Finance

How Much Is D&O Insurance?

Published: November 10, 2023

Looking for D&O Insurance? Find out how much it costs and protect your finances with comprehensive coverage.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Factors Influencing the Cost of D&O Insurance

- Coverage Options and their Pricing

- Importance of Tailored Coverage

- Comparison of D&O Insurance Costs from Different Providers

- Understanding Policy Limits and Deductibles

- Additional Considerations and Endorsements

- Ways to Lower D&O Insurance Premiums

- Conclusion

Introduction

Directors and officers (D&O) insurance is a crucial component of risk management for companies, offering protection to individuals serving in key executive roles. With the increasing complexity of corporate governance and the rise in shareholder litigation, D&O insurance has become essential for companies of all sizes.

This article will dive into the factors that influence the cost of D&O insurance, the different coverage options available, and the importance of tailored coverage. We will also discuss how to compare D&O insurance costs from different providers, understand policy limits and deductibles, consider additional endorsements, and explore ways to lower premiums.

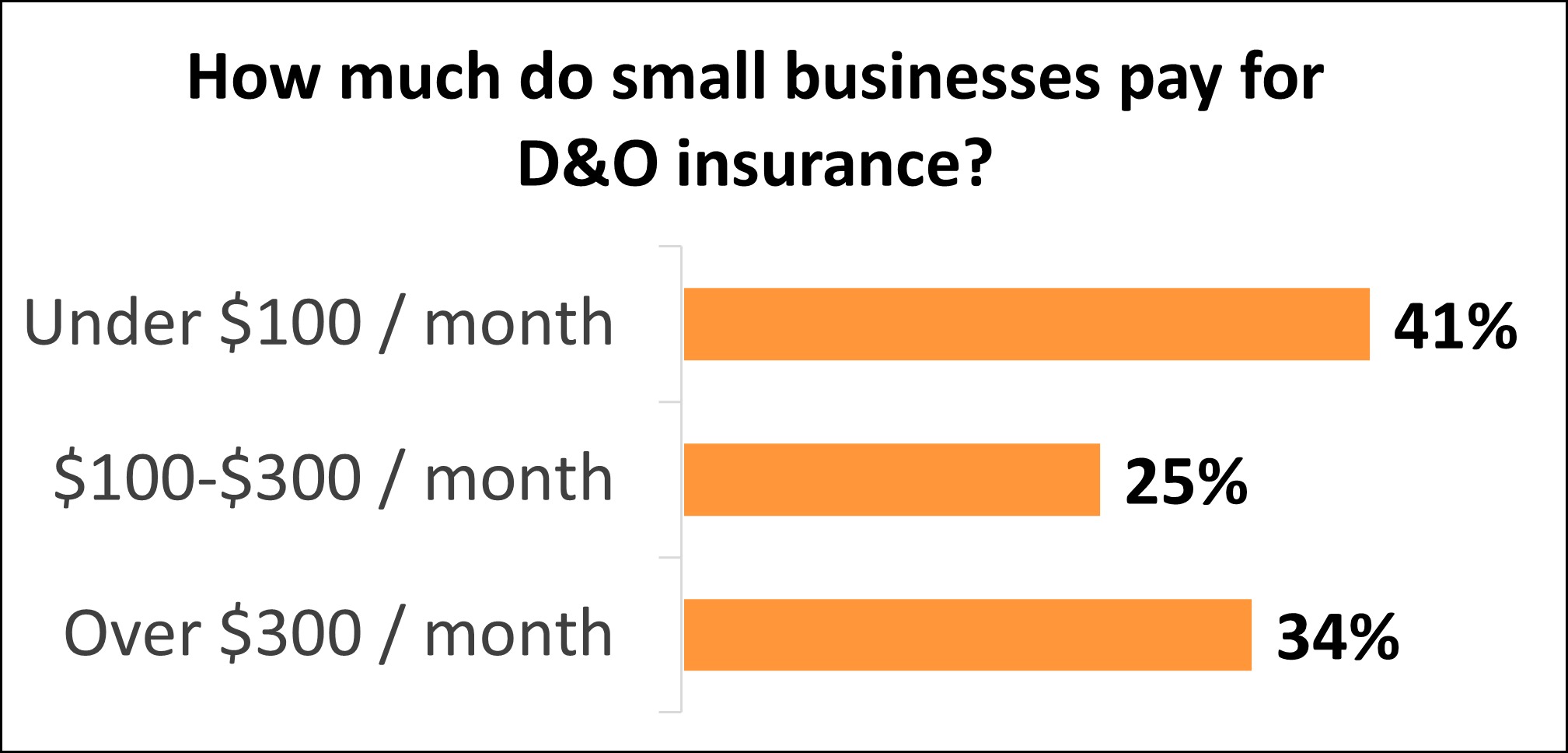

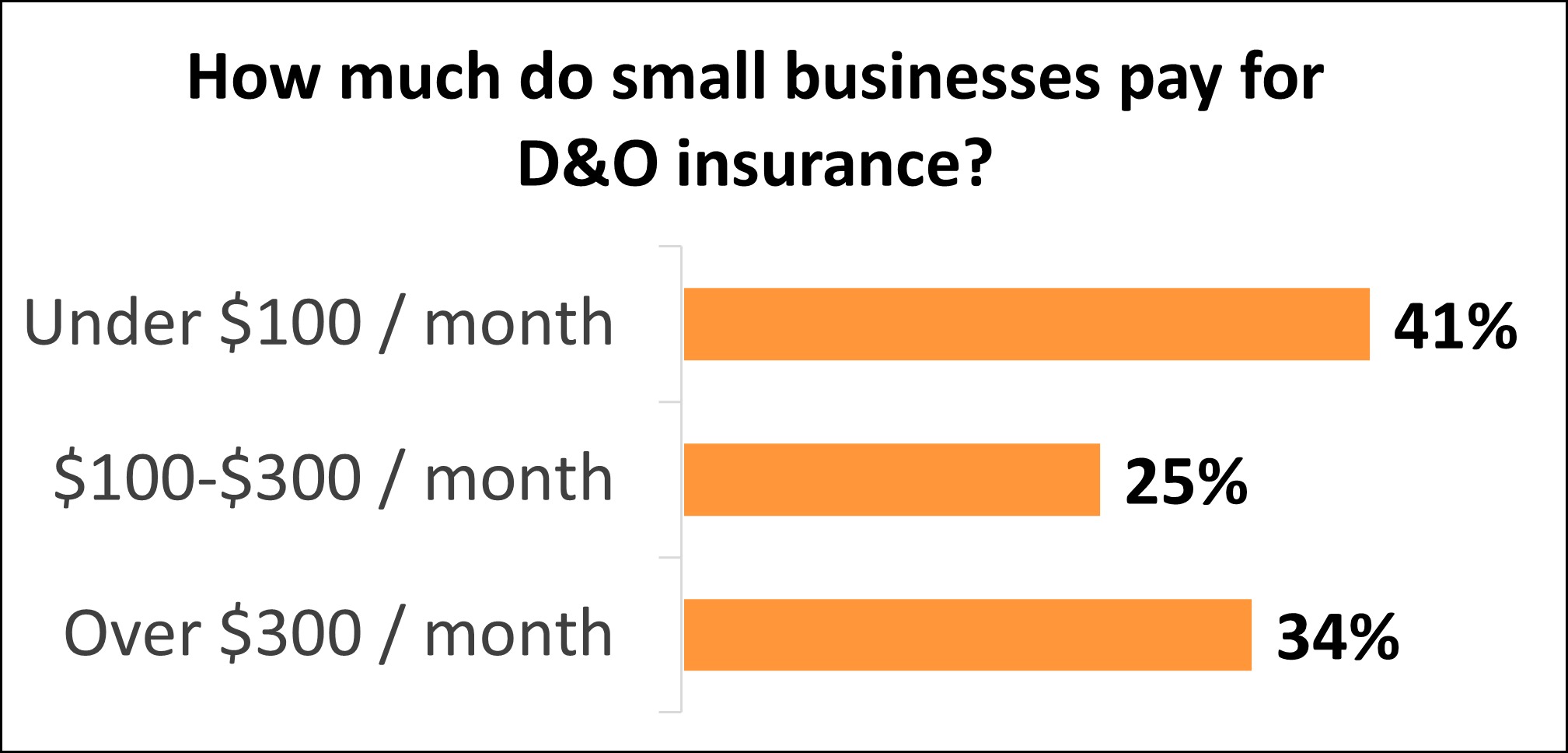

It’s important to note that the cost of D&O insurance can vary significantly depending on a variety of factors, including the size and type of the company, industry risks, claims history, and the chosen coverage limits. Understanding these factors will help businesses make informed decisions when it comes to obtaining D&O insurance with optimal coverage at a competitive price.

