Home>Finance>How To Calculate Minimum Payment On A Line Of Credit

Finance

How To Calculate Minimum Payment On A Line Of Credit

Published: February 26, 2024

Learn how to calculate the minimum payment on a line of credit and manage your finances effectively with our comprehensive guide. Understand the key factors that determine your minimum payment.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

A line of credit is a flexible financial tool that provides individuals and businesses with access to funds up to a predetermined credit limit. Unlike a traditional loan, a line of credit allows borrowers to withdraw funds as needed, making it a convenient option for managing fluctuating expenses or seizing unexpected opportunities. However, understanding how to calculate the minimum payment on a line of credit is crucial for responsible financial management.

Managing a line of credit effectively involves more than just making minimum payments. It requires a comprehensive understanding of the factors that influence the minimum payment amount and the implications of different payment strategies. By gaining insight into these aspects, borrowers can make informed decisions that align with their financial goals and avoid potential pitfalls associated with revolving credit.

In this article, we will delve into the intricacies of calculating the minimum payment on a line of credit. We will explore the fundamental concepts underlying lines of credit, examine the factors that affect minimum payments, and provide a step-by-step guide for calculating the minimum payment amount. Additionally, we will offer practical tips for managing line of credit payments effectively to empower borrowers with the knowledge needed to navigate this financial tool with confidence.

Understanding the nuances of minimum payments on a line of credit is essential for maintaining financial stability and leveraging this financial resource to its fullest potential. Let's embark on this insightful journey to unravel the intricacies of line of credit minimum payments and equip ourselves with the knowledge to make informed financial decisions.

Understanding the Line of Credit

Before delving into the specifics of calculating the minimum payment on a line of credit, it’s crucial to grasp the fundamental nature of this financial instrument. A line of credit is a revolving credit account extended by a financial institution, such as a bank or credit union, to an individual or business. Unlike a traditional term loan, which provides a lump sum of money that is repaid over a fixed period, a line of credit offers a predetermined credit limit from which the borrower can draw funds as needed.

One of the key features of a line of credit is its flexibility. Borrowers have the freedom to access funds up to the approved credit limit, and they are only obligated to pay interest on the amount borrowed. This flexibility makes lines of credit an attractive option for managing various financial needs, such as covering unexpected expenses, funding home improvements, or addressing short-term cash flow gaps for businesses.

Lines of credit come in different forms, including personal lines of credit and business lines of credit. Personal lines of credit are often used for personal expenses, such as home repairs, medical bills, or consolidating high-interest debt. On the other hand, business lines of credit are commonly utilized by small business owners to address working capital needs, manage inventory fluctuations, or seize growth opportunities.

Furthermore, lines of credit can be secured or unsecured. A secured line of credit is backed by collateral, such as a home or other asset, which reduces the lender’s risk and may result in a lower interest rate. In contrast, an unsecured line of credit does not require collateral but typically carries a higher interest rate to compensate for the increased risk to the lender.

Understanding the nature of a line of credit is essential for borrowers aiming to make informed financial decisions. By comprehending the flexibility, potential uses, and variations of lines of credit, individuals and businesses can effectively assess whether this financial tool aligns with their specific needs and financial objectives.

Factors Affecting Minimum Payment

When it comes to understanding the minimum payment on a line of credit, several factors come into play, influencing the calculation and the overall financial implications. By gaining insight into these factors, borrowers can develop a comprehensive understanding of the dynamics at play and make informed decisions regarding their line of credit management.

Outstanding Balance: The outstanding balance on a line of credit directly impacts the minimum payment amount. Typically, the minimum payment is calculated as a percentage of the outstanding balance, often ranging from 1% to 3% of the total balance. As the outstanding balance fluctuates due to withdrawals, repayments, and accrued interest, the minimum payment amount adjusts accordingly.

Interest Rate: The interest rate associated with the line of credit is a critical factor influencing the minimum payment. Higher interest rates result in larger interest charges, which, in turn, contribute to a higher minimum payment. Understanding the nuances of the interest rate and its impact on the minimum payment can help borrowers assess the cost of carrying a balance on their line of credit and explore strategies to minimize interest expenses.

Credit Limit Utilization: The utilization of the line of credit’s available limit affects the minimum payment calculation. When the outstanding balance approaches or exceeds the credit limit, the minimum payment is likely to increase, reflecting the higher level of credit utilization and associated risk for the lender. Managing credit limit utilization strategically can help borrowers maintain a manageable minimum payment and preserve their creditworthiness.

Payment Terms: The specific terms and conditions outlined in the line of credit agreement, including the minimum payment calculation method, grace periods, and any applicable fees, impact the minimum payment amount. Understanding the payment terms enables borrowers to anticipate their financial obligations and proactively manage their line of credit payments to avoid unnecessary fees and minimize interest costs.

Accrued Interest: Interest that accrues on the outstanding balance contributes to the total amount owed and influences the minimum payment. As interest accumulates over the billing cycle, it becomes part of the outstanding balance, leading to a higher minimum payment requirement. Being mindful of accrued interest and its impact on the minimum payment empowers borrowers to assess the long-term cost of maintaining a balance on their line of credit.

