Finance

How To Short Mortgage-Backed Securities

Published: November 26, 2023

Learn how to shorten mortgage-backed securities and optimize your finance portfolio with our comprehensive guide on Finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Mortgage-backed securities (MBS) are a type of financial instrument that represent an ownership interest in a pool of mortgages. These securities provide an opportunity for investors to participate in the real estate market and earn returns based on the income generated from the underlying mortgage loans.

However, there may be instances when investors believe that the value of mortgage-backed securities will decline. In such scenarios, investors can choose to engage in a strategy known as “shorting” mortgage-backed securities. Shorting involves selling securities that you do not currently own, with the expectation that you can buy them back at a lower price in the future, thereby profiting from the price difference.

Shorting mortgage-backed securities can be a complex and risky endeavor, requiring a deep understanding of the mechanics of the mortgage market and the factors that influence the value of these securities. In this article, we will explore the concept of shorting mortgage-backed securities, the steps involved in executing this strategy, as well as the risks and considerations to keep in mind.

Understanding Mortgage-Backed Securities

Mortgage-backed securities (MBS) are financial instruments that are created by pooling together a large number of individual mortgages. When someone takes out a mortgage to purchase a home, the lender usually sells that loan to a financial institution. In turn, the institution packages these mortgages together and creates mortgage-backed securities.

Investors can then buy these securities, essentially becoming stakeholders in a pool of mortgage loans. The cash flow generated from the monthly mortgage payments, including interest and principal, is distributed to the investors in proportion to their ownership of the securities.

Mortgage-backed securities are appealing to investors because they offer the opportunity to earn a steady stream of income and diversify their portfolios. Additionally, these securities are usually backed by real estate, which serves as collateral. This collateral helps mitigate some of the risks associated with investing in mortgage-backed securities.

There are different types of mortgage-backed securities, including residential MBS and commercial MBS. Residential MBS are backed by residential properties and include loans made to individuals for the purchase of homes. Commercial MBS, on the other hand, are backed by properties such as office buildings, retail centers, and hotels.

The value of mortgage-backed securities is influenced by various factors, such as changes in interest rates, prepayment risk, and credit risk. If interest rates rise, the value of these securities may decline, as potential homebuyers may be deterred from taking out mortgages. Prepayment risk refers to the possibility that borrowers may repay their loans earlier than expected, resulting in lower returns for MBS investors. Credit risk comes into play if borrowers default on their mortgage payments, leading to potential losses for investors.

Overall, understanding the nature of mortgage-backed securities is crucial for investors who are considering shorting these securities. It is necessary to have a grasp of how these securities are structured and what factors can affect their value.

Shorting Mortgage-Backed Securities

Shorting mortgage-backed securities involves selling securities that you do not currently own, with the expectation that you can buy them back at a lower price in the future. This strategy is based on the belief that the value of the securities will decline, allowing the investor to profit from the price difference.

To short mortgage-backed securities, investors typically borrow the securities from a broker or another lending institution and then sell them in the open market. The proceeds from the sale are held as collateral by the borrowing party. At a later date, the investor must repurchase the same securities and return them to the original lender. If the price of the securities has indeed declined, the investor can buy them back at a lower price, pocketing the difference as profit.

Shorting mortgage-backed securities can be an attractive strategy in certain market conditions. For instance, if there are signs of an impending housing market crash or a rise in mortgage delinquencies, investors may choose to short these securities to capitalize on the anticipated decline.

However, it is important to note that shorting mortgage-backed securities is not without risks. The value of these securities can be influenced by a myriad of factors, including economic conditions, housing market trends, and government policies. These factors can be unpredictable and volatile, making it essential for investors to thoroughly analyze the market before deciding to short mortgage-backed securities.

Furthermore, shorting mortgage-backed securities involves borrowing costs, as investors need to pay interest on the borrowed securities. If the investor holds the short position for an extended period, these borrowing costs can eat into potential profits.

In addition to considering market conditions and borrowing costs, it is crucial for investors to have a deep understanding of how mortgage-backed securities operate. This includes knowledge of the mortgage market, interest rate fluctuations, and potential risks associated with the underlying mortgages.

Overall, shorting mortgage-backed securities can be a lucrative strategy for experienced investors who have done their due diligence and can accurately predict market trends. However, it is not suitable for novice investors or those who are not comfortable taking on significant risks.

