Home>Finance>Where Is Interest Expense On Cash Flow Statement

Finance

Where Is Interest Expense On Cash Flow Statement

Published: December 20, 2023

Find out where interest expense is reported on the cash flow statement and how it impacts the overall financial picture. Explore the connection between finance and interest expense with expert insights.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Cash Flow Statement

- Components of the Cash Flow Statement

- Significance of Interest Expense

- Reporting Interest Expense on the Cash Flow Statement

- Differentiating between Operating and Financing Activities

- Calculation of Interest Expense

- Impact of Interest Expense on Cash Flow Statement Analysis

- Conclusion

Introduction

When analyzing the financial health of a company, one of the crucial documents to consider is the cash flow statement. This statement provides valuable insights into a company’s ability to generate cash and manage its financial obligations. While it covers various components, one element that deserves special attention is interest expense.

Interest expense represents the cost of borrowing funds and is an essential factor in evaluating a company’s financial performance. It primarily reflects the interest paid on debt obligations, such as loans, bonds, or credit facilities. Understanding how interest expense is reported on the cash flow statement can help investors and analysts gain a comprehensive understanding of a company’s financial position and its ability to meet its debt obligations.

In this article, we will dive deeper into the cash flow statement and explore the significance of interest expense. We will discuss how interest expense is reported, the difference between operating and financing activities, and the impact of interest expense on financial analysis.

So, let’s embark on this journey to unravel the mysteries of interest expense and its portrayal on the cash flow statement.

Understanding the Cash Flow Statement

The cash flow statement is a financial statement that provides information about the cash inflows and outflows from a company’s operations, investing activities, and financing activities. It is a key tool for assessing a company’s liquidity and ability to generate cash.

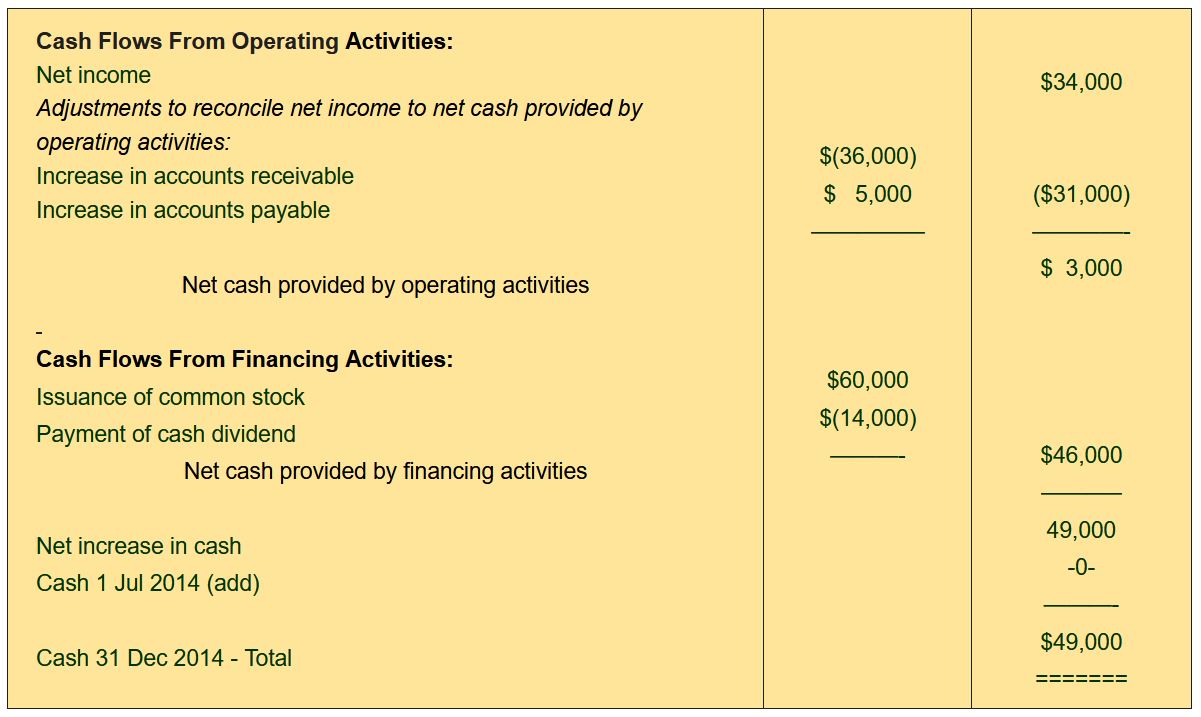

There are three main sections of the cash flow statement:

- Operating activities: This section includes cash flows from the company’s core operations, such as sales and purchases, expenses, and taxes. It reflects the day-to-day cash inflows and outflows related to the regular operations of the business.

