Finance

How To Open A Credit Union Account

Published: January 12, 2024

Learn how to open a credit union account and manage your finances effectively. Explore our step-by-step guide and start your financial journey today.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Research Different Credit Unions

- Step 2: Gather Required Documents

- Step 3: Choose an Account Type

- Step 4: Visit the Credit Union

- Step 5: Fill Out the Application

- Step 6: Deposit Money Into Your Account

- Step 7: Set Up Additional Services

- Step 8: Understand Fees and Policies

- Step 9: Start Using Your Credit Union Account

- Conclusion

Introduction

Are you tired of dealing with traditional banks and their high fees? Do you want to be part of a financial institution that prioritizes its members’ needs and offers personalized service? Opening a credit union account might be the ideal solution for you.

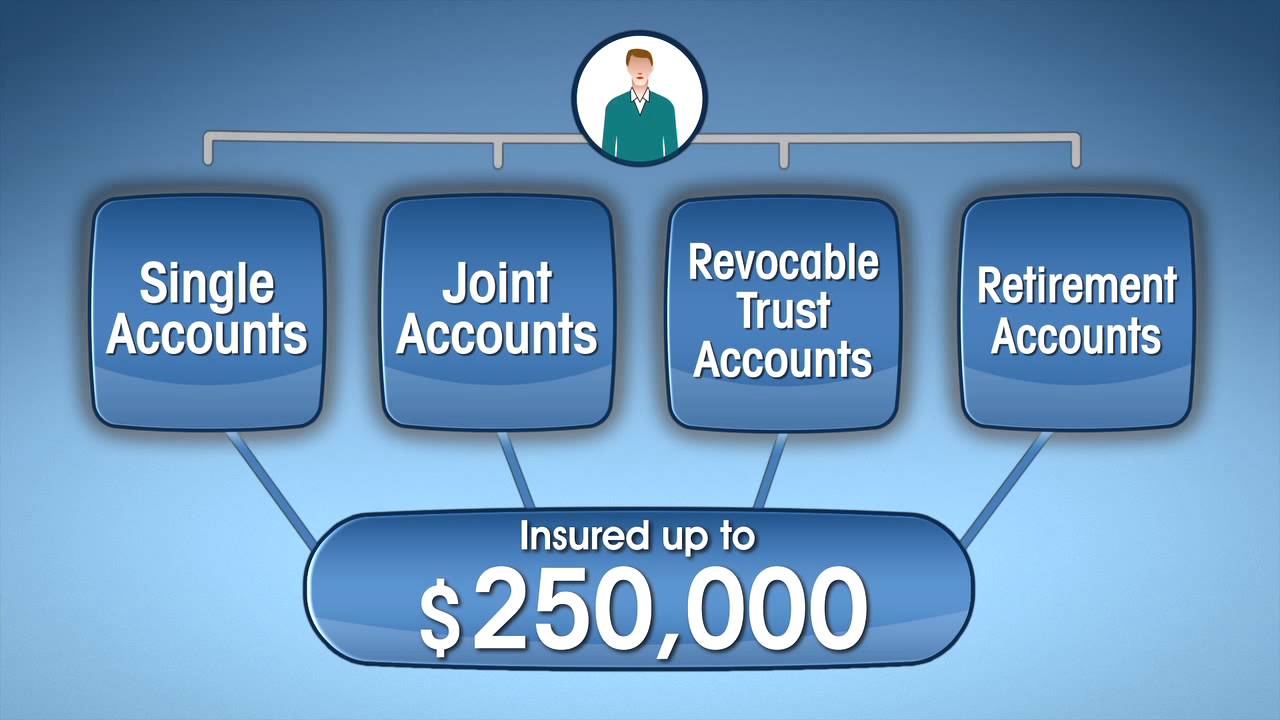

Credit unions are member-owned financial cooperatives that provide a wide range of services, including savings accounts, checking accounts, loans, and more. Unlike traditional banks, credit unions are not-for-profit institutions, meaning they exist solely to serve their members’ financial needs and goals.

