Finance

How To Buy Solid State Battery Stocks

Published: January 19, 2024

Looking to invest in solid state battery stocks? Our comprehensive guide will teach you everything you need to know about buying and trading these finance-focused investments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Solid State Batteries

- Benefits of Solid State Battery Technology

- Overview of Solid State Battery Stocks

- Research and Analysis of Solid State Battery Companies

- Factors to Consider When Buying Solid State Battery Stocks

- Steps to Buy Solid State Battery Stocks

- Risks and Challenges in Investing in Solid State Battery Stocks

- Solid State Battery Stocks to Consider

- Conclusion

Introduction

Welcome to the world of solid-state battery stocks! As the demand for electric vehicles (EVs) continues to grow, so does the need for advanced battery technologies. Solid-state batteries have emerged as a promising solution, offering improved energy density, enhanced safety, and shorter charging times compared to traditional lithium-ion batteries.

In this article, we will explore the ins and outs of solid-state battery stocks, helping you understand the technology behind them and providing valuable insights for investing in this exciting field. Whether you are a seasoned investor or someone looking to dip their toes into the world of investing, this guide will equip you with the necessary knowledge to make informed decisions.

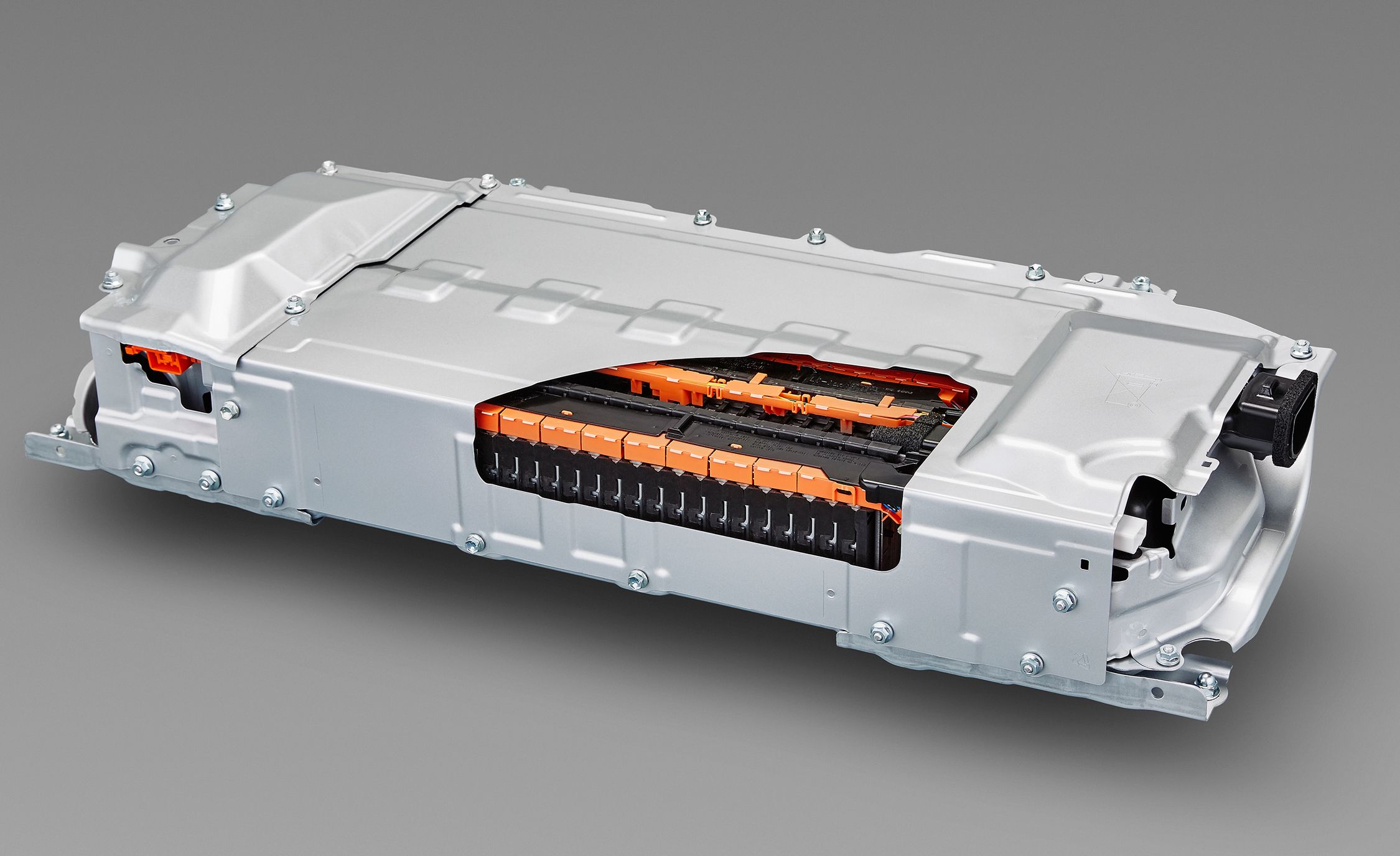

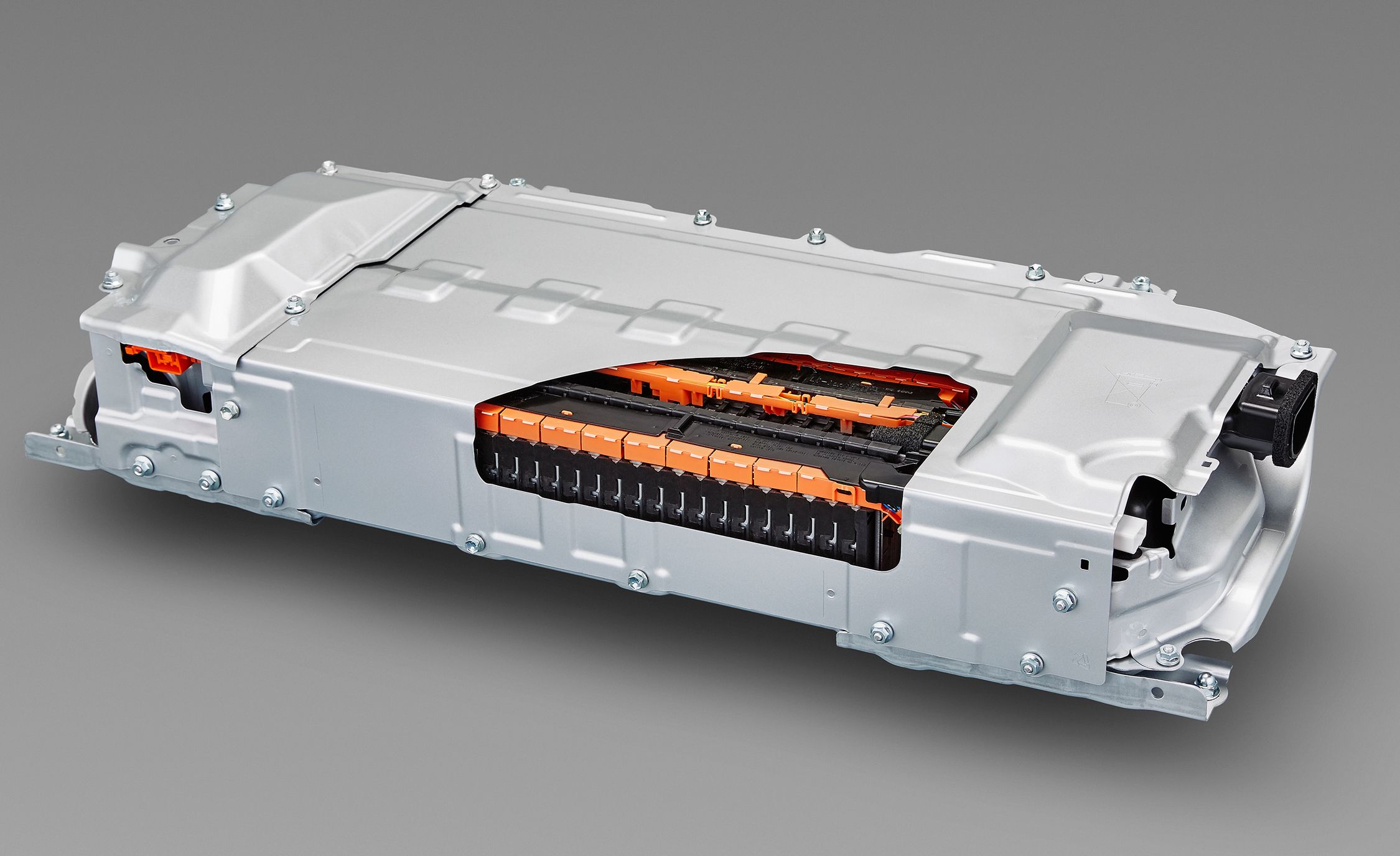

First, let’s dive into the basics and gain a clear understanding of what solid-state batteries actually are. Unlike conventional lithium-ion batteries, which use liquid electrolytes, solid-state batteries employ solid electrolytes. This structural difference makes them safer and more resistant to issues like thermal runaway, which is crucial in high-performance applications such as electric vehicles.

