-date coursework that aligns with your specific insurance license requirements.

Keep in mind that the cost of pre-licensing education is an investment in your professional development and can significantly impact your ability to pass the licensing exam and succeed in the insurance industry. So, make sure to choose a course that not only fits your budget but also provides high-quality education to enhance your knowledge and skills.

Additionally, consider any additional study materials or resources that may be recommended or required for the pre-licensing process. These can include textbooks, practice exams, or study guides, which may incur additional costs beyond the course fee.

By understanding the costs associated with pre-licensing education, you can effectively plan your budget and ensure that you meet the educational requirements necessary to obtain your insurance license.

Exam Fees

Aspiring insurance professionals are required to pass a state-administered licensing exam in order to obtain their insurance license. The exam fees associated with this licensing requirement can vary depending on the state and the type of license you are seeking.

The exam fees typically cover the cost of administering and grading the licensing exam, as well as the maintenance of the exam infrastructure and resources.

The exact amount of exam fees can differ significantly from one state to another. Some states may charge a flat fee for all types of insurance licenses, while others may have varying fees depending on the specific license type.

Exam fees can range from around $50 to over $200, depending on your location and the type of insurance license you are pursuing. It is important to research the specific fees charged by your state’s regulatory authority or insurance department.

It is worth noting that in some cases, exam fees may be separate from the pre-licensing education costs. Pre-licensing education fees cover the coursework or training required to prepare for the exam, whereas exam fees are specifically for the administration and grading of the exam itself.

Additionally, exam fees are typically non-refundable, so it is essential to adequately prepare yourself before taking the exam to maximize your chances of success.

If you do not pass the exam on your first attempt, some states may allow you to retake the exam for an additional fee. It is important to review the retake policies of your state so that you are aware of any additional costs that may be incurred if you need to retake the exam.

Make sure to budget for exam fees when calculating the overall cost of obtaining your insurance license. This includes factoring in any potential retake fees, study materials, or exam preparation resources that may be helpful in preparing for the exam.

By understanding and planning for the exam fees, you can ensure that you are financially prepared to take the licensing exam and increase your chances of successfully obtaining your insurance license.

Continuing Education Expenses

Once you have obtained your insurance license, the journey towards maintaining your license begins. Many states require insurance professionals to complete continuing education (CE) courses to stay up-to-date with industry changes and maintain their licenses.

The cost of continuing education can vary depending on your state’s requirements, the number of hours needed, and the providers you choose for your courses.

Continuing education expenses typically cover the cost of attending courses, workshops, seminars, or online programs that focus on relevant insurance topics. These courses aim to deepen your knowledge, enhance your skills, and keep you informed about the latest developments in the industry.

The cost of CE courses can vary widely. Some states may have set prices per credit hour, while others may have a flat fee for a specific number of hours. On average, insurance professionals can expect to spend anywhere from $100 to a few hundred dollars per license renewal period on continuing education.

Providers of continuing education can include professional organizations, colleges, online platforms, or specialized insurance training schools. It is important to choose reputable providers that offer courses approved by your state’s insurance department to ensure their eligibility for meeting the CE requirements.

In addition to the course fees, there may be other expenses associated with continuing education, such as travel costs if you attend in-person workshops or seminars. Online courses are typically more cost-effective as they eliminate the need for travel expenses.

It is crucial to plan and budget for continuing education expenses, considering the frequency of license renewal and the number of required CE hours. By staying on top of your CE requirements, you can maintain your license efficiently and stay updated with industry trends and regulations.

Research the approved providers and their course offerings to find the best value for your continuing education needs. Balancing the cost with the quality and relevance of the courses will help ensure that you are making the most of your investment in professional development.

By accounting for continuing education expenses, you can maintain your insurance license effectively and demonstrate your commitment to ongoing learning and professional growth in the insurance industry.

Background Check Fees

As part of the insurance licensing process, some states require individuals to undergo a background check to ensure they meet certain suitability requirements. Background checks help to protect consumers and maintain the integrity of the insurance industry.