Aside from being a member-owner, joining a credit union offers numerous advantages. You can enjoy lower fees, higher interest rates on savings, competitive loan rates, and a personalized approach to your financial journey. Credit unions also tend to have a strong community focus, providing support and resources to their members.

If you’re interested in opening a credit union account, this comprehensive guide will walk you through the steps involved. From researching different credit unions to understanding fees and policies, by the end of this article, you’ll be well-equipped to start your journey with a credit union.

Step 1: Research Different Credit Unions

When opening a credit union account, it’s essential to research different credit unions in your area or those that are available for membership. Start by considering factors such as the credit union’s reputation, membership eligibility, branch locations, and the services they offer. Here are a few key steps to follow:

- Identify potential credit unions: Use online resources, such as the National Credit Union Administration’s Credit Union Locator or websites like MyCreditUnion.gov, to find credit unions that are accessible to you.

- Check membership eligibility: Each credit union has specific criteria for membership, such as being associated with a particular employer or living in a specific geographic area. Make sure you qualify for membership before proceeding.

- Review their services: Take the time to explore the services offered by different credit unions. Look for features that align with your financial needs, such as high-interest savings accounts, low- or no-fee checking accounts, convenient online banking, or competitive loan rates.

- Read reviews and testimonials: Check online reviews, ratings, and testimonials from current or previous members. This can give you insights into the credit union’s reputation, customer service quality, and overall member satisfaction.

- Compare fees and account requirements: Consider the fees associated with the credit union’s accounts, such as monthly maintenance fees or ATM withdrawal charges. Additionally, take note of any minimum balance requirements or other conditions that might affect your account.

- Consider the branch network: If branch access is important to you, check the number and location of branches. Ensure that there are convenient branch locations near you or accessible ATMs for easy account access.

By performing thorough research, you can narrow down your options and find a credit union that perfectly suits your needs and preferences. Take the time to evaluate each credit union and make a shortlist of potential institutions before moving on to the next steps.

Step 2: Gather Required Documents

Before opening a credit union account, it’s important to gather the necessary documents to complete the application process smoothly. Each credit union may have slightly different requirements, but here are the common documents you will typically need:

- Identification documents: You will typically need to provide a valid government-issued photo ID, such as a driver’s license, passport, or state ID card. Make sure your identification document is current and not expired.

- Proof of address: Credit unions may require proof of your residential address. You can provide a utility bill, bank statement, or any official mail that displays your name and current address.

- Social Security number or Taxpayer Identification Number (TIN): In order to comply with federal regulations, credit unions need to verify your Social Security number (SSN) or Taxpayer Identification Number (TIN).

- Employment or income information: Some credit unions may require proof of your employment or income. This can be in the form of recent pay stubs, tax returns, or employment verification letters.

- Membership eligibility documents: If the credit union has specific membership eligibility requirements, such as being affiliated with a particular organization, you may need to provide supporting documents to prove your eligibility.

It’s important to contact the credit union directly or check their website to confirm the specific documents they require. Gathering these documents beforehand will save you time and ensure a smooth application process.

Once you have all the necessary documents, make copies or scan them to keep a digital copy for your records. This will help expedite the account opening process and provide a reference in case any documentation is missing or needs clarification.

Step 3: Choose an Account Type

Once you have completed the research and gathered the required documents, it’s time to choose the right account type that suits your financial needs and goals. Credit unions offer a variety of account options, so take the following factors into consideration when making your decision:

- Savings Accounts: Most credit unions offer basic savings accounts as a starting point. These accounts are designed to help you save money and earn interest on your deposits. Look for features like competitive interest rates, low or no minimum balance requirements, and easy access to your funds.

- Checking Accounts: Checking accounts are essential for day-to-day financial transactions. Look for features such as low fees, free check writing, access to ATMs, online banking, and mobile banking convenience.

- Certificate of Deposit (CD) or Time Deposit: If you have funds you can set aside for a specific period, consider a CD or Time Deposit account. These accounts typically offer higher interest rates in exchange for leaving your money untouched for a fixed term.