- Investing activities: This section encompasses cash flows related to the company’s investments, such as the purchase or sale of long-term assets or investments in other companies. It provides insights into the company’s growth and expansion strategies.

- Financing activities: This section comprises cash flows related to the company’s financing activities, including the issuance or repayment of debt, payment of dividends, or issuance or repurchase of company stock. It reveals how the company is raising capital and managing its financial obligations.

By analyzing the cash flow statement, investors and analysts can evaluate how a company is generating and utilizing cash. It allows them to assess the company’s financial strength, its ability to cover its expenses, invest in growth opportunities, and fulfill its debt obligations.

Now that we have a basic understanding of the cash flow statement, let’s delve deeper into the significance of interest expense and how it fits into this financial document.

Components of the Cash Flow Statement

The cash flow statement is composed of various components that help provide a comprehensive view of a company’s cash flows. These components are categorized into operating activities, investing activities, and financing activities. Let’s explore each component in more detail:

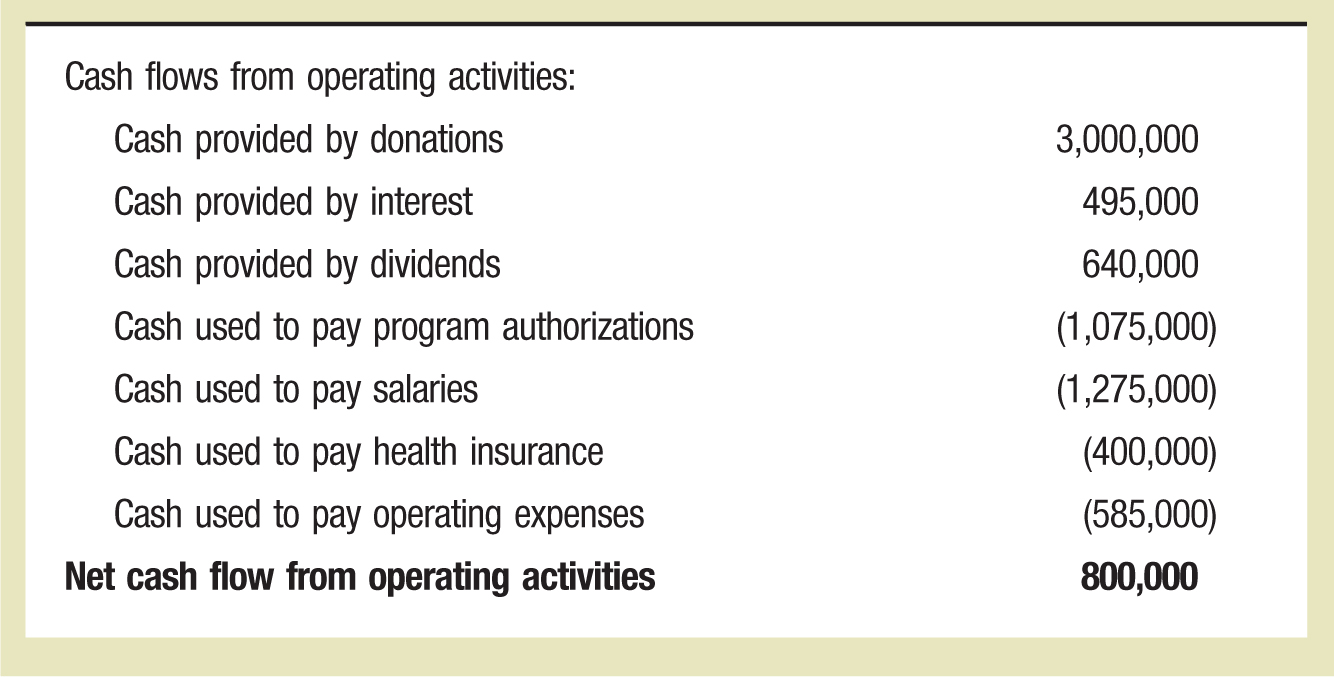

- Operating Activities: This component represents the cash flows from a company’s core operations. It includes cash inflows from sales, payments received from customers, and interest or dividends received. Cash outflows in this category typically include payments made to suppliers, service providers, employees, and interest payments.

- Investing Activities: This component covers cash flows related to a company’s investments in long-term assets, such as property, plant, and equipment, and investments in other companies. Cash inflows in this category may include proceeds from the sale of assets or investments, while cash outflows may include capital expenditures or acquisitions of assets.

- Financing Activities: This component encompasses cash flows related to a company’s financing activities. It includes cash inflows from issuing debt or equity, such as issuing bonds or shares, as well as cash inflows from loans. Cash outflows in this category may include debt repayments, dividend payments, or share repurchases.

Together, these components provide a detailed picture of how a company is managing its cash flows across its various activities, including operations, investments, and financing.

