Finance

How Often Does Citi Increase Credit Limit

Modified: January 15, 2024

Find out how often Citibank increases credit limits and how it can benefit your personal finances. Learn the best strategies to request a credit limit increase.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Factors That Determine Credit Limit Increases

- How Often Citi Reviews Credit Limits

- Citi’s Criteria for Increasing Credit Limits

- Tips to Improve Chances of Credit Limit Increase

- Requesting a Credit Limit Increase from Citi

- Frequently Asked Questions about Citi’s Credit Limit Increases

- Conclusion

Introduction

Welcome to our comprehensive guide on credit limit increases with Citi! Whether you’re a Citi cardholder looking to increase your existing credit limit or simply curious about the process, you’ve come to the right place. In this article, we will explore the factors that determine credit limit increases, how often Citi reviews credit limits, the criteria they consider when granting increases, and tips to improve your chances of getting a credit limit increase.

Credit limit increases can be beneficial for several reasons. They provide you with more purchasing power, improve your credit utilization ratio, and demonstrate financial responsibility to potential lenders. Many Citi cardholders wonder how often they can expect their credit limits to be reviewed, and what they can do to increase their chances of receiving an increase.

Citi, one of the largest financial institutions in the world, offers a wide range of credit cards to suit different needs. Whether you have a Citi Rewards Card, a Citi Simplicity Card, or any other Citi credit card, the process for credit limit increases remains relatively similar.

Understanding the factors Citi considers when reviewing credit limits and the steps you can take to increase your chances of success can empower you to make informed decisions about your credit. So, let’s dive in and explore the world of Citi credit limit increases!

Factors That Determine Credit Limit Increases

Curious about what factors Citi considers when reviewing credit limits? Understanding these factors can give you insight into how your creditworthiness is evaluated and what steps you can take to improve your chances of receiving a credit limit increase. Here are the key factors that Citi takes into account:

- Payment history: Citi looks at your payment history to assess your reliability in making on-time payments. Consistently paying your bills by the due date demonstrates responsible financial behavior, which can positively impact your chances of a credit limit increase.

- Income: Your income plays a crucial role in determining your creditworthiness. Citi wants to ensure that you have sufficient income to handle a higher credit limit. A steady and stable income can enhance your chances of receiving an increase.

- Credit utilization ratio: Citi considers your credit utilization ratio, which is the percentage of your credit limit that you currently use. Generally, a lower credit utilization ratio indicates responsible credit management and can boost your chances of securing a credit limit increase.

- Credit history: The length and depth of your credit history can impact Citi’s decision. A longer and more positive credit history demonstrates your ability to handle credit responsibly over time.

- Debt-to-income ratio: Citi may also evaluate your debt-to-income ratio, which measures the percentage of your monthly income that goes toward debt payments. A lower debt-to-income ratio suggests a lower financial burden and increases the likelihood of a credit limit increase.

- Overall creditworthiness: Citi considers your overall creditworthiness by evaluating a combination of factors mentioned above. They assess your risk as a borrower and analyze your financial stability and reliability.

It’s important to keep in mind that these factors are not the sole determinants of credit limit increases. Citi may have additional criteria that they consider when reviewing credit limits. By understanding these factors, however, you can work towards improving your financial situation and increasing the likelihood of a credit limit increase.

How Often Citi Reviews Credit Limits

One common question among Citi cardholders is how often Citi reviews credit limits. While there is no set timeframe for when Citi conducts these reviews, they typically review credit limits periodically. The frequency of these reviews can vary based on individual cardholder profiles and other internal factors.

Keep in mind that Citi’s review process is not limited to credit limit increases only. They also assess cardholders’ overall creditworthiness and make necessary adjustments to credit limits based on their risk assessment. This means that even if you have been utilizing your credit responsibly, it does not guarantee an automatic credit limit increase.

To increase the likelihood of your credit limit being reviewed, it’s important to demonstrate responsible credit management. This includes making timely payments, keeping your credit utilization ratio low, and maintaining a good credit history. By consistently exhibiting these positive financial behaviors, you are signaling to Citi that you are a reliable and responsible borrower.

