Home>Finance>How To Get Approved For Neiman Marcus Credit Card

Finance

How To Get Approved For Neiman Marcus Credit Card

Published: October 24, 2023

Discover how to improve your chances of getting approved for a Neiman Marcus Credit Card and take control of your finances. Find out how today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Benefits of Neiman Marcus Credit Card

- Eligibility Criteria for Neiman Marcus Credit Card

- Steps to Apply for Neiman Marcus Credit Card

- Required Documents for Neiman Marcus Credit Card Application

- Tips for Increasing Approval Chances

- Online Application Process for Neiman Marcus Credit Card

- In-Store Application Process for Neiman Marcus Credit Card

- After Approval: Understanding Neiman Marcus Credit Card Terms and Conditions

- Conclusion

Introduction

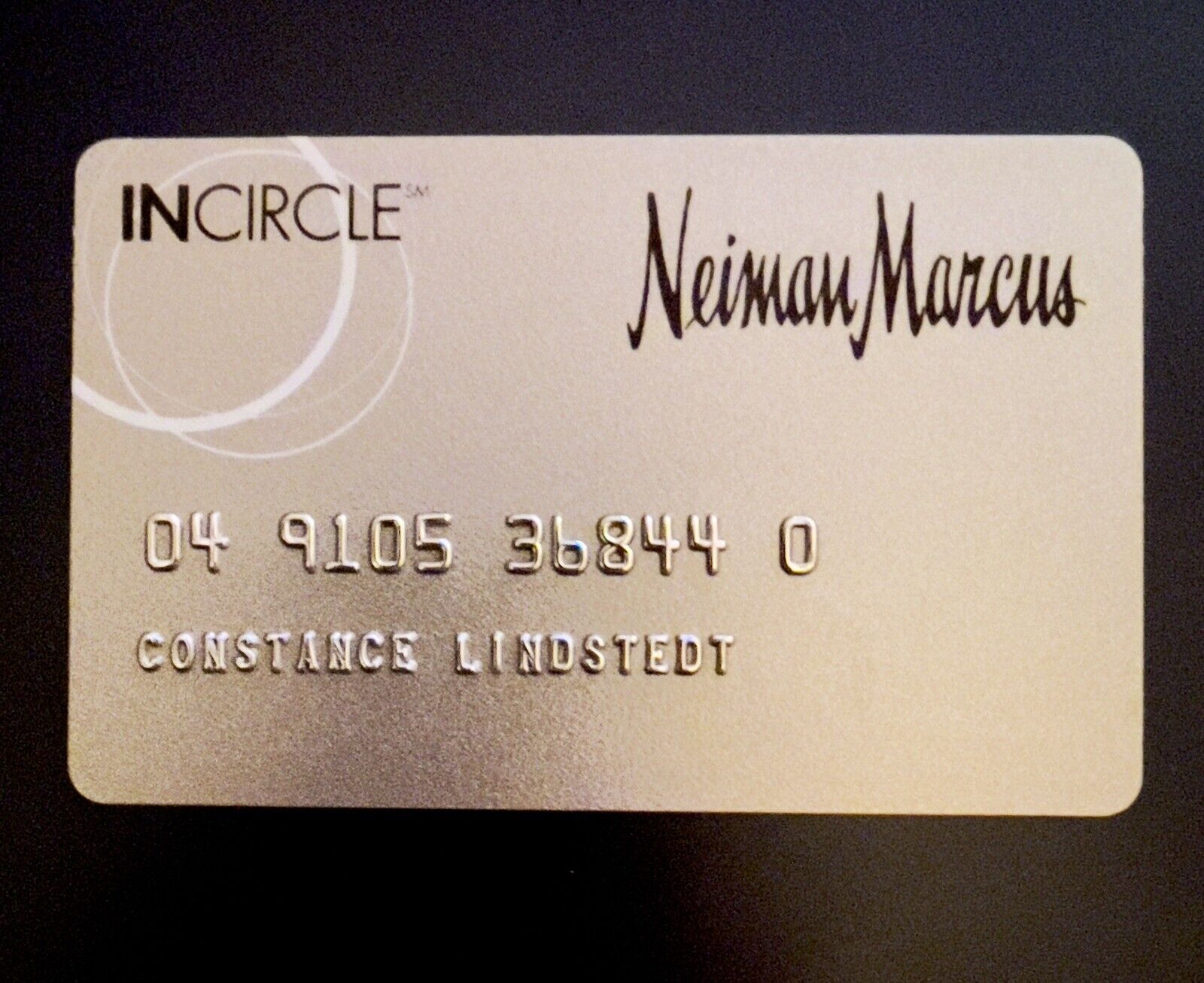

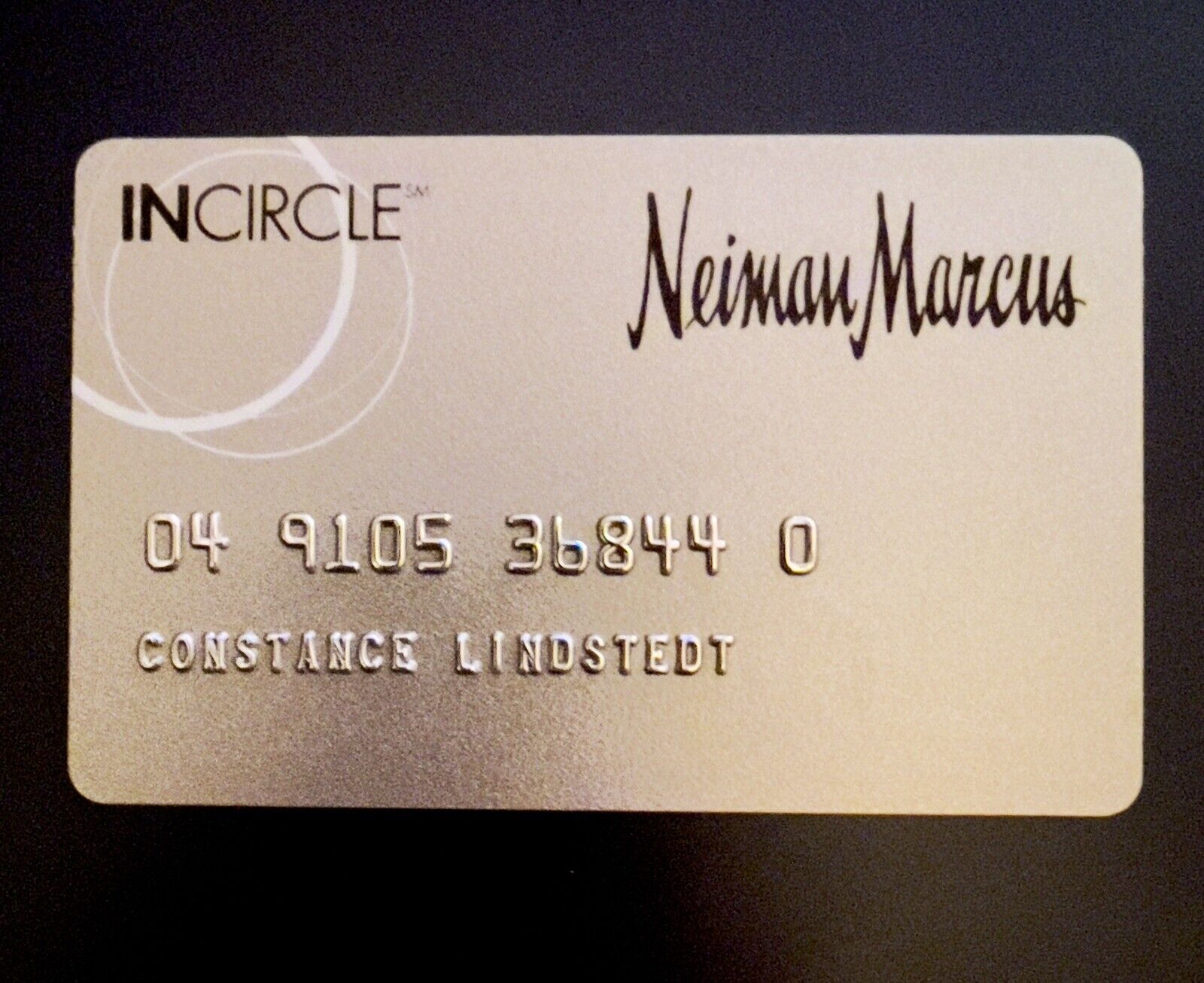

Welcome to the world of luxury and style offered by Neiman Marcus, where fashion and elegance go hand in hand. Neiman Marcus is renowned for its exquisite collection of designer clothing, accessories, and home furnishings. To enhance the shopping experience for their valued customers, Neiman Marcus also offers its own credit card – the Neiman Marcus credit card.

