Finance

How Old Do You Have To Be To Get A 401K

Published: October 17, 2023

Discover the age requirement to start a 401K and secure your financial future. Find out how to begin saving for retirement at a young age.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to planning for retirement, one of the most popular options is a 401(k) account. A 401(k) is a type of employer-sponsored retirement plan that allows individuals to save and invest a portion of their income for their future. It offers several tax advantages and flexibility in terms of investment options.

However, if you’re wondering whether you’re eligible to open a 401(k) account, one of the crucial factors to consider is your age. The age requirements for participating in a 401(k) plan can vary depending on several factors, including the specific plan and your employment status. In this article, we will delve into the age requirements for 401(k) eligibility and the benefits of starting a 401(k) early.

Whether you’re just starting your career or approaching retirement age, understanding the age restrictions and guidelines for 401(k) plans will help you make informed decisions regarding your financial future. So, let’s explore the age requirements for 401(k) eligibility and how they impact your retirement plans.

Age Requirements for 401(k) Eligibility

The age requirements for 401(k) eligibility vary depending on the specific plan and the policies set by your employer. However, in most cases, you must be at least 21 years old to participate in a 401(k) plan. This age requirement ensures that individuals have reached legal adulthood and are eligible to make financial decisions.

However, it’s important to note that some employers may have different eligibility rules, allowing employees to participate in the plan at a younger age. For example, certain companies may allow employees as young as 18 to participate in their 401(k) plan. It’s crucial to check with your employer or human resources department to understand the specific eligibility requirements for your plan.

Additionally, age is not the only factor that determines eligibility for a 401(k) plan. In most cases, you must also meet certain employment requirements. For instance, you may need to have completed a specific number of work hours or have been with the company for a certain duration of time. These requirements ensure that the 401(k) plan is primarily available to employees who have established a long-term commitment to the company.

It’s worth mentioning that even if you meet the age and employment requirements, your employer may have additional restrictions on when you can start contributing to the 401(k) plan. Some employers may have a waiting period before new employees can enroll, such as waiting for a specific number of months or until the next enrollment period.

Lastly, it’s essential to keep in mind that 401(k) eligibility may also vary for certain groups of employees, such as part-time or temporary workers. Some employers may have different rules for these employees or may not offer a 401(k) plan at all. Therefore, if you are a part-time or temporary employee, it’s crucial to check with your employer to understand your eligibility and retirement savings options.

Benefits of Starting a 401(k) Early

Starting a 401(k) account early in your career comes with several significant benefits that can have a substantial impact on your retirement savings. Here are some advantages of getting a head start on your retirement savings:

- Compound Interest: By starting a 401(k) early, you give your investments more time to grow through the power of compound interest. Compound interest is the interest earned on both the initial investment and the accumulated interest over time. The longer your money remains invested, the greater the potential for growth.

- Tax Advantages: 401(k) contributions are made with pre-tax dollars, reducing your taxable income for the year. This means that you are essentially saving money on taxes in the present, allowing you to invest more towards your retirement. Additionally, the earnings on your 401(k) investments grow tax-deferred until you make withdrawals in retirement.

- Employer Matching: Many employers offer a 401(k) matching program, where they contribute a certain percentage of your salary to your account. This is essentially free money and can significantly boost your retirement savings. By starting a 401(k) early, you have more years to take advantage of employer matching contributions and maximize your retirement savings potential.

- Financial Discipline: Starting a 401(k) early encourages financial discipline and regular savings habits. By making automatic contributions from your paycheck into your retirement account, you prioritize saving for the future. This helps develop a habit of budgeting and living within your means, setting you up for long-term financial success.

- Flexibility and Portability: Another benefit of starting a 401(k) early is the flexibility and portability of the account. If you change jobs, you can typically roll over your 401(k) into a new employer’s plan or into an individual retirement account (IRA). By starting early, you accumulate more funds in your 401(k) account, giving you greater flexibility and control over your retirement savings.

Overall, starting a 401(k) early provides you with a solid foundation for building a secure retirement. By taking advantage of compound interest, tax benefits, employer matching, and developing good financial habits, you can set yourself on a path towards a comfortable and financially stable retirement.

