Finance

How To Increase Citi Credit Card Limit

Modified: March 10, 2024

Learn how to increase your Citi credit card limit with effective finance strategies. Maximize your purchasing power and improve your financial flexibility today.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Having a credit card offers convenience and flexibility when it comes to making purchases and managing your finances. One key aspect of using a credit card is the credit card limit, which is the maximum amount of money you can borrow on your card. Credit card limits are determined by the financial institution or bank and are based on various factors such as your creditworthiness, income, and repayment history.

In the case of Citi Credit Cards, understanding how to increase your credit card limit can be beneficial if you need access to more purchasing power or want to improve your credit utilization ratio. Increasing your credit card limit can also enhance your financial flexibility and provide you with more financial freedom.

In this article, we will guide you on how to increase your Citi Credit Card limit effectively. We will cover the reasons for seeking a credit card limit increase, the steps to request one, the factors that influence the decision, and provide you with helpful tips to increase your chances of success. By following these guidelines, you can maximize the benefits of your Citi Credit Card and enhance your overall financial management.

Understanding Credit Card Limits

Before we dive into the process of increasing your Citi Credit Card limit, it’s important to have a clear understanding of what credit card limits are and how they work. A credit card limit is the maximum amount of money that the financial institution or bank allows you to borrow on your credit card.

The credit card limit acts as a safety net for the bank, ensuring that you won’t exceed your ability to repay the borrowed funds. It also serves as an indicator of your creditworthiness and helps shape your overall credit score. Credit card limits can vary greatly based on several factors, including your income, credit history, and the financial institution’s assessment of your creditworthiness.

When you’re approved for a credit card, the bank will assign you a starting credit card limit. This initial limit is determined based on your financial profile at the time of application. As you use your credit card responsibly and make timely payments, you may become eligible for a credit card limit increase over time.

It’s important to note that exceeding your credit card limit can have negative consequences. If you attempt to make a purchase that exceeds your credit limit, it may be declined or result in additional fees. Additionally, consistently maxing out your credit card or having a high credit utilization ratio can negatively impact your credit score.

Understanding your credit card limit and the implications of reaching or exceeding it is crucial for responsible card usage and maintaining a healthy credit profile. With this knowledge in mind, let’s explore the reasons why you may want to increase your Citi Credit Card limit.

Reasons for Increasing Credit Card Limit

Increasing your credit card limit can offer several benefits and opportunities for your financial management. Here are some common reasons why you may consider requesting a higher credit card limit on your Citi Credit Card:

- Expanded purchasing power: A higher credit card limit allows you to make larger purchases or handle unexpected expenses without maxing out your card. It provides you with the flexibility to access funds when you need them.

- Improved credit utilization ratio: Your credit utilization ratio is the percentage of your available credit that you are using. By increasing your credit card limit, you can lower your utilization ratio, which is a key factor in determining your credit score. A lower utilization ratio can positively impact your creditworthiness and improve your overall credit profile.

- Enhanced financial flexibility: Having a higher credit card limit can give you peace of mind knowing that you have a backup source of funds for emergencies or unexpected expenses. It provides a safety net that can be valuable during challenging times.

- Access to better credit card rewards: Some credit cards offer exclusive rewards and benefits based on your spending. By increasing your credit card limit, you may become eligible for higher-tier credit cards with enhanced rewards programs, such as cash back, travel rewards, or loyalty points.

- Building a positive credit history: Responsibly managing a higher credit card limit by making timely payments and keeping your balance low can help establish a positive credit history. This can be beneficial when applying for future credit products, such as loans or mortgages.

By understanding these reasons for increasing your credit card limit, you can make an informed decision about whether it aligns with your financial goals. In the next section, we will explore the process of requesting a credit card limit increase on your Citi Credit Card.

