Finance

How Often Does SWVXX Pay Dividends?

Published: January 3, 2024

SWVXX pays dividends on a regular basis. Explore the frequency of dividend payments and stay informed about the financial aspect of SWVXX.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on SWVXX dividends. SWVXX, short for the Schwab Value Advantage Money Fund, is a popular choice among investors looking to earn steady income from their investments. Dividends play a crucial role in the overall performance of any investment, and understanding the dividend payment frequency of SWVXX can help investors make informed decisions.

In this article, we will delve into the details of SWVXX dividends, exploring how often they are paid, the factors that influence dividend payments, and historical trends. Whether you are a novice investor or a seasoned professional, this article will provide you with the insights you need to optimize your investment strategy.

Dividends are a portion of a company’s earnings that are distributed to its shareholders. Investors often seek out dividend-paying investments as a means of generating regular income. The frequency of dividend payments varies from one investment to another, depending on several factors.

SWVXX is a money market mutual fund managed by Charles Schwab Investment Management, Inc. It aims to provide investors with a high level of current income while maintaining liquidity and preserving capital. As a money market fund, SWVXX invests primarily in short-term, high-quality debt securities.

Before diving into the specifics of SWVXX dividend payments, it’s important to understand the factors that influence dividend payments. These factors include the financial health of the company, profitability, cash flow, and management decisions. By assessing these factors, investors can gain insights into the sustainability and frequency of dividend payments.

In the next section, we will explore the dividend payment frequency of SWVXX and how it compares to other investment options. So, let’s dive in and uncover the dividend payout pattern of SWVXX.

Understanding SWVXX

Before we delve deeper into the dividend payment frequency of SWVXX, let’s first understand what SWVXX is and how it operates.

SWVXX, also known as the Schwab Value Advantage Money Fund, is a money market mutual fund offered by Charles Schwab Investment Management. It is designed for investors seeking a low-risk investment option that provides stability, liquidity, and a competitive yield.

As a money market fund, SWVXX primarily invests in short-term, high-quality debt securities, such as U.S. Treasury bills, commercial paper, and certificates of deposit. These securities have a relatively short maturity period, typically ranging from a few days to one year, making SWVXX a highly liquid investment option.

One of the primary objectives of SWVXX is to provide investors with a high level of current income. The income generated by the fund primarily comes from the interest earned on its investments. The fund managers actively monitor the market conditions and adjust the portfolio composition to maximize income while maintaining the fund’s stability and preserving capital.

SWVXX aims to maintain a stable net asset value (NAV) of $1 per share. This means that the value of each share in the fund is intended to remain constant. The stability of NAV makes SWVXX an attractive choice for investors looking to preserve their capital while earning a competitive yield.

Investors can buy and sell shares of SWVXX at the prevailing NAV, similar to buying and selling stocks. This flexibility allows investors to enter or exit the fund as per their investment goals and liquidity needs.

Now that we have a basic understanding of SWVXX let’s explore the dividend payment frequency of this money market fund in the next section.