By recognizing and analyzing these factors, borrowers can gain a comprehensive understanding of the elements shaping the minimum payment on a line of credit. This knowledge forms the foundation for making informed financial decisions and implementing effective strategies to manage line of credit payments responsibly and strategically.

Calculation of Minimum Payment

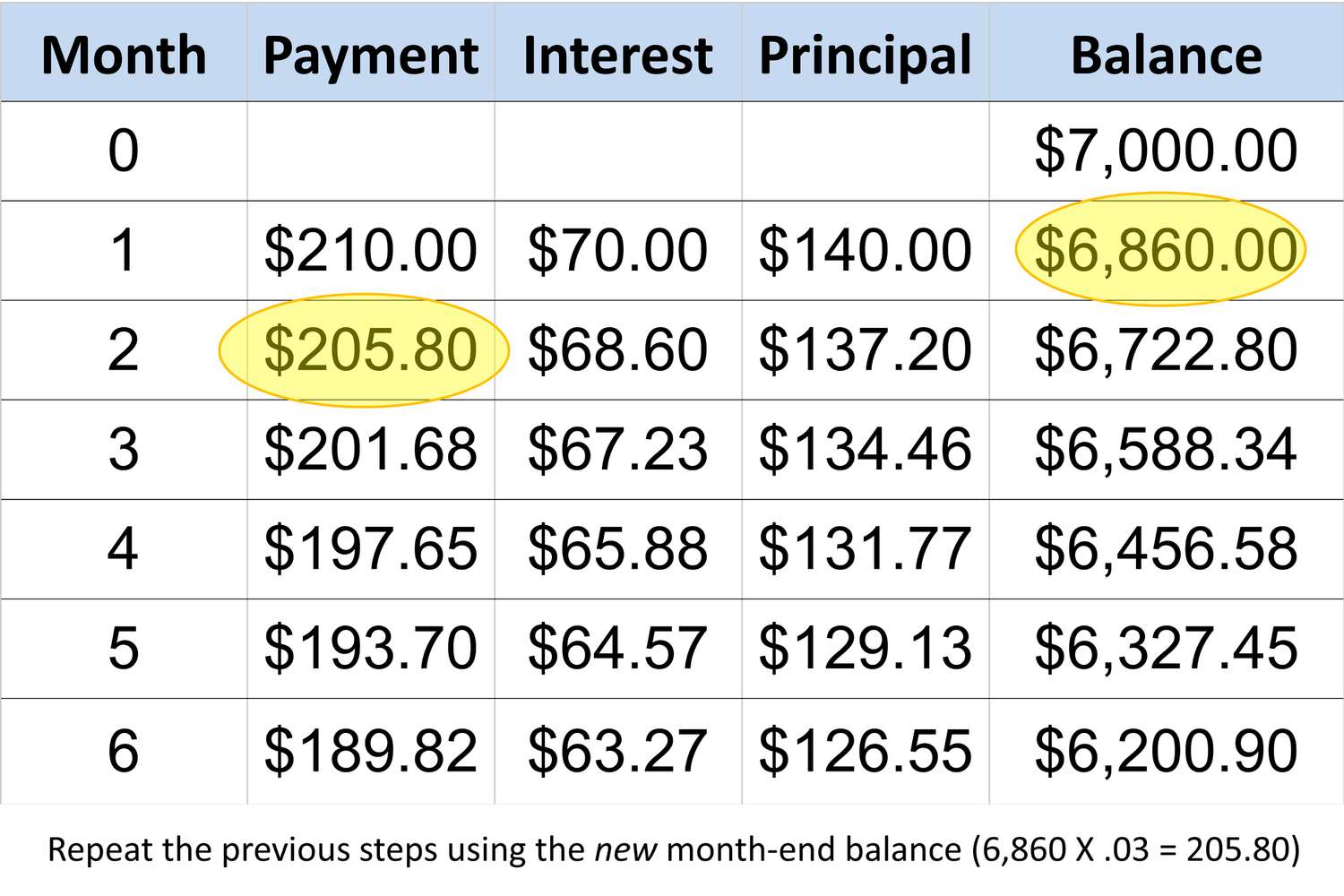

Understanding how the minimum payment on a line of credit is calculated is essential for borrowers seeking to manage their financial obligations effectively. While specific calculation methods may vary among lenders, the following general guidelines provide insight into the typical approach to determining the minimum payment amount.

Percentage of Outstanding Balance: One common method for calculating the minimum payment on a line of credit involves applying a percentage to the outstanding balance. This percentage, typically ranging from 1% to 3%, represents the minimum amount that must be paid each billing cycle. For example, if the outstanding balance on a line of credit is $5,000 and the minimum payment percentage is 2%, the minimum payment would be $100.

Interest Charges: In addition to the percentage-based approach, lenders may require borrowers to pay any accrued interest on the outstanding balance as part of the minimum payment. This ensures that the interest costs are being covered, preventing the balance from continuously growing solely due to interest charges. By addressing the interest charges within the minimum payment, borrowers can make progress in reducing the overall balance owed on the line of credit.

