Finance

How To Get Insurance To Pay For Skin Removal

Published: November 18, 2023

Learn how to finance your skin removal surgery and get insurance to cover the costs. Explore tips and strategies to navigate the process successfully.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Undergoing skin removal surgery can be a life-changing experience, whether it’s for health reasons or to improve one’s appearance after significant weight loss. However, the cost of the procedure can be a major concern for many individuals seeking this type of surgery. The good news is that insurance coverage may be available to help offset the expenses associated with skin removal.

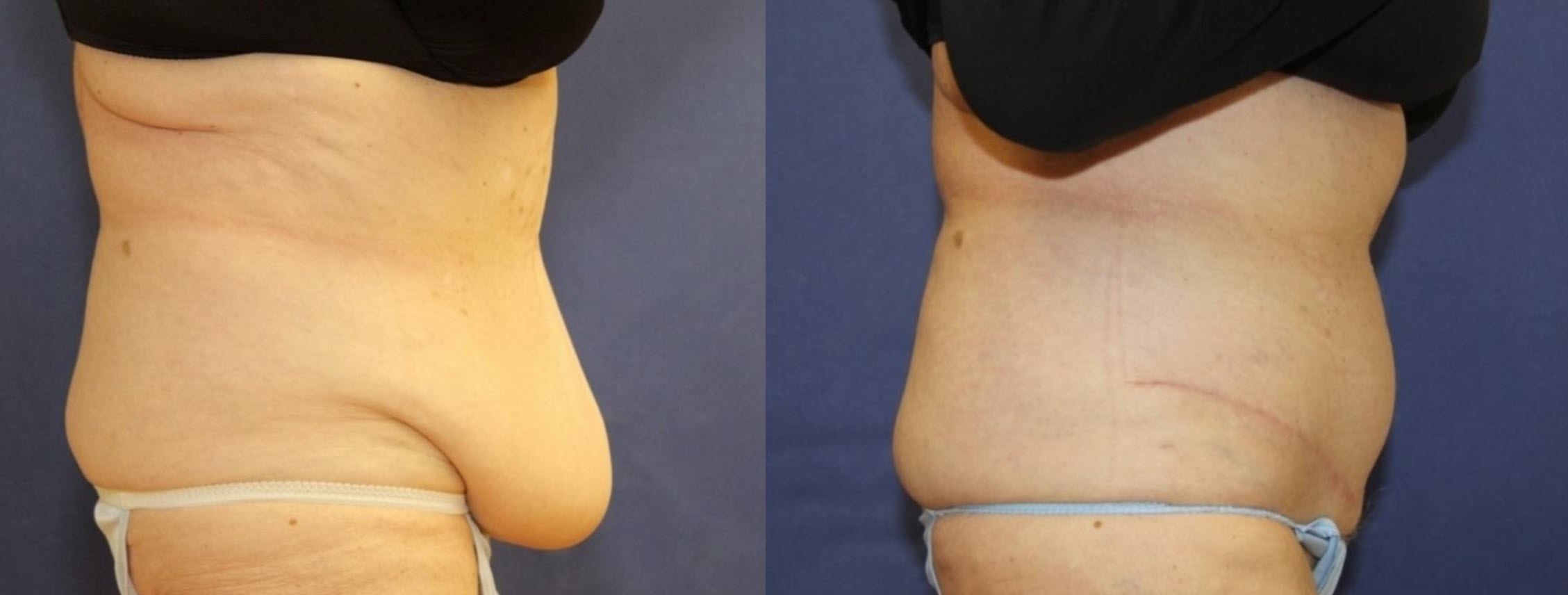

Skin removal surgery, also known as body contouring surgery, is a procedure that aims to remove excess skin and fat from various parts of the body, such as the abdomen, thighs, arms, and breasts. This is often necessary after significant weight loss or as a result of pregnancy, aging, or genetics. The removal of excess skin provides both physical and psychological benefits, improving mobility, reducing the risk of infections and rashes, and enhancing self-confidence.