Now that we have a clear understanding of the components of the cash flow statement, let’s explore the significance of interest expense and how it is reported on this financial document.

Significance of Interest Expense

Interest expense plays a significant role in understanding a company’s financial health and performance. It represents the cost of borrowing funds to finance its operations or invest in growth opportunities. Here are some key points that highlight the significance of interest expense:

- Debt Financing: Many companies rely on debt financing to fund their operations and growth initiatives. Interest expense reflects the cost associated with this debt, which can include interest payments on loans, bonds, or credit facilities. A higher interest expense may indicate higher levels of debt or higher interest rates, affecting a company’s profitability and cash flow.

- Financial Stability: The level of interest expense can provide insights into a company’s financial stability. If interest expenses are too high relative to its revenue or earnings, it may signify that the company is heavily burdened by debt obligations. This can pose a risk to the company’s financial health, as excessive interest expenses may hinder its ability to invest in growth opportunities or meet other financial obligations.

- Capital Structure: Interest expense is closely tied to a company’s capital structure. By comparing interest expenses with equity and debt levels, investors and analysts can assess the company’s leverage and risk profile. A company with a higher interest expense in relation to its equity may have a higher financial risk, as it relies more heavily on debt to finance its operations.

- Investor Attractiveness: Interest expense is a key consideration for potential investors. High interest expenses may result in lower profitability or cash flow for the company, impacting its ability to provide returns to shareholders. Investors analyze interest expenses to assess the company’s financial stability and determine whether it is a sound investment opportunity.

Overall, understanding the significance of interest expense provides important insights into a company’s financial position, debt management, and overall financial stability. It helps investors and analysts evaluate a company’s ability to generate profits, manage debt, and make informed investment decisions.

Next, let’s explore how interest expense is reported on the cash flow statement.