It’s worth mentioning that Citi may also perform a soft credit inquiry when reviewing your credit limit. A soft inquiry does not impact your credit score, unlike a hard inquiry that occurs when applying for new credit. Citi uses this information to assess your creditworthiness and gauge your eligibility for a credit limit increase.

While the exact timetable for credit limit reviews may vary, it’s recommended to wait at least six months after opening a new credit card account before requesting a credit limit increase. This allows Citi to evaluate your creditworthiness based on your payment history and overall financial stability.

If you’ve been a responsible cardholder and believe that you are eligible for a credit limit increase, there are steps you can take to request one from Citi. We will delve into this topic in the following sections.

Citi’s Criteria for Increasing Credit Limits

When it comes to increasing credit limits, Citi has specific criteria that they consider before granting an increase. While these criteria may vary depending on individual cardholder profiles and other internal factors, understanding the general guidelines can help you assess your eligibility for a credit limit increase. Here are some key factors that Citi looks for:

- Payment history: Citi values cardholders who consistently make on-time payments. A history of timely payments indicates responsible financial behavior and increases your chances of receiving a credit limit increase.

- Income and financial stability: Citi takes into account your income and overall financial stability when evaluating credit limit increase requests. They want to ensure that you have the means to handle a higher credit limit without financial strain.

- Credit utilization: Maintaining a low credit utilization ratio is crucial for receiving a credit limit increase. Citi analyzes how much of your available credit you are currently using. A lower utilization ratio typically indicates responsible credit management and can improve your chances of an increase.

- Credit history: The length and quality of your credit history play a significant role in Citi’s decision-making process. Those with a longer credit history and a positive track record are more likely to receive a credit limit increase.

- Debt-to-income ratio: Citi considers your debt-to-income ratio, which measures the portion of your income that goes towards debt payments. A lower debt-to-income ratio suggests a lower financial burden and increases your likelihood of getting a credit limit increase.

- Overall creditworthiness: Citi evaluates your overall creditworthiness by assessing a combination of the factors mentioned above. They aim to provide credit limit increases to cardholders who demonstrate responsible financial habits and exhibit low-risk borrower qualities.

It’s important to note that meeting these criteria does not guarantee a credit limit increase as Citi considers each request on a case-by-case basis. Additionally, Citi may have internal guidelines and thresholds that impact their final decision.

Remember, if you believe you meet Citi’s criteria for a credit limit increase, it’s worth considering a few additional tips to improve your chances. We’ll explore these tips in the next section to help you navigate the credit limit increase process with Citi.

Tips to Improve Chances of Credit Limit Increase

If you’re interested in increasing your credit limit with Citi, there are several steps you can take to improve your chances. While there’s no guarantee of a credit limit increase, following these tips can help you demonstrate responsible credit management and showcase your creditworthiness:

- Pay your bills on time: Consistently making on-time payments is crucial for building a solid payment history. Late payments can negatively impact your chances of a credit limit increase, so be proactive in meeting your payment obligations.

- Keep your credit utilization low: Aim to keep your credit utilization ratio – the percentage of your available credit that you use – as low as possible. To achieve this, avoid maxing out your credit cards and aim to use 30% or less of your available credit.

- Consolidate your debt: If you have multiple credit cards or outstanding balances, consider consolidating your debt. By reducing the number of open credit accounts or transferring balances to a single card, you can potentially lower your overall debt-to-income ratio and improve your chances of a credit limit increase.

- Keep your credit history active: Regularly using your Citi credit card and making small, manageable transactions can help keep your credit history active and demonstrate responsible credit usage. Be sure to pay off the balance in full each month to avoid accumulating unnecessary debt.

- Monitor your credit score: Regularly check your credit score and keep an eye on any factors that may be negatively impacting it. By monitoring your credit, you can identify areas for improvement and take the necessary steps to maintain good credit health.

- Contact Citi for periodic reviews: While Citi conducts periodic reviews on their own, you can also proactively reach out to Citi and request a credit limit increase. Be prepared to provide updated financial information and highlight your responsible credit management practices.