- Individual Retirement Account (IRA): Credit unions may offer IRA accounts to help you save for retirement. Explore the different IRA options, such as Traditional IRA or Roth IRA, and consider factors like tax advantages, contribution limits, and withdrawal rules.

- Specialty Accounts: Some credit unions offer specialty accounts for specific purposes, such as college savings accounts or health savings accounts (HSAs). If you have unique financial goals, these specialized accounts might be worth considering.

Consider your financial goals, lifestyle, and banking preferences when choosing an account type. It’s also a good idea to speak with a representative from the credit union to discuss your options and get tailored advice based on your individual circumstances.

Remember, you can always open multiple accounts at the same credit union if you have different financial needs. Be sure to review the account features, fees, and benefits before finalizing your decision.

Step 4: Visit the Credit Union

After narrowing down your options and choosing the account type that best suits your needs, it’s time to visit the credit union in person. Visiting the credit union allows you to get a feel for the institution, speak with staff members, and gather additional information before opening an account. Here are some key steps to follow during your visit:

- Schedule an appointment: Depending on the credit union’s policies, you may need to schedule an appointment in advance. This ensures that a representative will be available to assist you and answer any questions you may have.

- Bring your required documents: Remember to bring your identification documents and any other paperwork that the credit union has specified as part of the account opening process. This will help ensure a smooth and efficient visit.

- Speak with a representative: When you arrive at the credit union, ask to speak with a representative who can guide you through the account opening process. They can provide you with more detailed information about the account, explain any additional requirements, and address any concerns or questions you may have.

- Tour the facility: Take the opportunity to tour the credit union’s physical location if possible. Familiarize yourself with the branch layout, ATMs, teller windows, and other facilities. This will help you feel more comfortable and confident in using the credit union’s services.

- Ask about member benefits: Inquire about any special member benefits or promotions that the credit union offers. This could include discounted rates on loans, free financial education resources, or access to exclusive events or services.

- Discuss account features and services: Take the time to discuss the specific account features and services that are available. Ensure that you have a clear understanding of the account’s terms, fees, and any potential limitations.

Visiting the credit union gives you an opportunity to assess the customer service provided, the atmosphere, and the overall impression of the institution. It can also help you determine if the credit union aligns with your values and priorities, making you feel confident and comfortable in your decision to open an account.

Remember to take notes during your visit and gather any additional information or materials that the credit union provides. This will help you make an informed decision and have all the necessary details at hand when you’re ready to proceed with opening the account.

Step 5: Fill Out the Application

Once you’ve visited the credit union and gathered all the necessary information, it’s time to fill out the application to open your account. The application process may vary slightly between credit unions, but here are the general steps to follow:

- Obtain the application form: The credit union should provide you with an application form either in paper or electronic format. If you’re filling out a physical form, make sure to have a pen or pencil available.

- Provide personal information: Start by filling in your personal details, including your full name, date of birth, home address, phone number, and email address. Ensure accuracy and double-check the information before moving on.

- Enter identification details: Provide the necessary details from your identification document, such as your driver’s license number, passport information, or Social Security number (SSN).

- Select the account type: Indicate the specific account type you’ve chosen, whether it’s a savings account, checking account, CD, or any other option.

- Agree to terms and conditions: Read through the terms and conditions of the credit union and the specific account you’re opening. You may be required to acknowledge and agree to these terms by signing or checking a box.

- Review and submit the application: Take a moment to review all the information you’ve provided on the application form. Ensure its accuracy and completeness. Once you’re satisfied, submit the application to the credit union.

Be sure to ask the credit union representative if there are any additional documents or forms that need to be included with the application. For example, you may need to attach a copy of your identification document, proof of address, or other supporting materials.

During this step, it’s important to be accurate and honest in providing the required information. Any discrepancies or false information may delay the application process or result in the rejection of your application.

Once you’ve submitted the application, the credit union will review it and verify the information provided. They may contact you if further clarification or documentation is required. After the application has been processed and approved, you’ll be notified, and you can move on to the next steps to finalize the account opening process.

