Finance

How Much Is Auto Insurance In Texas?

Modified: February 21, 2024

Learn about the cost of auto insurance in Texas and how it can impact your finances. Get the information you need to make an informed decision.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Factors Affecting Auto Insurance Rates in Texas

- Minimum Auto Insurance Requirements in Texas

- Average Auto Insurance Rates in Texas

- Comparison of Auto Insurance Rates in Different Texas Cities

- Tips for Finding Affordable Auto Insurance in Texas

- Additional Factors to Consider When Choosing Auto Insurance in Texas

- Conclusion

Introduction

When it comes to owning a vehicle in Texas, auto insurance is a mandatory and essential requirement. Auto insurance provides financial protection in the event of an accident, theft, or damage to your vehicle. However, the cost of auto insurance can vary significantly based on various factors. Understanding the factors that influence auto insurance rates in Texas can help you make informed decisions and find the most affordable coverage.

There are several key factors that insurance companies take into consideration when determining the cost of auto insurance in Texas. These factors include:

- Driving Record: A clean driving record with no accidents or violations can result in lower insurance premiums, as it demonstrates responsible driving behavior.

- Age and Gender: Younger, less experienced drivers, are considered higher risk and may face higher insurance rates. Additionally, statistically, males tend to have higher accident rates, which can affect insurance premiums.

- Type of Vehicle: The make, model, and year of your vehicle can impact your insurance rates, as more expensive or high-performance cars may cost more to insure.

- Location: Where you live in Texas can also influence insurance rates. Urban areas typically have higher rates due to factors such as traffic congestion and higher likelihood of accidents or theft.

- Credit History: Insurance companies often consider your credit score when determining rates, as it’s believed that those with better credit are more likely to be responsible drivers.

It’s important to note that these factors are just a few examples, and insurance companies may consider additional criteria when calculating premiums. Additionally, Texas has specific minimum insurance requirements that all drivers must meet.

In Texas, all drivers must carry auto liability insurance with the minimum coverage limits set by the state. The minimum requirements include:

- $30,000 bodily injury liability coverage per person

- $60,000 bodily injury liability coverage per accident

- $25,000 property damage liability coverage per accident

These minimum coverage limits are in place to ensure that drivers have some level of financial protection in case of an accident. However, it’s worth noting that these minimum requirements may not provide sufficient coverage for all situations. For individuals with valuable assets or a higher risk profile, carrying additional coverage beyond the state minimums is usually advisable.

In the following sections, we’ll explore the average auto insurance rates in Texas, compare rates in different cities, and provide tips on finding affordable auto insurance in the Lone Star State.

Factors Affecting Auto Insurance Rates in Texas

Auto insurance rates in Texas are influenced by a variety of factors. Insurance companies take these factors into consideration when determining your premiums. Understanding these factors can help you better navigate the insurance market and find the most competitive rates. Here are some key factors that can impact your auto insurance rates in Texas:

- Driving Record: Your driving record has a significant impact on your insurance rates. Insurance companies assess your history of accidents, traffic violations, and claims. Drivers with clean records typically enjoy lower premiums, while those with a history of accidents and violations may face higher rates.

- Age and Gender: Younger drivers, especially teenagers, often face higher insurance rates due to their lack of driving experience. Similarly, statistics show that male drivers tend to have more accidents than female drivers, resulting in higher premiums for males.

- Type of Vehicle: The make, model, and year of your vehicle can affect your insurance rates. Insurance companies consider factors such as the cost of repairs, likelihood of theft, and safety features of the vehicle. Expensive, high-performance, or luxury vehicles usually result in higher insurance premiums.

- Location: Where you live plays a significant role in determining your insurance rates. Urban areas with higher traffic congestion and crime rates tend to have higher premiums compared to rural areas. Additionally, specific neighborhoods or zip codes within a city can have a notable impact on rates.

