Home>Finance>Commodity Price Risk: Definition, Calculation, And Main Risks

Finance

Commodity Price Risk: Definition, Calculation, And Main Risks

Published: October 30, 2023

Learn about commodity price risk in finance, including its definition, calculation methods, and key risks. Gain insights to manage this risk effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Commodity Price Risk: Definition, Calculation, and Main Risks

Finance is a vast field that encompasses various aspects of managing money, investments, and risks. One crucial aspect of finance that individuals and businesses alike must understand is commodity price risk. In this blog post, we will dive deep into the world of commodity price risk, exploring its definition, calculation methods, and main risks involved.

Key Takeaways:

- Commodity price risk refers to the potential for financial loss arising from changes in the prices of raw materials, such as oil, gas, metals, or agricultural products.

- Calculation of commodity price risk involves analyzing historical price data, market trends, and using mathematical models to estimate the potential impact on investments or production costs.

What is Commodity Price Risk?

Commodity price risk, as the name suggests, is the risk associated with fluctuations in the prices of commodities. It affects both producers and consumers of raw materials, who depend on stable prices for their business operations and financial well-being.

But why is understanding and managing commodity price risk important?

- For businesses involved in production, price volatility can significantly impact costs and profit margins.

- For investors and commodity traders, price fluctuations provide opportunities for profit or loss.

- Commodity price risk can influence inflation rates, affecting the overall economy.

Calculating Commodity Price Risk

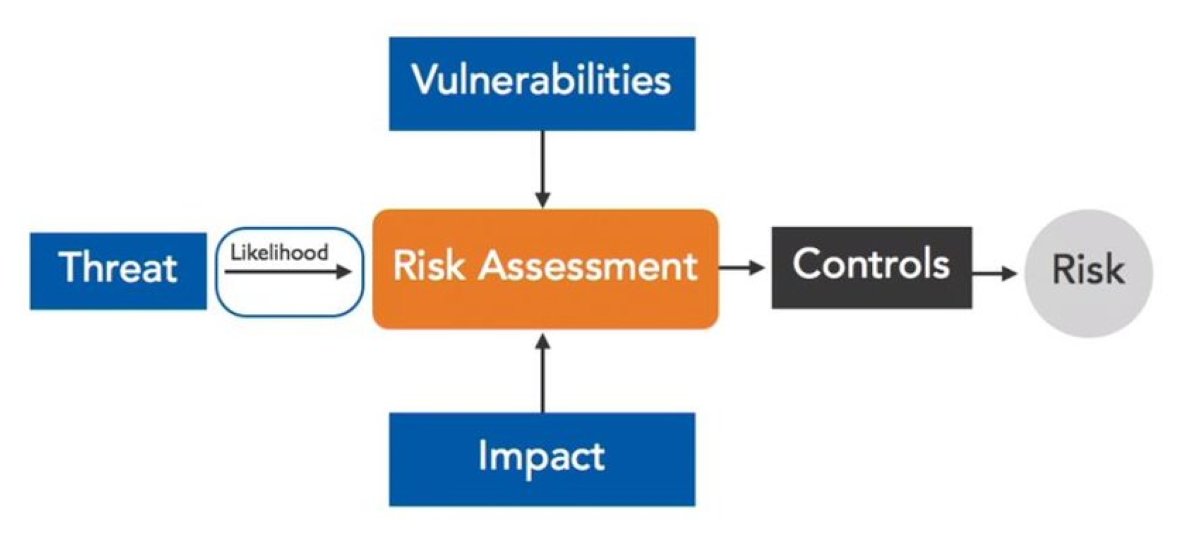

Measuring and managing commodity price risk involves a combination of analysis, modeling, and informed decision-making. Here are the key steps involved in the calculation process:

- Historical Data Analysis: Examining historical price movements and identifying trends, patterns, and price cycles.

- Market Research: Keeping a close eye on supply and demand dynamics, geopolitical factors, weather patterns, and regulatory changes that could impact commodity prices.

- Mathematical Models: Constructing mathematical models, such as regression analysis or Monte Carlo simulations, to estimate and forecast potential price movements.

- Scenario Analysis: Conducting scenario analysis to evaluate the impact of different price scenarios on investment portfolios or business operations.

Main Risks of Commodity Price Risk

While commodity price risk is an intrinsic part of the market, there are several key risks that individuals and businesses need to be aware of:

- Price Volatility: Sudden fluctuations in commodity prices make it challenging to forecast and plan effectively.

- Supply and Demand Factors: Changes in global economic conditions, political events, or natural disasters can disrupt supply chains and impact commodity prices.

- Geopolitical Risks: Political instability, trade wars, and sanctions among countries can introduce uncertainty and impact commodity prices.

- Technological Developments: Innovation and advancements in technology can disrupt traditional commodity markets, affecting prices and demand.

Managing these risks requires a proactive approach, staying well-informed about market dynamics, and implementing appropriate risk management strategies, such as hedging or diversification.

In Conclusion

Commodity price risk is a vital aspect of finance that individuals and businesses need to understand and manage effectively. By analyzing historical data, monitoring market trends, and using mathematical models, it is possible to calculate and estimate the potential impact of price fluctuations. Understanding the main risks associated with commodity price risk empowers market participants to make informed decisions and implement suitable risk management strategies.

Remember, in today’s interconnected world, staying ahead of commodity price risk can make a significant difference in navigating the complex financial landscape.