Finance

How To Issue Asset-Backed Securities

Published: November 26, 2023

Learn the process of issuing asset-backed securities and how it can help in financing various projects in the finance industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Asset-Backed Securities

- Benefits of Issuing Asset-Backed Securities

- The Process of Issuing Asset-Backed Securities

- Identifying Suitable Assets for Securitization

- Creating a Special Purpose Vehicle (SPV)

- Valuation and Rating of Asset-Backed Securities

- Legal and Regulatory Considerations

- Marketing and Distribution of Asset-Backed Securities

- Risk Management Strategies for Asset-Backed Securities

- Conclusion

Introduction

Welcome to the world of asset-backed securities! In today’s complex financial landscape, companies and institutions are constantly seeking innovative ways to raise capital and manage risk. Asset-backed securities (ABS) have emerged as a popular financial instrument that enables businesses to generate liquidity by leveraging their existing assets.

An asset-backed security represents a bundle of underlying assets, such as loans, mortgages, or receivables, which are converted into tradable securities. These securities offer investors exposure to the cash flows generated by the underlying assets, making them an attractive investment option.

This article aims to demystify the process of issuing asset-backed securities and shed light on the associated benefits, considerations, and strategies. Whether you are a financial professional, a business owner, or an investor, understanding the ins and outs of asset-backed securities can provide you with valuable insights for making informed investment decisions.

Throughout this article, we will explore the intricacies of asset-backed securities, including how they work, the benefits they offer, and the steps involved in issuing them. We will also delve into the selection and valuation of suitable assets, the legal and regulatory framework, and the risk management strategies associated with these securities.

So, fasten your seatbelts as we embark on this journey to unravel the world of asset-backed securities and discover the opportunities it holds.

Understanding Asset-Backed Securities

Asset-backed securities (ABS) are a type of financial instrument that allow companies to transform their illiquid assets into tradable securities. These securities represent a share of the cash flows generated by the underlying assets, making them an attractive investment option for both institutional and individual investors.

At its core, ABS is a form of securitization, which involves pooling together a group of assets and converting them into marketable securities. These assets can include diverse forms of debt, such as auto loans, mortgages, credit card receivables, or corporate debt. Once pooled, the cash flows generated by these assets are used to make interest and principal payments to the investors who hold the ABS.