Before delving into the specifics of D&O insurance costs, it’s crucial to understand what D&O insurance is and why it is necessary. D&O insurance offers financial protection to directors and officers against potential legal actions brought against them personally for alleged wrongful acts committed in their roles. These wrongful acts can include misrepresentation, breach of fiduciary duty, negligence, or errors in judgment that result in financial losses for stakeholders.

The primary purpose of D&O insurance is to safeguard the personal assets of directors and officers, providing coverage for legal defense costs, settlements, and judgments. Without this coverage, directors and officers would bear the financial burden of legal expenses, which can be substantial and potentially devastating.

D&O insurance not only protects individual directors and officers but also helps attract and retain qualified individuals for these positions. Knowing they have insurance coverage in place, directors and officers can perform their duties with confidence, knowing they have a safety net in case of legal action.

Factors Influencing the Cost of D&O Insurance

The cost of D&O insurance can vary based on several factors that insurers take into consideration when determining premiums. Understanding these factors can help businesses assess the potential cost of coverage and make informed decisions.

Company Size and Industry

The size and industry of the company play a significant role in determining the cost of D&O insurance. Larger companies with higher revenue and market capitalization tend to have higher premiums due to the increased risk exposure and potential for larger claims. Similarly, companies operating in high-risk industries, such as finance, healthcare, and technology, may face higher premiums due to the inherent risks associated with their operations.

Claims History

The claims history of a company is another important factor in determining D&O insurance costs. Insurers assess the likelihood of future claims based on past claims filed against the company and its directors and officers. Companies with a history of frequent or significant claims may face higher premiums as they are considered higher risk.

Company Financials

The financial stability and performance of a company can impact the cost of D&O insurance. Insurers examine the company’s financials, including revenue, assets, and debt levels, to assess its ability to manage risks and fulfill any potential claims. A financially robust company may be able to secure coverage at more favorable rates compared to a financially unstable company.

Board Composition

The composition of the board of directors can also influence the cost of D&O insurance. Insurers evaluate the experience and qualifications of directors, as well as their track record in risk management and compliance. A board with experienced directors who have a strong track record may present a lower risk profile and, thus, may secure coverage at more favorable rates.

Risk Management Practices

The risk management practices implemented by a company can impact the cost of D&O insurance. Insurers assess the company’s risk management protocols, including compliance measures, internal controls, and corporate governance practices. A robust risk management framework can demonstrate a company’s commitment to minimizing risks, potentially leading to lower premiums.

Policy Coverage and Limits

The extent of coverage and the limits chosen for D&O insurance can also affect the premium cost. Companies with higher coverage limits may face higher premiums as they are requesting more extensive protection. Additionally, the inclusion of specific policy enhancements or endorsements may lead to increased premiums, though these additional coverages can provide valuable protection.

Keep in mind that these factors are not exhaustive, and other variables specific to the insurance market and individual circumstances may come into play when determining the cost of D&O insurance. It’s essential to work with an experienced insurance broker who can assess your company’s unique needs and help navigate the complexities of D&O insurance pricing.

Coverage Options and their Pricing

When it comes to D&O insurance, there are various coverage options available depending on the needs and risk profile of the company. Each coverage option comes with its own pricing structure, and understanding these options is crucial for obtaining the right coverage at a reasonable cost.

Side A Coverage

Side A coverage provides protection for individual directors and officers when the company cannot indemnify them. This coverage is vital in situations where the company is financially unable to fulfill its indemnification obligations or is legally prohibited from doing so. Side A coverage typically has higher premiums due to the increased risk it covers for individual directors and officers.