The benefits of solid-state battery technology are numerous. One of the key advantages is their higher energy density, allowing for increased storage capacity and longer driving ranges in EVs. Additionally, solid-state batteries have quicker charging times, reducing the need for lengthy downtime during recharging. Furthermore, they have a longer lifespan compared to traditional batteries, resulting in cost savings for consumers and businesses over time.

The solid-state battery market is experiencing rapid growth, with several companies at the forefront of research, development, and commercialization. It is essential to perform thorough research and analysis to identify the most promising solid-state battery stocks for investment. Factors such as company financials, technological advancements, partnerships, and market trends should all be taken into account when evaluating potential investment opportunities.

However, investing in solid-state battery stocks also comes with risks and challenges. The technology is still in its infancy, and market uncertainties can impact the performance of companies in the sector. It is crucial to be aware of these risks and make informed investment decisions based on a careful assessment of both the potential rewards and the possible pitfalls.

In the following sections, we will delve deeper into the world of solid-state batteries and outline the steps to buying solid-state battery stocks. We will also discuss some of the notable companies in the industry and provide valuable insights on solid-state battery stock investment. By the end of this article, you will be well-equipped to navigate the exciting world of solid-state battery investing.

Understanding Solid State Batteries

Solid-state batteries are a revolutionary advancement in battery technology that has the potential to reshape the energy storage landscape. As the name suggests, these batteries utilize solid-state electrolytes instead of the liquid electrolytes found in traditional lithium-ion batteries. This structural difference offers several significant advantages in terms of performance, safety, and scalability.

The key component of a solid-state battery is the solid electrolyte, which acts as a medium for ion conduction. Unlike liquid electrolytes, solid electrolytes do not require a permeable separator to prevent the mixing of positive and negative electrodes. This eliminates the risk of leakage, thermal runaway, and other safety concerns associated with liquid electrolytes.

Furthermore, solid-state batteries have the potential to offer higher energy density, meaning they can store more energy per unit of volume or weight. This is achieved through the use of next-generation materials, such as solid-state electrolytes and high-capacity electrode materials like lithium metal. The higher energy density of solid-state batteries translates into longer battery life and increased driving range for electric vehicles.

In addition to improved safety and energy density, solid-state batteries also have faster charging capabilities. The absence of liquid electrolytes allows for quicker diffusion of ions, resulting in reduced charging times. This is a crucial advancement, as one of the main limitations of current electric vehicles is the amount of time it takes to recharge the battery. With solid-state batteries, EVs could be charged more rapidly, making them even more convenient and practical for everyday use.

Another significant advantage of solid-state battery technology is its potential for scalability. The manufacturing process for solid-state batteries is relatively simple compared to lithium-ion batteries, which require several complex steps. The simplified manufacturing process of solid-state batteries could lead to reduced production costs, making them more commercially viable and accessible for mass adoption.

