Finance

How Much Is A Kaiser Visit Without Insurance?

Published: November 18, 2023

Discover the cost of a Kaiser visit without insurance and find out how to manage your finances efficiently. Explore affordable healthcare options today.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to healthcare, having insurance is essential for many individuals and families to afford the cost of medical services. However, not everyone has access to health insurance, and this can raise concerns about the affordability of healthcare expenses. If you are considering a visit to Kaiser Permanente, one of the largest healthcare providers in the United States, without insurance, you may be wondering how much it will cost.

In this article, we will explore the average cost of a Kaiser Permanente visit without insurance, as well as factors that can affect the cost. Additionally, we will discuss some strategies to potentially lower the cost of your visit. While it is always advisable to have health insurance, understanding the potential costs of healthcare services without insurance can help you make informed decisions about your medical care.

Note that the information provided here is intended as a general guideline, and costs can vary depending on various factors such as location, type of visit, and specific medical services needed. It is always best to check with Kaiser Permanente directly for the most accurate and up-to-date information regarding costs.

Kaiser Permanente and Healthcare Costs

Kaiser Permanente is a well-known and reputable healthcare provider that operates across several states in the United States. As an integrated health system, Kaiser Permanente offers a wide range of medical services, including primary care, specialty care, hospital services, and more.

Like any healthcare provider, Kaiser Permanente incurs costs for providing medical services to patients. These costs can include staffing, equipment, facility maintenance, medications, and administrative expenses. To cover these costs and continue providing quality care, healthcare providers typically charge for their services.

Healthcare costs can vary significantly depending on the type of service being provided. Routine check-ups and preventive care visits tend to have lower costs compared to specialized procedures or emergency room visits.

Without health insurance, patients are typically responsible for paying the full cost of their healthcare services out-of-pocket. However, it is worth noting that Kaiser Permanente offers a variety of payment options and assistance programs to help individuals without insurance manage their healthcare expenses.

Understanding the factors that can affect the cost of a Kaiser Permanente visit without insurance can help you estimate the potential expenses you may encounter.

Some key factors that may impact the cost of a Kaiser Permanente visit without insurance include:

- The type of medical service needed: Costs can vary depending on whether you require a routine check-up, diagnostic tests, or specialized treatment.

- The complexity of the medical condition: More complex conditions may require additional tests, procedures, or consultations, which can increase the overall cost.

- The location of the healthcare facility: Healthcare costs can vary based on geographic location, with certain areas having higher overall healthcare expenses.

Factors Affecting the Cost of a Kaiser Visit without Insurance

Several factors can influence the cost of a visit to Kaiser Permanente without insurance. Understanding these factors can help you better estimate the potential expenses you may incur. While the specific cost will vary depending on your location and individual circumstances, here are some common factors that can affect the overall cost:

1. Type of Service: The specific medical service you require will play a significant role in determining the cost of your visit. Routine exams and preventive care visits generally have lower costs compared to specialized tests, procedures, or surgeries.

2. Complexity of the Medical Condition: The complexity and severity of your medical condition can impact the overall cost. Conditions that require more extensive testing, consultations with specialists, or ongoing treatments are likely to result in higher expenses.

3. Diagnostic Tests and Imaging: If you need diagnostic tests or imaging, such as X-rays, MRIs, or CT scans, these can significantly contribute to the cost. The type and number of tests required will impact the total expense.

4. Medications: The cost of medications can vary depending on the type, dosage, and duration of the prescription. Certain medications may have higher price tags, particularly if they are brand-name drugs.

5. Geographic Location: The cost of healthcare services can vary from one region to another. Factors such as the cost of living, local healthcare market, and availability of healthcare providers can impact the overall cost.

6. Additional Services: Certain visits may require additional services, such as laboratory tests, follow-up appointments, or referrals to specialists. These additional services can contribute to the overall cost.