How to Request a Credit Card Limit Increase

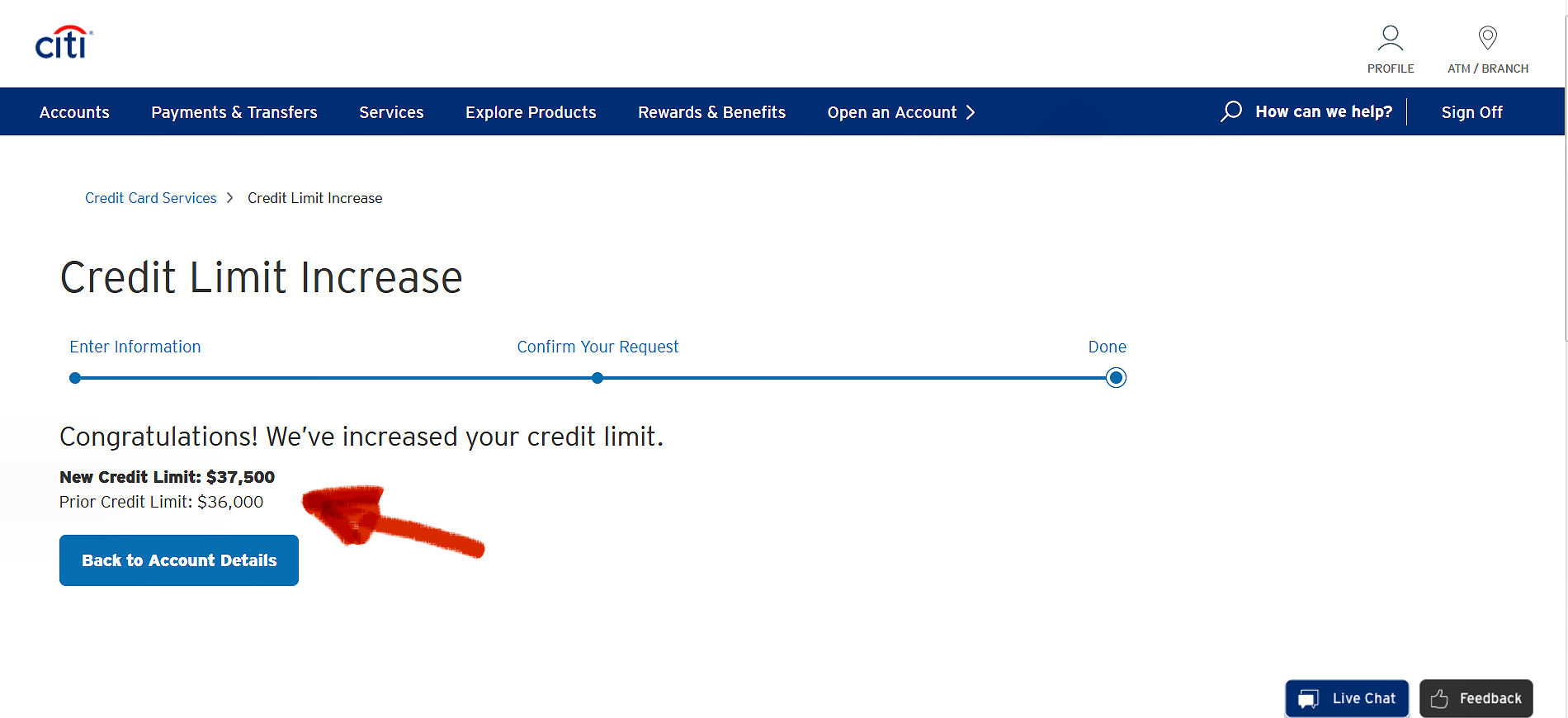

If you’ve decided that increasing your Citi Credit Card limit is the right choice for you, it’s time to take the necessary steps to request the increase. Here is a guide on how to request a credit card limit increase:

- Check your eligibility: Before submitting a request, ensure that you meet the eligibility criteria set by Citi. Typically, you should have a good credit history, a consistent income, and a positive repayment record on your current credit card.

- Gather required documents: Make sure you have all the necessary documents ready, such as recent pay stubs, bank statements, and any other relevant documentation that supports your income and financial stability.

- Contact customer service: Reach out to Citi customer service either by phone or through their online banking platform. Alternatively, you can visit a local branch and speak to a representative in person. Ensure that you have your credit card details and personal information readily available.

- State your request: Clearly express your desire to increase your credit card limit. Explain the reasons for your request, such as increased expenses, improved financial stability, or the need for more purchasing power. Providing a compelling rationale can strengthen your case.

- Provide supporting documents: When requested, provide the necessary documents to support your request, such as income verification and proof of financial stability. This helps the bank assess your creditworthiness and determine the feasibility of granting a higher credit card limit.