- Consider a credit limit increase request after a major life event: If you’ve experienced a significant increase in income, such as a promotion or a new job, it might be an opportune time to request a credit limit increase. Make sure to provide supporting documentation to strengthen your case.

Remember, building and maintaining good credit takes time and consistent effort. By following these tips and demonstrating responsible financial habits, you can improve your chances of receiving a credit limit increase from Citi.

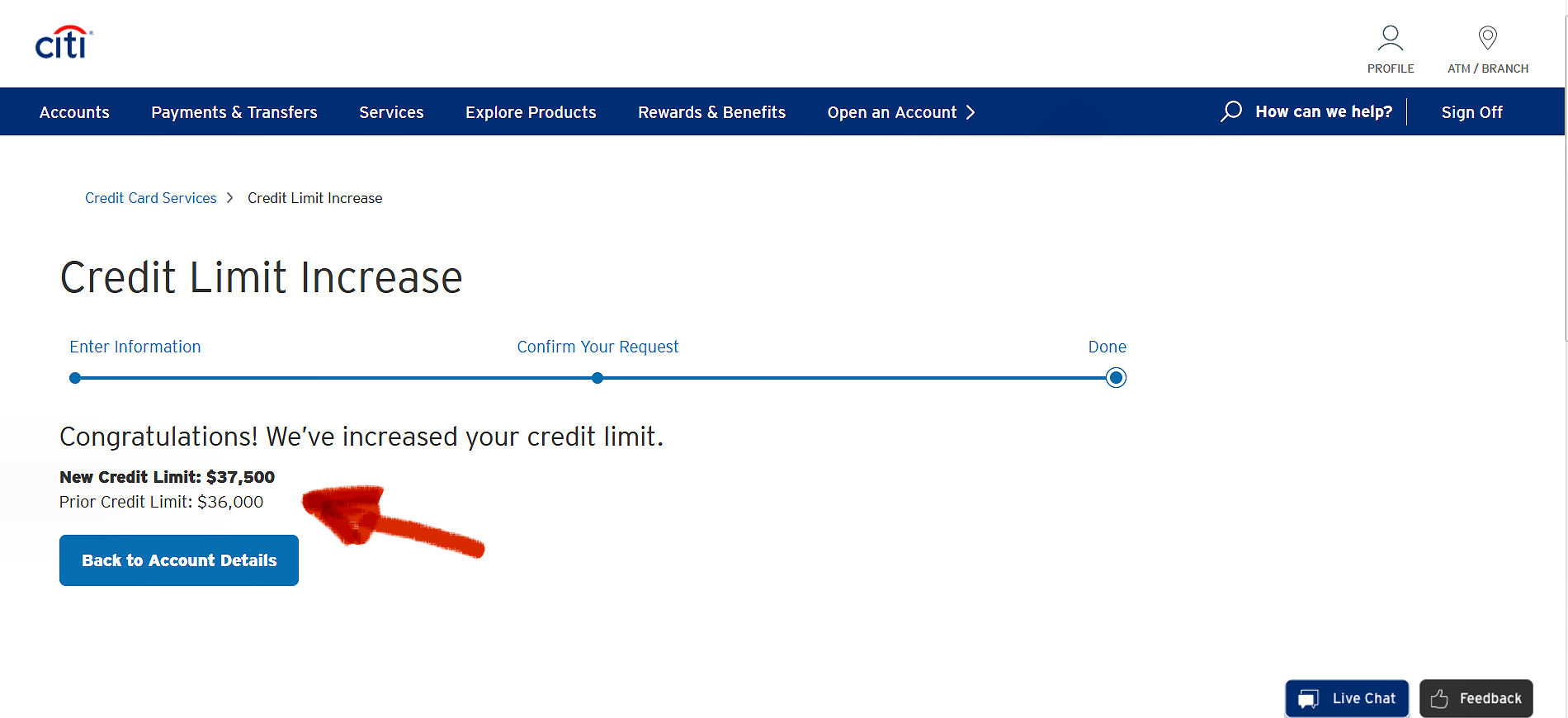

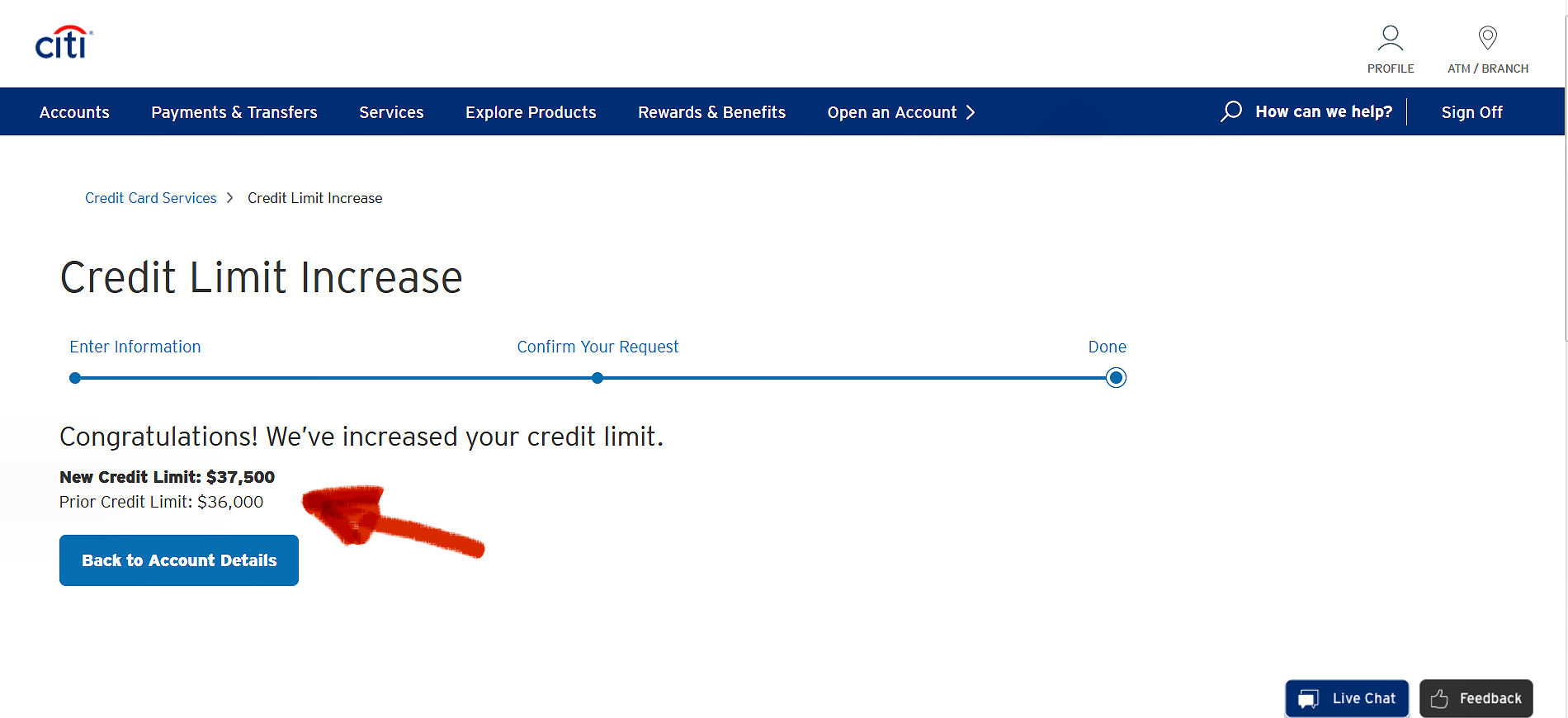

Requesting a Credit Limit Increase from Citi

If you believe you meet the criteria for a credit limit increase and want to request one from Citi, there are steps you can take to initiate the process. Follow these guidelines to increase your chances of a successful request:

- Check your eligibility: Before requesting a credit limit increase, review your credit card account and ensure that you have been using it responsibly. Make sure you meet Citi’s criteria, such as maintaining a good payment history and low credit utilization ratio.

- Review your financials: Before reaching out to Citi, take a thorough look at your financial situation. Consider factors such as changes in income, improved credit score, and responsible credit management habits that could strengthen your case for a credit limit increase.

