Finance

How To Calculate Builders Risk Insurance

Modified: December 29, 2023

Looking for answers on how to calculate builders risk insurance? Check out our comprehensive guide for all your finance needs.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is Builders Risk Insurance?

- Coverage and Policy Limitations

- Factors Affecting Builders Risk Insurance Premiums

- How to Calculate Builders Risk Insurance Premium

- Step 1: Determine the Total Project Cost

- Step 2: Calculate the Construction Period

- Step 3: Assess the Risk Level

- Step 4: Calculate the Builders Risk Insurance Rate

- Step 5: Apply the Rate to the Total Project Cost

- Step 6: Determine the Builders Risk Insurance Premium

- Additional Considerations in Calculating Builders Risk Insurance

- Conclusion

Introduction

Builders Risk Insurance is a specialized type of coverage that protects construction projects and the materials, equipment, and property involved in the construction process. It provides financial protection against various risks such as fire, theft, vandalism, and natural disasters during the construction period. Builders Risk Insurance is an essential component for contractors, builders, and property owners as it helps mitigate potential financial losses that may occur during the construction phase.

Construction projects are inherently susceptible to numerous risks and uncertainties. From the moment ground is broken to the final touches, there are countless variables that can impact the project. Accidents and mishaps can happen at any time, leaving contractors, builders, and property owners vulnerable to substantial financial loss.

Builders Risk Insurance acts as a safety net for construction projects, providing coverage for damages or losses to the property being built or renovated. This insurance policy covers not only the physical structure but also the materials, equipment, and machinery involved in the construction process.

Whether it’s a residential home, commercial building, or infrastructure project, having Builders Risk Insurance in place ensures that both the contractor and property owner are protected financially in the event of any unforeseen incidents that can delay or damage the construction project.

While Builders Risk Insurance is not mandatory, it is highly recommended for all parties involved in construction projects. Without adequate insurance coverage, contractors and builders may face substantial financial burdens in the event of unexpected damage or loss. It provides peace of mind and helps foster a secure working environment, allowing construction projects to proceed smoothly without worrying about potential risks.

In the following sections, we will delve deeper into the specifics of Builders Risk Insurance, including its coverage, policy limitations, factors affecting premiums, and ultimately, how to calculate the Builders Risk Insurance premium for a construction project.

What is Builders Risk Insurance?

Builders Risk Insurance, also known as Course of Construction Insurance, is a type of property insurance that provides coverage for damages or losses to a construction project during the building phase. It is designed to protect contractors, builders, and property owners from financial loss due to unforeseen events, such as fire, theft, vandalism, or natural disasters.

This insurance policy covers a wide range of risks that can occur during the construction period. It typically encompasses the physical structure being built, including materials, equipment, and fixtures, as well as any temporary structures or scaffolding on the construction site.

Builders Risk Insurance not only provides financial protection against property damage but also covers the expenses associated with delays in construction due to covered losses. This includes additional labor costs, equipment rentals, and other expenses necessary to resume and complete the project.

It’s important to note that Builders Risk Insurance is generally a temporary policy that is in effect until the construction project is completed. Once the project is finished, it is typically replaced by a permanent property insurance policy.

Who needs Builders Risk Insurance? This type of insurance is crucial for various parties involved in the construction process, including:

- Contractors: Contractors are responsible for the construction project and bear the risk of any potential damages or losses. Builders Risk Insurance provides them with financial protection and helps minimize their exposure to unforeseen risks.

- Builders: Builders, whether they are individual professionals or construction companies, invest significant time, money, and resources into construction projects. Builders Risk Insurance safeguards their investment by covering potential losses during the construction phase.

- Property Owners: Property owners who are financing the construction project or have a vested interest in its successful completion can benefit from Builders Risk Insurance. It offers them peace of mind and protection from potential financial burdens.

It’s important for all parties involved in a construction project to carefully assess their insurance needs and consider Builders Risk Insurance as part of their risk management strategy. By doing so, they can protect themselves from unexpected events and ensure the successful completion of the project.

Coverage and Policy Limitations

Builders Risk Insurance provides coverage for a wide range of damages and losses that can occur during the construction phase. However, it’s essential to understand the extent of coverage and the limitations of the policy to ensure adequate protection. Let’s explore the coverage and policy limitations of Builders Risk Insurance.

Coverage

Builders Risk Insurance typically covers the following risks:

- Fire: Coverage is provided for damages caused by fires, including structural damage, damage to materials, and equipment.

