Finance

How To Get Amex Credit Limit Increase

Published: March 5, 2024

Learn how to increase your Amex credit limit and manage your finances effectively. Discover valuable tips and strategies to improve your financial standing.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

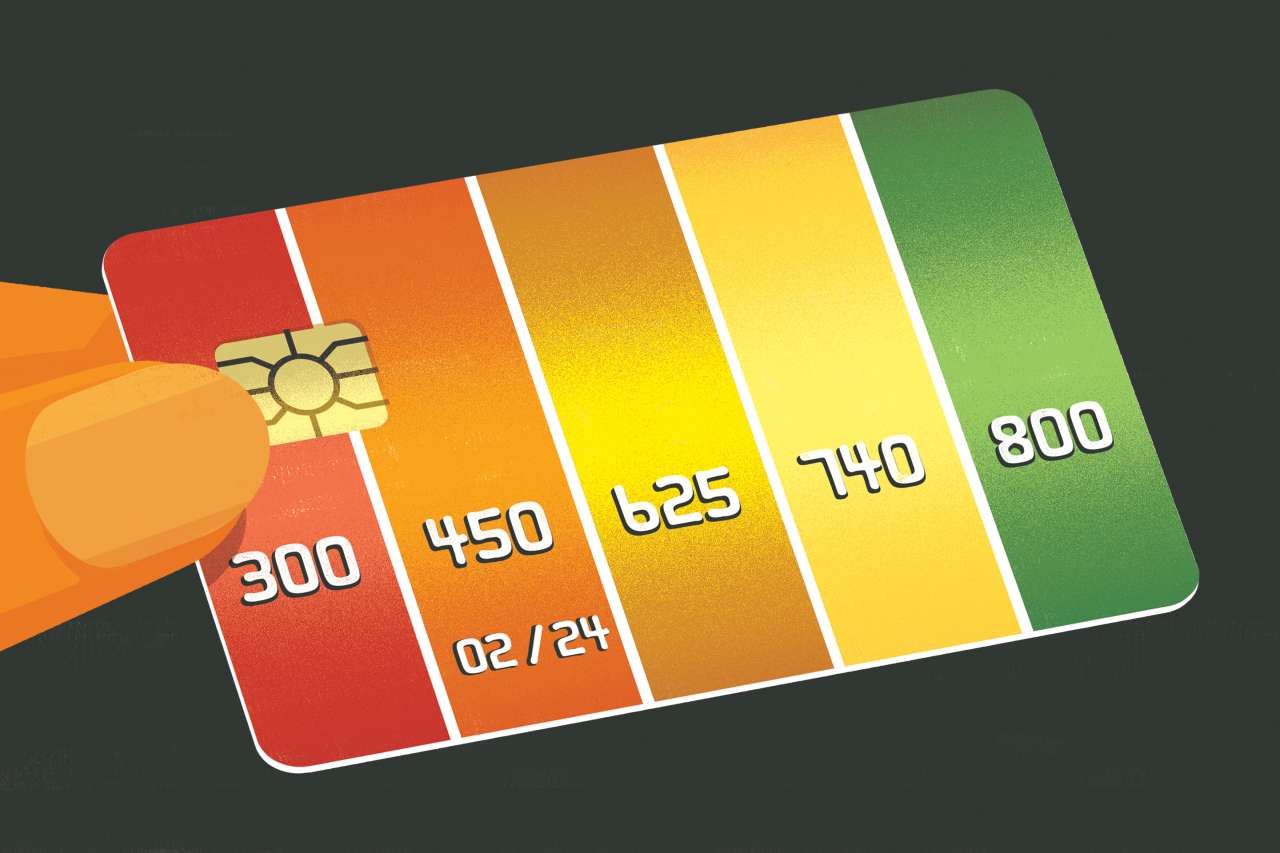

Welcome to the world of credit cards, where your purchasing power is often determined by a credit limit. An American Express (Amex) credit card is known for its prestige, rewards, and exceptional customer service. However, the initial credit limit you receive may not always align with your financial needs and spending habits. Fortunately, Amex provides cardholders with the opportunity to request a credit limit increase, allowing for greater flexibility and purchasing power.