Side B Coverage

Side B coverage, also known as corporate reimbursement coverage, reimburses the company for the costs of indemnifying directors and officers. This coverage is important for companies that have a responsibility to indemnify their executives. Side B coverage is typically less expensive than Side A coverage as it offers protection primarily to the company, rather than individuals.

Side C Coverage

Side C coverage, also known as entity coverage, provides protection to the company itself for securities claims made against the organization. This coverage is specifically designed to protect the company from claims alleging securities law violations. Side C coverage pricing is impacted by factors such as the company’s industry, financials, and prior claims history.

Combined Coverage

Many D&O insurance policies provide a combined coverage that includes aspects of Side A, B, and C coverage. This comprehensive coverage option offers protection for both individuals and the company, and its pricing is typically structured to reflect the broader coverage provided.

Pricing based on Coverage Limits

The pricing of D&O insurance also varies based on the coverage limits chosen by the company. Higher coverage limits will result in higher premiums, as the insurer is taking on greater financial risk. It’s crucial to assess the potential exposure faced by the company when determining the appropriate coverage limits, ensuring adequate protection without unnecessary financial burden.

When evaluating coverage options and pricing, it’s vital to work closely with an experienced insurance broker who can analyze the specific needs of the company and recommend the most suitable coverage. Insurance brokers have access to multiple insurance carriers and can help companies secure competitive pricing by obtaining quotes from different providers.

While cost is an important consideration, it’s equally essential to prioritize the adequacy of coverage. Opting for a cheaper policy with limited coverage may leave the company and its directors and officers exposed to significant risks. Striking the right balance between coverage and cost is crucial to ensure comprehensive protection within a reasonable budget.

Importance of Tailored Coverage

When it comes to directors and officers (D&O) insurance, one size does not fit all. Companies must ensure that they have tailored coverage that meets their specific needs and risk profile. Off-the-shelf policies may not adequately protect the company and its executives, leaving them exposed to potential financial losses.

Customized Protection

Each company operates within a unique and dynamic business environment, facing industry-specific risks and challenges. Generic D&O insurance policies may not address these specific risks, potentially leaving gaps in coverage. Tailored coverage allows companies to customize their policies to account for these individual circumstances, ensuring comprehensive protection.

Addressing Industry Risks

Companies operating in high-risk industries, such as finance, healthcare, or technology, face specific regulatory challenges and legal exposures. Tailored D&O insurance can address these industry-specific risks by providing coverage for potential claims related to these unique challenges. Generic policies may not offer the necessary protection needed in these specialized sectors.

Unique Business Operations

Every company has its own unique set of operations, strategies, and risk management protocols. Tailored D&O insurance takes into account these specific business operations and associated risks. It can provide coverage for risks such as mergers and acquisitions, initial public offerings (IPOs), and international operations, ensuring that the company is protected in its day-to-day operations and growth initiatives.

Legal and Regulatory Compliance

Companies must adhere to a wide range of legal and regulatory requirements. Tailored D&O insurance can provide coverage for claims arising from allegations of non-compliance with laws, regulations, or industry standards. This coverage addresses the potential financial risks associated with regulatory investigations, fines, and legal proceedings, helping companies navigate compliance challenges.

Evolution of Risks

The business landscape is constantly evolving, and with it, the risks faced by companies and their executives. Tailored D&O insurance is designed to adapt to these changing risks, ensuring that the coverage remains relevant and effective. Regular policy reviews and updates can help identify emerging risks and adjust the coverage to adequately protect against them.

Working closely with an experienced insurance broker is crucial in obtaining tailored D&O insurance coverage. Insurance brokers have the knowledge and expertise to assess the specific needs and risk profile of a company and guide them in selecting appropriate coverage options. By understanding the unique challenges and operations of the company, insurance brokers can recommend policy enhancements and endorsements to provide a tailored and comprehensive insurance solution.

Investing in tailored D&O insurance not only provides peace of mind to directors and officers but also demonstrates a company’s commitment to risk management and protecting its key executives. By addressing the specific risks and challenges faced by the company, tailored coverage minimizes potential gaps in protection and ensures that the company and its executives are adequately safeguarded against any legal and financial risks that may arise.

