Finance

How To Reduce Student Loan Interest Rate

Published: November 3, 2023

Looking for ways to reduce your student loan interest rate? Explore our expert finance tips to save money and lower your loan costs.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Why Student Loan Interest Rates Matter

- Understanding the Current Interest Rate

- Factors That Influence Student Loan Interest Rates

- Tips for Reducing Student Loan Interest Rates

- Consider Federal Loan Consolidation

- Explore Loan Refinancing Options

- Opt for Automatic Payments

- Make Biweekly Payments

- Pay Extra Whenever Possible

- Take Advantage of Loan Forgiveness Programs

- Seek Professional Help if Needed

- Conclusion

Introduction

Student loans play a vital role in helping individuals pursue their education and career goals. However, the burden of high interest rates can be overwhelming, causing financial stress for borrowers. If you’re struggling to keep up with your student loan payments, one effective strategy to alleviate some of the financial burden is to reduce your student loan interest rates.

Lowering your student loan interest rates can result in significant savings over the life of your loan. By reducing the amount of money that goes towards interest, you can allocate more funds towards paying off the principal balance, ultimately freeing yourself from debt sooner.

In this article, we will explore various strategies and tips to help you reduce your student loan interest rates. Understanding the factors influencing interest rates and knowing the options available to you will empower you to make informed decisions and take control of your financial future.

It’s important to note that each individual’s financial situation is unique, and what works for one person may not be suitable for another. However, by implementing the tips outlined in this article, you can increase your chances of securing a lower interest rate and potentially save thousands of dollars throughout the life of your student loan.

So, if you’re ready to discover how you can reduce your student loan interest rates and regain control of your financial well-being, let’s dive into the world of student loan interest rates and explore the various strategies at your disposal.

Why Student Loan Interest Rates Matter

Understanding why student loan interest rates matter is the first step towards taking control of your financial situation. The interest rate on your student loans determines how much additional money you’ll have to repay on top of the borrowed principal.

Here are a few key reasons why student loan interest rates are important:

- Cost of borrowing: The interest rate directly affects the total cost of your loan. A higher interest rate means you’ll end up paying more over the life of your loan.

- Impact on monthly payments: A higher interest rate leads to higher monthly payments. This can make it challenging to manage your budget and may result in financial stress.

- Length of repayment: With a higher interest rate, your loan repayment period may be extended, as a larger portion of your payments goes towards interest rather than the principal balance.

- Overall financial health: Student loan debt can have a significant impact on your overall financial health. By reducing your student loan interest rates, you can improve your financial situation and have more flexibility in achieving your other financial goals.

Given the potential financial impact of high-interest rates, it is essential to explore options for reducing the interest on your student loans. By doing so, you can save money, lower your monthly payments, and pay off your loans faster.

Now that we understand the significance of student loan interest rates let’s move on to the next section, where we will delve into how the current interest rate on your student loans is determined.

Understanding the Current Interest Rate

Before diving into strategies to reduce your student loan interest rates, it’s important to understand how the current interest rate on your student loans is determined. The interest rate on federal student loans is set by the government, while private student loan interest rates are determined by individual lenders.

Federal Student Loans:

For federal student loans, the interest rate is determined by a few factors:

- Type of loan: Federal student loans include Direct Subsidized Loans, Direct Unsubsidized Loans, and PLUS Loans. Each loan type may have a different interest rate structure.

- Academic year: The interest rates on federal student loans are updated annually. New loans disbursed within a given academic year will have the interest rate set for that year, and the rate remains fixed for the life of the loan.

- Rate calculation: The interest rates on federal student loans are based on the yield of the 10-year Treasury Note, plus a set percentage determined by Congress. This calculation ensures that the interest rates remain stable while taking into account the current economic conditions.

Private Student Loans:

Private student loans, on the other hand, have interest rates determined by the lender based on several factors:

- Borrower’s creditworthiness: Private lenders assess the borrower’s credit score and financial history to determine the interest rate. Higher credit scores typically result in lower interest rates.

