Home>Finance>How Much Is A Helicopter Ride To The Hospital With Insurance?

Finance

How Much Is A Helicopter Ride To The Hospital With Insurance?

Published: November 5, 2023

Discover how much a helicopter ride to the hospital costs with insurance. Get insights on financing options for emergency medical transportation.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Medical Helicopter Transportation

- The Role of Insurance in Helicopter Medical Transport

- Factors Affecting the Cost of Helicopter Rides to the Hospital

- Insurance Coverage for Helicopter Medical Transport

- Out-of-Pocket Expenses for Helicopter Rides with Insurance

- Case Studies: Cost of Helicopter Rides with Health Insurance

- Tips for Navigating Insurance Coverage for Helicopter Medical Transport

- Conclusion

Introduction

Medical emergencies can occur unexpectedly, and in some cases, immediate transport to a hospital may be necessary. In situations where ground transportation is not feasible due to remoteness, traffic congestion, or time constraints, medical helicopter transportation becomes a crucial option. Helicopter rides to the hospital can significantly reduce travel time, allowing patients to receive life-saving medical care quickly.

However, the cost of helicopter medical transport can be substantial, raising concerns about affordability for many individuals. Thankfully, health insurance coverage can help alleviate the financial burden associated with these emergency services. Understanding how insurance impacts the cost of helicopter rides to the hospital is essential for making informed decisions.

In this article, we will delve into the topic of insurance coverage for helicopter medical transport. We will explore the factors that affect the cost of helicopter rides, discuss insurance coverage options, and provide tips for navigating insurance policies to minimize out-of-pocket expenses. By the end, you should have a better understanding of what to expect when it comes to the cost of helicopter rides to the hospital with insurance.

Understanding Medical Helicopter Transportation

Medical helicopter transportation, also known as medevac or air ambulance services, involves transporting patients to medical facilities via a helicopter. It is primarily used in emergency situations where rapid transport is critical, such as severe injuries, cardiac events, or other life-threatening conditions. Helicopters are equipped with advanced medical equipment and staffed by trained medical professionals, allowing for immediate care during the transit to the hospital.

One of the key advantages of medical helicopter transportation is its speed and ability to bypass traffic congestion. Helicopters can quickly reach remote or inaccessible areas that ground ambulances may struggle to reach, ensuring that patients receive prompt medical attention when time is of the essence. For critical patients in need of specialized care available only at certain medical facilities, medical helicopter transportation can be a vital lifeline.

Additionally, helicopter transportation offers the benefit of enhanced mobility and flexibility. Unlike fixed-wing air ambulances, helicopters can land and take off from smaller areas such as helipads and open fields, allowing them to bring patients closer to the desired medical facility. This convenience can significantly reduce travel time and ensure faster access to necessary medical interventions.

It is important to note that not all medical situations require helicopter transportation. Emergency medical professionals evaluate patient conditions and determine the appropriate mode of transportation based on factors such as distance, urgency, and medical stability. Ground ambulances, for example, may be more suitable for shorter distances or stable patients who do not require immediate specialized care.

Understanding the role and capabilities of medical helicopter transportation is crucial for assessing its necessity in emergencies and making informed decisions regarding the most appropriate mode of transport. It also helps individuals understand the potential costs associated with helicopter rides to the hospital and the role of insurance coverage in mitigating those expenses.

The Role of Insurance in Helicopter Medical Transport

Insurance plays a critical role in covering the costs of helicopter medical transport. Health insurance policies typically provide coverage for emergency medical services, including helicopter rides to the hospital. However, it is important to note that the extent of coverage may vary depending on the specific insurance plan.

Insurance coverage for helicopter medical transport can help alleviate the financial burden associated with these services. The cost of a helicopter ride to the hospital can range from several thousand dollars to tens of thousands of dollars, depending on factors such as distance, flight time, and the level of medical care required during transport.

Having insurance coverage can provide peace of mind, knowing that a significant portion of the expenses will be taken care of. However, it is essential to review the terms and conditions of your insurance policy to understand the extent of coverage for helicopter medical transport.

Most health insurance plans cover emergency medical transportation, including helicopter rides, when it is deemed medically necessary. However, insurance policies may have specific guidelines and requirements for coverage. For example, some plans may require preauthorization or notification from a medical professional before the helicopter transport can occur.

