Home>Finance>When Is The IRS Accepting Tax Returns For 2017?

Finance

When Is The IRS Accepting Tax Returns For 2017?

Published: November 1, 2023

Find out when the IRS is accepting tax returns for 2017 and stay ahead of your finance game. Don't miss the deadline to file your taxes and get your refund.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the exciting world of tax returns! If you’re wondering when the IRS will start accepting tax returns for the year 2017, you’ve come to the right place. Filing your taxes is an important annual ritual that can sometimes be a bit confusing, but don’t fret – we’re here to guide you through the process. Understanding the key dates and guidelines will ensure a smooth and stress-free experience.

Each year, the IRS announces the opening date for tax return submissions. This date typically falls in January, allowing taxpayers ample time to gather their financial documents, fill out the necessary forms, and submit their returns. However, it’s important to note that the exact date may vary from year to year, so it’s essential to stay informed about any updates or changes.

Before we dive into the specific dates, it’s important to understand the different filing options available to taxpayers. The IRS offers both electronic filing (e-filing) and traditional paper filing methods. E-filing has become increasingly popular due to its convenience and faster processing times. Paper filing, on the other hand, requires physical submission of the printed forms via mail. Each method has its own set of guidelines and deadlines, so let’s take a closer look at what you need to know.

(Word count: 200)