- Loan terms: The repayment term and loan type (fixed or variable interest rate) chosen by the borrower can influence the interest rate. Generally, shorter repayment terms and fixed-rate loans may have higher interest rates.

- Market conditions: Private lenders may also take into account current market conditions and the interest rates set by financial institutions when determining the interest rate on private student loans.

Understanding how the current interest rate on your student loans is determined will provide insights into what factors you can work on to potentially lower your interest rate. In the next section, we will explore tips and strategies to help you reduce your student loan interest rates.

Factors That Influence Student Loan Interest Rates

Student loan interest rates can vary depending on several factors. Whether you have federal student loans or private student loans, understanding these factors can help you navigate your options for reducing your interest rates. Here are some key factors that influence student loan interest rates:

- Type of loan: The type of loan you have, such as federal or private, can impact the interest rate. Government-regulated federal loans typically have lower interest rates compared to private loans, which are set by individual lenders.

- Creditworthiness: For private student loans, the interest rate often depends on your creditworthiness. Lenders consider factors such as your credit score, credit history, and income when determining the interest rate. A higher credit score typically leads to a lower interest rate.

- Economic conditions: Economic conditions, including the state of the financial market and interest rates set by the Federal Reserve, can influence both federal and private student loan interest rates. When the overall interest rates are low, you may be able to secure a lower interest rate on your student loans.

- Loan term: The length of the loan term can impact the interest rate. Generally, loans with longer repayment terms may have higher interest rates compared to shorter-term loans.

- Loan type: Different types of student loans may have different interest rate structures. Subsidized loans, for example, offer more favorable terms as the government pays the interest during certain periods, while unsubsidized loans accrue interest throughout the life of the loan.

- Repayment options: Some student loan repayment programs, such as income-driven repayment plans, may offer lower interest rates or interest subsidies, especially for federal student loans. These programs consider your income and adjust your monthly payment accordingly, which can help you manage your debt more effectively.

It’s important to note that these factors may have varying degrees of influence on your interest rate, depending on the type of loan you have and the policies of the lender or government. Understanding these factors can help you evaluate your options and strategies for reducing your student loan interest rates.

In the next section, we will explore practical tips and strategies that you can implement to lower your student loan interest rates and save money in the long run.

Tips for Reducing Student Loan Interest Rates

Reducing your student loan interest rates can make a significant difference in your financial journey. Here are several tips and strategies that can help you lower your interest rates and save money:

- Consider Federal Loan Consolidation: If you have multiple federal student loans, consolidating them into a Direct Consolidation Loan can provide several benefits. It can simplify your repayment process, and in certain cases, it may offer a lower interest rate by taking the weighted average of the interest rates on your existing loans.

- Explore Loan Refinancing Options: Refinancing your student loans involves obtaining a new loan with a lower interest rate to pay off your existing loans. Private lenders offer refinancing options where you can potentially secure a lower interest rate based on your creditworthiness. However, be aware that refinancing federal loans with a private lender may result in the loss of federal loan benefits.

- Opt for Automatic Payments: Many lenders offer an interest rate reduction if you enroll in automatic payments. By setting up automatic payments, you not only lower the risk of missing a payment but also get the benefit of a reduced interest rate.

- Make Biweekly Payments: Instead of making monthly payments, consider switching to biweekly payments. This strategy allows you to make an extra payment each year, reducing the principal balance and overall interest paid over time.

- Pay Extra Whenever Possible: If you have extra funds available, consider making additional payments towards your principal balance. By allocating more money towards the principal, you can lower the amount of interest that accrues over the life of the loan.

- Take Advantage of Loan Forgiveness Programs: Public service loan forgiveness programs, such as the Public Service Loan Forgiveness (PSLF) program, can offer substantial benefits. If you qualify, remaining loan balances may be forgiven after a certain number of on-time payments. This can effectively reduce the total interest you pay over the life of the loan.