In some cases, health insurance may have agreements with specific air ambulance providers, also known as in-network providers. If you use an in-network provider, your insurance coverage may be more extensive, helping to reduce out-of-pocket costs. However, it is essential to confirm with your insurance provider to determine which air ambulance services are in-network.

Insurance coverage for helicopter medical transport is typically applied towards the overall deductible and out-of-pocket maximum limits of the policy. This means that you may still be responsible for a portion of the cost, even with insurance coverage. The specific cost-sharing details, such as copayments or coinsurance, can vary depending on your insurance policy.

It is crucial to understand the terms and limitations of your insurance coverage for helicopter medical transport. Familiarize yourself with the specific requirements, preauthorization processes, and any associated out-of-pocket expenses. Being well-informed about your insurance coverage will help you navigate the financial aspects of helicopter rides to the hospital and ensure that you receive the necessary care without facing excessive financial burdens.

Factors Affecting the Cost of Helicopter Rides to the Hospital

Several factors contribute to the cost of helicopter rides to the hospital. Understanding these factors can help you better comprehend why the expenses associated with medical helicopter transportation can vary widely.

Distance and flight time: One of the primary factors influencing the cost of a helicopter ride to the hospital is the distance traveled and the duration of the flight. Longer distances and extended flight times require more fuel and resources, resulting in higher costs.

Equipment and medical staff: Helicopters used for medical transportation are equipped with advanced medical equipment and staffed by trained medical professionals such as doctors, nurses, and paramedics. The cost of these highly skilled professionals and medical equipment can contribute to the overall expense.

Operational costs: Helicopter medical transport involves numerous operational costs, including maintenance, fuel, insurance, and overhead expenses. These costs, combined with the specialized nature of the service, can significantly impact the overall cost of a helicopter ride to the hospital.

Weather conditions and time of day: Weather conditions and the time of day can also affect the cost of helicopter rides. Adverse weather conditions may require additional safety precautions or prevent flights altogether. Similarly, nighttime or weekend flights may incur higher costs due to the availability of resources and staff.

Level of medical care required: The level of medical care needed during transport can influence the cost of helicopter rides. Patients requiring advanced life support, specialized equipment, or additional medical interventions may incur higher expenses due to the resources and expertise required.

Location and accessibility: The location and accessibility of the pick-up and drop-off points can impact the cost of helicopter rides. Remote areas that are difficult to reach or lack suitable landing zones may require additional resources or alternative landing sites, resulting in increased costs.

Air ambulance provider: Different air ambulance companies may have varying pricing structures and agreements with insurance providers. It is essential to research and understand the pricing models of different providers in your area to make informed decisions regarding the most cost-effective option.

These factors, along with other variables, can contribute to the overall cost of helicopter rides to the hospital. It is crucial to keep in mind that the specific expenses associated with medical helicopter transportation may vary based on individual circumstances, insurance coverage, and the policies of the air ambulance provider.

Insurance Coverage for Helicopter Medical Transport

Health insurance policies typically provide coverage for emergency medical transportation, including helicopter rides to the hospital. However, the extent of coverage can vary depending on your specific insurance plan.

Most insurance companies consider helicopter medical transport as a necessary and covered service in emergency situations. It is important to note that insurance coverage is typically dependent on the medical necessity of the transport. If a healthcare professional deems a helicopter ride as the most appropriate means of transportation based on the patient’s condition, insurance coverage is more likely to be provided.

Insurance coverage for helicopter medical transport generally includes the base charges for the flight, as well as the costs associated with medical personnel and equipment onboard the helicopter during the transport. However, it is essential to review the terms and conditions of your insurance policy to fully understand the extent of coverage for air ambulance services.

Furthermore, it is worth noting that the coverage for helicopter medical transport may differ between in-network and out-of-network providers. In-network providers have agreed-upon rates and negotiated contracts with insurance companies, which can result in lower out-of-pocket costs for policyholders. Out-of-network providers may still be covered by insurance, but the coverage amount may be limited, and the policyholder may be responsible for a larger portion of the expenses.