Steps to Short Mortgage-Backed Securities

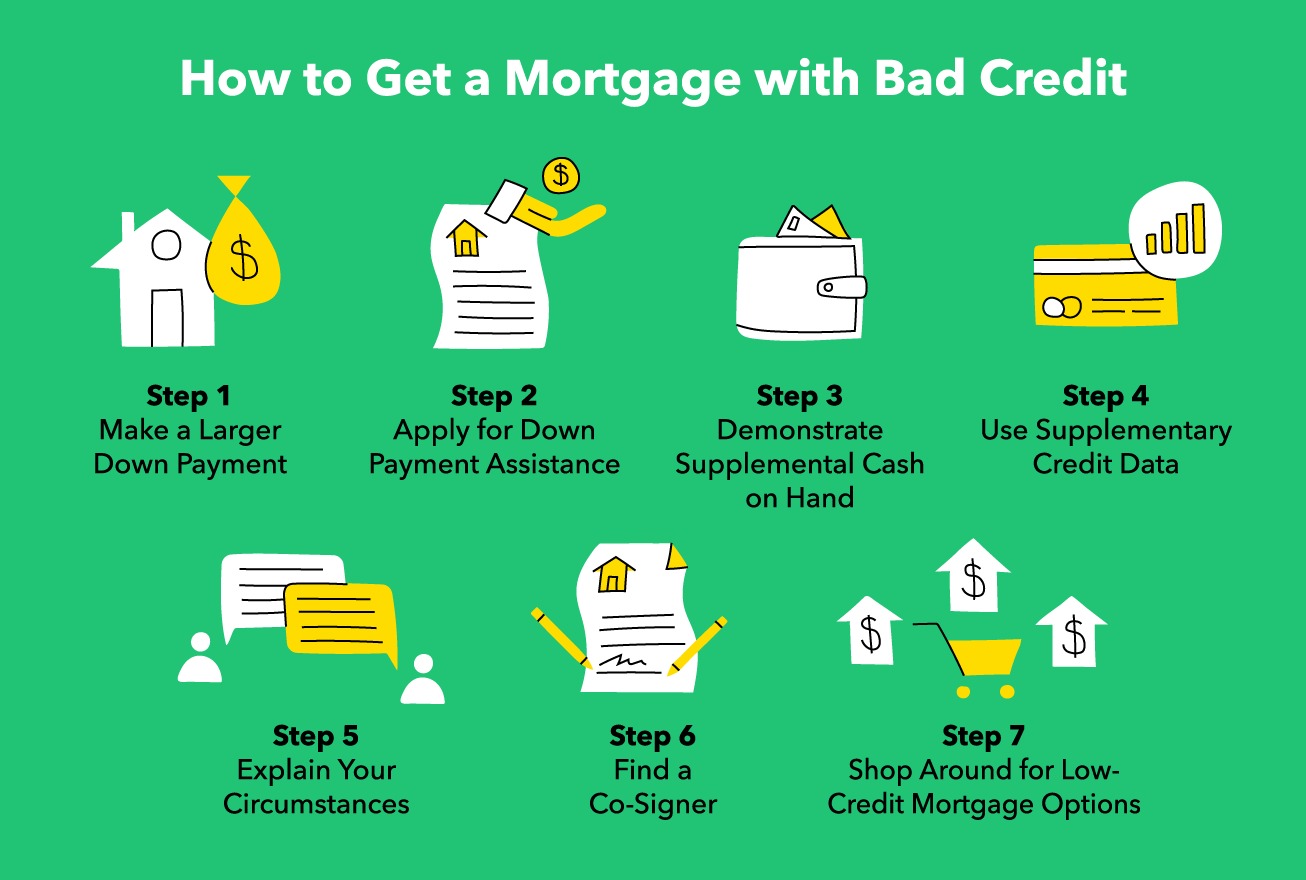

Shorting mortgage-backed securities requires a careful and strategic approach. Here are the steps involved in executing this strategy:

- Research and Analysis: Before deciding to short mortgage-backed securities, conduct thorough research and analysis of the market. Evaluate economic indicators, housing market trends, and any factors that may impact the value of these securities. This will help you form a well-informed opinion on the potential decline in their value.

- Select a Broker: Choose a reputable broker who facilitates short selling transactions. Ensure that the broker has experience and expertise in dealing with mortgage-backed securities. Additionally, familiarize yourself with the specific requirements and procedures of the broker regarding shorting securities.

- Borrow the Securities: Once you have selected a broker, contact them to inquire about borrowing the mortgage-backed securities you want to short. The broker will facilitate the borrowing process and provide the necessary documentation and agreements. You will typically need to put up collateral to secure the borrowed securities.