- Seek Professional Help if Needed: If you’re struggling to navigate your student loan repayment options or negotiating lower interest rates, consider seeking the assistance of a reputable student loan counselor or financial advisor. They can provide personalized guidance based on your financial situation and help you explore all available options.

Remember, the effectiveness of these tips may vary depending on your specific circumstances and the type of loan you have. It’s essential to assess your options carefully and consider the potential benefits and drawbacks of each strategy.

By implementing these strategies and being proactive in managing your student loan interest rates, you can take control of your financial situation and make significant progress towards paying off your loans faster and saving money in the process.

Now that you have a clearer understanding of how to reduce your student loan interest rates, let’s conclude with a few key takeaways.

Consider Federal Loan Consolidation

If you have multiple federal student loans, one option to reduce your student loan interest rates is to consider federal loan consolidation. Consolidating your loans involves combining all your federal loans into a single Direct Consolidation Loan with a new interest rate.

Here are some key benefits of federal loan consolidation:

- Simplified Repayment: By consolidating your loans, you will have a single loan with a single monthly payment. This can make repayment more manageable and reduce the chances of missing a payment.

- Potential Lower Interest Rate: When you consolidate your federal loans, the new interest rate on the Direct Consolidation Loan is determined by taking the weighted average of the interest rates on your existing loans and rounding it up to the nearest one-eighth of a percent. This means that your interest rate could be slightly higher or lower than the average of your current rates.

- Fixed Interest Rate: Once you consolidate your loans, the new interest rate on the Direct Consolidation Loan remains fixed for the life of the loan. This can provide stability and predictability in your monthly payments.

- Access to Loan Forgiveness Programs: Consolidating your loans preserves your eligibility for loan forgiveness programs, such as the Public Service Loan Forgiveness (PSLF) program. If you work in public service and plan to pursue loan forgiveness, consolidating your loans can ensure that the eligible payments you make count towards forgiveness.

However, it’s crucial to carefully consider the potential drawbacks of federal loan consolidation:

- Loss of Benefits: When you consolidate your federal loans, you may lose specific borrower benefits, such as interest rate discounts, loan cancellation benefits, or loan forgiveness options. Evaluate the terms and benefits of your existing loans before deciding to consolidate.

- Extended Repayment Period: Although consolidation simplifies repayment, it may result in a longer repayment period. If you aim to pay off your loans quickly, consolidating your loans may not be the best option.

- Impact on Interest Amount: Consolidating your loans may not necessarily lead to a significant reduction in your overall interest amount. While the new interest rate on the Direct Consolidation Loan is determined by taking the weighted average of your existing rates, it may result in a minimal difference or even a slightly higher rate.

Before making a decision, carefully assess your financial situation and consider the benefits and drawbacks of federal loan consolidation. You can use the Federal Student Aid Loan Consolidation Calculator to estimate the potential impact on your interest rate and monthly payments.

Remember, federal loan consolidation is only applicable for federal student loans. If you have private loans, you would need to explore refinancing options with private lenders to potentially lower your interest rates.

Now that we have explored federal loan consolidation, let’s move on to the next tip — exploring loan refinancing options.

Explore Loan Refinancing Options

If you’re looking to lower your student loan interest rates, exploring loan refinancing options can be a viable strategy. Refinancing involves obtaining a new loan from a private lender to pay off your existing student loans, including both federal and private loans.

Here are some key points to consider when exploring loan refinancing:

- Potential for Lower Interest Rates: Refinancing allows you to secure a new loan with a lower interest rate. This can result in significant savings over the life of your loan, as you would be paying less in interest.

- Single Monthly Payment: By refinancing and consolidating your loans, you’ll have a single monthly payment to manage. This can simplify your repayment and make it easier to stay on top of your finances.

- Favorable Terms and Conditions: Refinancing may provide you with the opportunity to choose new loan terms that align better with your financial goals. You can opt for a shorter repayment period or a fixed interest rate, depending on your preference and financial situation.