Prior authorization or notification may be required by your insurance company before arranging a helicopter medical transport. It is crucial to understand and comply with any preauthorization or notification requirements to ensure coverage and minimize potential claim denials or disputes.

Additionally, certain insurance plans may have limitations or exclusions for specific situations or circumstances. It is important to review your policy carefully and consult with your insurance provider to clarify any potential gaps in coverage for helicopter medical transport.

If you do not have health insurance, or your insurance does not fully cover helicopter medical transport, there may still be options available to assist with the expenses. Some air ambulance companies offer membership programs or payment plans that can help make the cost more manageable. It is advisable to inquire about such options and discuss them with the air ambulance provider directly.

In summary, health insurance coverage for helicopter medical transport can be a valuable resource in managing the expenses associated with emergency transportation. However, it is crucial to understand the specifics of your insurance plan, including coverage limitations, preauthorization requirements, and in-network provider options, to ensure appropriate coverage and minimize out-of-pocket costs.

Out-of-Pocket Expenses for Helicopter Rides with Insurance

While health insurance coverage can help alleviate the financial burden of helicopter rides to the hospital, it is important to understand that there may still be out-of-pocket expenses involved.

Out-of-pocket expenses refer to the costs that the insured individual is responsible for paying, in addition to the portion covered by the insurance provider. These expenses can include deductibles, copayments, and coinsurance.

The specific out-of-pocket expenses for helicopter rides with insurance will depend on your insurance plan and its terms and conditions. Let’s explore some of the common out-of-pocket expenses that you may encounter:

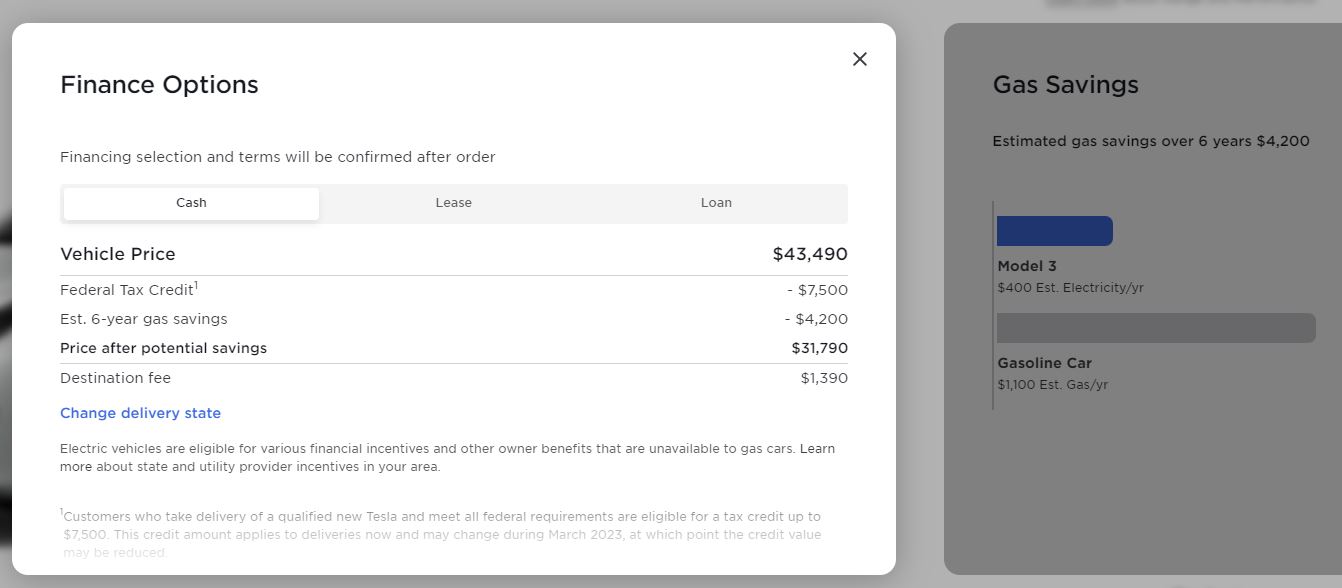

Deductibles: A deductible is the amount you must pay before your insurance coverage kicks in. For example, if your insurance policy has a $1,000 deductible and the cost of the helicopter ride is $5,000, you will be responsible for paying the first $1,000 out of pocket, and your insurance will cover the remaining $4,000.