- Theft and Vandalism: Damages resulting from theft or malicious acts are covered, including stolen materials or equipment and damages caused by vandalism.

- Weather-related events: Coverage is provided for damages caused by windstorms, hail, lightning, and other weather-related events.

- Explosions: Damages caused by explosions, such as gas leaks or accidental detonations, are typically covered.

- Water Damage: Coverage is provided for damages caused by burst pipes, flooding, or other water-related incidents.

- Debris Removal: The cost of removing debris from covered losses is usually included in the policy.

- Additional Coverages: Depending on the policy, additional coverage may include equipment breakdown, pollutant cleanup, and soft costs (e.g., architect fees, permits, financing costs).

Policy Limitations

While Builders Risk Insurance offers valuable coverage, there are certain limitations to be aware of:

- Exclusions: Insurance policies may have specific exclusions, such as acts of terrorism, earthquakes, intentional damage, or acts of war. It’s crucial to review the policy and understand the exclusions.

- End Date: Builders Risk Insurance is temporary and typically ends once the construction project is completed, reaches occupancy, or is turned over to the owner. It’s important to ensure the coverage aligns with the project timeline.

- Policy Deductibles: Like any insurance policy, Builders Risk Insurance may have deductibles. The deductible is the amount that the insured party is responsible for before the insurance coverage kicks in.

- Policy Limits: The policy will have a maximum limit of coverage, which represents the total amount the insurer will pay in the event of a covered loss. It’s essential to assess the project’s value and ensure the coverage limit is adequate.

- Subcontractor Coverage: Builders Risk Insurance typically covers the contractor and owner but may not automatically extend to subcontractors. It’s vital to communicate with subcontractors to understand their insurance coverage and mitigate any potential gaps.

Understanding the coverage and limitations of Builders Risk Insurance is crucial for all parties involved in a construction project. It allows contractors, builders, and property owners to make informed decisions, mitigate risks, and ensure they have adequate financial protection during the construction phase.

Factors Affecting Builders Risk Insurance Premiums

Builders Risk Insurance premiums are determined by several factors that evaluate the risk associated with the construction project. Insurance providers consider these factors to calculate the premium amount that contractors, builders, and property owners need to pay for their coverage. Let’s explore the key factors that influence Builders Risk Insurance premiums:

- Project Value: The total value of the construction project plays a significant role in determining the insurance premium. Higher-value projects generally have higher premiums as they involve more materials, equipment, and potential risks.

- Type of Construction: The type of construction, whether it’s residential, commercial, or industrial, impacts the insurance premium. Different types of constructions pose varying levels of risks, and insurance providers consider this when calculating the premium.

- Location: The geographical location of the construction project is a crucial factor in determining the premium. Areas prone to natural disasters or with higher crime rates may have higher premiums due to increased risks.

- Construction Timeline: The duration of the construction project is another factor that affects the premium. Longer construction timelines may lead to higher premiums as they expose the property to potential risks for a more extended period.

- Project History: The track record of the contractor and the history of past projects can impact the premium. Contractors with a history of successful project completions and minimal losses may receive more favorable premiums.

- Security Measures: The security measures implemented on the construction site can influence the premium. Insurance providers may offer discounts for projects with robust security systems, such as surveillance cameras, fencing, and security guards.

- Contractor Experience and Qualifications: The experience and qualifications of the contractor involved in the project can impact the premium. Contractors with a strong reputation and a proven track record may receive more favorable premiums.

- Value of Materials and Equipment: The value of the materials and equipment on the construction site is considered when calculating the premium. Higher-value materials and equipment pose a greater risk and may result in higher premiums.

- Additional Coverages: The inclusion of additional coverages, such as equipment breakdown or soft costs, can influence the premium. The more comprehensive the coverage, the higher the premium may be.

It’s important to note that each insurance provider may have their own formula and criteria for calculating Builders Risk Insurance premiums. Therefore, it’s advisable to obtain quotes from multiple insurers and compare their rates and coverage to ensure the best fit for your construction project.

Understanding the factors that impact Builders Risk Insurance premiums allows contractors, builders, and property owners to make informed decisions, manage costs, and secure adequate coverage for their construction projects.