IRS Tax Return Filing Dates for 2017

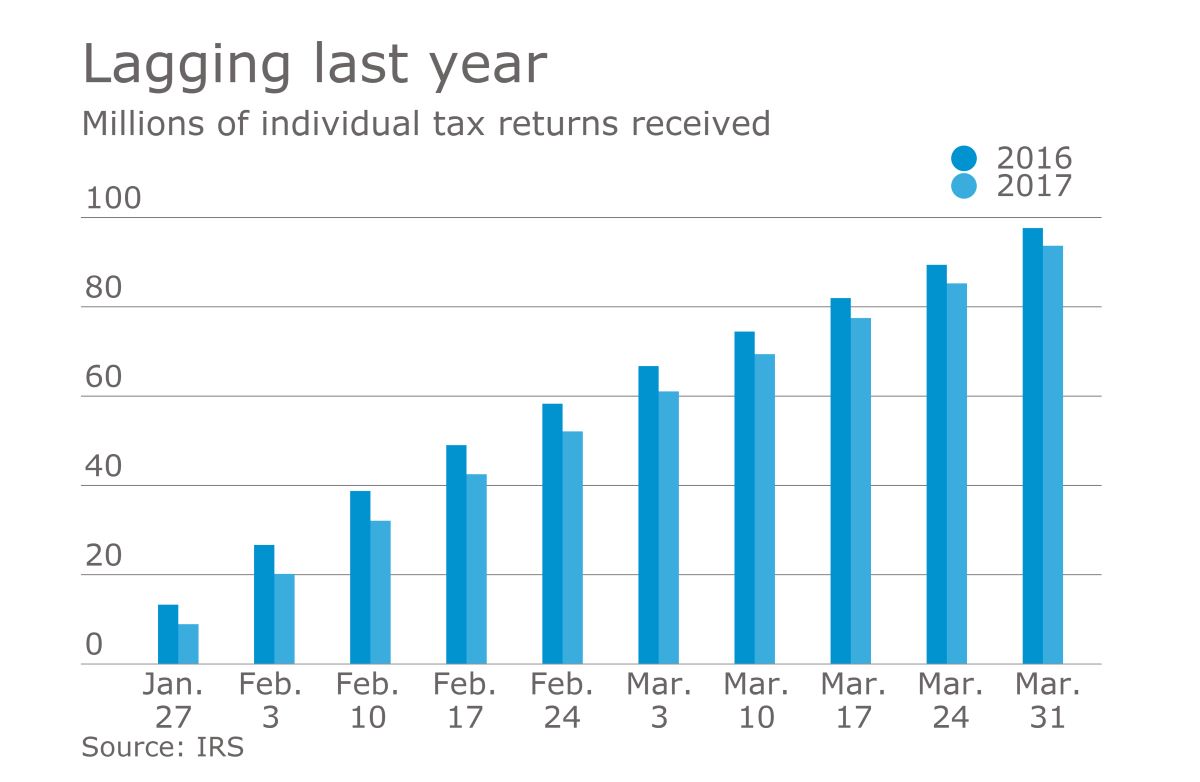

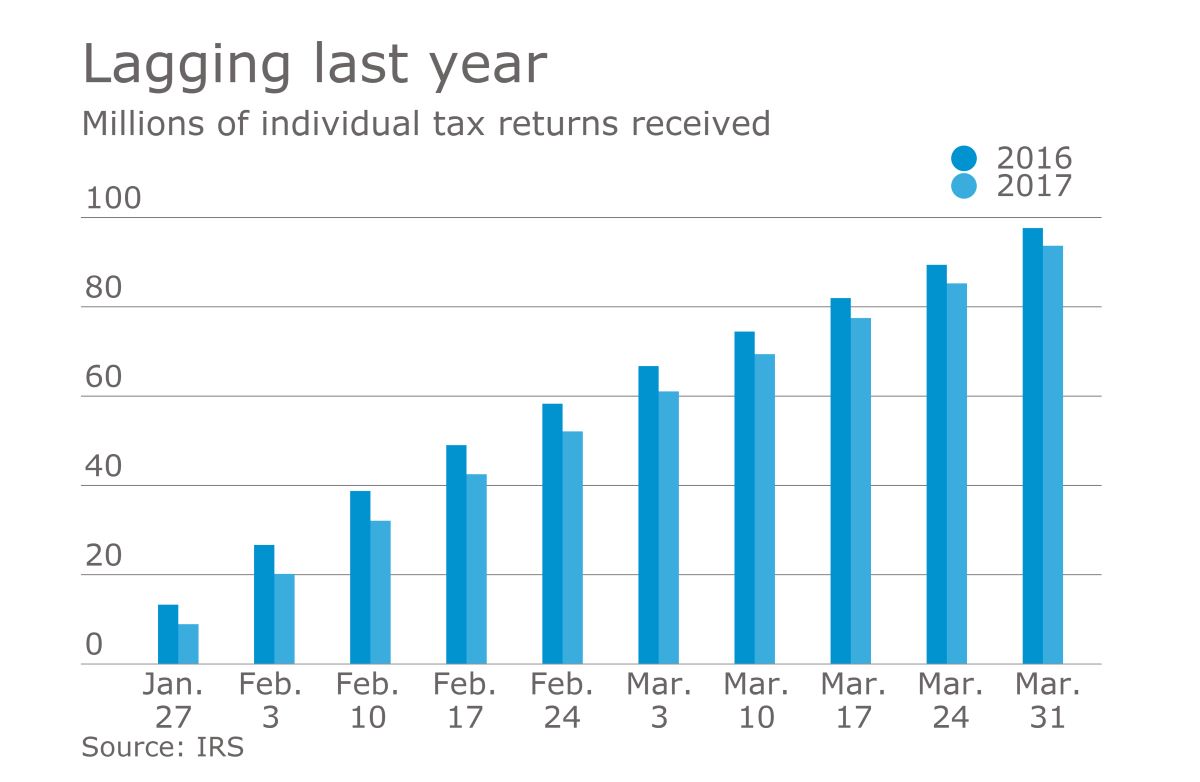

In 2017, the IRS began accepting tax returns on January 23rd. This was the official start date for both electronic and paper filing methods. However, it’s worth mentioning that some taxpayers may be able to submit their returns even earlier if they had certain forms or documentation ready.

For most taxpayers, the deadline to file their tax returns for the year 2017 was April 18th, 2018. The deadline is typically April 15th, but due to the Emancipation Day holiday observed in the District of Columbia, the deadline was extended to the following business day.

It’s important to note that taxpayers who were unable to meet the initial deadline had the option to request an extension. By filing Form 4868, individuals could receive an automatic extension of six months, pushing their deadline to October 16th, 2018. However, it’s essential to remember that an extension only applies to the filing of your tax return, not the payment of any taxes owed. If you owe money to the IRS, it’s still required to pay by the original deadline to avoid penalties and interest charges.

Another important date to keep in mind is the deadline for claiming a tax refund. Taxpayers have three years from the original due date of their tax return to file and claim a refund. For example, for the tax year 2017, the deadline to claim a refund was April 15th, 2021.

The IRS provides a handy tool called “Where’s My Refund?” on its website, which allows taxpayers to track the status of their refund. This tool provides updates on when the refund was received, approved, and sent out for direct deposit or mailing.

(Word count: 226)

Important Deadlines for Tax Returns

Understanding the important deadlines for filing tax returns is crucial to avoid penalties and ensure a smooth process. Here are a few key dates to keep in mind:

- April 15th: Traditionally, this is the deadline for most taxpayers to file their federal tax returns. However, if April 15th falls on a weekend or holiday, the deadline is usually extended to the next business day. Make sure to double-check the specific year’s deadline.