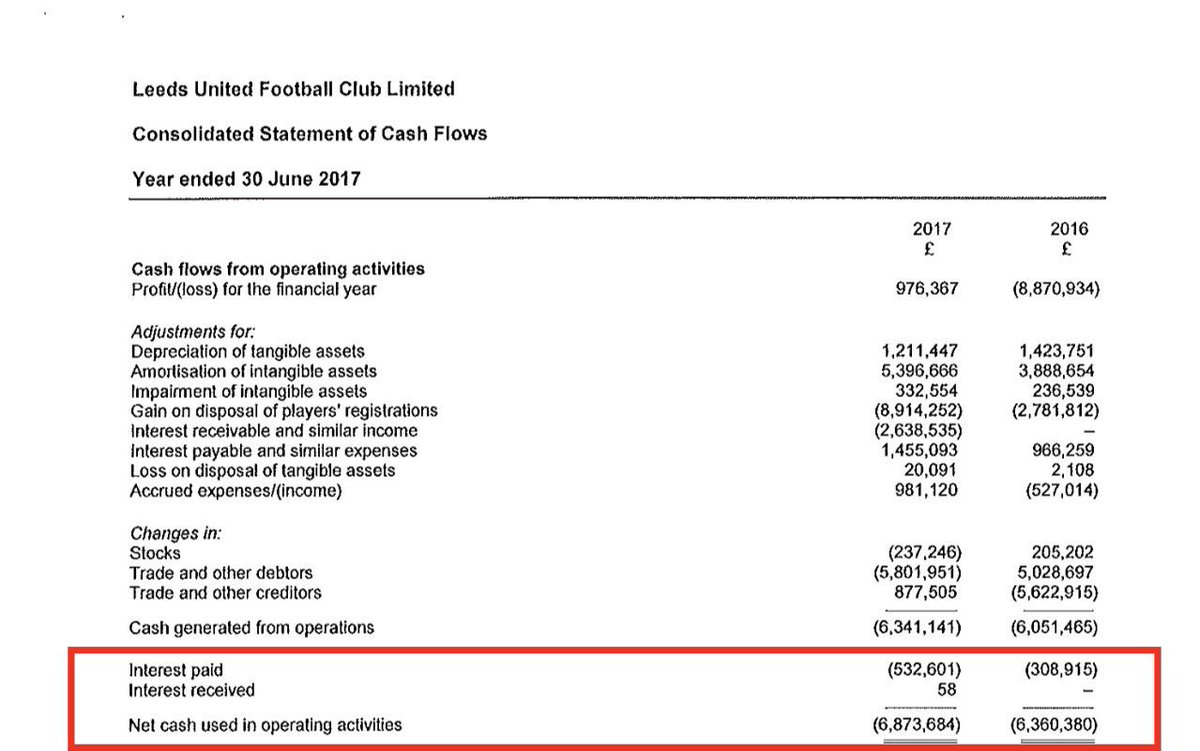

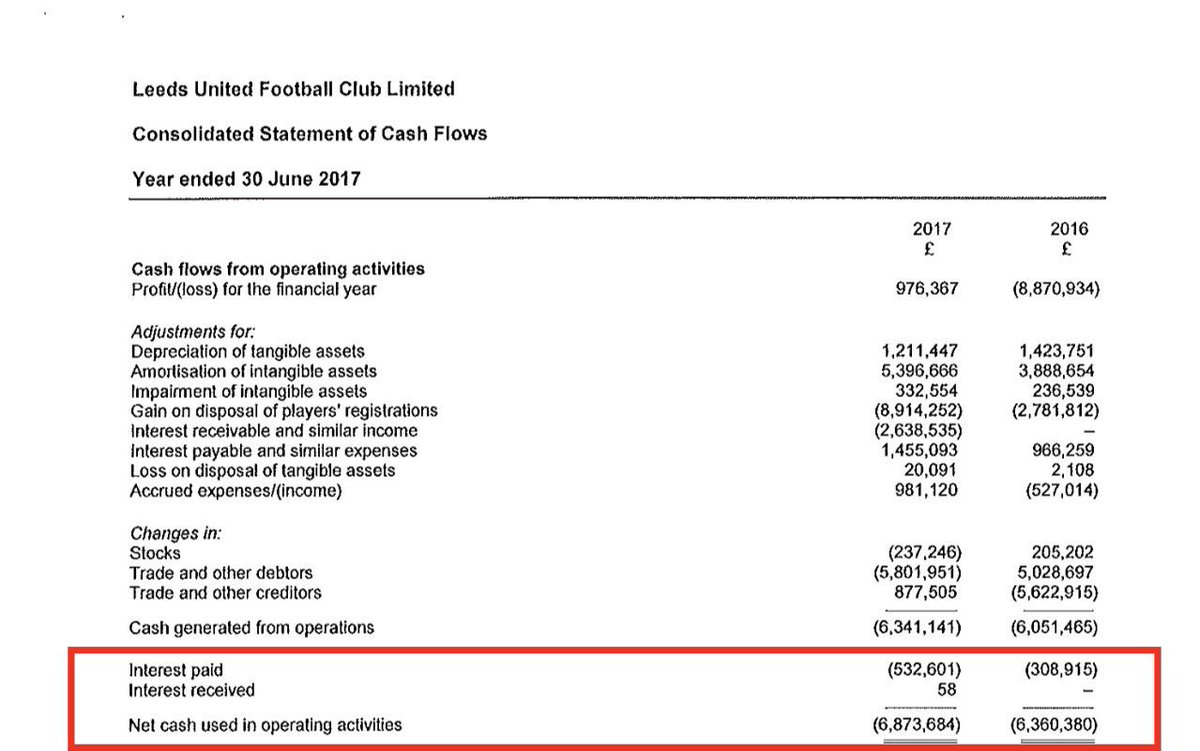

Reporting Interest Expense on the Cash Flow Statement

On the cash flow statement, interest expense is reported within the financing activities section. This section outlines cash inflows and outflows related to a company’s financing, including debt repayments, issuance of debt, dividend payments, and interest payments.

Interest expense is classified as an outflow of cash, as it represents the payment of interest on borrowed funds. It is typically listed as a separate line item under the financing activities section, alongside other relevant financing activities.

When preparing the cash flow statement, the interest expense is determined by reviewing the company’s income statement and identifying the interest paid or accrued during the reporting period. This can include interest on loans, bonds, or other forms of debt.

It is important to note that interest expense is distinct from interest income, which represents the interest earned on investments or loans made by the company. Interest income is typically categorized as an inflow within the operating activities or investing activities section, depending on the nature of the underlying transaction.

By explicitly reporting interest expense on the cash flow statement, investors and analysts can assess the magnitude and impact of interest payments on a company’s overall cash flow position. It helps provide transparency regarding the company’s financing activities and its ability to meet its debt obligations.

Now that we understand how interest expense is reported on the cash flow statement, let’s explore the key differences between operating and financing activities.

Differentiating between Operating and Financing Activities

On the cash flow statement, it is important to differentiate between operating activities and financing activities. This distinction helps provide clarity on the sources and uses of cash within a company’s financial operations. Let’s explore the key differences between these two categories:

- Operating Activities: Operating activities refer to the day-to-day cash inflows and outflows directly related to a company’s core operations. These activities are essential for generating revenue and sustaining the business. Examples of cash inflows from operating activities include customer payments, interest or dividend income, and cash rebates. Cash outflows in this category typically include payments to suppliers, wages and salaries, taxes, and interest expenses.