How to Calculate Builders Risk Insurance Premium

Calculating the Builders Risk Insurance premium involves assessing various factors related to the construction project and applying a rate determined by the insurance provider. While each insurance company may have its own specific formulas and criteria, the following steps provide a general framework for calculating the premium:

- Step 1: Determine the Total Project Cost

- Step 2: Calculate the Construction Period

- Step 3: Assess the Risk Level

- Step 4: Calculate the Builders Risk Insurance Rate

- Step 5: Apply the Rate to the Total Project Cost

- Step 6: Determine the Builders Risk Insurance Premium

Start by determining the total cost of the construction project, including the value of materials, labor, equipment, and other associated expenses. This value will serve as the basis for calculating the premium.

Evaluate the estimated duration of the construction project. This includes the time from the start of construction until expected completion. The longer the construction period, the higher the premium may be.

Evaluate the risk level associated with the construction project. Consider factors such as geographic location, construction type, historical data, and any potential risks specific to the project. This assessment helps determine the appropriate rate to be applied.

Insurance providers use various factors to determine the rate that will be applied to the project cost. These factors can include the type of construction, location, and risk assessment. The rate is typically expressed as a percentage of the project cost.

Multiply the rate calculated in the previous step by the total project cost. This will give you the premium amount before any adjustments or additional coverages.

Take into consideration any adjustments or additional coverages that may affect the premium. This can include deductibles, special endorsements, or specific policy limits. Adjust the premium accordingly to reflect these factors.

It’s important to note that this framework provides a general overview of the calculation process. Each insurance provider may have its specific formulas, criteria, and underwriting guidelines for calculating Builders Risk Insurance premiums. It’s recommended to consult with an insurance professional or request quotes from multiple insurers to obtain accurate premium calculations for your construction project.

By following these steps and understanding the factors involved in calculating the Builders Risk Insurance premium, contractors, builders, and property owners can make informed decisions, budget appropriately, and secure the necessary coverage to protect their construction projects.

Step 1: Determine the Total Project Cost

The first step in calculating the Builders Risk Insurance premium is to determine the total project cost. This includes assessing the value of materials, labor, equipment, and other associated expenses that will be incurred during the construction project.

To accurately determine the total project cost, consider the following factors:

- Materials: Calculate the cost of all the materials needed for the construction project, including the cost of purchasing or acquiring those materials.

- Labor: Include the anticipated labor costs, wages, and salaries of all individuals involved in the construction process, such as contractors, subcontractors, and workers.

- Equipment: Evaluate the value of any equipment or machinery that will be used on the construction site. This can include heavy machinery, tools, and vehicles.

- Permits and Fees: Consider any costs associated with obtaining permits, licenses, or other necessary regulatory approvals for the construction project.

- Architectural and Design Fees: Include the fees associated with hiring architects, engineers, and other design professionals involved in the planning and development of the project.

- Contingency Funds: It’s advisable to allocate a contingency fund to account for unforeseen expenses or changes during the construction process.

By carefully assessing and quantifying these factors, a comprehensive estimate of the total project cost can be derived. It’s essential to consult with professionals and stakeholders to ensure all relevant expenses are considered and accounted for.

Accurately determining the total project cost is critical in calculating the Builders Risk Insurance premium as it serves as the foundation for subsequent calculations. It provides insurance providers with a clear understanding of the financial risk associated with the construction project, enabling them to assess the appropriate level of coverage and premium.

It’s important to note that project costs can fluctuate throughout the construction process due to changes, delays, or unexpected expenses. Therefore, it’s recommended to regularly reassess and update the total project cost to ensure the Builders Risk Insurance coverage remains adequate throughout the duration of the project.

Step 2: Calculate the Construction Period

In order to calculate the Builders Risk Insurance premium, it is crucial to accurately determine the construction period. This refers to the duration of time involved in completing the construction project, from the start of the construction until its expected completion.

Calculating the construction period involves considering various factors that may impact the timeline of the project:

- Project Complexity: The complexity of the project, including its size, scope, and intricacies, can influence the construction period. Larger and more intricate projects often require more time to complete.

- Seasonal Factors: Consider how different seasons or weather conditions can affect construction progress. Extreme weather, such as heavy rain or snow, may cause delays and extend the construction period.

- Contractual Obligations: Review the terms and conditions of the construction contract to understand the agreed-upon timeline. This may include specific milestones or deadlines that can impact the construction period.

- Availability of Resources: The availability of labor, materials, and equipment can influence the timeline. If there are shortages or delays in receiving necessary resources, it may prolong the construction period.

- Project Phases: Break down the construction project into phases or stages and estimate the time required to complete each phase. This helps in assessing the overall construction period.