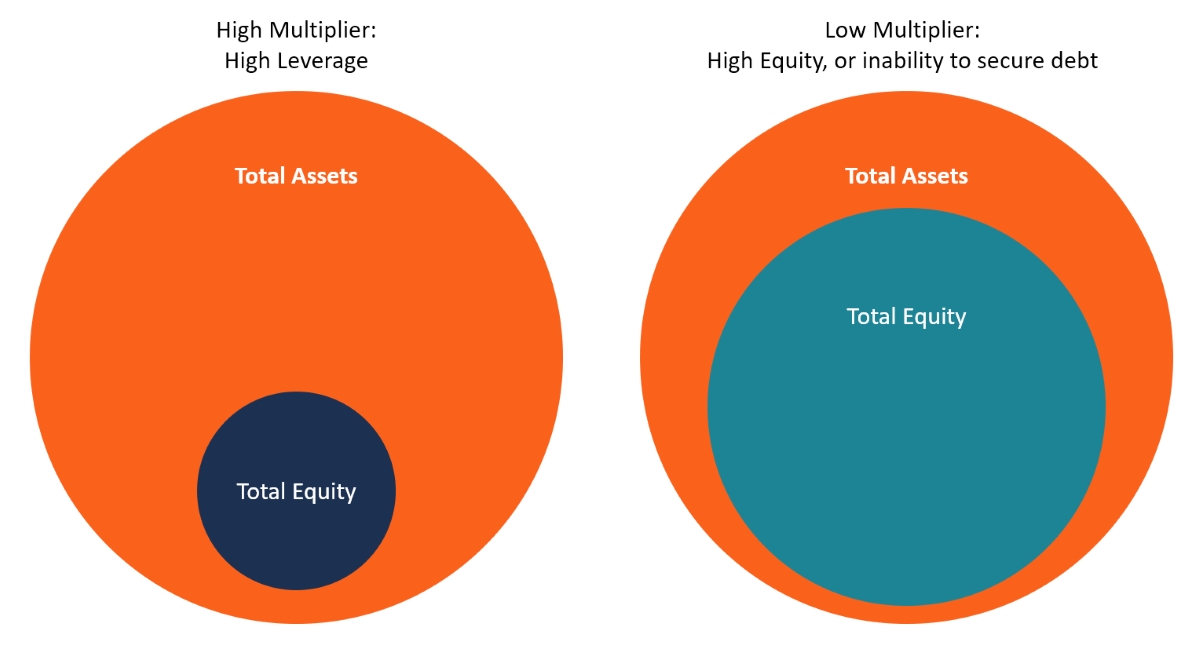

The structure of asset-backed securities typically involves the creation of a special purpose vehicle (SPV), which is a separate legal entity responsible for holding the underlying assets and issuing the ABS. The SPV is structured in a way that isolates the assets from the issuer’s balance sheet, providing added security to the investors.

What sets asset-backed securities apart from other types of fixed-income securities, such as corporate bonds, is their collateralization. ABS are backed by a specific pool of underlying assets, which act as collateral for the securities. This collateralization provides a layer of protection for investors, as the cash flows generated by the underlying assets are used to repay the principal and interest on the ABS.

Furthermore, asset-backed securities are often structured into different tranches, each with its own level of risk and return. The tranches are created based on the credit quality of the underlying assets and are designed to attract investors with varying risk appetites. The senior tranches generally have a higher credit rating and receive priority in receiving cash flows, while the junior tranches have a higher risk profile but offer the potential for higher returns.

Overall, asset-backed securities provide a way for companies to unlock the value of their illiquid assets and generate liquidity. By securitizing their assets, businesses can tap into the capital markets and expand their funding options. At the same time, ABS offer investors an opportunity to diversify their portfolios and gain exposure to a range of underlying assets. Understanding the mechanics and benefits of asset-backed securities is crucial for both issuers and investors in navigating the complex world of securitization.

Benefits of Issuing Asset-Backed Securities

Issuing asset-backed securities (ABS) offers numerous benefits for both companies and investors. Let’s explore some of the key advantages of utilizing ABS as a financing and investment tool.

Access to Liquidity: One of the primary benefits of issuing ABS is the ability to access liquidity. By securitizing their assets, companies can transform illiquid assets, such as loans or receivables, into tradable securities. This opens up opportunities to raise capital from investors who are willing to buy into the cash flows generated by the underlying assets. By tapping into the capital markets, companies can diversify their sources of funding and potentially obtain more favorable terms compared to traditional bank loans.

Risk Diversification: Asset-backed securities provide investors with an opportunity to diversify their portfolios. By investing in ABS, investors gain exposure to a pool of underlying assets, which can include different types of loans or receivables. This diversification helps spread risk across a range of assets and can potentially reduce the impact of individual asset defaults. Furthermore, the creation of different tranches within ABS allows investors to choose a risk-reward profile that aligns with their investment objectives.

Enhanced Credit Quality: Asset-backed securities are typically backed by specific pools of collateral, such as mortgages or auto loans. This collateralization provides an additional layer of security, resulting in enhanced credit quality compared to unsecured debt. The cash flows generated by the underlying assets are used to make principal and interest payments on the ABS, reducing the risk of default. This enhanced credit quality makes asset-backed securities an attractive investment option for risk-averse investors.

Improved Marketability: Asset-backed securities are designed to be highly liquid and easily tradable in the secondary market. The standardization and market acceptance of ABS make them more marketable compared to other types of complex financial instruments. This increased marketability provides investors with the flexibility to buy and sell their securities based on their investment goals and market conditions.