Comparison of D&O Insurance Costs from Different Providers

When searching for directors and officers (D&O) insurance, it’s important to compare costs from different insurance providers. Each insurer may have a unique underwriting process, risk assessment, and pricing structure, which can lead to variations in premium costs. By comparing costs, companies can find the best coverage and pricing options that align with their needs and budget.

Obtain Multiple Quotes

One of the key steps in comparing D&O insurance costs is to obtain multiple quotes from different providers. Insurance brokers can help companies navigate the insurance market, access multiple carriers, and gather quotes tailored to their specific needs. Having multiple quotes allows companies to compare premiums, coverage limits, deductibles, and policy terms to make an informed decision.

Consider Policy Coverage and Exclusions

When comparing costs, it’s essential to consider the coverage and exclusions offered by different insurers. A lower premium may seem attractive, but if it comes with significant exclusions or limited coverage, it may not provide adequate protection. Carefully review each policy to ensure it covers the specific risks faced by the company and its directors and officers.

Evaluate Insurers’ Reputation and Financial Strength

While cost is an important factor, it’s equally important to consider the reputation and financial strength of the insurance providers. A reputable insurer with a strong financial rating is more likely to provide reliable coverage and be able to pay claims when needed. Research each insurer’s reputation, read reviews, and assess their financial stability before making a decision.

Review Policy Terms and Conditions

Insurance policies can vary in terms of conditions and requirements. When comparing costs, carefully review the policy terms and conditions provided by each insurer. Look for any onerous conditions, limitations, or requirements that may impact the coverage or claims process. Understanding the policy’s terms and conditions is crucial in ensuring that the coverage meets the company’s expectations and requirements.

Consider Additional Services and Support

Some insurance providers may offer additional services and support that can add value to the policy, even if it comes with a slightly higher premium. These may include risk management resources, legal assistance, and claims support. Consider the value-added services provided by each insurer to see if they align with the company’s needs and can contribute to a more comprehensive insurance solution.

Remember that cost should not be the sole determining factor when choosing D&O insurance. The goal is to find a balance between cost and coverage that best suits the company’s risk profile and budgetary constraints. A comprehensive assessment of the insurance providers, policy terms, and additional offerings will help companies make an informed decision and secure the best possible coverage at a competitive price.

Working with an experienced insurance broker can greatly simplify the comparison process, as they have the knowledge and expertise to analyze quotes, explain coverage options, and guide companies towards the most suitable D&O insurance policy. An insurance broker can assist in negotiating terms and pricing, ensuring that the company secures the most advantageous coverage at the best possible cost.

Understanding Policy Limits and Deductibles

When it comes to directors and officers (D&O) insurance, understanding policy limits and deductibles is crucial. These two elements play a significant role in shaping the coverage and cost of the insurance policy. Let’s take a closer look at policy limits and deductibles and how they impact D&O insurance.

Policy Limits

Policy limits refer to the maximum amount an insurance policy will pay for covered claims during the policy period. When purchasing D&O insurance, companies need to carefully consider the appropriate policy limits to ensure adequate coverage. Insufficient policy limits may expose the company and its officers to financial risk if a claim exceeds the coverage available.

The selection of policy limits should be based on the company’s size, industry, risk exposure, and potential legal liabilities. Companies with larger operations and greater risks may require higher policy limits to ensure comprehensive protection. It’s important to assess the potential financial impact of lawsuits, settlements, and legal defense costs when determining appropriate policy limits.

Moreover, policy limits are typically expressed as “per claim” and “aggregate” limits. The per claim limit represents the maximum amount payable for each individual claim, while the aggregate limit is the total amount available for all claims during the policy period.

Deductibles

Deductibles are the amount that the insured company must pay out of pocket before the insurance policy kicks in. Selecting a deductible involves striking a balance between the premium cost and the financial risk the company is willing to assume. A higher deductible usually results in a lower premium, while a lower deductible may increase the premium cost.

When evaluating deductibles, it’s essential to assess the financial capability of the company to cover the deductible in the event of a claim. A deductible that is too high may place a significant burden on the company’s finances. On the other hand, a low deductible may result in higher premiums, which could be a more cost-effective choice if the company anticipates frequent claims.