However, obtaining insurance coverage for skin removal surgery can be a complex process. Insurance companies typically require specific criteria to be met in order to consider the procedure medically necessary and eligible for coverage. It is important to understand these requirements and navigate through the insurance system in order to maximize the chances of obtaining coverage.

It’s crucial to start by understanding your individual insurance policy and the coverage it provides. Each insurance plan may have different guidelines and criteria for determining medical necessity and coverage for skin removal surgery. Additionally, some insurance policies specifically exclude coverage for cosmetic procedures or have specific limitations on body contouring surgery. Therefore, it’s essential to thoroughly review your policy documents or contact your insurance provider to understand your coverage options.

In this comprehensive guide, we will explore the necessary steps to successfully navigate the insurance process and increase the likelihood of getting insurance to pay for skin removal surgery. From determining medical necessity to appealing a denial, we will provide valuable insights and strategies to help you obtain the coverage you need.

Understanding Skin Removal Surgery

Skin removal surgery, also known as body contouring surgery, is a surgical procedure that involves removing excess skin and fatty tissue from various areas of the body. This procedure is commonly performed after significant weight loss, either through diet and exercise or bariatric surgery. It is also sought by individuals who have loose or sagging skin due to pregnancy, aging, or genetic factors.

The main goal of skin removal surgery is to improve the body’s contour and tighten the skin, resulting in a more toned and proportionate appearance. The excess skin and fat are carefully removed through incisions made in strategic locations, such as the abdomen, thighs, arms, or breasts. The remaining skin is then draped and sutured to provide a smoother and more aesthetically pleasing result.

Individuals who have undergone significant weight loss may benefit greatly from skin removal surgery. After losing a substantial amount of weight, the skin can lose its elasticity and fail to tighten naturally, leaving behind folds and sagging skin. This can not only be physically uncomfortable but also lead to hygiene issues, skin irritation, and self-esteem concerns.

It’s important to note that skin removal surgery is a major surgical procedure that should not be taken lightly. It typically requires general anesthesia and involves a significant recovery period. This procedure should only be considered after you have reached a stable weight and have maintained it for some time. It is important to have realistic expectations and understand that the goal of this surgery is to improve the contour and appearance of the body, rather than achieve perfection.

Prior to undergoing skin removal surgery, it’s crucial to consult with a board-certified plastic surgeon who specializes in body contouring procedures. During the consultation, the surgeon will evaluate your overall health, assess your specific concerns, and discuss the potential risks and benefits of the procedure. They will also provide you with a personalized treatment plan tailored to your unique needs and goals.

It’s advisable to do thorough research and gather all the necessary information before deciding to undergo skin removal surgery. Educating yourself about the procedure, understanding the associated risks, and having realistic expectations will help you make an informed decision and ensure a successful outcome.

Determining Medical Necessity

When seeking insurance coverage for skin removal surgery, one of the crucial factors to consider is determining medical necessity. Insurance companies usually require that a procedure be deemed medically necessary in order to provide coverage. Medical necessity is typically determined by the impact the excess skin has on the patient’s health and quality of life.

To establish medical necessity, there are certain criteria that need to be met. These may vary depending on the insurance company or policy, but commonly include the following:

- Documented physical symptoms: Excess skin can cause various physical symptoms, such as rashes, infections, or chronic pain. These symptoms must be documented by a healthcare professional to support the medical necessity of the procedure.

- Functional impairment: Excess skin can restrict movement and limit daily activities. If the excess skin significantly impairs mobility or interferes with daily functions, it can be considered medically necessary to undergo skin removal surgery.

- Mental and emotional well-being: Excessive sagging skin can have a negative impact on a person’s mental and emotional well-being. If the excess skin causes significant psychological distress, including body image issues or reduced self-esteem, it can be deemed medically necessary to improve the patient’s overall quality of life.