The cost of a background check can vary depending on the state and the specific requirements. Background checks are typically conducted by a third-party agency that specializes in performing comprehensive background investigations.

The fees associated with a background check are generally paid directly to the agency conducting the check. The cost can range from around $20 to $100 or more, depending on the extent of the background check and any additional services included.

Background checks may include criminal history checks, verification of previous employment, education verification, credit history, and other relevant information. The depth of the background check may vary depending on the state’s regulations and the type of insurance license being pursued.

It is important to note that background check fees are typically non-refundable, regardless of the outcome of the investigation. Therefore, it is essential to ensure your eligibility and suitability before proceeding with the background check.

Before initiating the background check process, be sure to review the requirements and guidelines provided by your state’s insurance department or regulatory authority. They will provide you with the necessary instructions and information to complete the background check successfully.

Keep in mind that background check fees may vary depending on the agency selected to conduct the investigation. Be sure to research and choose a reputable and reliable agency with transparent pricing to ensure the accuracy and legitimacy of the background check results.

By understanding the background check fees and requirements, you can plan and allocate the necessary funds to complete this crucial step in the licensing process. A successful background check will help you demonstrate your suitability and trustworthiness as an insurance professional.

License Application Fees

When applying for an insurance license, there are typically fees associated with the application process. These fees cover the administrative costs of processing the application and issuing the license upon approval.

The specific license application fees can vary depending on the state and the type of insurance license you are seeking. Each state sets its own fee structure, and the amounts can vary significantly.

The cost of license application fees can range from as low as $50 to several hundred dollars, depending on the state and the type of license being applied for. It is essential to research and understand the specific requirements and associated fees in the state where you plan to obtain your insurance license.

License application fees are typically paid directly to the state’s insurance regulatory authority or licensing department. The fees are non-refundable, regardless of the outcome of the license application. Therefore, it is essential to ensure that you meet all the prerequisites and requirements before submitting your application.

It is important to note that license application fees are separate from any pre-licensing education costs, exam fees, or background check fees that may also be required during the licensing process. These additional fees should be considered when calculating the overall cost of obtaining your insurance license.

Some states may offer fee waivers or reduced fees for certain categories, such as veterans or low-income individuals. It is worth checking if you qualify for any fee exemptions or discounts to help offset the cost of the license application.

Being aware of the license application fees upfront will enable you to budget accordingly and ensure that you have the necessary funds available when it comes time to apply for your insurance license.

Make sure to check the specific fee schedule provided by your state’s insurance department or licensing authority to ensure that you have the most accurate and up-to-date information regarding license application fees.

By understanding and planning for license application fees, you can navigate the licensing process smoothly and efficiently, allowing you to pursue your career in the insurance industry with confidence.

License Renewal Fees

Once you have obtained your insurance license, it is important to remember that licenses usually have an expiration date. To maintain your license and continue practicing as an insurance professional, you will need to renew your license periodically. License renewal fees are associated with the process of keeping your license valid and up-to-date.

The specific license renewal fees can vary depending on the state and the type of insurance license you hold. Each state sets its own fee structure for license renewals, and the amounts can vary.

License renewal fees typically cover the administrative costs of processing the renewal application, updating the licensing database, and ensuring continuing compliance with licensing requirements.

The cost of license renewal fees can range from as low as $50 to several hundred dollars, depending on the state and the type of license being renewed. It is important to research and understand the specific renewal requirements and associated fees in the state where you hold your insurance license.

License renewal fees are usually paid directly to the state’s insurance regulatory authority or licensing department. These fees are often due at regular intervals, which can vary by state but typically occur every 1-2 years.

Failure to renew your license on time can result in penalties, additional fees, and even the potential suspension of your license. It is crucial to make note of your license expiration date and initiate the renewal process well in advance to avoid any disruptions in your ability to conduct insurance activities.