Flexibility in Structuring: Asset-backed securities offer issuers flexibility in structuring their financing arrangements. The creation of different tranches, each with its own risk and return profile, allows issuers to tailor the securities to meet the specific needs of investors. This flexibility can attract a wider range of investors with varying risk appetites, ultimately expanding the potential investor base for the ABS.

Regulatory Capital Relief: For financial institutions, issuing asset-backed securities can provide regulatory capital relief. By securitizing their loans, banks can remove them from their balance sheets and free up capital to support additional lending activities. This capital relief can help banks manage their risk exposure and meet regulatory requirements more efficiently.

Overall, the issuance of asset-backed securities offers a host of benefits, from increased access to liquidity and risk diversification to enhanced credit quality and marketability. This financial instrument plays a crucial role in the modern financial landscape, enabling companies to unlock the value of their assets and investors to achieve their financial goals through diversified and secure investment opportunities.

The Process of Issuing Asset-Backed Securities

The issuance of asset-backed securities (ABS) involves a series of steps that must be carefully followed to ensure a successful transaction. Let’s explore the key stages of the process:

- Identifying Suitable Assets: The first step in issuing ABS is identifying the suitable assets for securitization. These assets can include loans, mortgages, leases, or any other income-generating assets that can be converted into cash flows. It is important to assess the quality and characteristics of the assets to determine their potential value in the securitization process.

- Creating a Special Purpose Vehicle (SPV): Once the assets are identified, a special purpose vehicle (SPV) is created. The SPV is a separate legal entity responsible for holding the assets and issuing the ABS. The SPV isolates the assets from the issuing entity’s balance sheet, providing additional protection and reducing risk for investors. The SPV also ensures the proper management and administration of the underlying assets.

- Structuring the ABS: The ABS structure involves creating different tranches, each with its own risk and return profile. The tranches are designed based on the credit quality of the underlying assets and the desired risk appetite of investors. The structure determines the order in which cash flows are distributed among the tranches, with senior tranches receiving priority in repayment. The structure must comply with regulatory requirements and market standards.

- Valuation and Rating: The assets and the ABS are assessed and valued to determine their creditworthiness and market value. Independent third-party valuation firms may be engaged to provide an objective assessment of the assets and the ABS structure. Additionally, credit rating agencies assign ratings to the different tranches based on their credit risk. The ratings help investors assess the risk-return profile of the ABS and make informed investment decisions.

- Legal and Regulatory Considerations: Issuing ABS involves complying with various legal and regulatory requirements. Legal documentation, such as the trust agreement and offering memorandum, is created to outline the rights and obligations of the parties involved. Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, may require specific disclosures and filings to ensure transparency and investor protection.

- Marketing and Distribution: Once the ABS structure, valuation, and legal requirements are in place, the securities are marketed to potential investors. Financial institutions, investment banks, and institutional investors play a critical role in the distribution of ABS. Roadshows, investor presentations, and private placements are common methods used to attract investors. The marketing efforts aim to educate potential investors about the investment opportunity and highlight the benefits and risks of the ABS.

- Underwriting and Pricing: In the underwriting stage, investment banks or underwriters assess the demand for the ABS and determine the appropriate pricing. The underwriters commit to purchasing a certain portion of the ABS and facilitate the transaction. The pricing is influenced by factors such as market conditions, credit ratings, and investor demand.

- Closing and Settlement: Once the underwriting and pricing are finalized, the closing and settlement process takes place. This involves the transfer of ownership and the legal formalities for completing the issuance of the ABS. The funds raised from the sale of the ABS are typically transferred to the issuing entity, providing the desired liquidity.

It is important to note that the process of issuing ABS may vary depending on the jurisdiction and specific requirements. Working with experienced professionals, such as investment bankers, lawyers, and rating agencies, is crucial to ensure compliance with legal and regulatory guidelines and to optimize the success of the ABS issuance.