Having a Neiman Marcus credit card not only allows you to indulge in luxury goods but also provides access to exclusive benefits and rewards. With this credit card, you can enjoy special perks such as complimentary alterations, access to private shopping events, personalized service, and much more.

If you’re a loyal Neiman Marcus customer or someone who admires high-end fashion and wants to upgrade your shopping experience, applying for a Neiman Marcus credit card might be a great decision.

To successfully obtain a Neiman Marcus credit card, it’s important to understand the eligibility criteria, application process, and the documentation required. Additionally, there are certain tips and guidelines that can increase your chances of approval.

In this comprehensive guide, we will walk you through the benefits of having a Neiman Marcus credit card, the eligibility criteria, step-by-step application process, necessary documents, tips for increasing approval chances, and what to expect after approval. By following these guidelines, you’ll be well-prepared to apply for and make the most of your Neiman Marcus credit card.

Benefits of Neiman Marcus Credit Card

The Neiman Marcus credit card comes with a range of perks and benefits designed to enhance your shopping experience and provide you with exclusive privileges. Let’s explore some of the key benefits:

- Rewards Program: With the Neiman Marcus credit card, you can earn points for every dollar spent at Neiman Marcus, Bergdorf Goodman, Horchow, and other select stores. These points can be redeemed for a variety of rewards, including Neiman Marcus gift cards, luxury merchandise, and even unique experiences.

- Special In-Store Events: Neiman Marcus credit cardholders gain access to exclusive events, such as private shopping parties and trunk shows. These events provide an opportunity to preview new collections, meet designers, and receive personalized styling tips from fashion experts.

- Complimentary Alterations: As a Neiman Marcus credit cardholder, you can enjoy complimentary basic alterations on regular-priced merchandise. This perk ensures that your purchases fit you perfectly, enhancing your overall shopping experience.

- Birthday Surprise: Neiman Marcus believes in celebrating its customers, and as a cardholder, you can expect a special surprise on your birthday. Whether it’s a discount, a gift, or an exclusive offer, Neiman Marcus ensures that you feel appreciated and pampered on your special day.

- Personal Shopping Services: Neiman Marcus credit cardholders have access to personalized shopping assistance. From expert styling advice to assistance with finding the perfect outfit for a special occasion, Neiman Marcus provides dedicated experts to cater to your individualized needs.

- Exclusive Sales and Offers: In addition to the regular sales and promotions, Neiman Marcus credit cardholders receive early access to select sales events. This means you can get your hands on coveted designer items before they sell out.

These are just a few of the many benefits that come with owning a Neiman Marcus credit card. From the rewards program to the exclusive events and personalized services, the Neiman Marcus credit card is designed to cater to your luxury shopping desires while providing additional value.

Eligibility Criteria for Neiman Marcus Credit Card

Before applying for a Neiman Marcus credit card, it’s important to ensure that you meet the eligibility criteria. The criteria may vary, so it’s essential to review the specific requirements set by Neiman Marcus. Here are the general eligibility criteria to keep in mind:

- Age: You must be at least 18 years old to apply for a Neiman Marcus credit card.

- Residency: Neiman Marcus credit cards are typically available to U.S. residents only. You may be required to provide proof of residency, such as a valid U.S. address and identification.

- Creditworthiness: Neiman Marcus will consider your creditworthiness when reviewing your application. This involves assessing your credit history, credit score, and financial stability. While there is no specific credit score requirement mentioned, having a good credit score significantly increases your chances of approval.

- Income: While not explicitly stated, Neiman Marcus may consider your income level as part of the application process. This is to ensure that you have the financial means to repay any credit extended to you.

- Existing Credit Card Accounts: Neiman Marcus may also review your current credit card accounts, including any balances, payment history, and utilization. It’s essential to maintain a healthy credit profile and demonstrate responsible credit card usage.

It’s important to note that meeting the eligibility criteria does not guarantee approval for a Neiman Marcus credit card. The final decision is at the discretion of Neiman Marcus and their affiliated financial institution.

While these are the general eligibility criteria, it’s always advisable to review the specific requirements mentioned on the official Neiman Marcus website or consult with their customer service representative for the most accurate and up-to-date information.