- Weight stability: Insurance companies may require that a patient’s weight be stable for a certain period of time before considering skin removal surgery as medically necessary. This is to ensure that the patient has achieved a sustainable weight and that further weight loss or gain is unlikely to impact the results of the procedure.

It is important to thoroughly document and provide evidence of medical necessity when submitting a preauthorization request to the insurance company. This typically involves obtaining written evaluations and reports from healthcare providers, such as primary care physicians or specialists, who can validate the impact of excess skin on the patient’s health and quality of life.

Every insurance company has its own specific guidelines and criteria for determining medical necessity. It’s crucial to review your insurance policy’s documentation or contact your insurance provider directly to understand the specific requirements you need to meet. This will ensure that you have a clear understanding of the criteria you must fulfill to be eligible for coverage.

Understanding and meeting the requirements for determining medical necessity is a key step in the process of getting insurance to pay for skin removal surgery. By gathering the necessary documentation and demonstrating how the excess skin is affecting your physical and mental well-being, you will increase the likelihood of receiving coverage for the procedure.

Checking Insurance Coverage

Before proceeding with skin removal surgery, it is crucial to thoroughly check your insurance coverage to understand what costs may be covered. Insurance policies can vary significantly in terms of the procedures they cover, exclusions, and limitations. Taking the time to review your policy and communicate with your insurance provider will help you make informed decisions and avoid unexpected financial burdens.

Here are some important steps to follow when checking your insurance coverage for skin removal surgery:

- Review your insurance policy: Carefully read through your insurance policy documents or contact your insurance provider to obtain a clear understanding of your coverage. Look for any exclusions or limitations related to body contouring or cosmetic procedures.

- Identify coverage criteria: Determine the specific criteria that your insurance company requires in order to consider skin removal surgery as medically necessary. This may involve meeting certain physical symptoms, functional limitations, or mental health criteria.

- Verify in-network providers: Check whether the plastic surgeons who perform skin removal surgeries are included in your insurance company’s network of providers. In-network providers often have negotiated rates and agreements with the insurance company, which can help reduce your out-of-pocket expenses.

- Understand cost-sharing responsibilities: Familiarize yourself with the percentage of the cost that you will be responsible for paying. This includes deductibles, copayments, and coinsurance. Additionally, find out if there are any annual or lifetime maximums on coverage for skin removal surgery.

- Ask about prior authorization: Inquire if your insurance company requires prior authorization or preauthorization for skin removal surgery. This is a process where you obtain approval from the insurance company before undergoing the procedure. Not obtaining preauthorization may result in the denial of coverage.

- Consider seeking a second opinion: If you encounter any issues or challenges in understanding your insurance coverage, consider seeking a second opinion from a healthcare provider or consulting with a patient advocate who can help navigate the insurance process.

Keep in mind that insurance coverage can vary widely, and what may be covered for one person may not be covered for another. It’s essential to have a clear understanding of your specific insurance policy and its coverage for skin removal surgery.

By taking the time to check your insurance coverage, you can plan and budget accordingly for your skin removal surgery. It is always recommended to have open and honest communication with your insurance provider and healthcare professionals to ensure that you are well-informed about your coverage and any potential out-of-pocket expenses.

Obtaining a Referral from a Healthcare Provider

When pursuing insurance coverage for skin removal surgery, obtaining a referral from a healthcare provider is often an important step in the process. Insurance companies often require a referral or recommendation from a healthcare professional before considering the procedure as medically necessary.

Here are some key points to consider when obtaining a referral:

- Selecting the right healthcare provider: Choose a healthcare provider who is familiar with your medical history and who can assess your specific needs. This could be a primary care physician, a bariatric specialist, or a plastic surgeon specializing in body contouring procedures.

- Communicating your concerns: Clearly communicate your concerns and reasons for seeking skin removal surgery to your healthcare provider. This will help them understand the impact of excess skin on your physical and mental well-being, which can be documented in your medical records and support the referral.