Identifying Suitable Assets for Securitization

One of the critical steps in the issuance of asset-backed securities (ABS) is the identification of suitable assets for securitization. The selection of these assets plays a pivotal role in determining the success of the securitization transaction. Let’s explore the key considerations in identifying assets for securitization:

Income-Generating Assets: Assets eligible for securitization are typically income-generating assets such as loans, mortgages, leases, or receivables. These assets generate stable and predictable cash flows, making them suitable for converting into tradable securities. The underlying assets should have a sufficient track record of payments and cash flow performance to ensure a consistent repayment stream for ABS investors.

Homogeneous and Diverse Asset Pools: To enhance the marketability of the ABS, it is beneficial to create pools of assets that are homogeneous to some extent. Homogeneous assets have similar characteristics, such as credit quality or maturity, which helps in pricing and evaluating risks. However, the pool should also be diversified to mitigate the risk of concentration. A diverse asset pool helps spread risk across different sectors, geographies, or types of borrowers.

Low Default Risk: Selecting assets with low default risk is crucial for reducing the credit risk associated with the ABS. Assets with a solid credit history, strong collateral, or guaranteed payments are more likely to have a lower default risk. The assets should have established underwriting standards and effective risk management practices in place to minimize the potential of default or late payments.

Liquid and Transferable Assets: The assets chosen for securitization should be liquid and transferable in the market. This allows for ease of trading and enhances the liquidity of the ABS. Assets that are easily marketable and have an active secondary market contribute to the attractiveness of the ABS for potential investors.

Legal and Regulatory Compliance: It is crucial to ensure that the selected assets comply with legal and regulatory requirements. Compliance with relevant laws and regulations ensures that the asset’s transferability and enforceability are not hindered. It also provides greater transparency and protects both issuers and investors in the securitization process.

Data Availability and Transparency: Availability of accurate and reliable data about the assets is imperative for conducting proper due diligence and risk assessment. The information should include historical performance, delinquency rates, collateral values, and other relevant financial metrics. Transparency in asset quality and performance helps establish investor confidence and supports accurate valuations.

Stable Cash Flow Projections: The assets should have a predictable and stable cash flow pattern to ensure consistent payments to investors of the ABS. An analysis of historical cash flows and future projections is necessary to assess the viability of the asset pool and determine the potential risks and returns.

Originator’s Expertise and Track Record: The track record and expertise of the asset originator are crucial factors in assessing the quality of the assets. A reputable originator with a proven track record in underwriting, servicing, and managing the assets instills confidence in the securitization process and increases the likelihood of successful ABS issuance.

By carefully considering these factors, issuers can identify suitable assets for securitization. Working with financial professionals, credit rating agencies, and legal advisors can provide invaluable guidance in the asset selection process. The goal is to create an asset pool that maximizes the potential for success in the securitization transaction and meets the needs of both issuers and investors.

Creating a Special Purpose Vehicle (SPV)

When issuing asset-backed securities (ABS), one crucial step is the creation of a special purpose vehicle (SPV). The SPV is a separate legal entity that holds the underlying assets and issues the ABS, providing structure and protection to the securitization process. Let’s delve into the key aspects of creating an SPV:

Purpose and Structure: The main purpose of creating an SPV is to isolate the underlying assets from the issuing entity’s balance sheet. By doing so, the assets and associated liabilities are placed in a separate legal entity, enhancing the security for ABS investors. The SPV is typically a bankruptcy-remote entity, meaning that its assets and liabilities are ring-fenced from the issuer’s financial obligations.

Legal Formation: The SPV is typically formed as a corporation, trust, or limited partnership, depending on the jurisdiction and specific requirements. The legal structure chosen ensures compliance with local laws and provides the necessary flexibility for the securitization transaction. Legal counsel is usually involved in the formation process to ensure adherence to all legal and regulatory considerations.

Asset Acquisition: Once the SPV is established, it acquires the underlying assets from the originating entity. This transfer is made through a sale or contribution, ensuring that legal ownership of the assets is transferred to the SPV. The SPV becomes the legal holder of the assets and assumes full responsibility for their administration and management.