In this comprehensive guide, we will delve into the intricacies of Amex credit limit increases, exploring the factors that influence these decisions and providing valuable insights on how to successfully request a higher credit limit. Whether you’re aiming to boost your purchasing power for everyday expenses, travel, or major purchases, understanding the process of obtaining an Amex credit limit increase can be immensely beneficial.

By the end of this guide, you will have a clear understanding of the steps involved in securing a credit limit increase from Amex, as well as valuable tips to improve your chances of approval. So, let’s embark on this enlightening journey to unlock the secrets of obtaining an Amex credit limit increase and maximizing the potential of your American Express card.

**

Understanding Credit Limit Increase

**

Before delving into the process of obtaining a credit limit increase from American Express, it’s essential to grasp the significance of this financial maneuver. A credit limit increase refers to the adjustment of the maximum amount of credit extended to a cardholder by the issuing financial institution. This increase provides cardholders with greater purchasing power and can positively impact their credit utilization ratio, a key factor in determining credit scores.

When it comes to American Express, a credit limit increase can open doors to enhanced spending capabilities, allowing cardholders to make larger purchases, finance essential expenses, and take advantage of lucrative rewards programs without being constrained by a limited credit line.

Moreover, a credit limit increase can also contribute to the overall improvement of a cardholder’s credit profile. By demonstrating responsible credit usage and financial stability, individuals may enhance their creditworthiness and potentially qualify for better loan terms and interest rates in the future.

It’s important to note that a credit limit increase does not equate to additional income; rather, it offers the flexibility to manage expenses and payments more effectively. Understanding the implications and benefits of a credit limit increase is crucial for making informed financial decisions and leveraging the full potential of an American Express credit card.

**

Factors Influencing Amex Credit Limit Increase

**

When it comes to determining whether a cardholder is eligible for a credit limit increase, American Express considers several key factors that collectively shape the decision-making process. Understanding these factors is instrumental in preparing a compelling request and improving the likelihood of a successful outcome.

- Payment History: Your track record of making timely payments on your Amex account is a critical factor. Consistently paying at least the minimum amount due, if not the full balance, demonstrates financial responsibility and may positively influence the decision regarding a credit limit increase.

- Credit Utilization Ratio: This ratio reflects the percentage of your available credit that you are currently using. Maintaining a low credit utilization ratio, ideally below 30%, signals responsible credit management and may bolster your case for a credit limit increase.

- Income and Employment Stability: American Express assesses your income and employment stability to gauge your capacity to manage a higher credit limit. A steady income and employment history can instill confidence in the issuer regarding your ability to handle increased credit.

- Credit History: Your overall credit history, including the length of your credit accounts and your track record with other creditors, is taken into account. A positive credit history, characterized by a lack of derogatory marks and a proven ability to manage credit responsibly, can work in your favor.

- Account Age: The duration for which you have held an American Express account can influence the decision. Established account longevity can be indicative of a mutually beneficial relationship, potentially strengthening your case for a credit limit increase.

By comprehensively evaluating these factors, American Express aims to make informed decisions regarding credit limit increases, ensuring that cardholders are granted higher credit limits in a manner that aligns with their financial capabilities and credit management practices.

**

How to Request a Credit Limit Increase from Amex

**

Requesting a credit limit increase from American Express involves a strategic approach and a clear understanding of the necessary steps. By following these guidelines, you can navigate the process with confidence and maximize your chances of securing a higher credit limit.

- Assess Your Eligibility: Before submitting a request for a credit limit increase, it’s crucial to evaluate your eligibility based on factors such as your payment history, credit utilization ratio, and overall financial stability. Ensuring that these foundational elements are in good standing can bolster your case for an increase.

- Log into Your Amex Account: Access your American Express online account or mobile app to initiate the credit limit increase request. Navigate to the account management section, where you will find the option to request a credit limit increase.