- Creditworthiness Matters: Refinancing is typically based on your creditworthiness. Lenders will assess your credit score, income, and other financial factors to determine your eligibility and interest rate. If you have a good credit history and a stable income, you may qualify for more favorable refinancing terms.

- Loss of Federal Loan Benefits: It’s important to note that refinancing federal loans with a private lender means losing certain federal loan benefits, such as income-driven repayment plans, loan forgiveness programs, and deferment or forbearance options. Evaluate the potential loss of these benefits before refinancing.

- Compare Multiple Lenders: Take the time to research and compare refinancing offers from different lenders. Look for competitive interest rates, favorable repayment terms, and any additional borrower benefits or discounts that may be available to you.

Remember, refinancing is best suited for borrowers with good credit and a stable financial situation. If you’re struggling with your current loans or anticipate needing federal loan benefits in the future, refinancing may not be the most suitable option for you.

It’s crucial to carefully assess your individual circumstances and weigh the potential benefits and drawbacks of refinancing. Utilize online resources and tools to estimate the potential savings and determine if refinancing is the right choice for you.

Now that we have explored loan refinancing, let’s move on to the next tip — opting for automatic payments.

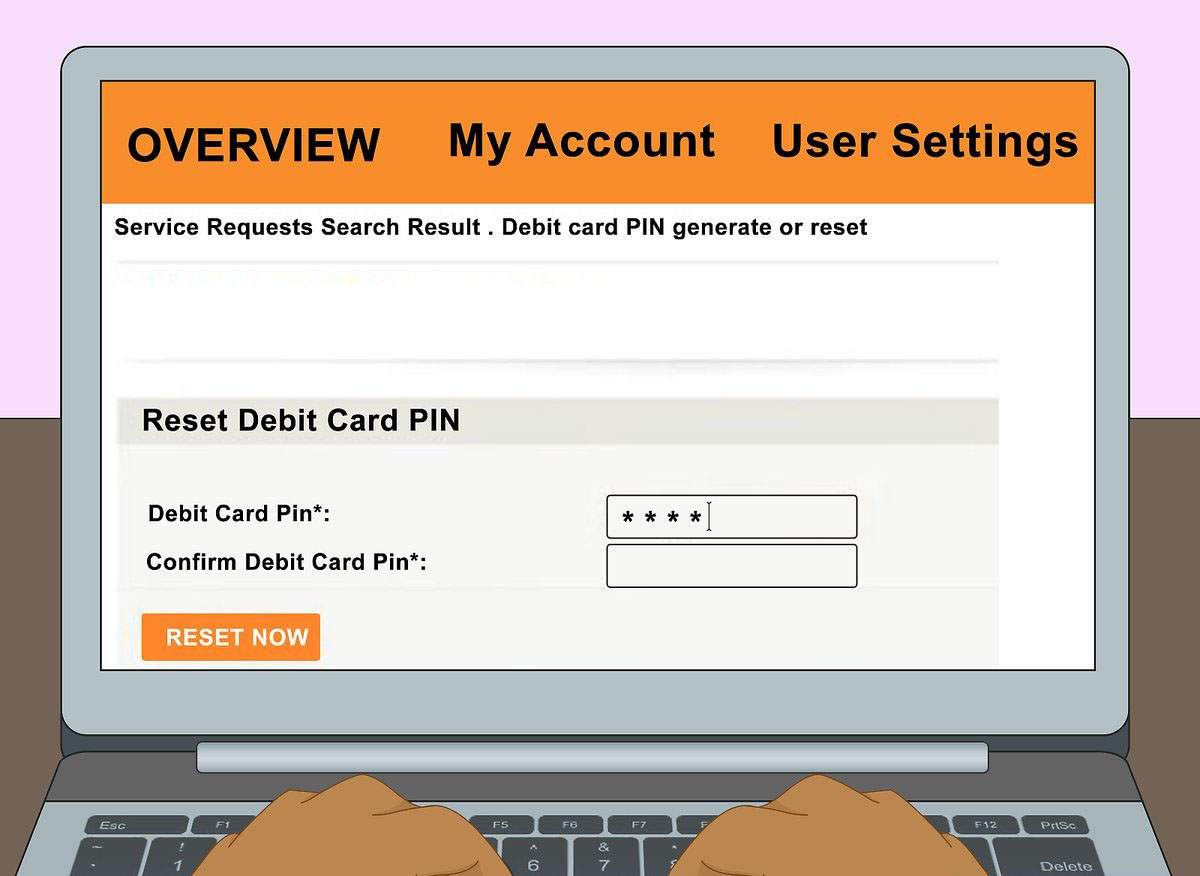

Opt for Automatic Payments

Opting for automatic payments is a simple yet effective way to reduce your student loan interest rates. Many lenders offer an interest rate reduction as an incentive for borrowers who enroll in automatic payment programs.

Here are some key reasons why you should consider opting for automatic payments:

- Interest Rate Reduction: By enrolling in automatic payments, you can often qualify for a small reduction in your interest rate. This reduction can save you money over the life of your loan.

- Timely Payments: Automatic payments ensure that your loan payments are made on time each month. This eliminates the risk of missing a payment, which could result in late fees or a negative impact on your credit score.

- Convenience and Ease: With automatic payments, you don’t have to worry about manually making your monthly payments. The funds are automatically deducted from your chosen bank account, freeing up your time and mental energy.

- Discount Programs: Some lenders offer additional benefits or discounts for borrowers who enroll in automatic payment programs. These benefits may include principal balance reductions, interest rate rewards, or loyalty incentives.

To set up automatic payments, you typically need to provide your bank account information to your loan servicer or lender. They will then deduct the monthly payment on the agreed-upon date.