Copayments: Copayments are fixed amounts that you must pay for certain services. Some insurance plans may require a copayment for helicopter rides, typically a flat fee (e.g., $100) that you pay at the time of service. The copayment amount may vary depending on your policy.

Coinsurance: Coinsurance is the percentage of the medical expenses that you are responsible for after meeting your deductible. For example, if your coinsurance is 20% and the total cost of the helicopter ride is $5,000, you would be responsible for paying 20% of that amount, or $1,000, while your insurance would cover the remaining 80%.

It is important to review your insurance policy and understand the details of your deductible, copayment, and coinsurance requirements for helicopter medical transport. This will help you estimate your potential out-of-pocket expenses and make informed financial decisions.

Additionally, it is crucial to be aware of any coverage limitations or exclusions that may apply to air ambulance services. For example, your insurance plan may impose a limit on the number of helicopter rides covered within a specific period or only cover transport to certain facilities. Understanding these limitations can help you avoid unexpected expenses.

To minimize out-of-pocket expenses, consider opting for an in-network helicopter provider, as they typically have negotiated rates with insurance companies. Using an in-network provider can help ensure that you receive the highest level of coverage and the lowest possible out-of-pocket costs.

If you are facing financial hardship or struggling to manage the out-of-pocket expenses associated with helicopter rides, it is advisable to reach out to your insurance provider for assistance. They may be able to provide guidance, offer payment plans, or suggest alternative resources to help you manage the costs.

In summary, while insurance can significantly reduce the financial burden of helicopter rides to the hospital, it is important to be prepared for out-of-pocket expenses. Understanding your insurance policy, including deductibles, copayments, and coinsurance, will help you navigate the financial aspect of helicopter medical transport and make well-informed decisions.

Case Studies: Cost of Helicopter Rides with Health Insurance

Examining case studies can provide valuable insights into the potential costs individuals may encounter when it comes to helicopter rides to the hospital with health insurance coverage. It is important to note that these case studies are for illustrative purposes only and actual costs can vary depending on various factors such as insurance plans, policies, and individual circumstances.

Case Study 1:

John, a 45-year-old individual, experienced a severe heart attack while camping in a remote area. Emergency medical professionals deemed a helicopter ride as the fastest and most appropriate mode of transportation to the nearest cardiac facility. John had health insurance coverage with a $1,500 deductible, 20% coinsurance, and a maximum out-of-pocket limit of $6,000.

The total cost of the helicopter ride was $15,000. Since John had not met his deductible, he was responsible for paying the first $1,500 out of pocket. After meeting the deductible, the coinsurance kicked in, requiring John to pay 20% of the remaining $13,500, which amounted to $2,700. Therefore, John’s total out-of-pocket expenses for the helicopter ride were $4,200.

Case Study 2:

Sarah, a 32-year-old individual, suffered a severe injury during a hiking accident in a remote mountainous region. Emergency medical professionals determined that she required immediate medical evacuation via helicopter. Sarah had health insurance coverage with a $2,000 deductible, a $250 copayment for air ambulance services, and a maximum out-of-pocket limit of $8,000.

The total cost of the helicopter ride was $12,000. Sarah had not met her deductible, so she was responsible for paying the first $2,000 out of pocket. Additionally, she had to pay the $250 copayment for air ambulance services as required by her insurance plan. Therefore, Sarah’s total out-of-pocket expenses for the helicopter ride amounted to $2,250.

Case Study 3:

Mark, a 50-year-old individual, experienced a serious car accident in a rural area with limited access to hospitals. Emergency medical professionals determined that he needed immediate transport to a trauma center via helicopter. Mark had health insurance coverage with a $3,000 deductible, a $500 copayment for air ambulance services, and a maximum out-of-pocket limit of $7,500.

The total cost of the helicopter ride was $20,000. Mark had already met his deductible for the year, so he was responsible for paying the $500 copayment for air ambulance services. Therefore, Mark’s total out-of-pocket expenses for the helicopter ride were $500.