Age Restrictions for 401(k) Withdrawals

While a 401(k) account is a valuable retirement savings tool, there are age restrictions when it comes to withdrawing funds from your account. The Internal Revenue Service (IRS) has established rules to ensure that 401(k) funds are primarily used for retirement purposes. Understanding these age restrictions is crucial to avoid penalties and make informed decisions about your retirement savings. Here are the key age restrictions for 401(k) withdrawals:

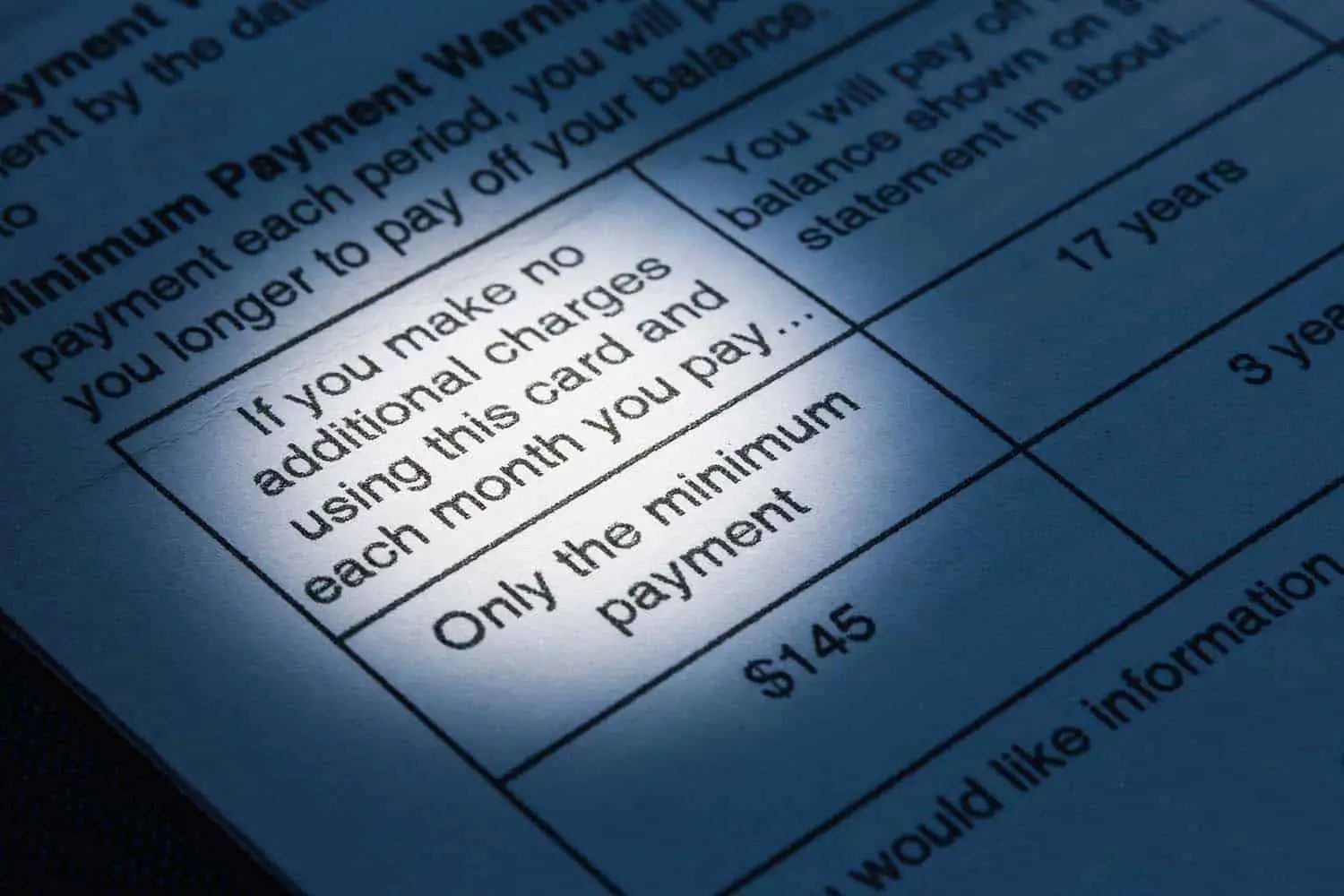

- Early Withdrawal Penalty: Normally, you must wait until you reach the age of 59½ before making withdrawals from your 401(k) account. Withdrawing funds before this age may subject you to an early withdrawal penalty of 10% in addition to regular income taxes on the amount withdrawn. This penalty is designed to discourage the use of retirement savings for non-retirement purposes.

- Required Minimum Distributions (RMDs): Once you reach the age of 72 (or 70½ if you were born before July 1, 1949), you are required to start taking withdrawals from your 401(k) account. These mandatory distributions, known as Required Minimum Distributions (RMDs), ensure that you gradually deplete your account over time and pay taxes on the funds. Failing to take RMDs can result in significant tax penalties.