Before enrolling in automatic payments, be sure to review your budget and ensure that you have sufficient funds in your account to cover the payments. You may also want to set up alerts or reminders to track your automatic payments and ensure everything is functioning as intended.

It’s important to note that if you have multiple loans with different lenders, you should check each individual lender’s policies regarding automatic payments and interest rate reductions. Some lenders may offer higher interest rate reductions than others, so it’s worth comparing your options to maximize your savings.

In the next tip, we will discuss the benefits of making biweekly payments on your student loans.

Make Biweekly Payments

Making biweekly payments is a proactive strategy that can help you reduce your student loan interest rates and pay off your loans faster. Instead of making monthly payments, biweekly payments involve splitting your monthly payment in half and paying it every two weeks.

Here’s why making biweekly payments can be beneficial:

- Accelerated Debt Repayment: By making biweekly payments, you end up making one extra payment over the course of a year. This extra payment goes directly towards reducing the principal balance and minimizes the amount of interest accruing on your loan.

- Reduced Interest Charges: With less time for interest to accumulate between payments, making biweekly payments can result in significant interest savings over the life of your loan. This allows you to pay off your loan faster and potentially save thousands of dollars in interest.

- Improved Cash Flow Management: Biweekly payments can align better with your paycheck schedule, making it easier to manage your cash flow. Instead of making one large payment each month, splitting it into smaller, more frequent payments may be more manageable for your budget.

When implementing biweekly payments, it’s important to communicate with your loan servicer or lender to ensure that the extra payments are applied correctly. You want to make sure that the additional payments are applied directly to the principal balance to maximize the impact on reducing your interest charges.

Before transitioning to biweekly payments, review your budget to ensure that you have the financial capacity to make these more frequent payments. Adjust your expenses if necessary to accommodate the biweekly payment schedule.

It’s worth noting that while biweekly payments can be effective in reducing interest and repaying your loan faster, not all loan servicers may offer this payment option. Contact your loan servicer to discuss the availability and setup process for biweekly payments.

By making biweekly payments, you can take control of your student loans and expedite your path to debt freedom.

Now, let’s move on to the next tip — paying extra whenever possible.

Pay Extra Whenever Possible

Paying extra towards your student loan whenever possible is a powerful strategy to lower your interest rates and accelerate your debt repayment. By making additional payments on top of your regular monthly payment, you can reduce the principal balance faster and minimize the amount of interest that accrues over time.