- Credit History: In many states, including Texas, insurance companies can factor in your credit history when setting premiums. Studies show that individuals with poor credit are more likely to file claims, resulting in higher rates. Maintaining a good credit score shows responsible financial behavior and can help you secure lower insurance rates.

- Marital Status: Married individuals usually enjoy lower insurance rates compared to single individuals. Statistics show that married individuals are perceived as more responsible and less likely to engage in risky driving behavior.

- Deductibles and Coverage Limits: The deductible and coverage limits you choose also affect your insurance rates. A higher deductible means you’ll pay more out of pocket in the event of a claim but can result in lower premiums. Likewise, higher coverage limits typically lead to higher premiums.

These factors are not exhaustive, and insurance companies may consider additional variables when calculating premiums. It’s essential to provide accurate information to insurance companies during the application process to ensure you receive an accurate rate quote.

Keep in mind that while these factors influence your insurance rates, not all insurance companies weigh them equally. Each company has its own proprietary rating systems and underwriting guidelines, meaning that rates can vary significantly between insurers. It’s advisable to shop around and compare quotes from multiple providers to find the best coverage at the most affordable price.

Minimum Auto Insurance Requirements in Texas

When it comes to auto insurance in Texas, all drivers are required to comply with minimum coverage requirements mandated by the state. It’s important to understand these requirements to ensure you have the necessary insurance protection. The minimum auto insurance requirements in Texas include:

- $30,000 bodily injury liability coverage per person: This coverage is meant to provide financial protection for injuries or death to a single individual in an accident caused by the insured driver. It helps cover medical expenses, lost wages, and other related costs.

- $60,000 bodily injury liability coverage per accident: This coverage is designed to provide compensation for injuries or death to multiple individuals in an accident caused by the insured driver. It helps cover medical expenses, lost wages, and other related costs.

- $25,000 property damage liability coverage per accident: This coverage takes care of the cost of repairing or replacing another person’s property, such as their vehicle or other damaged structures, if you are at fault in an accident.

These minimum requirements are often abbreviated as 30/60/25.

It’s important to note that these minimum coverage limits ensure some level of financial protection for drivers in the event of an accident. However, they may not provide sufficient coverage for all situations, especially if the damages exceed these limits. In such cases, you could be personally responsible for any additional costs beyond your insurance coverage, which could lead to significant financial repercussions.

To further protect yourself, it’s recommended to consider additional coverage options such as:

- Uninsured/Underinsured Motorist Coverage: This coverage helps protect you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage to fully compensate for your injuries or damages.

- Comprehensive Coverage: This coverage protects against non-collision events such as theft, vandalism, natural disasters, or damage caused by hitting an animal.

- Collision Coverage: This coverage helps pay for repairs to your vehicle if it’s damaged in a collision, regardless of who is at fault.

- Medical Payments Coverage: This coverage provides compensation for medical expenses for you and your passengers, regardless of who is at fault in an accident.

It’s essential to carefully review your coverage options and consider your specific needs before making a decision. While the minimum legal requirements provide a baseline, enhancing your coverage can offer additional peace of mind and protection.

Remember to consult with an insurance professional who can guide you through the process and help you select the right coverage options based on your unique circumstances and budget.

Average Auto Insurance Rates in Texas

Auto insurance rates in Texas can vary significantly based on several factors, including your location, driving record, age, and the type of vehicle you drive. It’s important to have an understanding of the average auto insurance rates in Texas to make informed decisions and seek the most competitive premiums.

According to the latest data, the average annual auto insurance premium in Texas is around $1,300 for full coverage. However, it’s important to note that this is just an average, and individual rates may be higher or lower depending on various factors. Keep in mind that these rates are subject to change and can fluctuate over time.

When determining auto insurance rates in Texas, insurance companies take into account the state’s high population density, traffic congestion, and relatively high accident rates. Urban areas like Houston, Dallas, and San Antonio generally have higher premiums compared to rural areas due to more significant risks associated with densely populated regions.