It’s essential to keep in mind that these factors are not exhaustive and that the cost of a Kaiser visit without insurance may involve other variables specific to your situation. It’s always advisable to consult directly with Kaiser Permanente or visit their website to get an accurate estimate of the potential costs you may face.

Average Cost of a Kaiser Visit without Insurance

The cost of a visit to Kaiser Permanente without insurance can vary depending on several factors, as previously mentioned. While the specific costs will differ based on your location and individual circumstances, we can provide a general understanding of the average expenses you may encounter.

It’s important to note that the following figures are approximate and can vary significantly. The costs provided here serve as a general guideline and should not be relied upon as absolute values.

A routine primary care visit at Kaiser Permanente without insurance can range from $100 to $200, which typically includes a basic evaluation, health screening, and consultation with a healthcare provider. However, additional costs may apply if further services, such as laboratory tests or diagnostic imaging, are required.

Specialized visits, such as visits to specialists or specific medical clinics, can have higher costs. These visits can range from $200 to $500 or more, depending on the complexity of the medical condition and the services provided during the visit.

Emergency room visits without insurance can be substantially more expensive, with costs potentially ranging from $500 to several thousand dollars, depending on the level of care needed and the treatment received.

Diagnostic tests and imaging can also add to the overall cost. Tests such as X-rays, MRIs, or CT scans can range from $100 to several hundred dollars or more, depending on the specific test and the facility where it is conducted.

It’s important to keep in mind that these figures are estimates and can vary based on multiple factors, including geographic location, healthcare facility charges, and individual circumstances. Costs may also vary depending on whether you visit a Kaiser Permanente facility or another provider that is within your healthcare network.

If you are concerned about the potential costs of a Kaiser Permanente visit without insurance, it is recommended to reach out directly to Kaiser Permanente or visit their website for more accurate and up-to-date information specific to your location and situation.

Ways to Lower the Cost of a Kaiser Visit without Insurance

If you find yourself in a situation where you need to visit Kaiser Permanente without insurance, there are several strategies you can employ to help lower the cost of your medical care. While these options may not completely eliminate expenses, they can help make healthcare more affordable:

- Explore Financial Assistance Programs: Kaiser Permanente offers financial assistance programs for individuals and families who qualify based on their income level. These programs can help reduce the overall cost of healthcare services. It is advisable to contact Kaiser Permanente’s financial assistance department to determine if you qualify for any available programs.

- Negotiate Payment Plans: In some cases, Kaiser Permanente may be willing to work out a payment plan based on your financial situation. Reach out to their billing department and explain your circumstances. They may offer a repayment plan that allows you to spread out the cost over a period of time, making it more manageable.

- Ask for Itemized Billing: Review your medical bills thoroughly and request an itemized breakdown of the charges. Ensure you are not being charged for any unnecessary or duplicate services. It is your right to understand what you are being billed for and to question any discrepancies.