- Follow up: After submitting your request, inquire about the expected timeframe for a decision. If you don’t receive a response within the stated timeframe, don’t hesitate to follow up and inquire about the status of your request.

- Consider alternative options: If your request for a credit card limit increase is denied, consider exploring other options such as applying for a new credit card or evaluating your overall financial situation to improve your creditworthiness in the future.

Remember, the decision to grant a credit card limit increase ultimately lies with the bank, and they consider various factors before approving or denying such requests. Therefore, it’s important to present a strong case with supporting documents and maintain a positive credit history to increase your chances of success.

Next, we’ll dive into the factors that influence the decision to increase your Citi Credit Card limit.

Factors that Influence Credit Card Limit Increase

When it comes to increasing your credit card limit, financial institutions like Citi consider several factors to determine whether to grant your request. Understanding these factors can help you prepare and increase your chances of a successful credit card limit increase. Here are the key factors that influence the decision:

- Creditworthiness: Your creditworthiness plays a significant role in the decision-making process. This includes factors such as your credit score, credit history, and payment behavior. Lenders are more likely to approve a credit limit increase for individuals with a strong credit history and responsible repayment habits.

- Income and financial stability: Lenders assess your income and financial stability to evaluate your ability to repay a higher credit card limit. A consistent and sufficient income demonstrates that you have the means to handle a larger credit limit.

- Debt-to-income ratio: Lenders also consider your debt-to-income ratio, which is the percentage of your income that goes towards debt repayments. A lower debt-to-income ratio indicates a healthier financial situation and makes you a more desirable candidate for a credit limit increase.

- Payment history: Your payment history is a vital indicator of your financial responsibility. Consistently making on-time payments and keeping your credit card balance low can positively impact your chances of a credit limit increase.

- Length of credit history: Financial institutions often prefer customers with a longer credit history as it offers a more comprehensive picture of your financial behavior. If you have a well-established credit history with Citi, it can work in your favor when requesting a credit card limit increase.

- Current credit card usage: Lenders evaluate how you currently use your credit card, including your utilization rate and the frequency of maxing out your credit. A low credit utilization ratio and responsible card usage demonstrate your ability to handle a higher credit limit.

- Market conditions: Economic factors and current market conditions can influence a bank’s decision to increase credit card limits. During periods of economic uncertainty, lenders may be more cautious in granting credit limit increases.

It’s important to note that the weightage of these factors may vary from one financial institution to another. While some factors are within your control, such as maintaining a good payment history, others like market conditions are external factors that you cannot directly influence. Therefore, focus on factors like creditworthiness, income stability, and responsible card usage to increase the likelihood of a successful credit card limit increase.

In the next section, we’ll provide you with practical tips to boost your chances of successfully increasing your Citi Credit Card limit.

Tips for Successfully Increasing Citi Credit Card Limit

Increasing your Citi Credit Card limit can provide you with greater financial flexibility and opportunities. To improve your chances of a successful credit limit increase, consider the following tips:

- Maintain a good credit score: Your credit score plays a crucial role in the decision-making process. Make sure to pay your bills on time, minimize your outstanding debt, and responsibly manage your credit to maintain a good credit score. Regularly review your credit report to identify and address any errors or inaccuracies.

- Use your credit card responsibly: Demonstrating responsible credit card usage can increase your chances of a credit limit increase. Pay your balance in full and on time each month. Avoid maxing out your credit card and strive to keep your credit utilization ratio low.

- Build a positive payment history: Consistently making timely payments is crucial for establishing a positive payment history. Paying more than the minimum required amount or even paying off your balance in full each month shows financial discipline and responsibility.

- Update your income information: If your income has increased since you first applied for your Citi Credit Card, be sure to update your income information with the bank. A higher income can demonstrate your ability to handle a larger credit limit.

- Review and update your personal information: Ensure that all your personal information, such as your contact details and employment status, is up to date. This helps the bank maintain accurate records and assess your financial stability more effectively.

- Monitor your credit utilization ratio: Aim to keep your credit utilization ratio below 30%. If you’re regularly using a high percentage of your available credit, it may indicate to the bank that you’re relying too heavily on credit and may be less likely to handle a higher credit limit.

- Use your Citi Credit Card frequently: Actively using your credit card and making regular transactions can demonstrate your responsible card usage and increase your chances of a credit limit increase. However, make sure to only use your card for necessary expenses and avoid unnecessary debt.