Once you have considered these factors, determine the estimated duration of the construction project. This will help insurance providers gauge the level of risk associated with the project and calculate the appropriate premium.

It is important to note that unforeseen circumstances or events during the construction process may alter the estimated construction period. Delays due to weather conditions, changes in design, or unforeseen site conditions can impact the timeline. Contractors and builders should stay vigilant in monitoring the progress of the project and communicate any changes in the construction period to insurance providers as necessary.

Calculating the construction period accurately is essential for determining the Builders Risk Insurance premium. A longer construction period may lead to a higher premium due to an extended exposure to potential risks and hazards. By taking into account relevant factors and making realistic assessments, contractors, builders, and property owners can ensure the stability of their insurance coverage throughout the construction project.

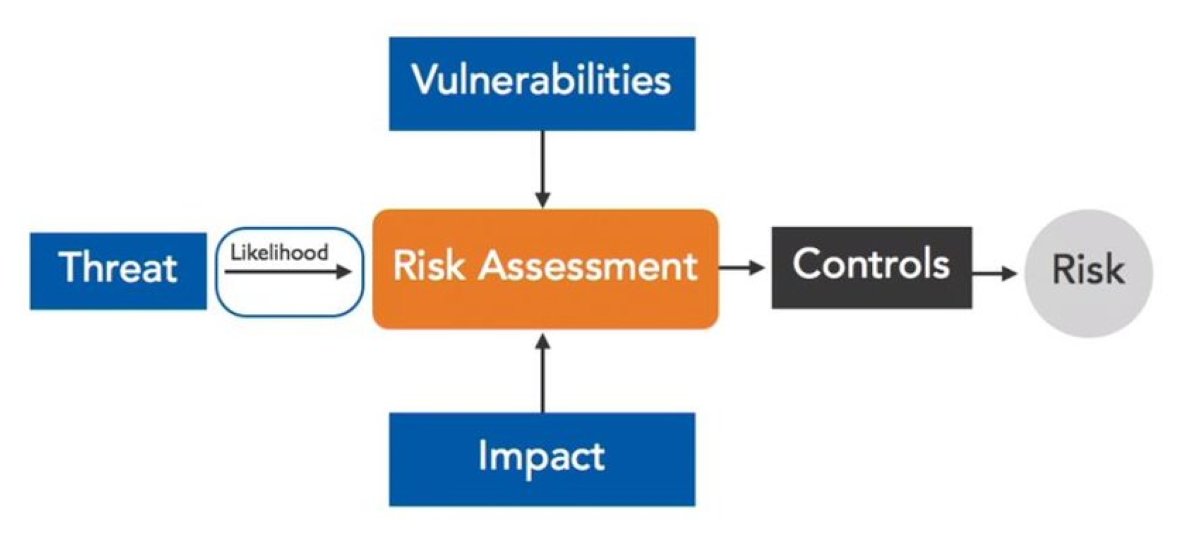

Step 3: Assess the Risk Level

When calculating the Builders Risk Insurance premium, it’s essential to assess the risk level associated with the construction project. This evaluation helps insurance providers determine the likelihood and potential severity of potential losses or damages. Factors to consider when assessing the risk level include:

- Location: Evaluate the geographic location of the construction project. Areas prone to natural disasters, such as hurricanes, earthquakes, or floods, may pose higher risks and result in higher premiums.

- Security Measures: Assess the security measures implemented on the construction site, such as fencing, surveillance cameras, and security personnel. Adequate security measures can help reduce the risk of theft, vandalism, and unauthorized access, potentially lowering the premium.

- Project Type and Scope: Consider the type of construction project and its specific characteristics. Different types of projects may present different risks. For example, a high-rise building project may involve greater risks than a residential house construction.

- Past Project Experience: Evaluate the track record of the contractor or builder. Insurance providers may take into account the contractor’s past performance, including any history of claims, to assess their risk level. Contractors with a solid history of successful projects and minimized losses may be considered lower risk.

- Quality Control Measures: Review the quality control measures in place to ensure the construction is done to industry standards. Proper checks and inspections throughout the construction process can help mitigate potential risks, resulting in a lower risk level and potentially lower premiums.

- Project Value: Consider the overall value of the project, including materials, equipment, and labor. Higher-value projects typically present higher risks and may result in higher insurance premiums.

By thoroughly assessing the risk level, insurance providers can determine the appropriate premium to charge for the Builders Risk Insurance policy. Projects with higher risks will likely have higher premiums to account for the potential financial exposure.