Dividend Payment Frequency of SWVXX

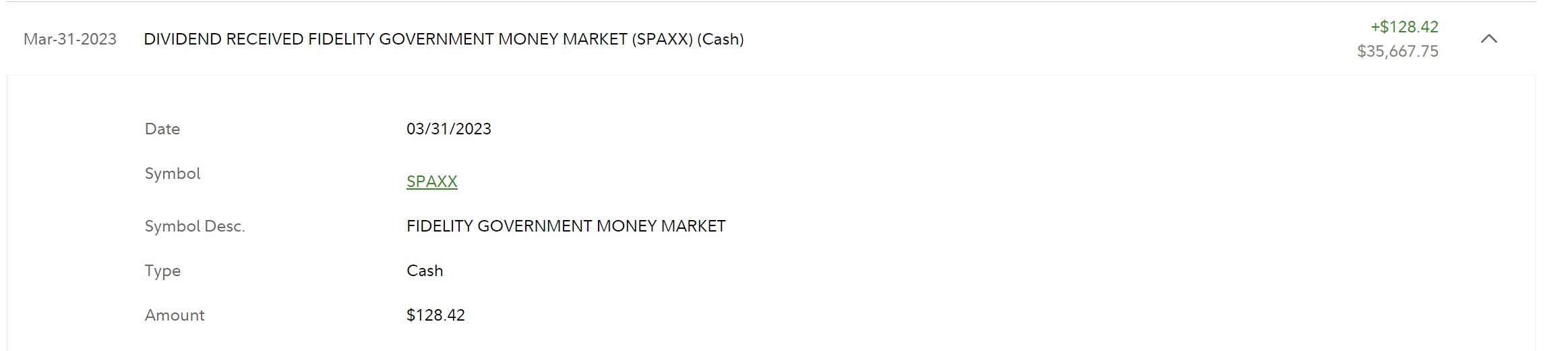

When it comes to the dividend payment frequency of SWVXX, investors can expect regular income distributions from this money market fund. SWVXX follows a monthly dividend payment schedule, meaning that dividends are typically paid out on a monthly basis.

This monthly dividend payment frequency offers investors a consistent stream of income, making SWVXX an attractive option for those who rely on regular dividend distributions to meet their financial needs and goals.

The monthly dividend payments of SWVXX are calculated based on the income generated by the fund’s underlying investments. As a money market fund invested in short-term debt securities, SWVXX earns interest on its portfolio holdings, which forms the basis for dividend calculations.

It’s important to note that the amount of dividends received by investors may vary from month to month. The dividend amount is influenced by several factors, including changes in interest rates, fluctuations in the overall market conditions, and the performance of the underlying debt securities held by the fund.

For instance, when interest rates are higher, SWVXX can potentially earn more interest income, leading to higher dividend payouts. On the other hand, if interest rates decline, the income generated by the fund may decrease, resulting in lower dividend distributions.

It’s also worth mentioning that while SWVXX aims to maintain a stable NAV of $1 per share, dividend payments may cause slight fluctuations in the NAV. This is because the income earned by the fund is distributed to shareholders, thereby reducing the net assets and potentially impacting the NAV.

Investors in SWVXX have the option to reinvest the dividends received through a dividend reinvestment program (DRIP). By choosing to participate in the DRIP, investors can automatically reinvest their dividends to purchase additional shares of SWVXX, compounding their investment over time.

Overall, the monthly dividend payment frequency of SWVXX provides investors with a predictable income stream, making it a popular choice for those seeking regular dividend distributions.

Next, we will explore the factors that influence dividend payments, shedding light on the sustainability and variations in SWVXX dividend distributions.

Factors Influencing Dividend Payments

Several factors come into play when determining the dividend payments of SWVXX. Understanding these factors can provide investors with insights into the sustainability and variations in dividend distributions. Let’s explore the key factors influencing dividend payments:

- Market Conditions: The overall market conditions, including interest rates and economic outlook, can significantly impact the income generated by SWVXX. When interest rates are high, the fund may earn more income from its short-term debt securities, resulting in higher dividend payouts. Conversely, in a low-interest-rate environment, the income generated by the fund may be lower, leading to reduced dividend distributions.

- Portfolio Composition: The composition of SWVXX’s portfolio plays a vital role in determining dividend payments. The fund’s investment managers carefully select a mix of short-term debt securities to maximize income while preserving capital. The performance and yields of these securities directly influence the dividend distributions of SWVXX. If the portfolio includes high-quality securities with attractive yields, it can contribute to higher dividend payouts.

- Expenses and Fees: Like any investment fund, SWVXX incurs operating expenses and fees associated with managing the fund. These expenses are deducted from the fund’s income before dividend distributions are made. Therefore, higher expenses can have an impact on the net income available for dividend payments, potentially resulting in lower dividend amounts.

- Profitability and Performance: The profitability and performance of the underlying debt securities held by SWVXX can directly influence dividend payments. If the fund’s investments perform well and generate higher income, it can translate into increased dividends for investors. Conversely, underperforming investments may lead to lower dividend distributions.