Steps to Apply for Neiman Marcus Credit Card

If you meet the eligibility criteria and are ready to take advantage of the exclusive benefits offered by a Neiman Marcus credit card, follow these steps to apply:

- Visit the Neiman Marcus Website: Start by visiting the official Neiman Marcus website. Navigate to the credit card section, where you will find detailed information about the credit card and the application process.

- Choose the Preferred Card: Neiman Marcus offers different types of credit cards, including co-branded cards and store-only cards. Carefully review the available options and select the card that best suits your needs and preferences.

- Click on the ‘Apply Now’ Button: Once you’ve chosen your preferred Neiman Marcus credit card, click on the ‘Apply Now’ button. This will take you to the online application form.

- Fill Out the Application Form: Provide accurate and complete information in the online application form. You will be asked to provide personal details such as your name, address, contact information, Social Security number, and employment details. Ensure that all the information is correct to avoid any delays or issues during the application process.

- Submit the Application: Double-check all the information you have provided, review the terms and conditions, and then submit your application. It’s a good practice to keep a copy of the application confirmation for your records.

- Wait for Approval: Once you’ve submitted your application, you will need to wait for the decision. Neiman Marcus or their associated financial institution will review your application and creditworthiness. The decision may take a few days, and you will be notified of the outcome via mail or email.

- Activate Your Neiman Marcus Credit Card: If your application is approved, you will receive your Neiman Marcus credit card in the mail. Follow the instructions provided to activate your card before you can start using it for your purchases.

It’s important to note that the steps mentioned above are for the online application process. Neiman Marcus may also offer the option to apply in-store. In that case, you can visit the nearest Neiman Marcus store, speak to a representative, and complete the application process there.

By following these steps, you will be on your way to experiencing the exclusive benefits and rewards that come with owning a Neiman Marcus credit card.

Required Documents for Neiman Marcus Credit Card Application

When applying for a Neiman Marcus credit card, you will need to provide certain documents to support your application. These documents help verify your identity, residency, and financial stability. While the specific requirements may vary, here are some common documents that may be required:

- Identification Documents: You will typically be asked to provide a valid government-issued identification document, such as a driver’s license, passport, or national ID card. This document serves to verify your identity and ensure that you are of legal age to apply.

- Proof of Address: Neiman Marcus may require proof of your residential address. This can be in the form of a utility bill, bank statement, or any other official document that clearly displays your name and current address. Make sure the document you provide is recent and matches the information you provided in the application.

- Proof of Income: Neiman Marcus may ask for proof of your income to assess your financial stability and ability to repay the credit. This can be in the form of recent pay stubs, bank statements, tax returns, or any other document that demonstrates your income level. Providing accurate and up-to-date information is crucial in this regard.

- Social Security Number: Neiman Marcus will require your Social Security number to verify your identity and perform a credit check. This number ensures that the credit report belongs to you and helps evaluate your creditworthiness.

- Other Financial Information: Depending on your financial situation, Neiman Marcus may ask for additional documents such as proof of existing credit card accounts, loan statements, investment statements, or any other financial information that provides a comprehensive overview of your financial standing.

It’s important to carefully review the specific documentation requirements mentioned on the official Neiman Marcus website or consult with their customer service representative for the most accurate and up-to-date information. By ensuring that you have all the necessary documents ready before starting the application process, you can streamline the application and reduce the chances of any delays or complications.

Tips for Increasing Approval Chances

While the final decision on your Neiman Marcus credit card application rests with the issuer, there are several steps you can take to increase your chances of approval. Here are some tips to help you enhance your approval prospects:

- Maintain a Good Credit Score: Your credit score plays a significant role in the credit card approval process. It reflects your creditworthiness and your ability to manage credit responsibly. To increase your chances of approval, maintain a good credit score by making timely payments, keeping your credit utilization low, and avoiding any negative marks on your credit report.

- Review Your Credit Report: Before applying for a Neiman Marcus credit card, carefully review your credit report for any errors or discrepancies. Reporting agencies can make mistakes, which can negatively impact your credit score. If you find any inaccuracies, dispute them and have them corrected to ensure an accurate representation of your creditworthiness.

- Pay Off Outstanding Balances: If you have any outstanding balances on your existing credit cards, make an effort to pay them off or reduce them as much as possible. A lower debt-to-income ratio makes you appear more financially stable and increases your chances of approval.

