Finance

How To Make Money With Good Credit

Published: January 12, 2024

Learn how to leverage your good credit to make money in the finance industry. Discover proven strategies and opportunities to maximize your financial potential.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Importance of Good Credit

- Building and Maintaining a Strong Credit Score

- Exploring Different Ways to Make Money with Good Credit

- Leveraging Credit for Investments and Financial Opportunities

- Maximizing Rewards and Benefits from Credit Cards

- Utilizing Credit to Start or Grow a Business

- Using Good Credit to Secure Loans and Lower Interest Rates

- Renting Properties and Real Estate Investing with Good Credit

- Conclusion

Introduction

Having good credit is not only beneficial for your financial health, but it can also open up a world of opportunities to make money. Your credit score is a crucial factor that lenders, landlords, and even potential business partners consider. It reflects your ability to manage and repay debts responsibly, and it can determine the interest rates you qualify for, the rental options available to you, and the overall financial opportunities that come your way.

In this article, we will delve into the various ways in which you can leverage your good credit score to make money. Whether you’re looking to invest, start a business, or simply enhance your financial well-being, having good credit can give you a significant advantage.

We will explore the importance of good credit, how to build and maintain a strong credit score, and the different avenues you can pursue to maximize the financial benefits associated with good credit. From utilizing credit for investments to taking advantage of credit card rewards and benefits, there’s a wide range of strategies you can employ to turn your good credit into a lucrative asset.

So, if you’re ready to unlock the potential of your good credit and start making money, let’s dive in and discover the opportunities that await!

Understanding the Importance of Good Credit

When it comes to personal finance, good credit is like a golden ticket. It opens doors, provides access to favorable loan terms and interest rates, and enhances your overall financial standing. But what exactly does it mean to have good credit?

Good credit refers to a high credit score, usually ranging from 670 to 850, as determined by the major credit reporting agencies. This score reflects your creditworthiness and the likelihood of you repaying debts on time. Lenders, landlords, and even employers often rely on this score to evaluate your financial responsibility and trustworthiness.

Having good credit is important for several reasons. Firstly, it can help you secure loans and credit cards at more favorable interest rates. With a good credit score, lenders are more willing to offer you lower interest rates, saving you money on interest payments over the life of the loan. This can make a big difference when it comes to major purchases, such as a home or a car.

Secondly, good credit can increase your chances of being approved for rental properties. Many landlords conduct credit checks to assess the reliability of potential tenants. If you have good credit, you’ll have an edge over other applicants, allowing you to choose from a wider range of rental options.

Moreover, good credit can also improve your insurance rates. Insurance companies often use credit scores as a factor to determine premiums. A higher credit score typically indicates a lower risk profile, resulting in better insurance rates.

Besides the financial advantages, having good credit can also provide peace of mind and financial security. It allows you to navigate unexpected expenses or emergencies more easily by accessing credit quickly and at more favorable terms. It also builds a solid foundation for future financial endeavors, such as starting a business or making investments.

Understanding the importance of good credit is the first step in leveraging its potential to make money. By recognizing how good credit can impact your financial life, you can begin to take proactive steps to build and maintain a strong credit score, paving the way for a brighter financial future.

Building and Maintaining a Strong Credit Score

Now that you understand the significance of good credit, let’s dive into the process of building and maintaining a strong credit score. Building credit from scratch or repairing a damaged credit history may take time and effort, but the rewards are well worth it.