Additionally, the specific coverage options and limits you choose will affect your insurance rates. Full coverage, which includes liability, comprehensive, and collision coverage, tends to be more expensive than minimum coverage. However, the extra protection it provides can be valuable if you’re involved in a severe accident or if your vehicle is stolen or damaged by a non-collision event.

Other factors, such as your age and driving experience, can also impact the cost of insurance. Younger drivers, especially teen drivers, often face higher premiums due to their higher risk profile and lack of driving experience. Additionally, drivers with a history of accidents or traffic violations may also face higher rates compared to drivers with a clean record.

It’s important to note that the average auto insurance rates mentioned here are just a guide. To get a more accurate estimate of premium costs, it’s best to obtain personalized quotes from insurance providers. By comparing quotes from multiple companies, you can find the most competitive rates that match your specific circumstances.

Remember, while cost is an essential factor, it shouldn’t be the sole consideration when choosing auto insurance. It’s crucial to weigh factors such as coverage options, customer service, and the financial stability of the insurance company. By evaluating all these factors, you can find the right balance between affordability and quality coverage that meets your needs and provides peace of mind on the roads of Texas.

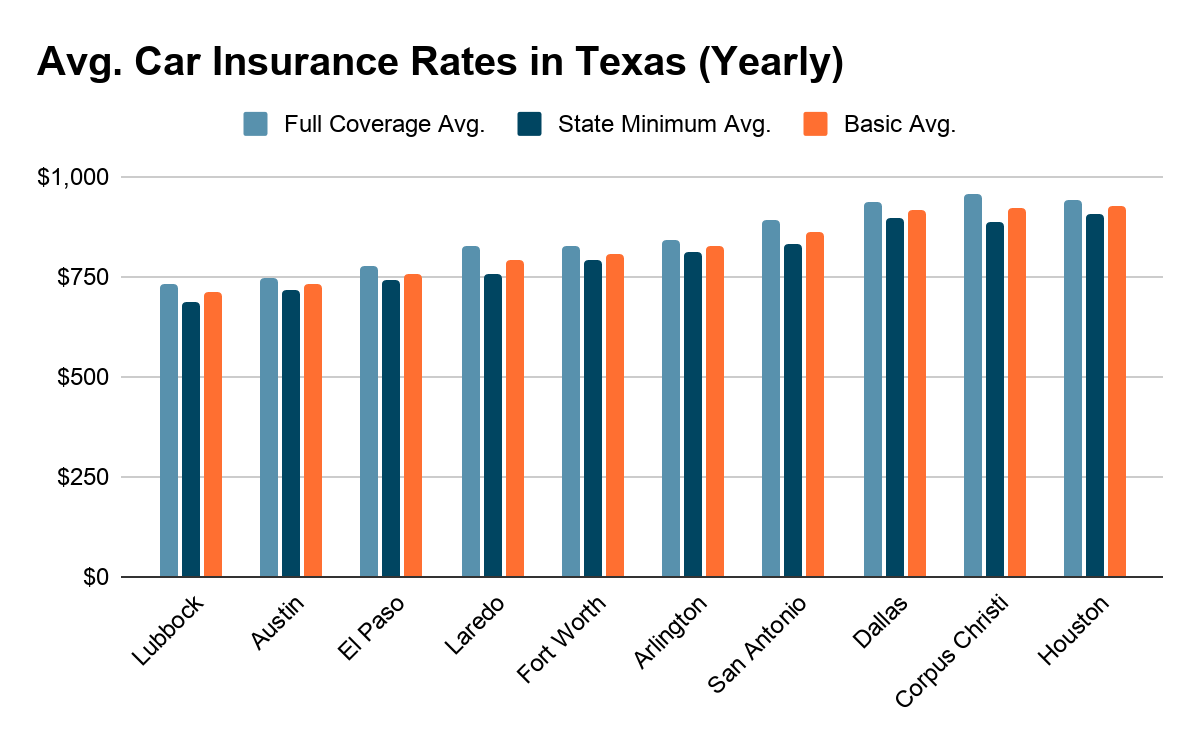

Comparison of Auto Insurance Rates in Different Texas Cities

Auto insurance rates in Texas can vary significantly from one city to another. Factors such as population density, traffic congestion, crime rates, and local regulations can impact insurance premiums in different areas. It’s important to understand these variations to get a better idea of what to expect in terms of insurance costs in different Texas cities.