These case studies illustrate the potential variation in costs and out-of-pocket expenses for helicopter rides to the hospital with health insurance coverage. It is important to note that individual insurance plans and policy details can greatly impact the final expenses. Consulting with your insurance provider and reviewing your policy before emergencies occur can provide a clearer understanding of the potential costs you may encounter.

Tips for Navigating Insurance Coverage for Helicopter Medical Transport

Understanding and navigating insurance coverage for helicopter medical transport can be a complex task. However, the following tips can help you navigate the process more effectively:

1. Review your insurance policy: Take the time to carefully review your insurance policy, paying close attention to the sections that outline coverage for emergency medical transportation and helicopter rides. Understand the specific terms, conditions, deductibles, copayments, and coinsurance requirements.

2. Know the limitations and exclusions: Be aware of any limitations or exclusions in your insurance policy regarding air ambulance services. This could include restrictions on the number of covered rides within a specific timeframe, specific medical conditions, or only covering transport to certain facilities. Understand what situations may result in limited or no coverage.

3. Understand preauthorization requirements: Familiarize yourself with any preauthorization or notification requirements set by your insurance provider. In many cases, you may need preapproval from a medical professional before arranging a helicopter medical transport. Failure to meet this requirement could result in denied coverage or increased out-of-pocket expenses. Follow the proper procedures to ensure full coverage.

4. Research in-network air ambulance providers: Check if your insurance plan has agreements with specific air ambulance providers, often known as in-network providers. Using an in-network provider can help you maximize your insurance coverage and reduce out-of-pocket expenses. Contact your insurance company to confirm which air ambulance companies are in-network.

5. Document everything: Keep thorough records of all communication with your insurance provider, including any authorizations or approvals. Maintain copies of medical reports, invoices, and receipts related to the helicopter ride to the hospital. These documents will be helpful if you need to dispute a claim or clarify coverage details.

6. Advocate for yourself: If you encounter challenges or disputes with your insurance provider regarding coverage for helicopter medical transport, be proactive in advocating for yourself. Understand your rights as a policyholder and be prepared to communicate your concerns and questions clearly. Consider contacting your state insurance department or seeking assistance from a patient advocate if necessary.

7. Explore alternative financial assistance options: If you find yourself facing significant out-of-pocket expenses that you cannot afford, explore alternative financial assistance options. Some air ambulance companies offer membership programs or payment plans that can help ease the financial burden. Additionally, you may qualify for state or local programs that provide financial assistance for emergency medical services.

By following these tips and being proactive in understanding your insurance coverage for helicopter medical transport, you can navigate the process more effectively and minimize potential financial stress. It is always recommended to consult with your insurance provider directly to address any specific questions or concerns related to your coverage.

Conclusion

Helicopter rides to the hospital can be life-saving in emergency situations, but they can also come with a hefty price tag. Health insurance coverage plays a crucial role in mitigating the financial burden associated with these services. Understanding the ins and outs of insurance coverage for helicopter medical transport is essential for ensuring appropriate care without facing excessive out-of-pocket expenses.

In this article, we explored various aspects of insurance coverage for helicopter rides to the hospital. We discussed factors that affect the cost of helicopter rides, the role of insurance in covering these costs, out-of-pocket expenses that individuals may still incur, and tips for navigating insurance coverage effectively.

It is important to note that insurance coverage can vary depending on the specific policy and insurance provider. Reviewing your insurance policy, understanding the terms and conditions, and adhering to any preauthorization requirements are crucial for ensuring maximum coverage.

Being aware of potential out-of-pocket expenses, such as deductibles, copayments, and coinsurance, can help individuals plan for the potential financial implications of helicopter medical transport. Exploring in-network providers, documenting all communication and documentation, and advocating for oneself when necessary are key strategies for navigating insurance coverage effectively.

Ultimately, the goal is to ensure timely access to necessary medical care without incurring significant financial burdens. By understanding your insurance coverage, working closely with your insurance provider, and exploring alternative financial assistance options if needed, you can navigate the complexities of insurance coverage for helicopter medical transport with greater confidence.

Remember, each insurance plan and individual circumstance is unique. It is advisable to consult with your insurance provider and healthcare professionals to fully understand your coverage and make informed decisions when it comes to helicopter rides to the hospital.