- Emphasizing medical necessity: Ensure that your healthcare provider is aware of the criteria for determining medical necessity set by your insurance company. By discussing these criteria, you can ensure that the referral explicitly states how skin removal surgery meets those requirements.

- Collaborating with your healthcare provider: Engage in open and collaborative discussions with your healthcare provider to develop a well-rounded treatment plan. They can provide guidance and recommend other treatments or therapies that may be beneficial before or in conjunction with skin removal surgery.

- Obtaining written documentation: Request a written referral letter from your healthcare provider that clearly states the medical necessity of the procedure. This letter should include details regarding your condition, the impact of excess skin on your health, and why skin removal surgery is necessary.

- Ensuring the healthcare provider is in-network: Confirm that your healthcare provider is within your insurance company’s network of providers. This will help streamline the process and potentially reduce your out-of-pocket expenses.

Having a referral from a healthcare provider can greatly strengthen your case for insurance coverage. It adds credibility to your request and provides the insurance company with documented evidence of the medical necessity of the procedure.

Keep in mind that each insurance company may have specific requirements when it comes to referrals. It is important to review your policy and thoroughly understand the referral guidelines set by your insurance company.

By working closely with your healthcare provider and obtaining a well-documented referral, you can increase the chances of receiving insurance coverage for skin removal surgery. Remember to maintain open and honest communication with your healthcare team throughout the process.

Preparing Insurance Documentation

When seeking insurance coverage for skin removal surgery, it is essential to adequately prepare all the necessary documentation to support your case. Proper documentation helps demonstrate the medical necessity of the procedure and increases the likelihood of insurance approval. Here are some key steps to follow when preparing insurance documentation:

- Gather medical records: Collect all relevant medical records that document your weight loss journey, such as records from bariatric surgery, consultations with healthcare providers, and any documented symptoms or complications caused by excess skin.

- Document physical symptoms: Keep a record of any physical symptoms you experience due to excess skin, such as chronic rashes, skin infections, or discomfort. Include photographs if possible to visually demonstrate the impact on your health.

- Obtain letters from healthcare providers: Request letters of support from healthcare providers who have treated you for the physical symptoms and complications caused by excess skin. These letters should outline your medical history, the impact of excess skin on your health, and the medical necessity of skin removal surgery.

- Include psychological evaluations: If excess skin has had a significant impact on your mental well-being, consider seeking a psychological evaluation and include a report from a mental health professional that supports the need for skin removal surgery.

- Document weight stability: Insurance companies often require that patients demonstrate weight stability before considering skin removal surgery. Provide documentation, such as medical records or weight loss logs, showing that you have maintained a stable weight for the required period of time.

- Research insurance guidelines: Familiarize yourself with your insurance company’s guidelines for skin removal surgery. Be aware of any specific requirements they may have regarding documentation and medical necessity criteria.

- Organize and present the documentation: Compile all the relevant documentation into a clear and organized package. Include a cover letter that summarizes your case and highlights the key points from the supporting documents.

By preparing thorough documentation, you can effectively convey the medical necessity of skin removal surgery to your insurance company. It is important to emphasize both the physical symptoms and the impact on your mental well-being to present a comprehensive case.

Be sure to keep copies of all documents for your own records, and consider submitting both physical copies and electronic versions for convenience and accessibility.

Remember, each insurance company may have specific requirements and guidelines for documentation. Review your policy and consult with your insurance provider to ensure that you meet their criteria and provide the necessary documentation.

Properly preparing insurance documentation demonstrates your commitment to providing evidence of medical necessity, improving the chances of securing insurance coverage for skin removal surgery.

Submitting a Preauthorization Request

Submitting a preauthorization request is a critical step in the process of getting insurance to pay for skin removal surgery. Preauthorization, also known as prior authorization or preapproval, is the process by which you obtain approval from your insurance company before undergoing the procedure. Here’s what you need to know about submitting a preauthorization request:

- Review your insurance policy: Familiarize yourself with your insurance policy’s preauthorization requirements and guidelines. Understand what information and documentation are needed to support your request.