- Maintain Stable Employment: Credit card issuers consider your income and employment stability when evaluating your application. Holding a steady job and having a consistent income stream demonstrate your ability to meet financial obligations. If possible, avoid changing jobs shortly before applying for a credit card.

- Limit the Number of Recent Credit Applications: Too many recent credit applications can raise red flags with credit card issuers. Each time you apply for credit, it results in a hard inquiry on your credit report, which temporarily lowers your credit score. Limit the number of credit applications you make in a short period to avoid negatively impacting your creditworthiness.

- Reduce Existing Debt: Apart from paying off outstanding balances, try to reduce your overall debt burden. Lenders assess your debt-to-income ratio to evaluate your ability to manage additional credit. By reducing your debt, you improve your creditworthiness and increase your chances of approval.

While following these tips can improve your chances of approval, it’s important to remember that credit card issuers have their own criteria and evaluation processes. Understanding and meeting the eligibility requirements is key to a successful application.

Lastly, keep in mind that responsible credit card usage is crucial even after approval. Making timely payments, keeping balances low, and practicing good financial habits will help you maintain a positive credit history and strengthen your credit profile over time.

Online Application Process for Neiman Marcus Credit Card

Applying for a Neiman Marcus credit card online is a convenient and straightforward process. The online application allows you to complete the necessary steps from the comfort of your own home. Here’s a step-by-step breakdown of the online application process:

- Visit the Neiman Marcus Website: Start by visiting the official Neiman Marcus website. Navigate to the credit card section, where you will find information about the available credit card options and their benefits.

- Select the Neiman Marcus Credit Card: Choose the Neiman Marcus credit card that best suits your needs and preferences. Take the time to review the features, rewards, and terms associated with each card to make an informed decision.

- Click on the ‘Apply Now’ Button: Once you’ve selected the desired Neiman Marcus credit card, click on the ‘Apply Now’ button or a similar option to initiate the online application process.

- Complete the Application Form: The online application form will require you to provide various details, including your personal information, employment details, income, and contact information. Fill out the form accurately and ensure that it matches the information on your identification documents.

- Review and Submit the Application: Take a moment to review the application form, ensuring that all the information you provided is accurate and complete. Read and understand the terms and conditions associated with the Neiman Marcus credit card. If you agree to the terms, click on the ‘Submit’ or ‘Apply’ button to submit your application.

- Receive Application Confirmation: Once your application is submitted, you will receive a confirmation message on the screen acknowledging the receipt of your application. Keep this confirmation for your records.

- Wait for Application Decision: Neiman Marcus or their associated financial institution will review your application and creditworthiness. The decision may take a few days, and you will be notified of the outcome via mail or email. If approved, you will receive your Neiman Marcus credit card in the mail.

- Activate Your Neiman Marcus Credit Card: Once you receive your Neiman Marcus credit card, you will need to activate it before using it for your purchases. Follow the instructions provided with the card to activate it, which typically involves calling a specified phone number or activating it online.

Remember to keep a copy of your application confirmation and any other relevant documentation for future reference. Applying online is quick and convenient, allowing you to enjoy the benefits of a Neiman Marcus credit card in no time.

In-Store Application Process for Neiman Marcus Credit Card

If you prefer a more personal touch or have specific questions about the Neiman Marcus credit card, you have the option to apply in-store. Here’s a step-by-step guide to the in-store application process:

- Locate a Neiman Marcus Store: Find the nearest Neiman Marcus store by visiting their website or using a store locator tool. Make sure to choose a location that offers the credit card application service.

- Visit the Neiman Marcus Store: Go to the selected Neiman Marcus store during their operating hours. It’s helpful to call ahead and inquire if an appointment is necessary or if they have specific times designated for credit card applications.

- Speak to a Neiman Marcus Associate: Once you’re at the store, approach a Neiman Marcus associate, preferably someone at the customer service or credit services desk. They will guide you through the application process and answer any questions you may have.

- Provide Required Information: The Neiman Marcus associate will ask you for the necessary information needed for the credit card application. This may include personal details, employment information, contact information, and identification documents. Ensure that you have the required documents on hand to support your application.

- Complete the Application Form: The associate will provide you with an application form to fill out. Take your time to carefully and accurately complete the form, providing all the required information. Double-check for any errors or missing details before you submit it.

- Review and Sign the Application: Before submitting the application form, carefully review all the information you have provided. Once you are satisfied that everything is accurate, sign the application form as required.