Here are some key reasons why paying extra whenever possible can be beneficial:

- Interest Savings: Every extra dollar you put towards your student loan goes directly towards reducing the principal balance. This results in less interest accruing over the life of your loan, which can save you a significant amount of money in the long run.

- Shortened Repayment Period: By making extra payments, you can effectively pay down your loan faster. This can help you become debt-free sooner, allowing you to allocate your financial resources towards other goals, such as saving for a house or investing for the future.

- Flexible Approach: Paying extra on your student loan gives you the flexibility to make additional payments whenever you have the financial means to do so. Whether it’s a one-time bonus, tax refund, or a consistent increase in income, any extra amount you contribute towards your loan can make a significant impact.

- Targeting Specific Loans: If you have multiple student loans, you can strategically target the loan with the highest interest rate or smallest balance. By paying extra towards that particular loan, you can expedite its repayment and then focus on the next one, creating a snowball effect and accelerating your progress.

- No Prepayment Penalties: Thankfully, most student loans do not have prepayment penalties. This means that you can make extra payments without incurring any additional fees or penalties. Take advantage of this opportunity to reduce your overall interest and get ahead in your debt repayment journey.

When making extra payments, ensure that you communicate with your loan servicer or lender to ensure that the additional funds are applied correctly. Request that the extra payments are applied towards the principal balance, rather than future payments, to maximize your interest savings.

Even if you can only afford to make small extra payments, remember that every little bit counts. Consistency is key, and over time, these extra contributions can make a substantial impact on reducing your overall interest and shortening your repayment timeline.

Now that you understand the importance of paying extra on your student loans, let’s move on to the next tip — taking advantage of loan forgiveness programs.

Take Advantage of Loan Forgiveness Programs

If you’re looking for ways to reduce your student loan interest rates and potentially have a portion of your loans forgiven, exploring loan forgiveness programs can be a game-changer. These programs offer eligible borrowers the opportunity to have a portion or even the entire remaining loan balance forgiven after meeting certain requirements.

Here are a few loan forgiveness programs to consider:

- Public Service Loan Forgiveness (PSLF): The PSLF program is designed for borrowers who work full-time for a qualifying employer, such as a government organization or a non-profit organization. After making 120 qualifying payments while working for an eligible employer, you may be eligible to have the remaining balance of your loans forgiven. It’s important to note that to qualify, you must be enrolled in an income-driven repayment plan.

- Teacher Loan Forgiveness: Teachers who work in low-income schools or educational service agencies may be eligible for the Teacher Loan Forgiveness program. After completing five consecutive years of teaching, you may qualify for forgiveness of up to $17,500 on your Direct Subsidized and Unsubsidized Loans, as well as your Subsidized and Unsubsidized Federal Stafford Loans.

- Income-Driven Repayment (IDR) Forgiveness: Income-Driven Repayment plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), offer loan forgiveness after a specific period of repayment. The forgiveness timeline can range from 20 to 25 years depending on the plan, and any remaining balance would be forgiven after that period.

- Loan Forgiveness for Medical Professionals, Lawyers, and other Professions: Some professions, such as doctors, nurses, lawyers, and certain other public service occupations, have specific loan forgiveness programs. These programs offer loan forgiveness to individuals who commit to working in certain underserved areas or fulfilling specific requirements in their field.

To take advantage of these loan forgiveness programs, it’s crucial to research the specific requirements and ensure that you meet all eligibility criteria. Keep in mind that loan forgiveness programs are typically applicable to federal student loans, so if you have private loans, you may not be eligible for these programs.

Enrolling in an income-driven repayment plan can be an excellent strategy to lower your monthly payments and maximize the potential benefits of loan forgiveness. It’s important to understand the terms and conditions of the program you’re considering and stay proactive in meeting the requirements.

Loan forgiveness programs can provide substantial relief from your student loan debt, as they not only reduce your interest rates but also offer an opportunity to have a portion of your loans completely forgiven.