Depository and Custodian Services: To ensure proper custody and safeguarding of the assets, the SPV often engages the services of a depository institution or custodian bank. The depository holds the asset documents, such as titles or loan agreements, on behalf of the SPV. This further enhances the separation between the assets and the issuing entity, providing additional security to investors.

ABS Issuance: The SPV is responsible for issuing the asset-backed securities to investors. It creates the necessary documentation, such as the trust agreement, offering memorandum, and investor disclosures, which outline the terms and conditions of the ABS. The SPV ensures compliance with legal and regulatory requirements and coordinates with underwriters and other financial intermediaries to facilitate the issuance and distribution of the securities.

Cash Flow Management: The SPV plays a vital role in managing the cash flows generated by the underlying assets. It receives the principal and interest payments from the assets and distributes them to the ABS investors according to the predetermined structure and priority set in the deal’s terms. This cash flow management ensures proper allocation and distribution of the funds generated by the underlying assets.

Independent Board and Directors: To maintain the independence and integrity of the SPV, it often has its own board of directors or managers. These directors are responsible for overseeing the operations of the SPV and ensuring that it operates in accordance with the terms of the securitization transaction. Independent directors provide an additional layer of governance and safeguard the interests of ABS investors.

Reporting and Compliance: The SPV is responsible for maintaining accurate and transparent reporting of the securitization transaction. It prepares financial statements, compliance reports, and other relevant disclosures to investors and regulatory authorities. This transparency ensures that ABS investors have access to the necessary information to assess the performance and risks associated with the asset-backed securities they hold.

The creation of an SPV is a critical step in the issuance of asset-backed securities. The SPV helps maintain legal separation between the issuing entity and the underlying assets, providing investors with additional security and mitigating risks. By carefully structuring the SPV and adhering to legal and regulatory considerations, issuers can facilitate a smooth and credible securitization process for the benefit of both issuers and investors.

Valuation and Rating of Asset-Backed Securities

Valuation and rating are crucial aspects of asset-backed securities (ABS) that provide investors with valuable insights into the performance and risk profile of these securities. Let’s explore the key considerations in the valuation and rating process:

Valuation: Valuation is the process of determining the economic value of the underlying assets and the ABS itself. It helps investors assess the fair price of the securities and make informed investment decisions. The valuation of ABS involves analyzing various factors:

- Asset Performance: The performance of the underlying assets, such as loan repayments or rental income, is closely analyzed to determine their present value and expected future cash flows. Historical data, projected cash flows, and potential risks are taken into consideration during the valuation process.

- Credit Enhancement: Credit enhancement measures, such as overcollateralization, excess spread, and reserve funds, are considered in the valuation. These measures provide additional protection to ABS investors, hence impacting the valuation of the securities.

- Market Conditions: Current market conditions, including interest rates, economic outlook, and investor demand, play a role in determining the valuation of ABS. Market sentiment and liquidity conditions can influence the pricing of the securities.

- Discount Rates: Valuation also takes into account the appropriate discount rate to apply to the future cash flows generated by the ABS. The discount rate reflects the risk associated with the securities and the expected rate of return demanded by investors.

Rating: Credit rating agencies play a crucial role in assigning ratings to asset-backed securities. These ratings provide an independent assessment of the creditworthiness and risk profile of the ABS, helping investors evaluate the quality of the investment. Key factors considered in the rating process include:

- Underlying Asset Quality: The credit quality of the underlying assets is a significant factor in determining the rating. A thorough analysis of creditworthiness, historical performance, and collateral quality helps evaluate the risk of default and delinquencies.

- Structural Features: The structure of the ABS, including the seniority of tranches, credit enhancement mechanisms, and cash flow distribution, impacts the rating. Strong structural features that provide protection to investors are viewed positively in the rating process.

- Issuer’s Risk Management: The risk management practices of the issuer, including their origination and servicing track record, influence the rating. A comprehensive risk management framework enhances the likelihood of timely payments and reduces the potential for default.