Despite these promising advantages, solid-state batteries are not without their challenges. One of the key hurdles is the development of solid electrolytes that provide good ion conductivity while maintaining stability and durability. Current solid electrolytes often face challenges related to ionic conductivity at room temperature, limiting the overall performance of solid-state batteries. However, significant progress is being made in this area, with researchers exploring various materials and compositions to overcome these limitations.

Overall, solid-state batteries represent a promising leap forward in energy storage technology, offering improved safety, higher energy density, faster charging times, and scalability. As research and development efforts continue, we can expect further advancements and commercialization of solid-state battery technology, leading to a brighter and greener future for energy storage and electric vehicles.

Benefits of Solid State Battery Technology

Solid-state battery technology is revolutionizing the energy storage landscape by offering a range of benefits over traditional lithium-ion batteries. These benefits make them a promising choice for various applications, particularly in the electric vehicle (EV) industry. Let’s explore the advantages of solid-state battery technology in more detail.

1. Enhanced Safety: One of the primary advantages of solid-state batteries is their improved safety. Traditional lithium-ion batteries use liquid electrolytes, which can be flammable and prone to thermal runaway. In contrast, solid-state batteries utilize solid electrolytes that are more stable and less likely to cause fires or explosions. This enhanced safety is critical, especially in high-performance applications like EVs, where safety is of utmost concern.

2. Higher Energy Density: Solid-state batteries offer higher energy density, meaning they can store more energy per unit of volume or weight. This increased energy density translates into longer driving ranges for electric vehicles, thus addressing one of the key limitations of EVs. With solid-state batteries, EVs can travel further on a single charge without compromising on vehicle performance.

3. Faster Charging Times: Another notable advantage of solid-state batteries is their ability to charge at a faster rate compared to traditional lithium-ion batteries. The absence of liquid electrolytes allows for more rapid ion diffusion, resulting in reduced charging times. This means that EV owners can spend less time waiting for their vehicle to recharge, making electric vehicles even more convenient and practical for everyday use.

4. Longer Lifespan: Solid-state batteries have a longer lifespan compared to traditional lithium-ion batteries. The use of stable and durable solid electrolytes and high-capacity electrode materials helps mitigate degradation and prolong the overall life of the battery. This longer lifespan results in cost savings for consumers and businesses over time, as they won’t need to replace the battery as frequently.

5. Improved Environmental Impact: Solid-state batteries offer a greener alternative to traditional lithium-ion batteries. They use materials that are less harmful to the environment, such as solid-state electrolytes that are non-toxic and non-flammable. Additionally, the increased energy density of solid-state batteries allows for more efficient energy use, reducing the carbon footprint associated with energy storage and electric transportation.

6. Scalability and Versatility: Solid-state battery technology has the potential for scalability and versatility. The manufacturing process for solid-state batteries is simpler and more streamlined compared to lithium-ion batteries, potentially leading to reduced production costs. This scalability opens up possibilities for various applications beyond electric vehicles, including consumer electronics, renewable energy storage, and grid-level energy storage.

As advancements in solid-state battery technology continue, we can expect even more benefits and improvements. The unique combination of enhanced safety, higher energy density, faster charging times, longer lifespan, improved environmental impact, and scalability makes solid-state batteries an exciting and promising innovation in energy storage.

Overview of Solid State Battery Stocks

As the demand for advanced battery technologies continues to rise, solid state batteries have emerged as a key player in the field. Investing in solid state battery stocks allows investors to capitalize on the growth and potential of this exciting technology. Let’s take a closer look at the current landscape of solid state battery stocks.

Several companies are at the forefront of research, development, and commercialization of solid state batteries. These companies are focused on overcoming the technical challenges associated with solid state battery technology and bringing viable products to market. Some notable players in the industry include:

- QuantumScape Corporation: QuantumScape is a leading solid state battery company that focuses on developing solid-state lithium-metal batteries. They have made significant progress in solid electrolyte and cell design, attracting attention from major automakers and investors.