- Contact Citi: Reach out to Citi’s customer service department using the phone number provided on the back of your credit card or through their online banking platform. Explain that you would like to request a credit limit increase and ask for guidance on the appropriate steps to follow.

- Provide updated information: When contacting Citi, be prepared to provide updated financial and personal information. This may include details about your current income, employment, and any major life events that may impact your creditworthiness.

- Be prepared for a credit inquiry: Citi may perform a hard credit inquiry as part of the credit limit increase evaluation process. Understand that this inquiry can temporarily impact your credit score, so be mindful of this potential consequence.

- Be patient: After submitting your request, be patient and allow Citi an appropriate amount of time to review your application. Remember that credit limit increase decisions are made on a case-by-case basis, and there is no guarantee of approval.

- Continue practicing responsible credit habits: While awaiting a decision, continue to exhibit responsible credit management habits. Make on-time payments, keep your credit utilization low, and maintain a solid credit history to further strengthen your case for a credit limit increase.

By following these steps and providing Citi with the necessary information, you can initiate the process of requesting a credit limit increase. Be sure to maintain open communication with Citi throughout the process to stay informed about the status of your request.

Frequently Asked Questions about Citi’s Credit Limit Increases

When it comes to credit limit increases with Citi, you may have some lingering questions. Let’s address some frequently asked questions to provide you with a clearer understanding:

- How long does it take for Citi to review a credit limit increase request?

The time frame for reviewing credit limit increase requests can vary. Generally, it can take a few weeks for Citi to review your request and make a decision. However, it’s important to note that this timeline is not set in stone and can be influenced by several factors, including your individual circumstances and Citi’s internal processes. - Will requesting a credit limit increase affect my credit score?

Requesting a credit limit increase typically results in a hard credit inquiry, which can have a slight impact on your credit score. However, the impact is generally minimal and temporary. It’s important to consider the potential benefits of a credit limit increase and weigh them against the potential impact on your credit score. - Can I request a credit limit increase for multiple Citi credit cards?

Yes, you can request a credit limit increase for multiple Citi credit cards. However, keep in mind that each request is evaluated independently based on the respective card’s account history and your overall creditworthiness. - Can Citi decrease my credit limit?

Yes, Citi has the right to decrease your credit limit if they determine that your creditworthiness has changed or if you have exhibited a higher level of risk. It’s important to maintain responsible credit management habits to avoid potential decreases in your credit limit. - How often can I request a credit limit increase with Citi?

While there are no strict limitations on how often you can request a credit limit increase, it’s generally recommended to wait at least six months between requests. This allows sufficient time for Citi to evaluate any changes in your financial situation and creditworthiness. - Will getting a credit limit increase automatically result in higher spending?

A higher credit limit may provide you with more spending power, but it’s important to remember that responsible credit management is key. Increasing your credit limit does not obligate you to spend more. It’s crucial to continue using credit responsibly and keep your spending within your means.

Keep in mind that while these answers serve as general guidelines, specific circumstances may vary. If you have more detailed or specific questions, it’s recommended to reach out to Citi directly for accurate and personalized information.

Conclusion

Understanding the credit limit increase process with Citi can help you navigate your financial journey more effectively. By considering the factors that determine credit limit increases, how often Citi reviews credit limits, and their criteria for granting increases, you can work towards improving your chances of receiving a credit limit increase.

Remember to practice responsible credit habits, such as making on-time payments, maintaining a low credit utilization ratio, and keeping your credit history active. These actions can positively influence Citi’s decision-making process and showcase your creditworthiness.

If you believe you meet the criteria for a credit limit increase, don’t hesitate to reach out to Citi and request one. Provide updated financial information, be patient throughout the review process, and continue practicing responsible credit management habits while waiting for a decision.

Lastly, keep in mind that a credit limit increase is not an invitation to overspend. It’s crucial to use credit responsibly and manage your finances wisely. By doing so, you can establish a strong credit history, maintain financial stability, and enhance your future borrowing opportunities.

We hope this comprehensive guide has shed light on the credit limit increase process with Citi and provided you with the knowledge to take the necessary steps towards financial growth and success.