- Market Conditions and Macroeconomic Factors: The overall market conditions, interest rates, economic factors, and regulatory environment also influence the rating. Changes in these factors can impact the performance and creditworthiness of ABS and therefore affect the assigned rating.

It is important to note that the rating assigned to ABS is an opinion based on an assessment of available information at a specific point in time. Ratings can change over time to reflect changing market conditions or other relevant factors. Investors should consider the ratings assigned by reputable credit rating agencies as part of their due diligence process but also perform their own analysis and consider additional factors.

Valuation and rating processes contribute to transparency and provide investors with valuable insights into the risks and potential returns of asset-backed securities. They aid in price discovery and enable investors to make informed investment decisions based on the credit quality, performance, and risk profile of ABS.

Legal and Regulatory Considerations

When issuing asset-backed securities (ABS), navigating the legal and regulatory landscape is of utmost importance. Compliance with relevant laws and regulations ensures the transparency, integrity, and legality of the securitization transaction. Let’s delve into the key legal and regulatory considerations associated with ABS:

Securities Laws: ABS issuances are subject to securities laws and regulations that govern the offering and sale of securities to the public. These laws vary by jurisdiction but often require the filing of offering documents, such as a prospectus or private placement memorandum, with regulatory authorities. Compliance with securities laws ensures the protection of investors and promotes fair and transparent markets.

Disclosure Requirements: ABS issuers are required to provide comprehensive and accurate disclosures to investors. These disclosures include information about the underlying assets, the structure of the securities, associated risks, and relevant financial information. Transparency is key in ensuring that investors have access to the necessary information to make informed investment decisions.

Risk Retention: In many jurisdictions, risk retention rules require ABS issuers to retain a portion of the credit risk associated with the securitized assets. These rules aim to align the interests of the issuer with those of the investors, ensuring that the issuer has “skin in the game.” Risk retention helps maintain the quality of the underlying assets and forces the issuer to have a stake in the performance of the ABS.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Requirements: ABS issuers and financial intermediaries must adhere to AML and KYC regulations to prevent money laundering, terrorist financing, and other illicit activities. These regulations require thorough due diligence on investors, verification of their identities, and the reporting of suspicious activities. Compliance with AML and KYC requirements is essential to maintain the integrity of the securitization process and protect against financial crimes.

Consumer Protection Laws: ABS issuers must also consider consumer protection laws that govern the origination, servicing, and collection practices related to the underlying assets. These laws aim to safeguard borrowers and ensure fair treatment in the lending and securitization process. Compliance with consumer protection laws helps maintain the quality and reputation of the ABS.

Regulatory Oversight: Regulatory authorities, such as the Securities and Exchange Commission (SEC) in the United States, play a crucial role in overseeing ABS issuances. These authorities monitor compliance with securities laws, review offering documents, conduct examinations, and enforce regulatory requirements. Collaboration with regulatory authorities is necessary to ensure compliance and obtain necessary approvals for ABS issuances.

Tax Considerations: The tax treatment of ABS varies by jurisdiction and can have significant implications for both issuers and investors. Tax considerations may include the treatment of interest income, capital gains, deductions, and withholding taxes. Seeking proper tax advice and structuring ABS in a tax-efficient manner is essential to optimize the financial outcomes for all parties involved.

Engaging legal counsel, compliance experts, and other professionals with expertise in securities laws and regulations is crucial to navigate the complex legal and regulatory landscape associated with ABS. By understanding and adhering to the applicable legal and regulatory requirements, issuers can ensure compliance, protect the interests of investors, and foster a trustworthy and efficient securitization market.

Marketing and Distribution of Asset-Backed Securities

The marketing and distribution stage is a critical component of the asset-backed securities (ABS) issuance process. It involves promoting the ABS to potential investors and facilitating the sale of the securities. Effective marketing and distribution strategies are essential to attract investors and ensure the success of the issuance. Let’s explore the key considerations in marketing and distributing ABS:

Investor Targeting and Segmentation: Identifying and targeting the right investors is crucial in marketing ABS. Potential investors can include institutional investors, such as pension funds, insurance companies, and asset managers, as well as individual investors. Segmenting the target investor base based on risk appetite, investment goals, and geographic location allows for tailored marketing efforts and better alignment with investor preferences.