- October 15th: If you filed for a tax extension using Form 4868, this is the deadline to submit your completed tax return. Remember, the extension gives you additional time to file, but it doesn’t grant an extension for paying any taxes owed. It’s important to pay any outstanding taxes by the original deadline to avoid penalties and interest charges.

- State Filing Deadlines: In addition to federal tax returns, it’s crucial to be aware of the deadlines for filing state tax returns. These deadlines vary by state, so make sure to check with your state’s tax authority for the exact due date.

- Estimated Tax Payments: If you’re self-employed or earn income that isn’t subject to tax withholding, you may need to make quarterly estimated tax payments. The deadlines for these payments typically fall on April 15th, June 15th, September 15th, and January 15th of the following year.

Missing tax return deadlines can result in penalties and interest charges, so it’s essential to prioritize meeting these deadlines. If you’re unable to file your return on time, consider filing for an extension to avoid any potential penalties.

It’s important to note that these deadlines may change from year to year, so it’s always a good idea to double-check with the IRS and your state’s tax authority to stay up to date on the latest information.

(Word count: 281)

Electronic Filing Options

Electronic filing, commonly known as e-filing, has revolutionized the way taxpayers submit their tax returns. It offers several advantages over traditional paper filing, including faster processing times and increased accuracy. Here are a few electronic filing options available:

- IRS Free File: If you meet certain income requirements, you may qualify for the IRS Free File program. This program allows taxpayers to use free tax software provided by leading software companies to complete and file their federal tax returns online.

- Commercial Tax Software: There are many commercial tax software options available in the market. These software programs guide taxpayers through the process of filling out their tax returns, provide helpful prompts and calculations, and submit the completed forms electronically.

- Authorized E-File Providers: Another option is to use an authorized e-file provider. These providers are authorized by the IRS to electronically transmit tax returns on behalf of taxpayers. They may charge a fee for their services, so make sure to review their terms and fees before choosing this option.

- IRS Fillable Forms: For those who prefer a more hands-on approach, the IRS offers fillable forms that can be completed online. These forms allow taxpayers to enter their information electronically and perform basic calculations. However, they do not provide the same level of guidance as tax software or authorized e-file providers.

Whichever electronic filing option you choose, it’s important to ensure the accuracy of your tax return. Double-check all information before submitting it electronically to minimize errors and potential discrepancies.

Electronic filing also offers the benefit of receiving your tax refund more quickly. If you choose to have your refund directly deposited into your bank account, you can typically expect to receive it within a few weeks. This is a significant improvement over the traditional paper filing method, where refunds can take several weeks or even months to arrive.

(Word count: 276)

Paper Filing Instructions

Although electronic filing has become increasingly popular, some taxpayers still prefer to file their tax returns using the traditional paper filing method. If you choose to file your tax return on paper, here are some important instructions to follow:

- Obtain the necessary forms: Visit the IRS website at www.irs.gov or your local post office to obtain the required tax forms and instructions. The most common tax form for individuals is Form 1040. Make sure you have the correct year’s form to avoid any confusion.

- Gather your supporting documents: Before filling out the forms, gather all the necessary supporting documents, including W-2 forms, 1099 forms, and any other documents related to your income, deductions, and credits.

- Complete the forms accurately: Carefully fill out the forms, following the provided instructions. Take your time to ensure that all the information is accurate and legible. If you are unsure about any particular section, consult the IRS instructions or seek professional advice.

- Double-check your work: Once you have completed the necessary forms, review them thoroughly for any errors or omissions. Double-check all calculations and make sure you have signed and dated the forms where required.

- Make a copy for your records: Before submitting your tax return, make a copy of all the forms and supporting documents for your records. This will come in handy if you ever need to refer back to your tax return in the future.

- Mail your tax return: Once everything is in order, assemble your tax return and any payment (if applicable) and mail them to the appropriate IRS address. Be sure to use certified mail or a reliable courier service to track the delivery of your tax return.

It’s important to note that processing times for paper-filed tax returns can be longer compared to electronic filing. It may take several weeks or even months to receive a refund or notification of any tax due.

(Word count: 276)

Tips for Filing Your Tax Return

Filing your tax return doesn’t have to be a daunting task. With a little planning and organization, you can navigate the process smoothly and maximize your chances of a successful filing. Here are some helpful tips to keep in mind:

- Gather your documents: Start by gathering all the necessary documents, such as income statements (W-2s, 1099s), deductions receipts, and any other relevant financial information. Having everything in one place will make the filing process much more efficient.