When comparing auto insurance rates, it’s essential to keep in mind that these rates are influenced by individual factors such as driving record, age, vehicle type, and coverage options. However, looking at the average rates in specific cities can provide a general idea of the cost differences among different regions.

Here is a comparison of auto insurance rates in select Texas cities:

- Houston: Houston is the largest city in Texas and typically has higher auto insurance rates compared to other cities. The average annual premium in Houston can range from $1,500 to $2,000 or more depending on individual factors.

- Dallas: Dallas, another major metropolitan area, also tends to have higher insurance rates. On average, drivers in Dallas can expect to pay between $1,400 and $1,800 per year for auto insurance.

- Austin: Austin, the state capital, generally has lower insurance rates compared to Houston and Dallas. The average annual premium in Austin may range from $1,200 to $1,500.

- San Antonio: San Antonio, known for its rich history and vibrant culture, falls in the mid-range when it comes to auto insurance rates in Texas. The average annual premium in San Antonio can vary from $1,300 to $1,700.

- Fort Worth: Fort Worth, located adjacent to Dallas, typically has insurance rates similar to its neighboring city. Drivers in Fort Worth can expect to pay an average annual premium of $1,400 to $1,800.

It’s important to note that these are just general estimates and individual rates can vary based on personal circumstances. Additionally, these rates are subject to change over time as factors such as local market conditions and insurance company policies evolve.

When comparing insurance rates in different cities, it’s advisable to obtain personalized quotes from multiple insurance providers. This will give you a more accurate picture of the costs you can expect based on your specific factors and coverage preferences.

Remember, while cost is an important consideration, it’s crucial to also evaluate the coverage options, customer service, and reputation of the insurance company. By finding the right balance between affordability and quality coverage, you can ensure you have reliable protection on the roads of any Texas city.

Tips for Finding Affordable Auto Insurance in Texas

Auto insurance is an essential expense for all drivers in Texas, but that doesn’t mean you have to break the bank to get adequate coverage. Here are some tips to help you find affordable auto insurance in the Lone Star State:

- Shop Around: Don’t settle for the first insurance quote you receive. Take the time to shop around and get quotes from multiple insurance providers. This allows you to compare prices and find the most competitive rates.

- Bundle Your Policies: Many insurance companies offer discounts if you bundle your auto insurance with another policy, such as homeowners or renters insurance. Consolidating your policies with one provider can lead to significant savings.

- Consider Higher Deductibles: Increasing your deductibles can lower your monthly premium. However, remember that you’ll need to pay the higher deductible out of pocket if you file a claim, so make sure you can comfortably afford the increased deductible amount.

- Keep a Clean Driving Record: Maintaining a good driving record is crucial for keeping your insurance rates down. Avoid accidents, traffic violations, and claims as they can cause your premiums to increase.

- Take Advantage of Discounts: Inquire about available discounts. Insurance companies often offer various discounts such as safe driver discounts, good student discounts, or discounts for completing a defensive driving course. Make sure to ask about any discounts you may qualify for.

- Consider Usage-Based Insurance: Usage-based insurance programs, such as programs that track your driving behavior through a mobile app or a plug-in device, can result in lower premiums for safe drivers who drive fewer miles.

- Improve Your Credit Score: In states where it’s allowed, insurance companies consider credit history when determining rates. Improving your credit score by paying bills on time and reducing debt can potentially lower your insurance premiums.

- Review and Update Your Policy Regularly: As your circumstances change, such as getting married or moving to a new location, review your policy and update the information with your insurance provider. These changes can impact your rates and you may be eligible for new discounts.