Step 6: Deposit Money Into Your Account

After your application has been approved, it’s time to make the initial deposit into your credit union account. This deposit is typically required to activate your account and start using its features and services. Here’s how to complete this step:

- Determine the required minimum deposit: The credit union may have a minimum deposit requirement for opening the account. This minimum deposit amount can vary depending on the type of account you’ve chosen. Make sure you have the necessary funds available.

- Choose your deposit method: Credit unions offer a variety of options for making your initial deposit. You can choose to deposit cash, write a check, transfer funds from another account, or make an electronic bank transfer. Select the method that is most convenient for you.

- Visit the credit union: If your initial deposit requires a physical presence, visit the credit union’s branch with the money you intend to deposit. Bring any necessary identification documents and inform the teller or representative that you’d like to make an initial deposit into your new account.

- Follow the deposit process: The credit union staff will guide you through the deposit process. They may provide you with a deposit slip to fill out or assist you in making an electronic transfer. If depositing cash, the teller will count the money and provide you with a receipt.

- Confirm the deposit: After completing the deposit, make sure to confirm that the funds have been successfully credited to your account. You can do this by checking your account balance online, receiving a receipt, or contacting the credit union’s customer service.

It’s important to note that some credit unions may require a higher initial deposit for certain accounts or may have additional restrictions or requirements. Ensure that you are aware of any specific terms related to your initial deposit.

Remember that the initial deposit is just the beginning. You can continue to add funds to your account regularly to help you achieve savings goals, make transactions, and take advantage of the credit union’s services.

If you prefer to make a deposit electronically or transfer funds from another account, follow the credit union’s instructions for establishing online banking or initiating the transfer. This will allow you to conveniently manage your account and make future deposits without visiting the branch.

Step 7: Set Up Additional Services

Once you’ve deposited money into your credit union account, you may want to explore and set up additional services to enhance your banking experience. Credit unions offer various features and services that can help you manage your finances more efficiently. Here are some common services to consider:

- Online Banking: Set up online banking to access your account information, view transaction history, transfer funds, and pay bills conveniently from your computer or mobile device. Most credit unions offer robust online banking platforms with user-friendly interfaces.

- Mobile Banking: Download the credit union’s mobile banking app to have even more flexibility in managing your account while on the go. You can check balances, deposit checks, and perform transactions from your smartphone or tablet.

- Direct Deposit: Arrange for direct deposit with your employer to have your paycheck automatically deposited into your credit union account. This eliminates the need for in-person check deposits and ensures quick and secure access to your funds.

- Debit or ATM Card: Request a debit or ATM card linked to your credit union account. This will allow you to make purchases at merchants or withdraw cash from ATMs conveniently. Familiarize yourself with any associated fees or limits.

- Bill Pay: Explore the credit union’s bill pay service, which enables you to schedule and pay your bills online through your account. This saves time and eliminates the need for writing checks or buying stamps.

- Electronic Statements: Opt for electronic statements instead of receiving paper statements in the mail. Not only is this environmentally friendly, but it also provides convenient access to your account statements online while reducing clutter.

- Overdraft Protection: Inquire about overdraft protection options to avoid potential insufficient funds charges. This service can link your account to another account at the credit union, a line of credit, or a savings account to cover any overdraft transactions.

During the account-opening process or when visiting the credit union, ask the representative about these services and any other additional features they offer. They can provide detailed information, explain any associated fees or requirements, and help you set up the services that best fit your needs.

Take advantage of the convenience and security these additional services provide, as they can help simplify your financial management and make banking with the credit union even more beneficial.

Step 8: Understand Fees and Policies

Before fully utilizing your credit union account, it’s crucial to understand the fees and policies associated with it. While credit unions often offer more favorable fee structures compared to traditional banks, it’s still important to be aware of any potential charges and the institution’s policies. Here are the key points to consider:

- Account Maintenance Fees: Check if the credit union charges any monthly or annual fees for maintaining your account. Some credit unions may require a minimum balance to avoid these fees.

- Transaction Fees: Familiarize yourself with any fees associated with specific account transactions, such as paper check withdrawals, wire transfers, or overdrafts.