- Gather supporting documentation: Compile all the necessary documentation, such as medical records, referral letters, photographs, and any supporting evidence of medical necessity. Make copies of the documents and keep the originals for your records.

- Complete the preauthorization form: Obtain the preauthorization form from your insurance company or download it from their website. Complete the form accurately and thoroughly, providing detailed information about the medical necessity and the specific procedure you are seeking.

- Attach supporting documentation: Include copies of all the supporting documentation you have gathered. Attach them to the preauthorization form as required or as additional supporting materials.

- Prepare a cover letter: Write a cover letter that summarizes the key points of your case. Clearly state the medical necessity of skin removal surgery, referencing specific medical records and symptoms, and emphasizing the impact on your health and quality of life.

- Double-check the submission requirements: Review the preauthorization form and the insurance company’s guidelines to ensure that you have followed all required submission requirements. Make sure you have included all necessary signatures and supporting documents.

- Submit the preauthorization request: Send the preauthorization request and supporting documents to your insurance company according to their preferred method (e.g., mail, fax, or online portal). Keep a copy of the submission receipt or confirmation for your records.

- Follow up with the insurance company: After submitting the preauthorization request, follow up with your insurance company to ensure they have received it. Inquire about the expected timeline for a decision and ask for any additional information or documentation they may require.

Submitting a preauthorization request can be a time-consuming process, but it is a crucial step in obtaining insurance coverage for skin removal surgery. It demonstrates your commitment to following the proper channels and provides an opportunity to present your case and supporting documents to the insurance company.

Keep in mind that response times may vary, and it is important to be patient during the review process. If you do not hear back from the insurance company within the expected timeframe, follow up with a call to inquire about the status of your request.

By following these steps and providing a comprehensive preauthorization request, you maximize your chances of receiving approval for insurance coverage for skin removal surgery.

Appealing a Denial

If your preauthorization request for skin removal surgery is denied by your insurance company, don’t lose hope. You have the right to appeal the decision and provide additional information to support your case. Here are the important steps to take when appealing a denial:

- Review the denial letter: Carefully read through the denial letter from your insurance company. Take note of the specific reasons for the denial and any additional documentation they may require.

- Understand the appeals process: Familiarize yourself with your insurance company’s appeals process. Determine the deadlines for submitting an appeal and any specific requirements or forms you need to complete.

- Gather additional documentation: Evaluate the reasons for denial and gather any additional documentation that can support your case. This can include further medical records, additional healthcare provider letters, or any new information that strengthens the medical necessity of the procedure.

- Write a detailed appeal letter: Craft a formal appeal letter addressing each reason for the denial and providing evidence to counter those reasons. Clearly articulate how the additional information supports the medical necessity of skin removal surgery and emphasize the potential health benefits and quality of life improvements.

- Submit the appeal: Submit the appeal letter and any additional documentation to your insurance company according to their specified process. Keep copies of all the materials you submit and obtain confirmation of receipt.

- Follow up on the status of your appeal: Contact your insurance company to confirm they have received your appeal. Inquire about the expected timeline for a response and ask if there is any additional information they need to process your appeal.

- Consider involving a patient advocate: If you are facing challenges with the appeals process, consider seeking assistance from a patient advocate or healthcare professional who specializes in insurance appeals. They can provide guidance and support in navigating the process.

- Document all communication: Keep detailed records of all interactions, including dates, names of representatives spoken to, and notes on the discussions. This documentation will be valuable if you need to escalate your appeal or file a complaint.

- Explore alternative options: If your appeal is still denied, assess your options. These may include seeking alternative financing options, exploring charitable organizations that assist with surgical expenses, or considering a second opinion from another insurance company or provider.

Remember, the appeals process can take time, patience, and perseverance. Stay organized, responsive, and persistent throughout the process. Be sure to adhere to all deadlines and requirements set by your insurance company.

