Finance

How Is The Citi Minimum Payment Calculated

Published: February 25, 2024

Learn how the Citi minimum payment is calculated and manage your finances effectively. Understand the key factors impacting your credit card payments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Credit cards are a convenient financial tool that allows individuals to make purchases and manage their expenses. However, it's crucial to understand the various aspects of credit card usage, including the minimum payment requirement. When it comes to Citi credit cards, the calculation of the minimum payment is a significant factor that cardholders should comprehend.

In this article, we will delve into the intricacies of the Citi minimum payment calculation, shedding light on the factors that influence it and the formula used for its determination. By gaining a comprehensive understanding of this essential aspect of credit card management, you can make informed decisions regarding your finances and ensure responsible credit card usage.

Understanding how the Citi minimum payment is calculated is vital for every cardholder. It not only helps in managing your monthly budget effectively but also enables you to avoid unnecessary fees and interest charges. Moreover, by comprehending the calculation methodology, you can take proactive steps to maintain a healthy credit score and financial well-being.

As we embark on this exploration of the Citi minimum payment calculation, it's essential to recognize the significance of this financial concept in the broader context of personal finance. By the end of this article, you will have a clear understanding of the factors that influence the minimum payment, the formula used for its calculation, and practical examples to illustrate its application. Let's embark on this journey to demystify the Citi minimum payment calculation and empower ourselves with valuable financial knowledge.

Understanding the Citi Minimum Payment

The minimum payment on a Citi credit card represents the lowest amount that a cardholder is required to pay by a specified due date. This payment is typically a percentage of the total outstanding balance, subject to a minimum threshold. Understanding the dynamics of the Citi minimum payment is essential for responsible credit card management.

When you receive your Citi credit card statement, it will include details about the minimum payment due. It’s important to recognize that while paying the minimum amount by the due date helps you avoid late fees and maintains your account in good standing, it may result in accruing interest on the remaining balance. Therefore, it’s advisable to pay more than the minimum amount, if possible, to reduce the overall interest and expedite the repayment of the outstanding balance.

Moreover, comprehending the minimum payment requirement is crucial for individuals seeking to maintain a favorable credit score. Timely and consistent payment of at least the minimum amount reflects positively on your credit history, demonstrating responsible financial behavior to credit bureaus and potential lenders.

By understanding the significance of the Citi minimum payment, cardholders can make informed decisions about their repayment strategy, budgeting, and overall financial planning. It serves as a pivotal aspect of credit card management, influencing both short-term financial obligations and long-term creditworthiness.

As we delve deeper into the factors that influence the calculation of the Citi minimum payment, it’s important to recognize its role in the broader context of personal finance. The minimum payment requirement is not just a financial obligation but a tool for individuals to navigate their credit card usage responsibly, mitigate unnecessary fees, and cultivate a healthy credit profile.

Factors Affecting Citi Minimum Payment Calculation

The calculation of the minimum payment on a Citi credit card is influenced by several key factors, each of which plays a crucial role in determining the amount due. Understanding these factors is essential for cardholders to effectively manage their credit card obligations and make informed financial decisions.

- Outstanding Balance: The total amount owed on the credit card, including purchases, cash advances, and any applicable fees, directly impacts the minimum payment. As the outstanding balance increases, the minimum payment also rises proportionally.

- Minimum Payment Percentage: Citi, like many other credit card issuers, applies a minimum payment percentage to the outstanding balance. This percentage is typically around 1%-3% of the total balance, ensuring that the minimum payment adjusts in accordance with the amount owed.

- Interest Rate: The annual percentage rate (APR) on the credit card determines the interest accrued on the outstanding balance. The minimum payment calculation takes into account the accrued interest, influencing the total amount due.

- Fee Assessment: Any applicable fees, such as late payment fees or over-limit fees, can impact the minimum payment requirement. These additional charges contribute to the total outstanding balance, thereby affecting the minimum payment calculation.

- Payment History: Cardholders’ previous payment behavior, including the timeliness and consistency of payments, can influence the minimum payment calculation. Positive payment history may result in a lower minimum payment requirement, while a history of late payments could lead to a higher minimum payment.

By considering these factors, cardholders can gain insight into the dynamics of the minimum payment calculation and its responsiveness to changes in the outstanding balance, interest rate, and fee assessment. This understanding empowers individuals to proactively manage their credit card usage, make strategic repayment decisions, and maintain financial stability.