- ATM Fees: Determine if the credit union has its own ATM network and if there are any surcharges for using ATMs outside of the network. Find out if the credit union refunds any fees incurred when using other banks’ ATMs.

- Overdraft Policies: Understand the credit union’s overdraft policies, including any fees or interest rates charged for overdraft protection or unauthorized overdrafts.

- Statement and Document Delivery: Confirm how the credit union delivers account statements, notices, and other important documents. Determine if there are any associated fees for receiving paper statements or requesting additional copies.

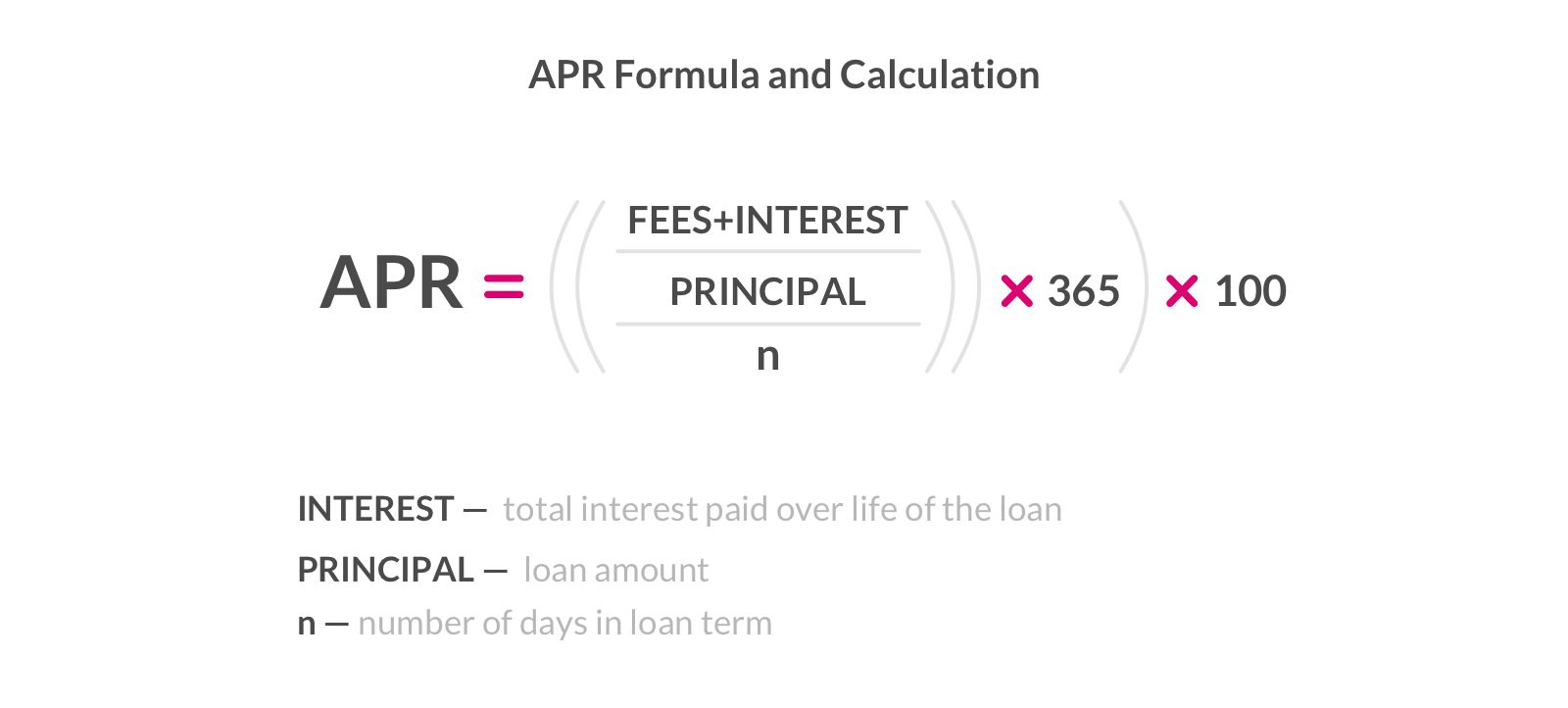

- Interest Rates: If you have a savings account or a certificate of deposit (CD), review the interest rates offered by the credit union. Understand how interest is calculated and when it is credited to your account.