- Financing Activities: Financing activities encompass cash inflows and outflows related to a company’s capital structure and its sources of external funding. These activities involve borrowing, repaying debt, issuing equity, and paying dividends. Cash inflows from financing activities can include proceeds from issuing bonds or shares, new loans, or investments from shareholders. Cash outflows may include debt repayments, dividend payments, share buybacks, or interest payments.

The key distinction between operating and financing activities lies in their nature and purpose. Operating activities focus on the day-to-day cash flows required to maintain and grow the business, while financing activities pertain to cash flows associated with capital structure, debt management, and raising external funding.

By separating operating and financing activities on the cash flow statement, investors and analysts can gain insights into how a company generates cash from its core operations and how it manages its financial obligations. Additionally, this differentiation helps in assessing a company’s cash flow stability, profitability, and financial health.

Next, let’s explore how to calculate interest expense and its impact on the cash flow statement analysis.

Calculation of Interest Expense

Calculating interest expense involves reviewing a company’s financial records and income statement to identify the amount of interest paid or accrued during a specific period. The calculation is typically straightforward, but it may vary depending on the complexity of a company’s debt structure. Here’s a general approach to calculate interest expense:

- Gather Financial Information: Start by collecting the necessary financial information, including the company’s income statement and any additional records related to interest-bearing debt or loans.

- Identify Interest-Bearing Debt: Review the company’s debt obligations and identify the loans, bonds, or credit facilities that incur interest expenses. This can include long-term loans, lines of credit, or outstanding bonds.

- Determine Interest Rate: Identify the interest rate associated with each interest-bearing debt. This information can usually be found in the loan agreement or bond prospectus.