Some states may offer online renewal portals or support automatic renewal systems, making the renewal process more convenient and efficient. It is important to familiarize yourself with the renewal procedures specific to your state and ensure that you adhere to any required continuing education or other renewal requirements.

By planning for and budgeting for license renewal fees, you can ensure that you meet the necessary requirements to keep your license active and maintain your status as a licensed insurance professional.

Make sure to review the specific fee schedule provided by your state’s insurance department or licensing authority to ensure that you have the most accurate and up-to-date information regarding license renewal fees.

By understanding and preparing for license renewal fees, you can navigate the renewal process seamlessly and continue your career in the insurance industry with confidence.

Errors and Omissions (E&O) Insurance Costs

Errors and Omissions (E&O) insurance, also known as professional liability insurance, is coverage that provides protection against claims of negligence, mistakes, or inadequate work in the performance of professional duties. E&O insurance is particularly relevant for insurance professionals who provide advice, recommendations, or services to clients.

The cost of E&O insurance can vary depending on several factors, including the type of insurance license you hold, the scope of your activities, the coverage limits, and the insurance provider you choose.

E&O insurance premiums are typically paid on an annual basis. The premium amount is based on the assessed risk associated with your specific role in the insurance industry and the likelihood of potential claims.

Insurance agents who primarily deal with property and casualty insurance policies may have different E&O insurance costs compared to those who specialize in life or health insurance. Additionally, the level of experience, geographic location, and claims history can also influence the premium amount.

E&O insurance costs can range from a few hundred dollars to several thousand dollars annually, depending on the factors mentioned above. It is essential to obtain quotes from different insurance providers and compare coverage options and premiums to find the best fit for your needs.

When determining your E&O insurance needs, consider the coverage limits you require. Higher coverage limits often translate to higher premiums. Assessing the potential risks associated with your profession will help you determine an appropriate coverage level.

Some states may require insurance professionals to carry a specific minimum amount of E&O insurance as a regulatory requirement. It is important to review your state’s requirements and ensure compliance when selecting your coverage.

It is worth noting that while E&O insurance is not a mandatory requirement in all states, it is highly recommended for insurance professionals, as it offers financial protection against costly lawsuits and claims.

By budgeting for E&O insurance costs and obtaining proper coverage, you can protect yourself from potential liability and safeguard your professional reputation in the insurance industry.

Consult with insurance providers specializing in E&O insurance and discuss your specific needs to receive accurate quotes and make an informed decision regarding your coverage and associated costs.

Conclusion

Obtaining an insurance license is an essential step in starting or advancing your career in the insurance industry. However, it is crucial to understand the various costs associated with acquiring and maintaining an insurance license. By considering these costs upfront, you can effectively plan your budget and avoid any financial surprises.

Factors that affect insurance license costs include state licensing fees, pre-licensing education expenses, exam fees, continuing education requirements, background check fees, license application fees, license renewal fees, and potential costs for errors and omissions (E&O) insurance.

Researching and understanding the specific requirements and associated fees for your state is essential. Each state may have different fee structures and regulations. It is also worth exploring potential fee waivers or discounted rates for specific categories such as veterans or low-income individuals.

Remember to factor in pre-licensing education costs, exam fees, continuing education expenses, and additional fees like background checks and license application fees when estimating the overall cost of obtaining your insurance license.

License renewal fees are recurring expenses that should be accounted for, typically paid every 1-2 years. Additionally, consider the importance of errors and omissions (E&O) insurance, which provides coverage for professional liability. Evaluating the potential risk and obtaining appropriate coverage is crucial for your protection and peace of mind.

By thoroughly understanding the costs associated with acquiring and maintaining an insurance license, you can plan your finances effectively and ensure that you are fully prepared for success in the insurance industry.

Consult with your state’s insurance department, licensing authority, or reputable insurance professionals to gather the most accurate and up-to-date information regarding the specific fees and requirements in your area.

With the proper knowledge and financial preparation, you can confidently navigate the licensing process and embark on a successful career as an insurance professional.