Fixed Minimum Amount: Some lenders establish a minimum dollar amount that must be paid each billing cycle, regardless of the outstanding balance or accrued interest. This fixed minimum amount provides a baseline for the borrower’s financial commitment, ensuring that a certain level of payment is maintained irrespective of the balance fluctuations. For example, a lender may set a minimum payment requirement of $50, providing clarity and predictability for borrowers.

It’s important for borrowers to review their line of credit agreement and consult with their lender to understand the specific method used to calculate the minimum payment. By gaining clarity on the calculation approach, borrowers can anticipate their financial obligations, make informed decisions regarding their line of credit usage, and develop strategies to manage their minimum payments effectively.

Furthermore, understanding the nuances of the minimum payment calculation empowers borrowers to assess the long-term financial implications of carrying a balance on their line of credit. By proactively managing their minimum payments and exploring opportunities to reduce the outstanding balance, borrowers can work toward financial stability and leverage their line of credit as a valuable financial resource.

Tips for Managing Line of Credit Payments

Effectively managing line of credit payments is essential for maintaining financial stability and maximizing the benefits of this flexible financial tool. By implementing strategic approaches and adopting responsible financial habits, borrowers can navigate their line of credit obligations with confidence and minimize the long-term financial impact. Here are valuable tips for managing line of credit payments:

- Regular Monitoring: Stay proactive by regularly monitoring the outstanding balance and tracking the accrued interest on your line of credit. By staying informed about the evolving financial dynamics, you can anticipate the minimum payment requirements and make well-informed decisions regarding your financial commitments.

- Strategic Credit Utilization: Avoid maxing out your line of credit, as high credit utilization can lead to larger minimum payments and potential strain on your finances. Aim to use your line of credit judiciously, keeping the utilization within manageable limits to maintain a reasonable minimum payment amount.

- Timely Payments: Ensure that you make your line of credit payments on time to avoid late fees and potential negative impacts on your credit score. Timely payments demonstrate financial responsibility and contribute to a positive credit history, which can benefit your overall financial well-being.

- Pay More Than the Minimum: Whenever possible, strive to pay more than the minimum required amount. By allocating additional funds toward reducing the outstanding balance, you can minimize interest costs and accelerate progress toward paying off the line of credit, ultimately saving money in the long run.

- Review Payment Terms: Familiarize yourself with the specific payment terms outlined in your line of credit agreement. Understand the minimum payment calculation method, grace periods, and any associated fees. Clarity on these terms enables you to plan and manage your payments effectively.

- Financial Planning: Incorporate your line of credit payments into your overall financial planning. Consider how these payments fit into your budget and financial goals. By integrating your line of credit obligations into your broader financial strategy, you can ensure that they align with your financial well-being.

- Seek Guidance: If you encounter challenges or uncertainties regarding your line of credit payments, don’t hesitate to seek guidance from financial advisors or your lender. Professional advice can offer valuable insights and assistance in navigating your line of credit obligations effectively.

By embracing these tips and integrating them into your financial practices, you can take control of your line of credit payments and leverage this financial resource responsibly. Strategic management of line of credit payments contributes to financial stability, fosters positive credit management, and supports your overall financial well-being.

Conclusion

Understanding how to calculate the minimum payment on a line of credit is a fundamental aspect of responsible financial management. As we’ve explored the intricacies of lines of credit, delved into the factors influencing minimum payments, and examined the calculation methods, it’s evident that strategic management of line of credit payments is essential for borrowers seeking to maintain financial stability and make informed financial decisions.

By comprehending the nature of lines of credit, including their flexibility and potential uses, borrowers can assess whether this financial tool aligns with their specific needs and financial objectives. The factors affecting minimum payments, such as outstanding balance, interest rates, and credit limit utilization, provide valuable insights into the dynamics shaping the minimum payment amount. Armed with this knowledge, borrowers can navigate their line of credit obligations with clarity and foresight.

Furthermore, the tips for managing line of credit payments offer practical strategies for borrowers to proactively address their financial commitments. From regular monitoring and strategic credit utilization to timely payments and financial planning, these tips empower borrowers to take control of their line of credit payments and leverage this financial resource responsibly.

Ultimately, informed decision-making and proactive management of line of credit payments contribute to financial stability, positive credit management, and long-term financial well-being. By integrating these principles into their financial practices, borrowers can optimize the benefits of their line of credit while minimizing the potential drawbacks associated with revolving credit.

As borrowers continue to navigate the complexities of personal and business finance, the knowledge and insights gained from understanding line of credit minimum payments serve as a valuable asset. Empowered with this understanding, individuals and businesses can make informed financial decisions, cultivate responsible financial habits, and work toward achieving their broader financial goals.

In conclusion, the ability to calculate and manage line of credit payments strategically is a hallmark of financial prudence and empowerment. By embracing this knowledge, borrowers can harness the potential of lines of credit as a valuable financial tool while safeguarding their financial well-being.