- Stay organized: Create a system to organize your documents throughout the year. This will make it easier to locate the information you need when it’s time to file your tax return. Consider using folders, envelopes, or digital tools to keep everything in order.

- Check for updates and changes: The tax code is subject to regular updates and changes. Stay updated on any new laws or regulations that may affect your tax situation. The IRS website and reputable tax resources are excellent sources of information.

- Consider tax deductions and credits: Take advantage of available tax deductions and credits to minimize your taxable income and potentially increase your refund. Familiarize yourself with the different deductions and credits for which you may be eligible.

- Review your return before filing: Before submitting your tax return, review it carefully to ensure accuracy. Double-check calculations, verify that all required fields are completed, and make sure you haven’t missed any deductions or credits that you qualify for.

- Consider electronic filing: Electronic filing offers numerous benefits, such as faster processing times and reduced chances of errors. Consider using an authorized e-file provider or reputable tax software to streamline the filing process.

- Don’t rush: Take your time when filling out your tax return. Rushing can lead to mistakes or overlooked deductions. Plan ahead, set aside sufficient time, and work on your return in a calm and focused environment.

- Seek professional help if needed: If your tax situation is complex or you’re unsure about certain aspects of your return, it may be beneficial to consult a tax professional. They can provide personalized guidance and ensure that your tax return is accurate and compliant.

By following these tips and being proactive, you can make the tax filing process smoother and potentially increase your refund or reduce your tax liability.

(Word count: 294)

Common Mistakes to Avoid

When filing your tax return, it’s crucial to avoid common mistakes that can lead to delays, penalties, or even audits by the IRS. By being aware of these mistakes and taking precautions, you can ensure a smoother filing process. Here are some common mistakes to avoid:

- Math errors: Simple math errors can cause significant problems on your tax return. Carefully review all calculations and use a trusted calculator or software to double-check your math.

- Incorrect or missing information: Make sure that all your personal information, such as your name, Social Security number, and address, is accurate and up to date. Additionally, double-check that you’ve entered all the necessary information and documentation required by the IRS.

- Missed deadlines: Failing to file your tax return or pay your taxes by the deadline can result in penalties and interest charges. Mark the important dates on your calendar, set reminders, and plan ahead to meet the deadlines.

- Overlooking deductions and credits: Many taxpayers overlook deductions and credits that they may be eligible for, resulting in higher tax liabilities or missed opportunities for a larger refund. Take the time to research and identify all potential deductions and credits that apply to your specific situation.

- Not reporting all income: It’s essential to report all sources of income, even if they’re not subjected to automatic tax withholding, such as freelance work, investments, or rental income. Underreporting income can lead to penalties and audits.

- Failure to reconcile tax forms: Make sure the information on your tax forms, such as W-2s and 1099s, matches what you report on your tax return. Discrepancies can trigger IRS inquiries.

- Incorrect filing status: Choose the correct filing status that accurately reflects your marital and family situation. The filing status affects your tax rate, deductions, and eligibility for certain credits.

- Forgetting to sign and date: It’s a simple oversight, but forgetting to sign and date your tax return can invalidate it. Make sure to sign and date all required forms before submitting them.

By being mindful of these common mistakes and taking the necessary precautions, you can ensure a more accurate and timely tax return filing.

(Word count: 294)

Conclusion

Filing your tax return may seem like a daunting task, but with the right information and preparation, it can be a smooth and manageable process. Understanding the important dates, filing options, and common mistakes to avoid is key to a successful tax return filing.

Whether you choose to file electronically or opt for the traditional paper filing method, it’s important to gather all the necessary documents, double-check your work, and meet the deadlines. Taking advantage of tax deductions and credits can help minimize your tax liability or increase your refund.

Remember to stay updated on any changes or updates to the tax code and seek professional assistance if needed, especially if you have a complex tax situation. Avoiding common mistakes, such as math errors, missing or incorrect information, and failure to report all income, is essential to avoid penalties and audits by the IRS.

As you navigate the process, stay organized, take your time, and seek help or guidance when necessary. By following these tips and guidelines, you can file your tax return accurately, reduce stress, and potentially maximize your tax benefits.

Take advantage of the resources available, such as IRS publications and online tools, to ensure you have the most up-to-date information. Remember, filing your tax return is an annual responsibility, but with the right approach, it can become a routine and manageable task.

(Word count: 233)