Deductibles can be structured on either a per claim or an aggregate basis. A per claim deductible means that the deductible applies to each individual claim, while an aggregate deductible means that the deductible applies to the total of all claims during the policy period.

Considerations for Policy Limits and Deductibles

When determining policy limits and deductibles, it’s crucial to consider the company’s risk appetite, financial capabilities, claims history, and potential exposure. Collaborating with an experienced insurance broker can help businesses navigate these considerations and make informed decisions that align with their unique circumstances.

It’s also important to review and reassess policy limits and deductibles regularly. As a company grows, operations change, and risks evolve, the insurance coverage should be adjusted accordingly. An annual review with an insurance broker allows companies to assess the adequacy of their coverage and make any necessary updates to policy limits and deductibles.

Understanding policy limits and deductibles is essential in tailoring D&O insurance coverage to meet the specific needs and risk tolerance of the company. Careful consideration of these elements ensures that the company and its directors and officers are adequately protected against potential legal liabilities while maintaining cost-effectiveness in insurance coverage.

Additional Considerations and Endorsements

When it comes to directors and officers (D&O) insurance, there are additional considerations and endorsements that can enhance the coverage and tailor it to the specific needs of the company. These considerations and endorsements provide extra protection and address unique risks that may not be covered under a standard policy.

Non-Profit D&O Insurance

Non-profit organizations have their own set of unique risks and challenges. Non-profit D&O insurance specifically caters to the needs of non-profit organizations, providing protection for board members, officers, and volunteers. This type of coverage can include coverage for allegations of mismanagement, regulatory actions, conflicts of interest, and employment practices liability.

Employment Practices Liability Insurance

Employment practices liability insurance (EPLI) is often included as an endorsement or as a standalone policy to protect against claims related to wrongful termination, discrimination, harassment, and other employment-related issues. This coverage can help safeguard the company and its directors and officers from costly legal proceedings and damages.

Cyber Liability Insurance

In today’s digital age, cyber risks pose a significant threat to companies of all sizes. Cyber liability insurance provides coverage for losses and expenses resulting from data breaches, cyber-attacks, and unauthorized access to sensitive information. This coverage can extend to cover liability claims arising from the failure to protect customer data and mitigate the financial impact of a cyber incident.

Entity Securities Coverage

Entity securities coverage extends the protection of D&O insurance to include claims related to violations of securities laws by the company itself. This endorsement provides coverage for claims brought by shareholders or regulatory authorities alleging false or misleading statements, stock manipulation, insider trading, or other securities law violations.

Defense Outside the Limit

A “defense outside the limit” endorsement separates the costs of legal defense from the policy limits. This means that the expenses incurred for legal defense are covered in addition to the policy limits, effectively providing more coverage for potential claims. This endorsement can be valuable in ensuring that defense costs do not erode the overall coverage available.

Policy Severability

A policy severability endorsement ensures that individual directors and officers are protected even if others may be subject to exclusions or policy limitations. This endorsement ensures that the actions or knowledge of one individual do not impact the coverage available to other insured individuals.

It is important to work closely with an experienced insurance broker to assess the specific needs and risks of the company and determine which additional considerations and endorsements are appropriate. The broker can guide companies through the process of selecting the most suitable endorsements and policy enhancements, ensuring comprehensive coverage tailored to the unique requirements of the business.

While additional considerations and endorsements may increase the cost of D&O insurance, they provide valuable coverage and protection against specific risks that may not be adequately addressed by a standard policy. It’s crucial to evaluate the potential exposure of the company and its directors and officers and weigh the benefits of these endorsements against the associated costs.

By exploring these additional considerations and endorsements, companies can enhance their D&O insurance coverage and mitigate potential risks, providing peace of mind to directors, officers, and stakeholders alike.

Ways to Lower D&O Insurance Premiums

Directors and officers (D&O) insurance is a vital component of risk management, but it can be costly for companies, especially those operating in high-risk industries. However, there are several strategies that businesses can employ to lower their D&O insurance premiums without compromising on the quality and adequacy of coverage.

1. Risk Management Practices

Implementing robust risk management practices can help demonstrate to insurers that the company takes risk mitigation seriously. This may include establishing strong corporate governance measures, conducting regular internal audits, implementing compliance programs, and maintaining transparent communication with stakeholders. By showcasing a commitment to risk management, companies may be viewed as lower risk, potentially resulting in lower premium costs.