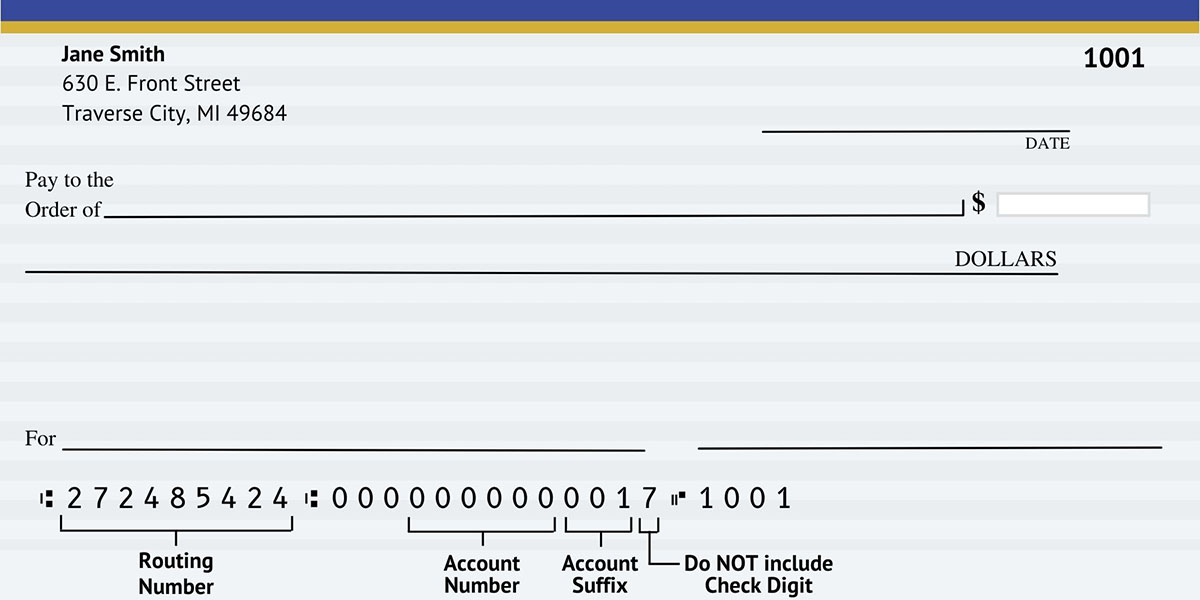

The first step in building credit is to establish a credit history. This can be done by opening a credit card or taking out a small loan. It’s essential to use credit responsibly by making timely payments and keeping your credit utilization low. Payment history and credit utilization ratio play significant roles in determining your credit score.

Another strategy to build and maintain a strong credit score is to diversify your credit. Having a mix of different types of credit, such as credit cards, loans, and mortgages, can demonstrate your ability to handle a variety of credit obligations. However, it’s important to manage these accounts responsibly and avoid taking on more credit than you can handle.

Consistency is key when it comes to maintaining a strong credit score. Paying bills on time, keeping credit card balances low, and avoiding excessive credit inquiries can all contribute to a positive credit profile. Monitoring your credit report regularly and addressing any errors or inaccuracies promptly is also crucial.

Additionally, it’s essential to be patient and avoid quick-fix solutions that promise to repair or boost your credit overnight. Building good credit is a long-term process that requires responsible financial habits and a commitment to financial stability.

By building and maintaining a strong credit score, you not only improve your chances of qualifying for better loan terms and interest rates but also increase your financial flexibility and options. It lays the foundation for the various ways you can make money with good credit, such as leveraging credit for investments or securing loans to start a business.

Remember, a strong credit score is a valuable asset that can open doors to financial opportunities. So, take the necessary steps to build and maintain good credit, and you’ll be well on your way to reaping the benefits.

Exploring Different Ways to Make Money with Good Credit

Having good credit not only provides financial stability but also presents various opportunities to make money. Let’s explore some of the different ways you can leverage your good credit to enhance your income:

1. Investing: With good credit, you can access favorable loan terms and lower interest rates, making it easier to finance investments. Whether it’s investing in stocks, real estate, or even starting a small business, good credit enables you to access capital and maximize your potential returns.

2. Credit Card Rewards & Benefits: Many credit cards offer cashback rewards, travel miles, or other perks for using them responsibly. By leveraging your good credit to qualify for premium reward credit cards, you can earn money or enjoy benefits on your everyday spending.

3. Starting a Business: Good credit makes it easier to secure business loans or lines of credit to start or expand your own venture. With a solid credit score, you are more likely to qualify for favorable terms and lower interest rates, giving your business a better chance of success.

4. Lower Interest Rates: When you have good credit, lenders are more willing to offer lower interest rates on loans or credit cards. This can save you a significant amount of money in interest payments, allowing you to allocate those funds towards other investments or savings.

5. Real Estate Investing: Good credit opens up opportunities for real estate investments. From purchasing rental properties to participating in real estate crowdfunding platforms, having good credit can make it easier to secure financing and capitalize on the income-generating potential of real estate.