Investor Education and Communication: Educating potential investors about the benefits and risks of ABS is essential in attracting their interest. Providing clear and transparent communication about the underlying assets, the ABS structure, cash flow mechanisms, and associated risks helps investors make informed investment decisions. Investor presentations, roadshows, and one-on-one meetings facilitate direct communication and allow investors to ask questions and seek clarification.

Investment Bank or Financial Intermediary Engagement: Investment banks or financial intermediaries play a crucial role in the marketing and distribution of ABS. They serve as underwriters or placement agents, providing access to their network of investors and assisting in the pricing and structuring of securities. Engaging reputable and experienced financial intermediaries helps enhance credibility and expands the reach to potential investors.

Timing and Market Conditions: Timing is crucial in marketing ABS. Monitoring market conditions, interest rates, and investor sentiment is essential to determine optimal timing for issuance. Identifying favorable market conditions and aligning issuance dates with investor demand can increase the likelihood of a successful offering.

Efficient Pricing and Allocation: Working closely with underwriters, issuers determine the pricing of the ABS based on market conditions, asset quality, credit ratings, and investor demand. Efficient pricing ensures that the securities are appropriately priced, balancing the issuer’s need for funding and the desired returns for investors. Allocation of the securities to investors is managed to ensure a fair and equitable distribution of the ABS based on investor demand.

Utilizing Multiple Distribution Channels: ABS can be distributed through various channels to reach a wider investor base. These channels may include private placements, public offerings, institutional sales, or online platforms. Leveraging multiple distribution channels allows for broader market access and increases the chances of finding interested investors.

Market Making and Secondary Market Liquidity: Enhancing secondary market liquidity is important for ABS investors. Collaborating with market makers or liquidity providers can facilitate trading and enhance liquidity in the secondary market. Increased liquidity improves marketability and potentially attracts more investors to the ABS. Liquidity is often enhanced through standardized documentation, creating market standards, and facilitating ease of trading.

Compliance with Securities Laws and Regulations: Compliance with securities laws and regulations is essential throughout the marketing and distribution process. Ensuring that all disclosure requirements, prospectus filings, and regulatory mandates are met ensures investor protection and avoids potential legal implications. Collaboration with legal counsel and adherence to regulatory requirements foster investor confidence and trust in the ABS.

The marketing and distribution of ABS require a structured and well-executed approach. By effectively targeting investors, providing transparent communication, leveraging intermediaries, and complying with legal and regulatory requirements, issuers enhance the prospects of successful marketing and distribution, attracting a diverse and interested investor base.

Risk Management Strategies for Asset-Backed Securities

Risk management is a crucial aspect of asset-backed securities (ABS) to ensure the security and stability of the investment. Implementing effective risk management strategies is essential to identify, assess, and mitigate potential risks associated with ABS. Let’s explore some key risk management strategies for ABS:

Thorough Due Diligence: Conducting thorough due diligence on the underlying assets is the first step in mitigating risk. This includes analyzing the quality of the assets, their historical performance, borrower creditworthiness, collateral adequacy, and other relevant factors. Utilizing reliable data sources and performing comprehensive financial analysis helps identify potential risks and assess the overall risk profile of the ABS.

Credit Risk Assessment: Assessing the credit risk associated with the ABS is crucial. This involves evaluating the creditworthiness of the borrowers, the underwriting standards used in originating the assets, and the performance of the assets over time. Credit risk can be managed through credit enhancement mechanisms, such as overcollateralization or subordination, which provide additional protection to investors in the event of default or delinquency.

Market Risk Management: Managing market risk is important for ABS investors. Market risk factors, such as interest rate fluctuations, prepayment risks, or changes in economic conditions, can impact the value of ABS. Employing hedging strategies, such as interest rate swaps or utilizing derivatives, can mitigate exposure to market risk and provide stability to the investment.