- Solid Power: Solid Power is known for its solid-state battery technology, which aims to enable widespread adoption of electric vehicles. They have partnerships with key players in the automotive industry, making them a strong contender in the solid state battery market.

- ION Energy: ION Energy is an emerging player in the solid state battery space, focusing on materials and battery management systems. They aim to offer cost-effective and scalable solid-state battery solutions for various applications, including automotive and grid storage.

- BlueSolutions: BlueSolutions is a subsidiary of the Bolloré Group and specializes in solid-state lithium metal polymer batteries. They have a range of applications in electric vehicles, energy storage, and other sectors, positioning them as a key player in the evolving solid state battery market.

It’s important to note that solid state battery technology is still in the early stages of commercialization, and there may be additional companies that emerge as significant players in the future. Therefore, conducting thorough research and staying updated on the industry’s developments will be essential when considering solid state battery stocks for investment.

Investing in solid state battery stocks offers potential opportunities for growth and returns. However, it’s crucial to carefully evaluate each company’s financial health, technological advancements, partnerships, and market positioning before making investment decisions. Consider factors such as a company’s track record, intellectual property portfolio, manufacturing capabilities, and customer base to assess its long-term viability and growth potential.

Furthermore, keeping an eye on industry trends and regulatory developments will provide valuable insights into the future prospects of solid state battery stocks. Growing demand for electric vehicles, government initiatives supporting clean energy, and advancements in solid state battery technology are all factors that can shape the market dynamics and drive the growth of solid state battery stocks.

As with any investment, it’s important to diversify your portfolio and consult with a financial advisor to ensure your investment strategy aligns with your risk tolerance and financial goals. Solid state battery stocks can offer exciting prospects for investors looking to capitalize on the rapidly evolving world of battery technology and its potential to transform various industries.

Research and Analysis of Solid State Battery Companies

When considering investing in solid state battery companies, thorough research and analysis are essential to make informed investment decisions. Here are some key factors to consider when evaluating solid state battery companies:

- Technological Advancements: Assess the technological advancements made by the company in developing solid state battery technology. Look for companies that have made significant progress in overcoming technical challenges, improving energy density, enhancing safety features, and optimizing manufacturing processes.

- Intellectual Property Portfolio: Examine the company’s intellectual property portfolio, including patents and proprietary technologies. A strong IP portfolio can provide a competitive advantage and protect the company’s innovations in the solid state battery space.

- Partnerships and Collaborations: Evaluate the company’s partnerships and collaborations with industry leaders, research institutions, and potential customers. Strong partnerships can provide access to resources, expertise, and market opportunities, enhancing the company’s credibility and growth prospects.

- Financial Health: Analyze the company’s financial health, including revenue growth, profitability, and cash flow. A solid financial foundation is crucial for sustained research and development efforts, manufacturing scale-up, and future expansion plans.

- Market Positioning: Examine the company’s positioning within the solid state battery market. Consider factors such as market share, competitive landscape, customer base, and target industries. Companies that have established a strong presence and have strategic partnerships may have a competitive edge.

- Manufacturing Capabilities: Assess the company’s manufacturing capabilities and capacity to meet increasing demand. Solid state battery companies with efficient and scalable production processes are well-positioned to capitalize on market opportunities and drive cost competitiveness.

- Evaluating the Team: Consider the expertise and experience of the company’s management team and technical staff. A strong team with a proven track record in battery technology and commercialization can significantly influence the success of the company.

- Industry and Regulatory Factors: Stay updated on industry trends, regulatory developments, and government support for clean energy and electric vehicle adoption. Understanding the broader market dynamics can provide insights into the growth potential and risks associated with solid state battery companies.

It’s crucial to conduct comprehensive research and analysis of solid state battery companies before making investment decisions. Consider consulting with industry experts, financial advisors, and conducting due diligence to gather relevant information and insights. Additionally, keeping a close eye on technological advancements, market trends, and competitive landscape will allow for ongoing evaluation and adjustment of investment strategies.