- Submit the Application: Hand over the completed and signed application form to the associate. They will process your application and provide any necessary instructions or documentation for your reference.

- Wait for Application Decision: Neiman Marcus or their affiliated financial institution will review your application and creditworthiness. The decision may take some time, and you will be notified of the outcome via mail or email. If approved, you will receive your Neiman Marcus credit card in the mail.

- Activate Your Neiman Marcus Credit Card: Once your Neiman Marcus credit card arrives, follow the provided instructions to activate it before using it for your purchases. Activation usually involves calling a specified phone number or activating it online.

The in-store application process allows you to receive personalized assistance and guidance throughout the application. It gives you an opportunity to ask any questions you may have and get immediate feedback from a Neiman Marcus expert. By applying in-store, you can ensure a seamless and enjoyable experience while applying for your Neiman Marcus credit card.

After Approval: Understanding Neiman Marcus Credit Card Terms and Conditions

Congratulations on being approved for a Neiman Marcus credit card! After you receive your card, it’s essential to familiarize yourself with the terms and conditions associated with it. Understanding these terms will help you make the most of your credit card and avoid any misunderstandings. Here are some key aspects to consider:

- Annual Percentage Rate (APR): The APR is the annualized interest rate charged on any outstanding balances on your Neiman Marcus credit card. It is important to be aware of the APR as it determines the cost of borrowing and ensuring timely payments to avoid accumulating high-interest charges.

- Grace Period: The grace period refers to the time between the end of a billing cycle and the payment due date. Neiman Marcus may offer a grace period during which no interest is charged on new purchases if the previous balance is paid in full. Understanding the length of the grace period can help you manage your payments effectively.

- Minimum Payment: Neiman Marcus will specify the minimum monthly payment that must be paid to keep your account in good standing. It is important to make at least the minimum payment by the due date to avoid penalties and potential damage to your credit score.

- Rewards Program: Review the details of the rewards program associated with your Neiman Marcus credit card. Understand how you earn and redeem rewards points, any expiration dates, and any restrictions or limitations on rewards redemption. This will enable you to maximize the benefits and enjoy the perks associated with your credit card.

- Late Payment Fees and Penalties: Neiman Marcus will outline the fees and penalties associated with late or missed payments. It is crucial to pay your credit card bill on time to avoid incurring these additional charges and safeguarding your creditworthiness.

- Annual Fees and Other Charges: Take note of any annual fees or other charges associated with your Neiman Marcus credit card. Understanding these costs will help you assess the value of the card’s benefits and determine if it aligns with your financial goals.

- Cardholder Benefits: Neiman Marcus credit cards often come with additional benefits such as exclusive discounts, complimentary services, and special event invitations. Familiarize yourself with these benefits to take full advantage of the perks available to you.

Make sure to carefully read through the terms and conditions provided with your Neiman Marcus credit card. If you have any questions or need clarifications, don’t hesitate to reach out to Neiman Marcus customer service for assistance. By understanding the terms and conditions, you can confidently use your Neiman Marcus credit card and enjoy all the privileges it offers while maintaining financial responsibility.

Conclusion

Obtaining a Neiman Marcus credit card allows you to experience the world of luxury and elevate your shopping experience. By understanding the benefits, eligibility criteria, and application process, you can successfully apply for and enjoy the perks offered by a Neiman Marcus credit card.

We explored the benefits of having a Neiman Marcus credit card, including a rewards program, exclusive events, complimentary alterations, personal shopping services, and access to exclusive sales and offers. These benefits add value to your shopping experience and provide you with a range of privileges.

We discussed the eligibility criteria for a Neiman Marcus credit card, taking into consideration factors such as age, residency, creditworthiness, and income. Meeting these criteria increases your chances of approval.

We laid out the steps to apply for a Neiman Marcus credit card, both online and in-store, providing a clear roadmap to follow. Understanding the required documents and tips to increase approval chances helps streamline the application process.

Lastly, we emphasized the importance of understanding the terms and conditions associated with your Neiman Marcus credit card after approval. Knowing the APR, grace period, minimum payment, rewards program, fees, and other cardholder benefits enables you to make informed financial decisions and optimize the use of your credit card.

If you’re ready to experience the luxury and benefits offered by Neiman Marcus, take the next step and apply for a Neiman Marcus credit card. Remember to use your credit card responsibly, make payments on time, and enjoy the exclusive perks that come with being a Neiman Marcus credit cardholder.