Liquidity Risk Monitoring: Liquidity risk can arise from the ability to buy or sell the ABS in the market. Monitoring secondary market liquidity and actively managing it through market-making agreements or liquidity facilities can enhance liquidity and reduce the risk of being unable to liquidate the investment when needed.

Servicing and Collection Risk: The proper servicing and collection of payments from the underlying assets are crucial in managing risk. Ensuring that the servicer has appropriate expertise, systems, and controls in place is essential to maintain timely and accurate collection. Regular monitoring of servicer performance, including compliance with servicing standards, can help mitigate risk in this area.

Legal and Regulatory Compliance: Staying compliant with legal and regulatory requirements is fundamental in mitigating risk. This includes adhering to securities laws, disclosure requirements, consumer protection regulations, and anti-money laundering (AML) regulations. Engaging legal counsel and compliance experts helps ensure compliance and minimize legal and regulatory risks.

Scenario Analysis and Stress Testing: Conducting scenario analysis and stress testing helps assess the potential impact of adverse events on the ABS. By simulating various scenarios, such as economic downturns or asset defaults, issuers and investors can assess the resilience of the ABS and its ability to withstand severe market conditions. This analysis aids in risk identification, capital planning, and contingency planning.

Monitoring and Reporting: Regular monitoring of the asset performance, market conditions, and risk factors is crucial in managing ABS risk. Timely reporting of relevant data and information allows for proactive risk management, early identification of issues, and appropriate decision-making. Transparency and open communication between all parties involved in the securitization process are key in managing risks effectively.

Diversification: Building a diversified portfolio of ABS can help manage risk. Investing in ABS backed by a variety of asset types, industries, or geographic regions can spread risk and reduce the impact of individual asset defaults. Diversification helps protect against concentration risk and promotes stability in the overall ABS portfolio.

Implementing a robust risk management framework is crucial for successful investing in asset-backed securities. By conducting thorough due diligence, assessing credit and market risks, monitoring liquidity and servicing, ensuring legal and regulatory compliance, engaging in scenario analysis, and promoting diversification, issuers and investors can minimize risk and maximize the potential for positive returns in the ABS market.

Conclusion

Asset-backed securities (ABS) provide companies with a valuable tool to generate liquidity by securitizing their existing assets, while offering investors an opportunity to diversify their portfolios and gain exposure to a range of underlying assets. Throughout this article, we have explored the various aspects of issuing ABS, including the understanding of what ABS are, the benefits they offer, the process of issuing them, identifying suitable assets for securitization, creating a special purpose vehicle (SPV), valuing and rating ABS, legal and regulatory considerations, marketing and distribution strategies, and risk management strategies.

ABS offer several benefits to both issuers and investors. Companies can transform illiquid assets into tradable securities, accessing additional liquidity and diversifying their funding sources. Meanwhile, investors can diversify their portfolios, gain exposure to cash flows generated by a pool of underlying assets, and potentially benefit from enhanced credit quality.

The process of issuing ABS involves several stages, from identifying suitable assets and creating an SPV to valuation, legal considerations, marketing, and distribution. Compliance with legal and regulatory requirements is crucial to ensure transparency and protect the interests of investors. Proper risk management strategies, including due diligence, credit risk assessment, and scenario analysis, are essential to mitigate risks associated with ABS investments.

As the asset-backed securities market continues to evolve, understanding the intricacies of ABS becomes increasingly vital for financial professionals, businesses, and investors. By staying informed about market trends, regulatory developments, and best practices, stakeholders can make informed decisions and maximize the benefits offered by ABS.

In conclusion, asset-backed securities provide a valuable avenue for issuing companies to unlock the value of their assets and investors to diversify their portfolios. With their potential for enhanced liquidity, credit quality, and risk-adjusted returns, ABS present an attractive investment option in the ever-changing financial landscape.