Now let’s move on to the final tip: seeking professional help if needed.

Seek Professional Help if Needed

If you’re feeling overwhelmed or unsure about how to effectively reduce your student loan interest rates, seeking professional help can provide valuable guidance and support. Student loan counselors, financial advisors, and other professionals can assist you in navigating the complexities of the student loan system and help you make informed decisions.

Here’s why seeking professional help can be beneficial:

- Expert Guidance: Student loan counselors and financial advisors have in-depth knowledge and expertise in managing student loan debt. They can provide personalized advice tailored to your unique financial situation and goals.

- Exploring All Available Options: A professional can help you explore various options for reducing your student loan interest rates, such as federal loan repayment programs, loan consolidation, refinancing, or forgiveness programs. They can evaluate the pros and cons of each option and help you choose the best strategy for your specific circumstances.

- Understanding the Fine Print: Student loan documents can be complex, and deciphering all the fine print can be overwhelming. Professionals can help you understand the terms, conditions, and implications of your loans, ensuring that you are aware of any hidden fees, penalties, or benefits that could impact your interest rates.

- Financial Planning: Seeking professional help goes beyond student loans. These experts can assist you with creating a comprehensive financial plan that takes into account your income, expenses, savings goals, and long-term financial objectives. They can help you prioritize your student loan repayment alongside other financial obligations.

- Advocacy and Negotiation: In some cases, professionals can advocate for you and negotiate with lenders on your behalf. They can explore potential interest rate reductions, refinancing options, or hardship programs that you may not be aware of.

It’s important to note that when seeking professional help, it’s crucial to choose reputable, qualified individuals or organizations. Look for certified financial planners, student loan counselors who are members of recognized organizations, or advisors with expertise in student loan management. Read reviews, ask for recommendations, and ensure that their fees are reasonable and transparent.

Professional help can be a valuable investment in your financial future. They can provide clarity, support, and strategic advice to help you effectively reduce your student loan interest rates and achieve your long-term financial goals.

As we conclude this article, I hope that these tips have provided you with actionable strategies to lower your student loan interest rates. By exploring federal loan consolidation, refinancing options, opting for automatic payments, making biweekly payments, paying extra whenever possible, taking advantage of loan forgiveness programs, and seeking professional help if needed, you can take control of your student loan debt and set yourself on a path to financial freedom.

Remember, everyone’s financial situation is unique, so it’s important to assess your options based on your individual circumstances. Choose the strategies that align with your goals and work towards achieving a brighter financial future.

Conclusion

Reducing your student loan interest rates is a crucial step in taking control of your finances and achieving financial freedom. By implementing the strategies outlined in this article, you can potentially save thousands of dollars over the life of your loans and pay off your debt faster.

We discussed several tips and strategies for reducing student loan interest rates, including considering federal loan consolidation, exploring loan refinancing options, opting for automatic payments, making biweekly payments, paying extra whenever possible, taking advantage of loan forgiveness programs, and seeking professional help if needed.

It’s important to remember that each individual’s circumstances are unique, and what works for one person may not work for another. Evaluate your options, taking into account factors such as your loan type, creditworthiness, financial goals, and eligibility for loan forgiveness programs.

Before making any decisions, understand the potential benefits and drawbacks of each strategy and how they align with your long-term financial plans. Consider consulting with professionals, such as student loan counselors or financial advisors, to help guide you through the process and make informed choices.

Reducing your student loan interest rates is an ongoing process that requires discipline and commitment. Regularly review your financial situation, explore opportunities for refinancing or consolidation, and consistently make payments towards your loans. Over time, your efforts will yield significant results and move you closer to a debt-free future.

Remember, reducing your student loan interest rates not only saves you money but also provides you with the freedom and flexibility to pursue your other financial goals. By taking control of your student loan debt, you can shape a brighter financial future and pave the way for long-term financial success.

So, take action today, implement these strategies, and embark on your journey towards lower student loan interest rates, financial stability, and a brighter financial future.