6. Peer-to-Peer Lending: Peer-to-peer lending platforms allow individuals to lend money directly to borrowers, bypassing traditional financial institutions. With good credit, you can participate as a lender and earn interest income by investing in loans that align with your risk appetite.

7. Negotiating Better Terms: When negotiating contracts, such as rental agreements or car purchases, good credit can give you leverage to secure more favorable terms or discounts. Landlords and sellers may be more willing to negotiate when they see a strong credit history.

These are just a few examples of how you can make money with good credit. The key is to leverage your creditworthiness to access opportunities and financial resources that can generate additional income streams. Remember, good credit is a valuable asset that can provide a solid foundation for your financial success.

Leveraging Credit for Investments and Financial Opportunities

One of the significant advantages of having good credit is the ability to leverage credit for investments and financial opportunities. Whether you’re looking to grow your wealth or diversify your portfolio, your good credit can serve as a powerful tool in achieving your investment goals.

Here are some ways you can leverage your good credit to tap into investment and financial opportunities:

1. Real Estate Investing: Real estate can be a lucrative investment, but it often requires substantial upfront capital. With good credit, you can secure mortgages or loans with favorable terms, allowing you to invest in rental properties or participate in real estate development projects. By leveraging your credit to fund real estate investments, you can generate rental income or benefit from property appreciation.

2. Stock Market Investments: Good credit can also help you access capital for stock market investments. Whether through margin accounts or personal loans, having a strong credit score can provide you with the buying power to invest in stocks or exchange-traded funds (ETFs). Remember to conduct thorough research and seek professional advice before venturing into the stock market.

3. Business Expansion: If you already own a business, good credit can enable you to expand operations or launch new product lines. By securing business loans or lines of credit, you can access the necessary funds to invest in marketing, inventory, or equipment. This can help your business grow and increase its profitability.

4. Peer-to-Peer Lending: Peer-to-peer lending platforms allow individuals to lend money to others, bypassing traditional financial institutions. With good credit, you can participate as a lender and earn interest income by investing in loans. This can diversify your investment portfolio and potentially generate higher returns compared to traditional savings accounts.

5. Angel Investing or Venture Capital: Good credit can make it easier to qualify for angel investing or venture capital opportunities. These investments involve funding startups or small businesses in exchange for equity or other stakes in the company. By leveraging your creditworthiness, you can position yourself as a potential investor and participate in the exciting world of entrepreneurship.

Remember, while leveraging credit for investments and financial opportunities can be rewarding, it’s crucial to approach these endeavors with careful consideration and a solid understanding of the associated risks. Always conduct thorough research, seek expert advice, and diversify your investments to mitigate potential downsides.

With good credit, you have the financial leverage to pursue these investment avenues. By utilizing credit responsibly and strategically, you can unlock a world of opportunities and potentially reap significant financial rewards.

Maximizing Rewards and Benefits from Credit Cards

One of the perks of having good credit is the ability to maximize rewards and benefits from credit cards. Credit card companies offer various incentives to attract and retain customers, and with good credit, you can qualify for premium cards that offer lucrative rewards and exclusive benefits.

Here are some strategies to help you make the most out of credit card rewards and benefits:

1. Cashback Rewards: Many credit cards offer cashback rewards on eligible purchases. By using your credit card for everyday expenses such as groceries, gas, and dining out, you can earn a percentage of your spending back in the form of cash rewards. Look for credit cards that offer higher cashback rates in categories relevant to your spending habits.

2. Travel Rewards and Airline Miles: If you enjoy traveling, consider using a travel rewards credit card. These cards typically earn points or miles for every dollar spent, which can later be redeemed for flights, hotel stays, and other travel-related expenses. Look for cards that offer sign-up bonuses or partner with your preferred airline or hotel chain.

3. Points-Based Rewards: Some credit cards offer points that can be redeemed for a variety of rewards, including merchandise, gift cards, or experiences. By using your credit card strategically and accumulating points, you can enjoy free or discounted items or unique experiences.

4. Exclusive Benefits and Perks: Premium credit cards often come with exclusive benefits and perks, such as airport lounge access, concierge services, and travel insurance. Take advantage of these extra features to enhance your travel experiences or enjoy additional protection for your purchases.