- Account Closure Fee: Check if there is a fee associated with closing your account, particularly if you need to close it within a certain timeframe after opening.

- Privacy and Security Policies: Take the time to review the credit union’s privacy and security policies. Understand how they protect your personal information and what measures are in place to safeguard your account.

It’s recommended to carefully review the credit union’s fee schedule and policies, which are typically available on their website or provided in a printed document. If anything is unclear or requires further explanation, don’t hesitate to reach out to a representative for clarification.

By understanding the fees and policies, you can better manage your account, avoid unexpected charges, and ensure a smooth banking experience with your credit union.

Step 9: Start Using Your Credit Union Account

Once you have completed the necessary steps to open your credit union account, it’s time to start utilizing the various services and features it offers. Here’s a guide on how to get started:

- Access your account: Log in to your online banking portal or mobile banking app using the credentials provided by the credit union. This will allow you to view your account balances, transaction history, and other account details.

- Make deposits: Deposit money into your account through various methods, such as direct deposit, electronic transfers, or in-person deposits at the credit union’s branch or ATM. Set up recurring transfers or deposits to build your savings.

- Make withdrawals: Withdraw cash as needed from ATMs within the credit union’s network or branch locations. Be mindful of any withdrawal limits imposed by the credit union.

- Transfer funds: Use online or mobile banking to transfer funds between your credit union accounts, pay bills, or send money to other individuals or accounts.

- Monitor your account: Regularly review your account activity and statements to ensure accuracy and detect any potential unauthorized transactions. Report any discrepancies or concerns to the credit union immediately.

- Explore additional services: Take advantage of the additional services offered by your credit union, such as bill pay, mobile deposit, budgeting tools, loan applications, and financial education resources.

- Stay informed: Keep up-to-date with any changes to the credit union’s policies, service fees, or account offerings. Read emails, notifications, and announcements from the credit union on new promotions or important updates.

- Engage with the credit union: Attend any events or seminars hosted by the credit union, participate in member surveys or feedback opportunities, and take advantage of any member-exclusive benefits or discounts.

Remember, your credit union account is designed to support your financial goals and needs. Regularly review and reassess your account usage to ensure it aligns with your evolving needs.

If you have any questions, encounter issues, or require assistance with your account, don’t hesitate to reach out to the credit union’s customer service team. They are there to help you navigate your account and address any concerns you may have.

By actively using and managing your credit union account, you can take full advantage of the benefits, services, and personalized approach that credit unions offer.

Conclusion

Congratulations on successfully opening your credit union account! By following the steps outlined in this guide, you have taken a significant step towards accessing personalized financial services, lower fees, and a community-focused banking experience.

Remember, when it comes to credit unions, thorough research is vital. Take the time to explore different credit unions, consider their services, fees, and membership eligibility requirements. Find the one that aligns with your financial goals and values.

Gathering the required documents and filling out the application accurately are important steps in the account-opening process. By providing all the necessary information, you can ensure a smooth and efficient process.

Once your account is open, take advantage of the additional services offered by your credit union, such as online and mobile banking, direct deposit, bill pay, and more. These services can help you manage your finances effectively and conveniently.

Stay informed about the credit union’s policies, fees, and changes that may affect your account. Regularly monitor your account activity, review statements, and keep track of any notifications or updates from the credit union.

Lastly, remember that credit unions are member-focused institutions, aiming to serve the best interests of their members. Engage with the credit union, participate in events, and take advantage of any educational resources or member-exclusive benefits they offer.

By opening a credit union account, you have joined a community of like-minded individuals who prioritize financial well-being and mutual support. Embrace the advantages and personalized service that credit unions provide, and leverage your account to achieve your financial goals.

Enjoy the benefits of your new credit union account and continue to explore the opportunities it offers to enhance your financial journey.