Remember, investing in solid state battery companies carries inherent risks, as the commercialization of solid state battery technology is still in progress. It’s important to diversify your investment portfolio and carefully evaluate the potential risks and rewards associated with investing in this emerging sector. By conducting thorough research and analysis, you can identify promising companies that align with your investment goals and have the potential to drive future growth in the solid state battery industry.

Factors to Consider When Buying Solid State Battery Stocks

Investing in solid state battery stocks can be an exciting opportunity to capitalize on the growth potential of this emerging technology. However, it’s essential to carefully evaluate various factors before buying solid state battery stocks. Here are some key considerations to keep in mind:

- Technology and Innovation: Assess the technological advancements and innovation capabilities of the company. Look for companies that have proprietary technology, a strong intellectual property portfolio, and a track record of developing breakthroughs in solid state battery technology.

- Market Potential: Evaluate the market potential for solid state batteries, particularly in the electric vehicle (EV) and energy storage sectors. Consider the growing demand for EVs, government initiatives supporting clean energy, and the potential for solid state batteries to disrupt the market. Companies with a strong market position and partnerships with key industry players may have an advantage.

- Financial Health: Analyze the company’s financial health, including revenue growth, profitability, and cash flow. Look for companies with a strong balance sheet and sufficient resources to support continued research and development efforts, as well as manufacturing scale-up.

- Competitive Landscape: Assess the competitive landscape and the company’s position within it. Consider factors such as market share, competition from established battery manufacturers, and the company’s ability to differentiate itself through technological advancements, partnerships, or cost efficiencies.

- Partnerships and Collaborations: Evaluate the company’s partnerships and collaborations with key industry players, such as automakers, battery manufacturers, and research institutions. Strong partnerships can provide access to resources, expertise, and market opportunities, enhancing the company’s growth prospects.

- Regulatory Environment: Stay informed about regulatory developments and government policies that may impact the adoption and commercialization of solid state batteries. Consider factors such as subsidies, incentives, and regulations related to electric vehicles and clean energy. A favorable regulatory environment can drive market growth and create opportunities for solid state battery companies.

- Risks and Challenges: Understand the risks and challenges associated with investing in solid state battery stocks. These may include technological uncertainties, manufacturing scale-up, competition, and regulatory changes. Thoroughly evaluate the company’s risk management strategies and its ability to navigate these challenges.

- Long-Term Outlook: Consider the long-term outlook for solid state battery technology. Assess industry projections, market trends, and the potential for further advancements in solid state battery performance, cost reduction, and scalability. Companies that demonstrate a clear vision and strategy for long-term growth may be more attractive investment opportunities.

Remember, investing in solid state battery stocks comes with risks, as the commercialization of this technology is still in progress. It’s important to conduct thorough research, diversify your investment portfolio, and consult with financial advisors or experts in the field. By carefully evaluating these factors and staying updated on industry developments, you can make informed decisions when buying solid state battery stocks and navigate the exciting opportunities in this evolving sector.

Steps to Buy Solid State Battery Stocks

Investing in solid state battery stocks can be a rewarding endeavor, allowing you to participate in the growth potential of this emerging technology. Here are the steps to consider when buying solid state battery stocks:

- Educate Yourself: Start by educating yourself about solid state battery technology, the companies operating in the industry, and the overall investment landscape. Understand the basics of how solid state batteries work, the key players in the field, and the potential risks and rewards associated with investing in this sector.

- Research Solid State Battery Companies: Conduct thorough research on the solid state battery companies you are interested in. Evaluate their technological advancements, financial health, partnerships, and competitive positioning. Consider factors such as their potential for growth, market share, and industry reputation.

- Assess Risk Tolerance and Investment Goals: Determine your risk tolerance and investment objectives. Consider factors such as your financial situation, time horizon, and investment goals. Solid state battery stocks can be more volatile and higher risk due to the emerging nature of the technology, so it’s important to align your investment strategy accordingly.