5. Introductory Offers: Credit card companies frequently provide introductory offers, such as 0% APR for balance transfers or purchases for a certain period. If you have good credit, you may qualify for these offers, allowing you to save on interest charges or consolidate high-interest debts.

To maximize credit card rewards and benefits, it’s important to use your cards responsibly. Pay your bills on time and in full to avoid interest charges, late fees, and negative impacts on your credit score. Monitor your credit card statements regularly to catch any unauthorized charges or errors.

Additionally, consider combining different credit cards to optimize rewards in different spending categories. For example, you may use one card for groceries with a high cashback rate, another for travel expenses with generous miles rewards, and a third for everyday purchases with great points-based rewards.

Remember, credit card rewards and benefits should enhance your financial situation, not tempt you to overspend. Use them wisely, and they can be a valuable tool to save money, earn rewards, and enhance your overall financial well-being.

Utilizing Credit to Start or Grow a Business

For aspiring entrepreneurs or existing business owners, good credit can be a powerful asset in utilizing credit to start or grow a business. Whether you’re launching a startup or looking to expand your operations, having access to capital can make a significant difference in your business’s success.

Here are some ways you can utilize credit to start or grow a business:

1. Business Loans: Good credit makes it easier to qualify for business loans from banks, credit unions, or online lenders. These loans can provide the necessary funds to kickstart your business, purchase equipment, cover operating expenses, or invest in marketing and advertising.

2. Lines of Credit: A business line of credit is a flexible financing option that allows you to access capital when needed. With good credit, you may qualify for higher credit limits and lower interest rates, giving you the financial flexibility to manage cash flow, handle unexpected expenses, or seize growth opportunities.

3. Business Credit Cards: Business credit cards are specifically designed to meet the needs of business owners. They offer benefits such as higher credit limits, rewards programs, and expense management tools. By using a business credit card, you can separate personal and business expenses, build credit for your business, and potentially earn rewards on your business-related purchases.

4. Vendor and Supplier Credit: Building strong relationships with vendors and suppliers can lead to favorable credit terms. This means you can negotiate longer payment terms or even secure credit from suppliers, allowing you more time to generate revenue before paying for goods and services.

5. Equipment Financing: If your business requires specialized equipment or machinery, you can leverage your good credit to obtain equipment financing. This type of loan allows you to purchase or lease necessary equipment with structured repayment terms that align with your cash flow.

When utilizing credit to start or grow a business, it’s important to have a solid business plan, financial projections, and a clear strategy for repayment. Demonstrating a strong credit history and responsible financial management can enhance your chances of successfully obtaining credit and using it effectively for business purposes.

While credit can provide the capital necessary for business growth, it’s equally important to manage business finances wisely. Implement sound financial management practices, track your business’s cash flow, and use credit as a strategic tool to fuel growth and profitability.

Remember, leveraging credit to start or grow a business is a significant undertaking, and it requires careful planning, research, and execution. With good credit, you can access the funding you need and position your business for success.

Using Good Credit to Secure Loans and Lower Interest Rates

One of the most tangible benefits of having good credit is the ability to secure loans and enjoy lower interest rates. Whether you’re looking to borrow for major purchases or consolidate existing debts, your good credit can serve as a powerful tool in saving money and achieving your financial goals.

Here’s how you can use your good credit to secure loans and lower interest rates:

1. Personal Loans: Personal loans are versatile and can be used for various purposes, such as home improvements, debt consolidation, or unexpected expenses. With good credit, lenders are more likely to approve your loan application and offer more favorable interest rates, saving you money over the loan term.

2. Mortgage Loans: When it comes to purchasing a home, having good credit is essential. Lenders consider your creditworthiness when determining loan eligibility and interest rates. With a strong credit history, you can qualify for lower mortgage rates, resulting in significant savings over the life of your mortgage.

3. Auto Loans: Buying a car can be a significant financial commitment. Good credit can help you secure an auto loan with lower interest rates, reducing the overall cost of your vehicle. This means lower monthly payments and potentially paying off your loan faster.

4. Debt Consolidation: If you have multiple high-interest debts, such as credit card balances or personal loans, consolidating them into a single loan with a lower interest rate can save you money and simplify your debt management. Good credit makes it easier to qualify for a consolidation loan with more favorable terms.