As we explore the formula for calculating the Citi minimum payment, it’s important to recognize the interplay of these factors and their collective influence on the minimum payment requirement. By comprehending these dynamics, cardholders can navigate their credit card obligations with confidence and make informed choices that align with their financial goals.

Formula for Calculating Citi Minimum Payment

The calculation of the minimum payment on a Citi credit card follows a specific formula that takes into account various components, including the outstanding balance, minimum payment percentage, and accrued interest. Understanding this formula is essential for cardholders to gauge the minimum amount due and plan their repayment strategy accordingly.

The general formula for calculating the minimum payment on a Citi credit card is as follows:

Minimum Payment = (Outstanding Balance * Minimum Payment Percentage) + Accrued Interest + Applicable Fees

Where:

- Outstanding Balance: This represents the total amount owed on the credit card, including purchases, cash advances, and any relevant fees.

- Minimum Payment Percentage: Citi typically applies a percentage, often between 1% and 3%, to the outstanding balance to determine the minimum payment amount.

- Accrued Interest: The interest accrued on the outstanding balance, based on the card’s annual percentage rate (APR), is added to the minimum payment calculation.

- Applicable Fees: Any relevant fees, such as late payment fees or over-limit fees, are included in the minimum payment calculation, contributing to the total amount due.

By utilizing this formula, Citi determines the minimum payment requirement for each billing cycle, taking into account the various financial elements that influence the total amount due. Cardholders can use this formula as a guide to estimate their minimum payment and assess the impact of changes in their outstanding balance, interest rate, and fee assessment on the minimum payment obligation.

Understanding the formula for calculating the Citi minimum payment empowers cardholders to make informed financial decisions, plan their budget effectively, and navigate their credit card obligations with clarity. By demystifying the minimum payment calculation process, individuals can take proactive steps to manage their credit card usage responsibly and maintain financial stability.