- Management Decisions: The fund managers play a crucial role in determining dividend payments. They assess market conditions, evaluate the portfolio’s performance, and make strategic decisions to optimize income generation. The managers’ expertise and decision-making processes can impact the dividend distributions of SWVXX.

It’s essential to note that while these factors influence dividend payments, they do not guarantee a specific dividend amount or consistency. Dividend payments can vary from month to month based on the dynamic nature of the market and fund performance.

By considering these factors and staying informed about the market conditions and performance of the fund, investors can gain a better understanding of the potential variations and sustainability of SWVXX dividend payments.

Next, we will examine the historical dividend payments of SWVXX, providing insights into its track record and trends over time.

Historical Dividend Payments

Examining the historical dividend payments of SWVXX can provide valuable insights into its track record and trends over time. While past performance is not indicative of future results, it can guide investors in understanding the dividend distribution patterns of the fund. Here’s an overview of SWVXX’s historical dividend payments:

SWVXX has a consistent track record of monthly dividend distributions. Over the years, investors have received regular income from their investments in SWVXX, making it a reliable source of dividend payments.

The dividend amounts paid by SWVXX can vary based on market conditions and the performance of the underlying debt securities. However, the fund aims to provide a competitive yield and steady income to its shareholders.

It’s important to note that SWVXX dividend payments have remained relatively stable, with modest variations over time. Investors can expect a reliable stream of income from SWVXX, making it an attractive option for income-focused strategies.

Furthermore, the historical dividend payments of SWVXX demonstrate the fund’s commitment to offering consistent and transparent distributions to its investors. This consistency can help investors plan their finances and rely on SWVXX as a dependable income-generating investment.

Investors interested in reinvesting their dividends can take advantage of SWVXX’s dividend reinvestment program (DRIP). By participating in the DRIP, investors can automatically reinvest their dividends into additional shares of SWVXX, potentially compounding their investment over time.

It’s important for investors to review the historical dividend payments alongside other aspects, such as the fund’s performance, fees, and overall investment strategy, to make informed decisions.

Before making any investment decisions, investors should conduct thorough research, assess their financial goals and risk tolerance, and consult with a financial advisor if necessary.

Overall, the historical dividend payments of SWVXX reflect its commitment to providing investors with regular income. By considering historical dividend trends, investors can gain insights into SWVXX’s dividend distribution patterns and make informed investment decisions.

Now, let’s conclude our exploration of SWVXX dividend payments.

Conclusion

In conclusion, SWVXX, the Schwab Value Advantage Money Fund, offers investors a reliable and consistent stream of income through its dividend payments. As a money market mutual fund, SWVXX follows a monthly dividend payment schedule, providing investors with regular income distributions.

Several factors influence the dividend payments of SWVXX, including market conditions, portfolio composition, expenses and fees, profitability and performance, and management decisions. Understanding these factors can help investors gauge the sustainability and variations in dividend distributions.

SWVXX has a history of steady dividend payments, with modest variations reflecting market conditions and fund performance. This consistency contributes to the fund’s reputation as a reliable income-generating investment option.

Investors also have the option to reinvest their dividends through SWVXX’s dividend reinvestment program (DRIP), providing an opportunity to potentially compound their investment over time.

It’s important for investors to conduct thorough research, assess their financial goals and risk tolerance, and consider other factors such as the fund’s performance and fees before making any investment decisions. Consulting with a financial advisor can provide additional guidance and ensure that the investment aligns with one’s financial objectives.

SWVXX stands as a testament to the potential for stability and regular income in money market mutual funds. By analyzing the historical dividend payments of SWVXX, investors can gain insights into its track record and make informed investment choices.

Whether you are seeking a stable source of income or diversifying your investment portfolio, SWVXX’s monthly dividend payments offer a predictable stream of returns. It is crucial, however, to stay updated on market trends and monitor the performance of SWVXX to make informed investment decisions.

As with any investment, it’s important to review the fund’s prospectus, understand the risks involved, and consult with professionals to ensure that SWVXX aligns with your investment goals and risk tolerance.

Overall, SWVXX’s monthly dividend payment frequency, combined with its consistent track record, makes it an attractive choice for investors looking to generate steady income from their investments.