5. Student Loans: Student loans are often a part of financing higher education. With good credit, you can qualify for student loans with lower interest rates, reducing the financial burden of student loan repayments after graduation.

By leveraging your good credit, you demonstrate to lenders that you are responsible and reliable in managing your debts. This increases your credibility and enhances your chances of securing loans at competitive interest rates.

In addition to securing loans at lower interest rates, good credit can also offer advantages like higher credit limits and better repayment terms. This provides you with greater financial flexibility and the opportunity to achieve your goals more efficiently.

Remember, maintaining good credit requires responsible financial habits. Pay your bills on time, keep your credit card balances low, and regularly monitor your credit report for any errors. By doing so, you’ll continue to enjoy the benefits of good credit, secure loans at lower interest rates, and keep your financial journey on a positive trajectory.

Renting Properties and Real Estate Investing with Good Credit

Having good credit opens up numerous opportunities in the realm of real estate, both as a renter and an investor. Your creditworthiness plays a crucial role when it comes to renting properties or delving into real estate investment ventures.

Here’s how you can leverage your good credit in renting properties and real estate investing:

1. Renting Properties: Landlords often conduct thorough credit checks to ensure that potential tenants have a history of responsible financial behavior. With good credit, you stand out as a trustworthy applicant, increasing your chances of being approved for desirable rental properties. You’re also more likely to negotiate favorable lease terms and rental rates.

2. Real Estate Investing: Good credit can be a valuable asset for real estate investors. It provides access to favorable loan terms, making it easier to secure financing for investment properties. With lower interest rates and better loan terms, your overall investment costs decrease, increasing your potential return on investment. Good credit can also help you qualify for investment property loans or participate in real estate crowdfunding platforms.

3. Building a Real Estate Portfolio: As a real estate investor, good credit allows you to expand your property portfolio more easily. With a strong credit history, lenders view you as a reliable borrower, giving you access to larger loan amounts and better financing options. This, in turn, enables you to acquire more properties and potentially increase your passive rental income.

4. Refinancing or Equity Extraction: If you already own investment properties, good credit can facilitate refinancing to lower interest rates or extract equity. By refinancing at a lower rate, you reduce monthly mortgage payments, increasing your cash flow. Extracting equity can provide additional funds for future real estate investments or property improvements.

5. Partnerships and Joint Ventures: Good credit enhances your credibility in real estate partnerships and joint venture opportunities. Potential partners are more likely to trust and collaborate with someone who has a proven track record of responsible credit management. This can open doors to mutually beneficial partnerships, allowing you to leverage each other’s resources and expertise.

Having good credit is crucial in the real estate landscape. It not only improves your chances of securing rental properties but also grants you access to more favorable financing options for real estate investments. By responsibly managing your credit, you set yourself up for success in the renting and investing realms, facilitating growth and wealth-building in the real estate market.

Conclusion

In conclusion, having good credit is not just about financial stability, but it also opens up a wide range of opportunities to make money and improve your overall financial well-being. Your good credit score serves as a valuable asset that can be leveraged in various ways.

By understanding the importance of good credit and taking steps to build and maintain a strong credit score, you position yourself for financial success. Good credit allows you to secure loans at lower interest rates, providing access to capital for personal and business endeavors. It also expands your options when it comes to renting properties, as landlords see you as a trustworthy tenant.

Furthermore, good credit can be a gateway to diverse investment opportunities. Whether you’re interested in stocks, real estate, or entrepreneurship, your creditworthiness can help you secure financing, negotiate better terms, and maximize the potential returns on your investments.

Additionally, good credit allows you to make the most out of credit card rewards and benefits, earning cashback, travel miles, or points for your everyday expenses. This gives you the opportunity to save money or enjoy perks on your purchases.

It’s important to remember that maintaining good credit requires discipline and responsible financial management. Pay your bills on time, keep your credit utilization low, and regularly monitor your credit report for any discrepancies. This diligence will help you sustain your good credit and continue to enjoy the benefits it brings.

In conclusion, good credit is an invaluable asset that can enrich your financial life. By utilizing credit wisely, you can open doors to financial opportunities, make sound investments, and achieve your goals. So, continue to cultivate and leverage your good credit to unlock the full potential of your financial future.