- Open an Investment Account: If you don’t already have one, open an investment account with a reputable brokerage firm. Choose a brokerage that suits your needs in terms of fees, account types, research tools, and investment options. Ensure that the brokerage offers access to the stock exchanges where the solid state battery companies you’re interested in are listed.

- Perform Due Diligence: Before making any investment decisions, thoroughly analyze the solid state battery stocks you wish to purchase. Review their financial statements, recent news, analyst reports, and any other relevant information. This due diligence will help you make informed investment choices and minimize potential risks.

- Place Your Order: Once you have identified the solid state battery stocks you want to buy, place your order through your brokerage account. There are different types of orders available, such as market orders, limit orders, and stop orders. Select the appropriate order type and specify the number of shares or the dollar amount you wish to invest.

- Monitor and Manage Your Investment: After purchasing solid state battery stocks, monitor and manage your investment on an ongoing basis. Stay updated on company news, industry trends, and market developments that may affect the performance of your stocks. Periodically review your investment portfolio and make adjustments as needed.

- Consider Professional Advice: If you are uncertain about investing in solid state battery stocks or need guidance, consider consulting with a financial advisor who specializes in the technology sector. They can provide personalized recommendations based on your investment goals and risk tolerance.

Remember that investing in solid state battery stocks carries risks, as the technology is still undergoing commercialization and market uncertainties may arise. It’s important to diversify your investment portfolio and avoid putting all your eggs in one basket. By following these steps, conducting thorough research, and staying informed, you can make informed decisions and potentially benefit from the growth of solid state battery technology.

Risks and Challenges in Investing in Solid State Battery Stocks

While investing in solid state battery stocks can be an exciting opportunity, it’s important to be aware of the potential risks and challenges associated with this emerging sector. Here are some key factors to consider:

- Technology Development: Solid state battery technology is still undergoing research and development, and there is a level of uncertainty regarding commercial viability and scalability. Technical challenges, such as achieving high ion conductivity at room temperature, can impact the performance and commercialization timeline.

- Market Uncertainty: The market for solid state batteries is evolving, and there is a degree of uncertainty regarding adoption rates and market demand. Shifts in consumer preferences, changes in government policies, and competition from other battery technologies could impact the growth prospects of solid state battery companies.

- Manufacturing Scale-up: Scaling up production of solid state batteries can be a complex process, and there may be challenges in achieving cost-effective and high-volume manufacturing. Companies must overcome hurdles related to production efficiency, quality control, and supply chain management to meet increasing demand.

- Regulatory Landscape: Regulatory changes and policies related to electric vehicles and clean energy can impact the adoption and commercialization of solid state batteries. Changes in subsidies, incentives, or regulations could influence market dynamics and create uncertainties for solid state battery companies.

- Competition: The solid state battery industry is becoming increasingly competitive, with established battery manufacturers and new entrants vying for market share. Competition can drive innovation and market growth but also pose challenges for individual companies trying to establish their position in the industry.

- Financial Risks: Investment in solid state battery stocks carries financial risks. Companies in the emerging technology sector may experience periods of losses, and their financial performance can be volatile. Investors should carefully assess the financial health and sustainability of companies before making investment decisions.

- Intellectual Property: Solid state battery technology relies on intellectual property protection. Companies with weak or inadequate patent portfolios may face challenges in safeguarding their innovations and preventing competitors from replicating their technology, which could impact market share and profitability.

- Dependency on Partnerships: Solid state battery companies often rely on partnerships and collaborations for research, development, and market access. However, these partnerships can introduce risks and dependencies, such as potential disagreements, limited control over intellectual property, or delays in commercialization due to external factors.

It’s important for investors to carefully evaluate these risks and challenges when considering investments in solid state battery stocks. Conduct thorough research, stay informed about industry developments, and diversify your investment portfolio to mitigate potential risks. Additionally, consulting with financial advisors or experts in the field can provide valuable insights and guidance tailored to your investment goals and risk tolerance.