- Engage with Citi customer service: Building a positive relationship with Citi customer service representatives can be beneficial. Reach out to them with any questions or concerns and express your interest in a credit limit increase. Their guidance and support can be invaluable throughout the process.

Remember, a credit limit increase is not guaranteed and is subject to the bank’s evaluation. However, by following these tips and maintaining a responsible credit card usage pattern, you can enhance your chances of successfully increasing your Citi Credit Card limit.

In the next section, we will discuss potential challenges you may encounter and offer suggestions on how to overcome them.

Potential Challenges and How to Overcome Them

While requesting a credit card limit increase on your Citi Credit Card, you may encounter certain challenges. Being aware of these challenges and knowing how to overcome them can help you navigate the process more effectively. Here are some potential challenges and suggestions for overcoming them:

- Denied request: It’s possible that your request for a credit card limit increase may be denied. If this happens, don’t be discouraged. Take the opportunity to better understand the reasons for the denial and work on improving the factors within your control, such as your credit score or payment history. You can consider reapplying in the future or exploring alternative options.

- Insufficient credit history: If you have a limited credit history, financial institutions may be hesitant to grant a credit limit increase. In such cases, focus on building a positive credit history over time. Make timely payments, keep your credit utilization low, and demonstrate responsible credit usage. With a solid credit history, you’ll be in a stronger position to request a credit card limit increase in the future.

- Unstable income: Financial stability and a consistent income are important factors for credit limit increases. If your income is unpredictable or has recently fluctuated, it may affect your chances of approval. In such cases, consider increasing your income stability through additional sources of income or demonstrating a clear track record of consistent earnings. Documenting your income through pay stubs, tax returns, or bank statements can also help establish your credibility.

- High outstanding debt: A significant amount of outstanding debt can raise concerns for lenders, as it suggests a higher risk of defaulting on payments. If you have substantial debt, focus on reducing it and improving your debt-to-income ratio. Create a budget, prioritize debt payments, and explore strategies like debt consolidation to gradually decrease your outstanding balances.

- Lack of communication: Failing to effectively communicate your request or provide supporting documents can hinder the credit limit increase process. Ensure that you clearly express your intention to increase your credit limit and provide accurate and up-to-date information. Engage with Citi customer service and follow up on the progress of your request to stay informed.

- Market conditions and company policies: External factors such as market conditions and changes in company policies can impact the decision-making process for credit card limit increases. Unfortunately, these factors are beyond your control. In such situations, focusing on the aspects within your control, such as maintaining a good credit score and responsible credit card usage, can help improve your chances of success.

Overcoming these challenges requires patience, persistence, and a proactive approach. By addressing the factors within your control, maintaining open communication with the bank, and diligently working on improving your financial profile, you can increase your chances of successfully obtaining a credit card limit increase.

In the next section, we will wrap up the article by summarizing the key points discussed.

Conclusion

Increasing your Citi Credit Card limit can provide you with greater financial flexibility, improved credit utilization, and access to better card rewards. By understanding the factors that influence the decision and following the right approach, you can maximize your chances of success.

In this article, we covered the importance of understanding credit card limits and the reasons for seeking a credit card limit increase. We discussed the step-by-step process of requesting a credit card limit increase on your Citi Credit Card, including gathering documents and contacting customer service. We also explored the factors that financial institutions consider when evaluating credit limit increase requests.

Furthermore, we provided valuable tips for successfully increasing your Citi Credit Card limit, such as maintaining a good credit score, using your card responsibly, and engaging with customer service representatives. It’s important to remember that the decision ultimately rests with the bank, but by demonstrating responsible credit usage and financial stability, you can enhance your chances.

We also discussed potential challenges, such as denied requests or insufficient credit history, and offered suggestions on how to overcome them. It’s essential to persevere, continuously improve your creditworthiness, and maintain open communication with the bank to achieve a successful credit limit increase.

In conclusion, increasing your Citi Credit Card limit can empower you to make larger purchases, improve your credit utilization ratio, and enhance your financial flexibility. By following the guidelines and taking a proactive approach, you can increase your chances of successfully obtaining a credit card limit increase and enjoy the benefits that come with it.

Remember, responsible credit card usage and maintaining a positive credit history are key to long-term financial success. Use your increased credit limit wisely and always strive to manage your finances responsibly.