It’s important to note that risk assessments can involve a degree of subjectivity, and insurance providers may use their own proprietary models to evaluate risk. Communication with insurance professionals and underwriters can help better understand the specific factors they consider when assessing the risk level.

By accurately assessing the risk level associated with the construction project, contractors, builders, and property owners can ensure they have the proper insurance coverage in place to protect against potential losses or damages.

Step 4: Calculate the Builders Risk Insurance Rate

Calculating the Builders Risk Insurance rate is a crucial step in determining the insurance premium for a construction project. The rate is a percentage applied to the total project cost and represents the cost of the insurance coverage. Insurance providers consider several factors to determine the appropriate rate, including:

- Construction Type: Different types of construction projects pose varying levels of risk. Factors such as the materials used, the complexity of the design, and the project’s purpose can influence the rate. For example, a residential project may have a different rate compared to a commercial or industrial project.

- Location: The geographic location of the construction project plays a role in determining the rate. Areas prone to natural disasters, high crime rates, or other risks may result in higher rates to account for the increased likelihood of losses.

- Project Value: The total project cost is a significant factor in calculating the rate. The higher the project value, the more potential risk the insurance provider assumes, which may result in a higher rate.

- Risk Assessment: Insurance providers assess the overall risk level associated with the project. This includes evaluating the construction site’s security measures, past performance of the contractor, any known risks in the area, and other factors that impact the likelihood of losses.

- Reputation and Experience: Contractors with a solid reputation and extensive experience may be considered lower risk, potentially resulting in a lower rate. Demonstrating a history of successful projects and minimal claims can help secure a more favorable rate.

Insurance providers typically determine the rate based on their own underwriting guidelines and risk assessment processes. The rate is expressed as a percentage of the total project cost, and it represents the cost of the insurance coverage for the construction project.

It’s important to note that insurance rates can vary significantly between insurance providers, and contractors, builders, and property owners should obtain quotes from multiple insurers to compare rates and coverage options.

By accurately calculating the Builders Risk Insurance rate, stakeholders can understand the cost of the insurance coverage and ensure they have appropriate financial protection for their construction project.

Step 5: Apply the Rate to the Total Project Cost

Once the Builders Risk Insurance rate has been determined, the next step is to apply that rate to the total project cost. The rate, expressed as a percentage, represents the cost of the insurance coverage for the construction project. By multiplying this rate by the total project cost, the insurance premium can be calculated.

To apply the rate to the total project cost:

- Convert the Rate to a Decimal: If the rate is given as a percentage, convert it to a decimal by dividing it by 100. For example, if the rate is 2.5%, divide it by 100 to get 0.025.

- Multiply the Total Project Cost by the Rate: Multiply the total project cost by the decimal rate calculated in step 1. For example, if the total project cost is $500,000 and the rate is 0.025, the calculation would be: $500,000 * 0.025 = $12,500.

The result of the multiplication represents the Builders Risk Insurance premium before any adjustments or additional coverages are taken into account. This calculated premium reflects the cost of the insurance coverage for the construction project based on the determined rate.

It’s important to note that the rate applied to the total project cost should align with the insurance policy terms and conditions. Review the policy carefully to ensure that the correct rate is used to accurately calculate the premium.

By applying the rate to the total project cost, contractors, builders, and property owners can arrive at the initial premium amount that is based on the risk level and value of the construction project. However, additional considerations and adjustments should be made to obtain the final Builders Risk Insurance premium.

Step 6: Determine the Builders Risk Insurance Premium

After applying the rate to the total project cost, the next step is to determine the Builders Risk Insurance premium. This involves considering any adjustments or additional coverages that may affect the final premium amount.

Factors to consider when determining the Builders Risk Insurance premium include:

- Policy Deductibles: Assess if there are any deductibles associated with the insurance policy. A deductible is the amount that the insured party must pay out of pocket before the insurance coverage applies. Adjust the premium to reflect the deductible amount.

- Special Endorsements: Evaluate if any special endorsements or modifications have been added to the insurance policy. Special endorsements provide additional coverage specific to the construction project. Adjust the premium accordingly to reflect any endorsed coverages.

- Specific Policy Limits: Consider if the policy has any specific coverage limits. These limits determine the maximum amount the insurance provider will pay in the event of a covered loss. Ensure the premium aligns with the specified limits.

- Additional Coverage: Assess if there are any additional coverages included in the policy, such as equipment breakdown coverage or pollutant cleanup coverage. Adjust the premium accordingly to reflect the inclusion of these additional coverages.