While solid state battery technology holds great potential, it’s crucial to approach investments in this sector with caution and a long-term perspective. By understanding and navigating the risks and challenges, investors can make informed decisions and potentially benefit from the growth and advancements in solid state battery technology.

Solid State Battery Stocks to Consider

As solid state battery technology continues to advance, several companies are emerging as key players in the field. While investing in solid state battery stocks carries risks, there are companies worth considering based on their technological advancements, market positioning, and potential for growth. Here are a few solid state battery stocks to keep an eye on:

- QuantumScape Corporation (QS): QuantumScape is a leading solid state battery company that aims to commercialize solid-state lithium-metal batteries. They have made significant progress in developing a solid ceramic electrolyte and have attracted attention from major automakers like Volkswagen. Their partnerships and technological advancements position them as a potential leader in the solid state battery market.

- Solid Power: Solid Power focuses on developing and commercializing solid-state batteries for various applications, including electric vehicles and aerospace. Their partnerships with automakers and their demonstration of high energy density solid-state batteries have garnered attention in the industry.

- ION Energy: ION Energy is an emerging player in the solid state battery space, focusing on materials and battery management systems. They aim to provide cost-effective and scalable solid-state battery solutions for electric vehicles, grid storage, and other applications. Their focus on affordability and partnerships with industry leaders make them an interesting option to consider.

- BlueSolutions (BLP): BlueSolutions, a subsidiary of the Bolloré Group, specializes in solid-state lithium metal polymer batteries. Their batteries are used in electric vehicles, energy storage systems, and other sectors. With their parent company’s experience in battery technology and strong market presence, BlueSolutions could be a solid investment opportunity.

- Other Established Battery Manufacturers: Established battery manufacturers are also venturing into solid state battery technology. Companies like Panasonic, Samsung SDI, and LG Chem are investing in research and development to enter the solid state battery market. These companies have the advantage of existing manufacturing capabilities, industry expertise, and established customer relationships.

It’s important to note that the solid state battery industry is still evolving, and the performance of individual companies can vary. Conduct thorough research and due diligence on any potential investment, considering factors such as financial health, partnerships, technological advancements, and market positioning. Additionally, stay informed about industry trends, regulatory developments, and advancements in solid state battery technology.

As with any investment, diversifying your portfolio and consulting with a financial advisor can help create a well-rounded investment strategy that aligns with your risk tolerance and financial goals. By carefully evaluating solid state battery stocks and staying updated on industry developments, you can identify potential investment opportunities in this exciting and evolving sector.

Conclusion

Solid state battery technology is rapidly advancing, offering numerous benefits and possibilities for the future of energy storage, particularly in the electric vehicle sector. Investing in solid state battery stocks can be an enticing opportunity for investors looking to capitalize on this emerging industry.

Throughout this article, we have explored the fundamentals of solid state battery technology, the benefits it offers, and the key factors to consider when investing in solid state battery stocks. We have discussed the importance of thoroughly researching solid state battery companies, analyzing their technological advancements, partnerships, and financial health.

There are certainly risks and challenges associated with investing in solid state battery stocks, such as technological uncertainties, market dynamics, and regulatory changes. However, by conducting careful research, staying informed, and diversifying your investment portfolio, you can mitigate some of these risks and potentially benefit from this promising technology.

Companies like QuantumScape Corporation, Solid Power, ION Energy, BlueSolutions, and established battery manufacturers are worth considering for their advancements in solid state battery technology, market positioning, and partnerships. However, it’s important to continue monitoring the industry, regulatory developments, and individual company performance to make informed investment decisions.

It’s crucial to note that investing in solid state battery stocks requires a long-term perspective and an understanding of the potential risks involved. Consulting with financial advisors or experts in the field can provide valuable insights and guidance tailored to your investment goals and risk tolerance.

In summary, solid state battery technology is poised to reshape the energy storage landscape, and investing in solid state battery stocks presents an opportunity to be part of this transformation. By keeping yourself informed, conducting thorough research, and staying attuned to industry developments, you can position yourself to make informed investment decisions and potentially benefit from the growth and advancements in solid state battery technology.