- Calculate Interest Expense: Multiply the outstanding principal balance of each interest-bearing debt by the applicable interest rate to calculate the interest expense for the given period. For example, if a company has a $1 million loan with an annual interest rate of 5%, the interest expense for a year would be $50,000.

- Aggregate Interest Expenses: Sum up the interest expenses for all interest-bearing debts to determine the total interest expense for the period.

It is important to note that interest expense may also include other costs associated with borrowing, such as bank fees or commitment fees. These additional costs should be included in the calculation when applicable.

Once the interest expense is calculated, it can be reported as a separate line item under the financing activities section of the cash flow statement. This helps investors and analysts understand the impact of interest payments on the company’s cash flows and financial performance.

Now that we know how interest expense is calculated, let’s explore the impact of interest expense on cash flow statement analysis.

Impact of Interest Expense on Cash Flow Statement Analysis

The inclusion of interest expense on the cash flow statement has a significant impact on the analysis of a company’s financial performance and cash flow position. Here are some key points to consider when evaluating the impact of interest expense:

- Cash Flow from Financing Activities: Interest expense is classified as a cash outflow within the financing activities section of the cash flow statement. It represents the company’s use of cash to meet its debt obligations. A high interest expense can indicate a greater cash outflow, potentially affecting the company’s ability to generate positive cash flow or invest in growth opportunities.

- Debt Management and Financial Stability: The level of interest expense provides insights into a company’s debt management and overall financial stability. High interest expenses relative to revenue or earnings may suggest that the company is heavily burdened by debt obligations. This can increase financial risk and impact the company’s long-term viability.

- Profitability and Cash Flow Analysis: Interest expense reduces a company’s profitability by increasing its operating costs. When analyzing the cash flow statement, it is important to consider the impact of interest expense on the company’s net income and cash flow from operating activities. A high interest expense can negatively affect profitability and limit the amount of cash available for reinvestment or distribution to investors.

- Ability to Meet Debt Obligations: Interest expense is indicative of a company’s ability to meet its debt obligations. If the interest expense is higher than the company’s operating cash flow, it may be an indication of financial distress or an unsustainable debt burden. Investors and creditors closely monitor the relationship between interest expense and operating cash flow to assess a company’s ability to fulfill its financial commitments.

- Debt-to-Equity Ratio: Interest expense is influential in determining a company’s capital structure and debt-to-equity ratio. Higher interest expenses relative to equity can indicate higher financial risk, as it suggests a heavier reliance on debt financing. This ratio is important for investors and creditors to assess the company’s leverage and evaluate its financial health.

In summary, analyzing interest expense on the cash flow statement provides valuable insights into a company’s financial position, debt management, and overall financial health. It helps investors and analysts understand the impact of interest payments on cash flow, profitability, and the company’s ability to meet its financial obligations.

Now, let’s conclude our discussion on interest expense and its portrayal on the cash flow statement.

Conclusion

The cash flow statement is a fundamental financial statement that provides invaluable insights into a company’s cash generation and utilization. Within this statement, interest expense holds a significant role in evaluating a company’s financial health and performance.

Interest expense represents the cost of borrowing funds and is reported in the financing activities section of the cash flow statement. By understanding how interest expense is calculated and its impact on cash flows, investors and analysts can gain a deeper understanding of a company’s financial position.

The significance of interest expense goes beyond its representation on the cash flow statement. It provides insights into a company’s debt financing strategies, financial stability, and debt management practices. A high interest expense relative to revenue or earnings may indicate increased financial risk and affect a company’s profitability and cash flow.

Analyzing interest expense alongside other components of the cash flow statement allows for a comprehensive assessment of a company’s liquidity, ability to meet debt obligations, and overall financial performance. It provides a clearer picture of the sources and uses of cash within the organization.

In summary, interest expense on the cash flow statement serves as a crucial indicator of a company’s financial health. It aids investors and analysts in evaluating a company’s debt management, profitability, and ability to generate cash flow to support its operations and fulfill its financial obligations.

By considering the impact of interest expense, investors and analysts can make more informed decisions and assess the long-term viability and sustainability of a company.

Now armed with a deeper understanding of interest expense and its portrayal on the cash flow statement, investors and analysts can better navigate the realm of finance and make sound investment decisions.