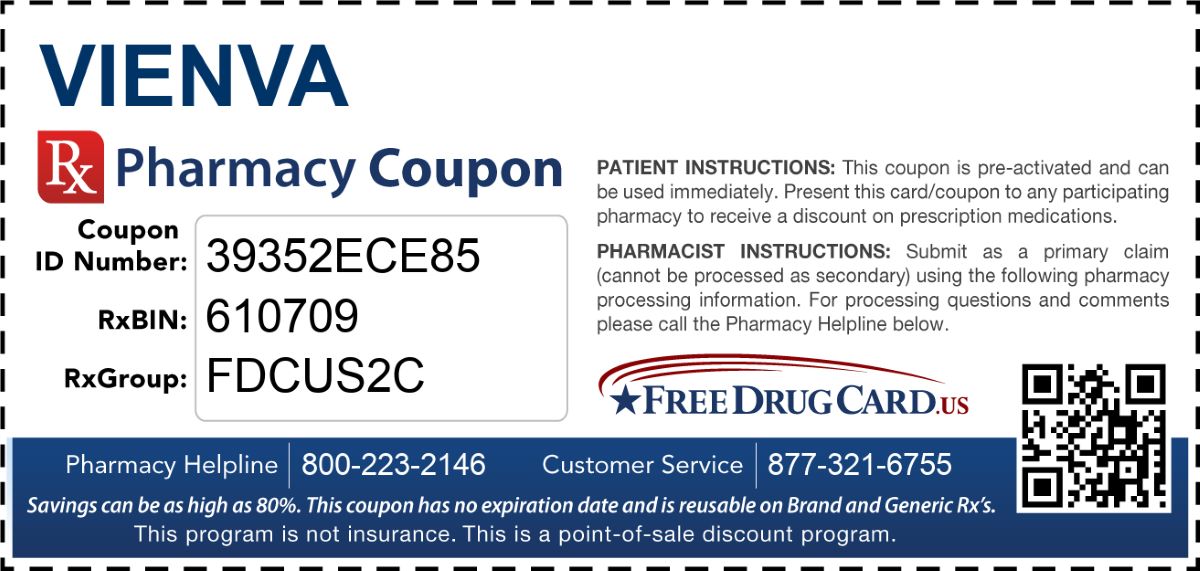

- Consider Generic Medications: If you require medications, ask your healthcare provider if there are generic alternatives available. Generic medications are often more affordable than brand-name drugs and can help reduce your out-of-pocket expenses.

- Seek Out Community Health Centers: Community health centers provide affordable healthcare services to individuals and families who are uninsured or have limited resources. These centers may offer services similar to those provided by Kaiser Permanente at a lower cost. Research and locate community health centers in your area for potential cost savings.

- Explore Healthcare Savings Accounts: If you have the means, consider setting up a healthcare savings account (HSA) or a flexible spending account (FSA). These accounts allow you to set aside pre-tax income specifically for medical expenses, helping you save money on healthcare costs.

- Shop for Competitive Pricing: Before undergoing any non-emergency procedures or tests, consider researching and comparing prices at different healthcare facilities. There can be significant price disparities between providers for the same service, so take the time to shop around and find the best option for your budget.

- Take Advantage of Preventive Care: Regularly scheduled preventive care visits are crucial in maintaining your health and preventing potential future complications. By staying proactive with your health, you may be able to catch any issues early on, potentially reducing the need for more expensive treatments later.

Remember, while these strategies can help lower the cost of your visit, it is still advisable to obtain health insurance if possible. Insurance provides comprehensive coverage and protects you from unexpected medical expenses. Consider exploring your options for obtaining health insurance through government programs, employer-sponsored plans, or the healthcare marketplace.

By utilizing these cost-saving measures and being proactive in managing your healthcare expenses, you can help mitigate the financial burden of visiting Kaiser Permanente without insurance.

Conclusion

Visiting Kaiser Permanente without insurance can raise concerns about the cost of healthcare services. While having health insurance is the ideal way to manage healthcare expenses, there are options available to help lower the cost of your visit.

Kaiser Permanente offers various payment options and financial assistance programs for individuals and families who qualify based on their income level. Exploring these options can significantly reduce the overall cost of your medical care.

Additionally, negotiating payment plans, seeking out community health centers, and shopping for competitive pricing are strategies that can help you save money on healthcare services. Taking advantage of preventive care visits and considering healthcare savings accounts can also contribute to lower expenses.

It’s important to understand that the cost of a visit to Kaiser Permanente without insurance can vary depending on factors such as the type of service needed, the complexity of the medical condition, and the geographic location. It’s advisable to contact Kaiser Permanente directly or visit their website for accurate and up-to-date information specific to your situation.

While these strategies can help lower costs, obtaining health insurance remains the best approach to managing healthcare expenses. Consider exploring your options for health insurance through government programs, employer-sponsored plans, or the healthcare marketplace to ensure comprehensive coverage.

Remember, healthcare is a crucial aspect of maintaining your overall well-being. By being proactive and informed, you can navigate the potential costs of visiting Kaiser Permanente without insurance and make the best decisions for your health and financial situation.