- Provide Financial Information: When prompted, furnish details regarding your current income, employment status, and any relevant financial changes since you opened your Amex account. Transparency and accuracy in reporting this information are essential for a thorough evaluation of your request.

- Specify the Desired Increase: Indicate the amount by which you wish to increase your credit limit. It’s advisable to request a reasonable and justifiable increase based on your financial needs and spending patterns.

- Submit the Request: Once you have completed the necessary fields and reviewed the information provided, submit your credit limit increase request through the secure online portal. After submission, American Express will review your request and notify you of the decision.

It’s important to approach the credit limit increase request process with a proactive mindset, ensuring that your financial standing and request details are accurately represented. By following these steps and presenting a compelling case for an increased credit limit, you can position yourself for a favorable outcome.

**

Tips for Getting Approved for an Amex Credit Limit Increase

**

Securing approval for a credit limit increase from American Express entails careful planning and a proactive approach. Implementing the following tips can significantly enhance your chances of obtaining a higher credit limit, thereby empowering you with increased financial flexibility and purchasing power.

- Maintain a Positive Payment History: Consistently making on-time payments and ideally paying off the full balance showcases responsible credit management, which is a pivotal factor in the decision-making process for credit limit increases.

- Manage Credit Utilization: Keeping your credit utilization ratio low, ideally below 30%, demonstrates prudent credit usage and may bolster your case for a credit limit increase. Paying down existing balances before requesting an increase can positively impact this ratio.

- Update Your Income Information: If your income has increased since you opened your Amex account, ensure that this updated information is reflected in your credit limit increase request. A higher income can strengthen your case for a larger credit limit.

- Demonstrate Financial Stability: Providing evidence of consistent employment and a stable financial situation can instill confidence in American Express regarding your capacity to manage a higher credit limit responsibly.

- Request a Modest Increase: When specifying the desired credit limit increase, aim for a reasonable and justifiable amount based on your financial needs and spending patterns. Requesting an excessively high increase may diminish the likelihood of approval.

- Monitor Your Credit Report: Regularly reviewing your credit report for accuracy and addressing any discrepancies can contribute to a positive credit profile, potentially influencing the decision on a credit limit increase.

- Engage in Responsible Spending: Exercise prudence in your spending habits, showcasing responsible use of your existing credit limit. This can further demonstrate your creditworthiness and financial responsibility to American Express.

By implementing these proactive strategies and maintaining a disciplined approach to credit management, you can position yourself for a successful credit limit increase request with American Express. Demonstrating financial responsibility and aligning your request with your current financial standing are key components of a compelling application for a credit limit increase.

**

Conclusion

**

Obtaining a credit limit increase from American Express is a strategic endeavor that offers cardholders the opportunity to enhance their purchasing power and strengthen their financial profile. By understanding the factors that influence credit limit increase decisions and following a structured approach to requesting an increase, individuals can navigate this process with confidence and maximize their chances of approval.

It is essential to recognize the significance of responsible credit management, including maintaining a positive payment history, managing credit utilization, and demonstrating financial stability. These elements play a pivotal role in shaping the decision-making process for credit limit increases and are instrumental in positioning cardholders for success.

By proactively updating income information, engaging in responsible spending, and monitoring credit reports for accuracy, cardholders can further bolster their case for a credit limit increase. Additionally, specifying a reasonable and justifiable increase based on individual financial needs and spending patterns can contribute to a compelling request.

Ultimately, the process of obtaining a credit limit increase from American Express is a collaborative effort between cardholders and the issuing financial institution. By aligning with the principles of responsible credit management and presenting a well-structured request, individuals can unlock the potential of their American Express credit card and enjoy increased financial flexibility.

Armed with the insights and strategies outlined in this guide, cardholders can confidently embark on the journey to secure a higher credit limit, leveraging the benefits of their American Express card to fulfill their financial aspirations and achieve greater peace of mind.