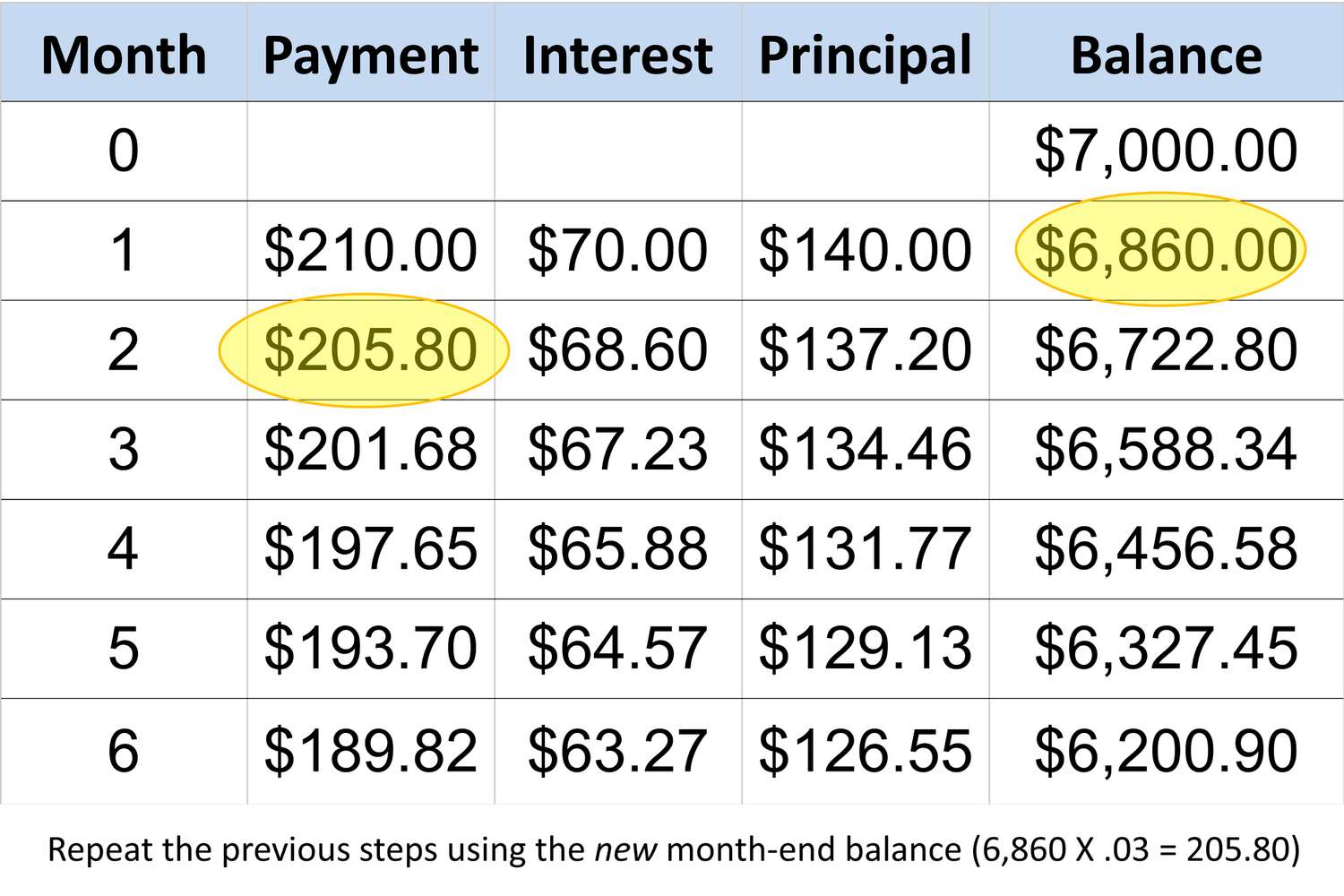

Examples of Citi Minimum Payment Calculation

Let’s explore practical examples to illustrate the calculation of the minimum payment on a Citi credit card. These examples will provide insight into how the minimum payment amount is determined based on the outstanding balance, minimum payment percentage, accrued interest, and applicable fees.

Example 1:

Assume a cardholder has an outstanding balance of $2,500 on their Citi credit card, and the minimum payment percentage set by Citi is 2%. Additionally, the card’s APR is 18%, and there are no applicable fees for this billing cycle.

Using the formula for calculating the minimum payment:

Minimum Payment = ($2,500 * 2%) + ($2,500 * 18% / 12) + $0

Minimum Payment = ($50) + ($37.50) + $0 = $87.50

In this example, the minimum payment for the billing cycle would amount to $87.50, considering the outstanding balance, minimum payment percentage, and accrued interest.

Example 2:

Now, let’s consider a scenario where the outstanding balance is $1,000, the minimum payment percentage is 3%, the APR is 20%, and there is a late payment fee of $25 applicable for this billing cycle.

Using the formula for calculating the minimum payment:

Minimum Payment = ($1,000 * 3%) + ($1,000 * 20% / 12) + $25

Minimum Payment = ($30) + ($16.67) + $25 = $71.67

In this example, the minimum payment for the billing cycle would amount to $71.67, factoring in the outstanding balance, minimum payment percentage, accrued interest, and the late payment fee.

These examples demonstrate how the minimum payment on a Citi credit card is calculated, showcasing the impact of the outstanding balance, minimum payment percentage, interest rate, and applicable fees on the total amount due. By understanding these calculations, cardholders can gain clarity on their minimum payment obligations and make informed decisions regarding their repayment strategy and financial planning.

Conclusion

Understanding the intricacies of the Citi minimum payment calculation is paramount for responsible credit card management and effective financial planning. By exploring the factors that influence the minimum payment, the formula used for its determination, and practical examples of its application, cardholders can gain valuable insights into this essential aspect of credit card usage.

Comprehending the dynamics of the minimum payment calculation empowers individuals to make informed decisions regarding their repayment strategy, budgeting, and overall financial well-being. It enables cardholders to navigate their credit card obligations with clarity, mitigate unnecessary fees, and cultivate a positive payment history that contributes to a healthy credit profile.

Moreover, by recognizing the impact of the outstanding balance, minimum payment percentage, accrued interest, and applicable fees on the minimum payment requirement, individuals can proactively manage their credit card usage and make strategic choices aligned with their financial goals.

As you engage with your Citi credit card, remember that while meeting the minimum payment is crucial to avoid late fees and maintain a good standing, it’s advisable to pay more than the minimum amount whenever possible. By doing so, you can reduce the overall interest accrued and expedite the repayment of the outstanding balance, fostering financial stability and long-term creditworthiness.

In conclusion, the Citi minimum payment calculation serves as a fundamental component of credit card management, influencing both short-term financial obligations and long-term financial health. By equipping yourself with a comprehensive understanding of this concept, you can navigate your credit card usage responsibly, make informed financial decisions, and embark on a path towards financial empowerment and security.