Remember, while finding affordable auto insurance is important, it’s equally crucial to ensure you have adequate coverage to protect yourself financially. Don’t sacrifice necessary coverage just to save a few dollars. Evaluate your needs, consider your budget, and strike a balance between affordability and sufficient protection.

By following these tips and conducting thorough research, you can find affordable auto insurance in Texas without compromising on quality coverage.

Additional Factors to Consider When Choosing Auto Insurance in Texas

Choosing the right auto insurance in Texas involves more than just finding affordable rates. It’s important to consider several additional factors that can impact your overall experience and coverage. By taking these factors into account, you can make an informed decision and select the best auto insurance for your needs:

- Financial Stability of the Insurance Company: Evaluate the financial strength and stability of the insurance company you are considering. This ensures they have the resources to fulfill their obligations and pay out claims in a timely manner.

- Customer Service and Reputation: Research the reputation of the insurance company for customer service and claims handling. Read reviews and check ratings from independent sources to gauge the experiences of other policyholders.

- Claims Process: Consider the efficiency and ease of the claims process. Look for an insurance company that has a user-friendly claims reporting system, quick response times, and a reputation for fair settlement practices.

- Coverage Options and Limits: Evaluate the different coverage options offered by the insurance company. Assess your specific needs and ensure that the company provides the necessary coverage for your circumstances, such as comprehensive, collision, and uninsured/underinsured motorist coverage.

- Discounts and Rewards: Inquire about the available discounts and rewards programs offered by the insurance company. Reliable insurers often provide various discounts such as multi-policy discounts, good driver discounts, and discounts for safety features installed in your vehicle.

- Online Access and Mobile Apps: Consider the digital tools and resources offered by the insurance company. Online access to policy information, payment options, and a user-friendly mobile app can greatly enhance your convenience and overall experience.

- Network of Repair Shops: Find out if the insurance company has a network of preferred repair shops or if they allow you to choose your own. Having access to trusted repair facilities can expedite the claims process and ensure quality repairs.

- Annual or Monthly Premiums: Consider whether you prefer to pay your premiums annually or monthly. Some companies offer discounts for paying annually, while others may offer convenient monthly payment plans. Choose the payment method that best aligns with your budget and financial preferences.

By carefully considering these factors, you can make an informed decision and select an auto insurance policy that not only meets the legal requirements but also provides the coverage, service, and peace of mind you desire. Remember to thoroughly research and compare different insurance providers to find the best fit for your unique needs and circumstances.

Conclusion

Auto insurance is a vital aspect of owning a vehicle in Texas. It provides financial protection and peace of mind in the event of accidents, theft, or damages. As you navigate the insurance market, it’s crucial to consider various factors that can influence your rates and coverage options.

Factors such as your driving record, age, location, type of vehicle, and credit history play significant roles in determining your auto insurance rates. Understanding these factors can help you anticipate costs and make informed decisions.

Additionally, it’s important to comply with the minimum auto insurance requirements set by the state of Texas. These requirements ensure that drivers have a baseline level of financial protection, but it’s often advisable to consider additional coverage options to adequately safeguard your assets.

When searching for auto insurance, take the time to shop around and compare quotes from different insurers. Consider bundling policies, opting for higher deductibles, and taking advantage of available discounts to find affordable premiums. However, cost shouldn’t be the only consideration. Evaluate the reputation, customer service, claims process, and coverage options of insurance companies before making your decision.

Finally, remember that auto insurance rates can vary significantly between different Texas cities. Factors such as population density, traffic congestion, and local demographics can impact premiums. When comparing rates, be sure to obtain personalized quotes based on your specific circumstances and needs.

By considering these factors and following the tips outlined in this article, you can find the most affordable auto insurance in Texas without compromising on coverage or quality. Ensure that you have adequate financial protection while enjoying the privilege of driving on the roads of the Lone Star State.