By taking these adjustments and considerations into account, the final determination of the Builders Risk Insurance premium can be made. The premium amount represents the cost of the insurance coverage, including any adjustments or additional coverages specified in the policy.

It’s important to review the insurance policy and understand the terms and conditions to accurately determine the Builders Risk Insurance premium. The final premium should reflect the coverage provided by the policy and any specific policy limits, deductibles, or special endorsements that may apply.

Consulting with insurance professionals or underwriters can provide further guidance and help ensure the accuracy of the final premium determination. It’s also advisable to obtain quotes from multiple insurance providers to compare premiums and coverage options.

By determining the Builders Risk Insurance premium accurately, contractors, builders, and property owners can have the necessary coverage in place to protect against potential losses or damages during the construction project.

Additional Considerations in Calculating Builders Risk Insurance

When calculating Builders Risk Insurance, it’s important to take into account additional factors and considerations that may impact the premium and overall coverage. These considerations further refine the insurance policy and ensure comprehensive protection for the construction project. Here are some additional factors to consider:

- Subcontractor Coverage: If subcontractors are involved in the project, it’s crucial to assess whether their activities are covered under the primary Builders Risk Insurance policy or if they require separate coverage. Lack of coverage for subcontractors can lead to potential gaps in insurance protection.

- Policy Term Extensions: Some construction projects may experience delays that extend beyond the initial policy term. In such cases, it’s important to discuss the possibility of policy term extensions with the insurance provider to maintain continuous coverage throughout the extended construction period.

- Material and Equipment Storage: If project materials and equipment are stored off-site during construction, consider whether coverage extends to these locations or if additional insurance is required to protect against potential losses or damages at storage facilities.

- Renovations and Alterations: If the project involves renovations or alterations to existing structures, evaluate whether the insurance policy covers these activities and provides adequate coverage for any potential damages or losses that may occur during the construction process.

- Notice Period and Reporting Requirements: Familiarize yourself with the notice period and reporting requirements outlined in the insurance policy. It’s essential to understand when and how to report any incidents or potential claims to ensure compliance and avoid any issues with insurance coverage.

- Insurance Endorsements: Consider if there are any optional insurance endorsements available that can enhance the coverage provided by the Builders Risk Insurance policy. Endorsements can be tailored to specific project needs and provide additional protection for unique risks associated with the construction project.

Each construction project is unique, and understanding these additional considerations is crucial in tailoring the Builders Risk Insurance coverage to specific project requirements. Assessing risks, ensuring appropriate coverage for subcontractors, and understanding policy terms and requirements help mitigate potential gaps in insurance protection.

It is highly recommended to consult with insurance professionals who specialize in construction insurance. They can provide expert advice, identify potential risk factors, and address any specific concerns or requirements related to the construction project. Their expertise ensures that the Builders Risk Insurance coverage is comprehensive and suitable for the project’s needs.

By considering these additional factors and seeking guidance from insurance professionals, contractors, builders, and property owners can secure robust Builders Risk Insurance coverage tailored to their specific construction project.

Conclusion

Builders Risk Insurance is a vital component for contractors, builders, and property owners involved in construction projects. It provides essential financial protection against a wide range of risks that can occur during the construction phase, including property damage, theft, vandalism, and natural disasters.

In this article, we have explored the key aspects of Builders Risk Insurance, including what it is, its coverage, policy limitations, and the factors that influence insurance premiums. We have outlined a step-by-step process for calculating the Builders Risk Insurance premium, from determining the total project cost to applying the rate and considering additional factors.

By accurately calculating the insurance premium based on the specific project requirements, contractors, builders, and property owners can ensure they have adequate financial protection and peace of mind during the construction phase. It’s important to assess project risks, understand policy terms and limitations, and consider additional coverages to address any unique aspects of the construction project.

Consulting with insurance professionals and obtaining quotes from multiple insurers can help in making informed decisions while securing the most suitable coverage at competitive rates. Insurance providers have their own underwriting guidelines and risk assessment processes, so it’s crucial to have open communication and gather all necessary information for an accurate premium calculation.

Ultimately, Builders Risk Insurance plays a critical role in mitigating potential financial losses and ensuring a successful construction project. It is a valuable investment that protects the investment of time, money, and resources involved in construction projects. By understanding the intricacies of Builders Risk Insurance and actively managing risk, contractors, builders, and property owners can navigate the construction process with confidence and safeguard their projects.