2. Loss Control Measures

Take proactive measures to minimize potential claims and losses. This can be done through effective employee training programs, clear policies and procedures, regular reviews of internal controls, and maintaining an open and inclusive corporate culture that promotes ethical behavior and compliance. Insurers are more likely to offer competitive premiums to companies that demonstrate a strong commitment to loss control.

3. Claims History Review

Review your company’s claims history with the assistance of an insurance broker. Identifying any patterns or recurring issues that have led to past claims can help tailor the insurance policy to address those specific risks. By addressing these underlying issues, companies can present a more favorable claims history to insurers, potentially resulting in lower premiums.

4. Negotiate Policy Terms

Work closely with an experienced insurance broker to negotiate favorable policy terms and premiums. Insurance brokers have extensive knowledge of the insurance market and can leverage relationships with insurers to negotiate competitive pricing. Additionally, brokers can help companies assess and understand the nuances of policy terms and identify any potential areas for negotiation or customization.

5. Increase Deductibles

Consider increasing the deductible amount on the D&O insurance policy. A higher deductible typically translates to a lower premium. However, it’s essential to carefully assess the financial impact of a higher deductible and ensure that the company can comfortably afford to pay it in the event of a claim.

6. Review Policy Limits

Evaluate the adequacy of the policy limits and carefully assess the potential risk exposure faced by the company. Lowering policy limits may result in reduced premiums, but it should only be done if the coverage remains sufficient to protect the company and its directors and officers. Conduct a thorough review of the risks and their potential financial impact to determine the appropriate policy limits.

7. Seek Multiple Quotes

Obtain quotes from different insurance providers and compare their offerings. Insurance brokers can assist in this process, providing access to a wide range of insurers and helping companies secure competitive quotes. By exploring multiple options, businesses can leverage the competitive insurance market to find the best combination of coverage and pricing.

8. Review and Update Coverage Regularly

Regularly review and update the D&O insurance coverage to ensure it stays aligned with the current needs and risk profile of the company. As the business evolves, risks change, and coverage requirements may shift. Collaborate with an insurance broker to conduct periodic policy reviews and make any necessary adjustments to optimize coverage and mitigate unnecessary costs.

By implementing these strategies, companies can effectively lower their D&O insurance premiums while maintaining comprehensive coverage. Remember to work closely with an experienced insurance broker who can provide valuable guidance and negotiate on behalf of the company to secure the most advantageous coverage and pricing.

Conclusion

Directors and officers (D&O) insurance is a critical component of risk management for companies, offering protection to individuals serving in executive roles. Understanding the factors that influence the cost of D&O insurance, such as company size, industry, claims history, and risk management practices, is essential in obtaining coverage that meets the company’s needs.

When considering D&O insurance, it’s important to evaluate the coverage options and pricing from different insurance providers. By obtaining multiple quotes and working with an experienced insurance broker, companies can compare premiums, consider policy coverage and exclusions, and evaluate the reputation and financial strength of insurers.

Policy limits and deductibles are vital considerations in tailoring D&O insurance coverage. Careful assessment of the company’s risk appetite, financial capabilities, and potential exposure is necessary in determining appropriate policy limits and deductibles. Additionally, exploring additional considerations and endorsements, such as non-profit D&O insurance, cyber liability insurance, and entity securities coverage, can further enhance coverage based on the specific risks faced by the company.

Companies can also employ strategies to lower D&O insurance premiums without compromising on coverage quality. Implementing robust risk management practices, reviewing claims history, negotiating policy terms, and seeking multiple quotes are effective ways to secure competitive pricing. Regularly reviewing and updating coverage ensures it remains aligned with the evolving needs and risk profile of the company.

In conclusion, selecting the right D&O insurance coverage requires careful consideration of various factors. By understanding the intricacies of coverage options, policy limits, deductibles, and additional endorsements, companies can protect their directors, officers, and organizational interests while optimizing insurance costs. Working with knowledgeable insurance professionals is vital in navigating the complexities of D&O insurance and finding the most suitable coverage for the unique needs of the company.