Each insurance company has its own unique appeals process, so it is essential to review your policy documents and follow their specific guidelines. Stay proactive and determined in your efforts to appeal the denial and fight for the coverage you believe you deserve.

Seeking Assistance from a Patient Advocate

When navigating the complex world of insurance coverage for skin removal surgery, it can be incredibly helpful to seek the assistance of a patient advocate. A patient advocate is a knowledgeable professional who specializes in assisting individuals in navigating the healthcare system and advocating for their rights. Here’s how a patient advocate can support you:

- Expertise in insurance processes: Patient advocates have extensive knowledge and experience working with insurance companies. They understand the intricacies of insurance policies, preauthorization requirements, and appeals processes. They can guide you through the necessary steps and help you understand your rights and options.

- Assistance with documentation: Patient advocates can help you gather the necessary documentation and ensure that it is comprehensive and meets the specific requirements of your insurance company. They can review your medical records, assist with obtaining referrals and healthcare provider letters, and ensure that all documentation is organized and properly submitted.

- Advocacy during the appeals process: If your preauthorization request is denied, a patient advocate can provide valuable support during the appeals process. They can help you draft a compelling appeal letter, review the denial reasons, and identify any additional documentation or information that could strengthen your case. Their expertise and guidance can significantly improve your chances of a successful appeal.

- Communication liaison: Patient advocates can serve as a communication liaison between you and your insurance company. They can help you navigate the complex phone systems, ensure that messages are properly relayed, and follow up on the status of your case. Their communication skills and knowledge of insurance processes can expedite the resolution of your insurance coverage concerns.

- Emotional support: Dealing with insurance issues and the potential denial of coverage can be emotionally stressful. Patient advocates can offer compassionate support during this challenging time. They can provide guidance, reassurance, and empathy, helping you navigate the emotional roller coaster associated with insurance coverage for skin removal surgery.

When selecting a patient advocate, it is important to choose someone who has experience and expertise in the area of insurance coverage for surgical procedures. Look for advocates who specialize in medical insurance advocacy or have a background in healthcare administration. Consider seeking recommendations from healthcare providers, support groups, or other individuals who have undergone similar procedures.

While there may be a cost associated with accessing the services of a patient advocate, their expertise and support can be invaluable in ensuring that you receive the coverage and care you deserve. They can help alleviate the stress and confusion associated with navigating the insurance system and provide you with the best possible chance of obtaining insurance coverage for your skin removal surgery.

Conclusion

Obtaining insurance coverage for skin removal surgery can be a complex and challenging process. However, with the right knowledge and strategies in place, you can increase your chances of getting insurance to pay for this life-changing procedure.

Throughout this guide, we have explored the necessary steps to navigate the insurance system effectively. From understanding the procedure and determining medical necessity to checking insurance coverage, obtaining referrals, preparing documentation, submitting preauthorization requests, appealing denials, and seeking assistance from patient advocates, each step plays a vital role in your journey towards obtaining insurance coverage for skin removal surgery.

Remember that each insurance company has its own specific guidelines and criteria. It is essential to thoroughly review your insurance policy, communicate directly with your insurance provider, and ensure that you understand the requirements for coverage.

Additionally, don’t hesitate to seek support from healthcare providers, patient advocates, and others who have experience in navigating the insurance process. Their expertise and guidance can be invaluable in helping you present a strong case for medical necessity and successfully navigate the appeals process if needed.

While navigating the insurance process requires time, patience, and perseverance, don’t lose sight of the potential benefits and positive impact that skin removal surgery can have on your physical and emotional well-being. By following the steps outlined in this guide, you are taking proactive measures to improve your health, regain confidence, and enhance your overall quality of life.

Remember, you are not alone. Many individuals have successfully navigated the insurance process and obtained coverage for skin removal surgery. Stay informed, stay determined, and don’t be afraid to advocate for yourself. With the right knowledge, preparation, and support, you can increase your chances of getting insurance to pay for skin removal surgery and embark on a transformative journey towards a healthier and happier you.