- Exceptions: While there are strict age limitations for penalty-free withdrawals, there are a few exceptions that allow earlier access to your 401(k) funds without penalties. For example, if you become permanently disabled or experience financial hardship, you may be eligible for penalty-free withdrawals. Additionally, if you separate from your employer at age 55 or older, you can withdraw funds from that specific employer’s 401(k) without a penalty.

- Roth 401(k) Accounts: If you have a Roth 401(k) account, which is funded with after-tax contributions, the rules differ slightly. As long as you have held the account for at least five years, you can withdraw contributions from a Roth 401(k) at any age without penalties or taxes. However, earnings on Roth 401(k) contributions may be subject to penalties if withdrawn before the age of 59½.

It’s important to note that these rules and restrictions may change over time, so it’s essential to stay informed and consult with financial professionals to ensure compliance with the latest regulations. By understanding the age restrictions for 401(k) withdrawals, you can make strategic decisions about when and how to access your retirement savings while minimizing penalties and maximizing your financial security in retirement.

Options for Younger Individuals

While retirement may seem far off for younger individuals, it’s never too early to start planning for the future. If you’re in your 20s or 30s, here are some options to consider when it comes to your 401(k) and retirement savings:

- Participate in Employer Matching: If your employer offers a matching contribution program, make sure to take full advantage of it. Employer matching is essentially free money that can significantly boost your retirement savings. Contribute at least enough to your 401(k) to get the maximum matching contribution from your employer.

- Invest for Long-Term Growth: Since you have several decades until retirement, focus on investing for long-term growth. Allocate your 401(k) contributions to funds that have a higher potential for growth, such as stocks or equity mutual funds. While these investments may have more short-term volatility, they tend to generate higher returns over the long run.

- Consider Roth 401(k) Contributions: If your employer offers a Roth 401(k) option, consider making contributions to it. Roth contributions are made with after-tax dollars, meaning you won’t get a tax deduction now. However, your withdrawals in retirement will be tax-free, providing you with tax diversification and potentially lower tax liability in retirement.

- Increase Contributions Regularly: As your career progresses and your income increases, aim to increase your 401(k) contributions. Even small increases can make a significant difference in the long run. Try to allocate a portion of any raises or bonuses towards your retirement savings to accelerate your progress towards your retirement goals.

- Take Advantage of IRA Options: If your employer doesn’t offer a 401(k) plan or if you want to supplement your 401(k) savings, consider opening an Individual Retirement Account (IRA). IRAs offer similar tax advantages to 401(k) plans and provide additional flexibility and control over your investments. You can contribute up to the annual IRA contribution limit, which is separate from your 401(k) contribution limit.

Additionally, it’s essential to stay educated about personal finance and retirement planning. Leverage online resources, books, podcasts, and financial advisors to enhance your knowledge. Regularly review your 401(k) investments and make adjustments as needed to align with your long-term goals.

Remember, the power of compounding works in your favor when you start saving early. By taking advantage of employer matching, investing for growth, increasing contributions, and exploring additional retirement savings options, younger individuals can build a solid foundation for a financially secure retirement down the road.

Conclusion

Achieving a comfortable retirement requires careful planning and taking advantage of the available tools and resources. A 401(k) account is an excellent opportunity to save for the future, but it’s essential to understand the age requirements and restrictions that govern these retirement plans.

By meeting the age requirements and eligibility criteria established by your employer, you can start contributing to your 401(k) at an early age. Starting early offers several advantages, including the power of compound interest, tax benefits, and potential employer matching contributions. It also instills financial discipline and allows for greater flexibility and portability of your retirement funds.

However, it’s important to be aware of the age restrictions when it comes to making withdrawals from your 401(k) account. Withdrawing funds too early may incur penalties, while mandatory distributions come into play once you reach a certain age.

For younger individuals, it’s crucial to take advantage of employer matching, invest for long-term growth, consider Roth contributions, and increase 401(k) contributions over time. Exploring additional retirement savings options, such as Individual Retirement Accounts (IRAs), can also enhance your long-term financial security.

In conclusion, understanding the age requirements and restrictions of a 401(k) account is vital for effective retirement planning. By leveraging the benefits of starting early, making informed investment choices, and maximizing retirement savings opportunities, individuals can lay the groundwork for a financially stable and enjoyable retirement.