- Sell the Securities: Once you have borrowed the mortgage-backed securities, you can sell them in the open market. This involves placing a sell order through your broker. The proceeds from the sale will be held as collateral until you close your short position.

- Monitor the Market: Keep a close eye on the market conditions and factors that may impact the value of the mortgage-backed securities you have shorted. Stay updated on economic news, interest rate changes, and any updates in the housing market. This will help you gauge the ideal time to close your short position.

- Buy Back and Close Position: When you believe that the value of the mortgage-backed securities has declined, it’s time to buy them back and close your short position. Place a buy order with your broker to repurchase the securities. Ideally, the purchase price should be lower than the price at which you initially sold them, allowing you to profit from the price difference.

- Return the Borrowed Securities: After buying back the mortgage-backed securities, return them to the lender or broker as per the terms of your borrowing agreement. Once the securities are returned, your short position is closed.

It’s important to note that the timing of executing these steps is crucial. Shorting mortgage-backed securities requires careful monitoring and swift decision-making to take advantage of market movements. It is highly recommended to consult with a financial advisor or experienced professional to ensure you have a comprehensive understanding of the process.

Risks and Considerations

Shorting mortgage-backed securities involves significant risks and considerations that investors should be aware of before engaging in this strategy. Here are some important factors to consider:

- Market Volatility: The market for mortgage-backed securities can be highly volatile, with prices influenced by various economic and housing market factors. Rapid changes in interest rates, shifts in government policies, or unexpected economic events can have a substantial impact on the value of these securities. As a result, investors should be prepared for potential fluctuations and be able to react quickly to market movements.

- Losses and Unlimited Liability: Unlike traditional investing where the maximum loss is limited to the amount invested, short selling can result in unlimited losses. If the price of the mortgage-backed securities increases instead of declining as expected, investors must repurchase the securities at a higher price, leading to potential losses. It is essential to establish risk management strategies and set stop-loss orders to mitigate potential losses.

- Borrowing Costs: Shorting mortgage-backed securities involves borrowing the securities and paying borrowing costs in the form of interest to the lender. These costs can erode potential profits, especially if the short position is held for an extended period. It is crucial to carefully analyze and consider the borrowing costs to determine if the potential returns outweigh the expenses.

- Timing and Liquidity: Shorting mortgage-backed securities requires precise timing. Predicting the timing of market downturns can be challenging and risky. Moreover, the liquidity of the market for these securities can vary, which may impact the ease of executing short selling transactions. Investors should consider the availability of shares to borrow and the potential impact on transaction costs.

- Regulatory and Legal Considerations: Short selling is subject to regulatory and legal restrictions that may vary by jurisdiction. It is important for investors to familiarize themselves with the applicable regulations and ensure compliance. Violating regulations can lead to legal consequences and reputational damage.

It is crucial for investors to thoroughly assess their risk tolerance, conduct in-depth analysis, and seek advice from qualified professionals before deciding to short mortgage-backed securities. Shorting requires a sophisticated understanding of the market and a disciplined approach to managing risks. It is not suitable for inexperienced investors or those who are not willing to accept the potential losses involved.

Conclusion

Shorting mortgage-backed securities can be a complex and high-risk strategy, but it can also provide opportunities for experienced investors to profit from potential declines in the value of these securities. Before engaging in short selling, it is crucial to thoroughly research and analyze the market, understand the intricacies of mortgage-backed securities, and consider the associated risks.

While shorting mortgage-backed securities can lead to potential profits, it is important to remember that it also involves significant risks. Market volatility, unlimited liability, borrowing costs, and timing challenges are all factors that investors must carefully evaluate and manage.

Moreover, shorting mortgage-backed securities requires a deep understanding of the mortgage market and the various factors that can impact the value of these securities. Economic conditions, interest rate fluctuations, and government policies can all influence the performance of mortgage-backed securities. It is critical to stay informed and monitor these variables closely to make informed decisions.

Shorting mortgage-backed securities should be approached with caution and preferably with the guidance of a financial advisor or experienced professional. They can help assess market conditions, develop risk management strategies, and guide investors through the complexities of executing short selling transactions.

In conclusion, shorting mortgage-backed securities is a sophisticated investment strategy that should only be pursued by investors with a deep knowledge of the mortgage market and a high-risk tolerance. Thorough research, careful analysis, and discipline are paramount to success in short selling mortgage-backed securities. As with any investment, it is crucial to weigh the potential rewards against the inherent risks and make informed decisions based on individual financial goals and risk appetite.