Finance

How To Refinance Parent Student Loans

Published: January 20, 2024

Want to refinance your parent student loans? Learn how to save money and manage your finances with our expert tips and advice on refinancing options for parents.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Parent Student Loans

- Why Refinance Parent Student Loans

- Eligibility for Refinancing Parent Student Loans

- Finding the Right Lender

- Application Process for Refinancing Parent Student Loans

- Benefits and Risks of Refinancing Parent Student Loans

- Tips for a Successful Loan Refinancing

- Conclusion

Introduction

Student loans have become a burden for many parents who have taken on the responsibility of financing their child’s education. With high interest rates and long repayment terms, parent student loans can make it challenging to manage finances effectively. However, there is a solution that can provide relief and potentially save thousands of dollars over the life of the loan: refinancing.

Refinancing parent student loans involves replacing an existing loan with a new one, typically at a lower interest rate and better terms. This can result in lower monthly payments, decreased interest charges, and the opportunity to pay off the loan faster. It’s a financial strategy that allows parents to regain control of their finances and build a more secure future.

Before diving into the refinancing process, it’s essential to understand how parent student loans work. These loans are specifically designed to help parents fund their child’s education and are typically taken out in the parent’s name. Unlike federal student loans, which are taken out by the student, parent student loans can have higher interest rates and fewer repayment options.

The reasons for refinancing parent student loans are numerous. Firstly, it can provide significant savings over the life of the loan. By securing a lower interest rate, parents can decrease their monthly payments and reduce their overall debt burden.

Secondly, refinancing can simplify the repayment process. Parents often have multiple loans to manage, including mortgage payments, car loans, and credit card debt. Refinancing allows them to consolidate their parent student loans into one monthly payment, making it easier to track and manage their finances.

Another reason to refinance parent student loans is to modify the loan term. For parents who are struggling to meet the monthly payments, refinancing can extend the loan term, resulting in lower monthly payments. Conversely, for those who wish to pay off the loan faster and save on interest, refinancing can shorten the loan term.

Finally, refinancing can provide access to additional benefits and features. Many refinancing lenders offer perks such as unemployment protection, interest rate discounts for setting up automatic payments, and flexible repayment options.

However, refinancing parent student loans is not suitable for everyone. It’s important to assess eligibility and carefully consider the potential benefits and risks before proceeding. In the following sections, we will explore the eligibility criteria, finding the right lender, the application process, and the benefits and risks of refinancing parent student loans.

Understanding Parent Student Loans

Before considering refinancing parent student loans, it is essential to have a good understanding of what these loans entail. Parent student loans are loans taken out by parents to finance their child’s education. They differ from federal student loans in that they are in the parent’s name and are typically unsubsidized, meaning interest accrues from the time the loan is disbursed.

Parent student loans are available through various lenders, including banks, credit unions, and online lenders. The most common type of parent student loan is the Parent PLUS loan, which is offered by the U.S. Department of Education. These loans generally have higher interest rates compared to federal student loans taken out by students.

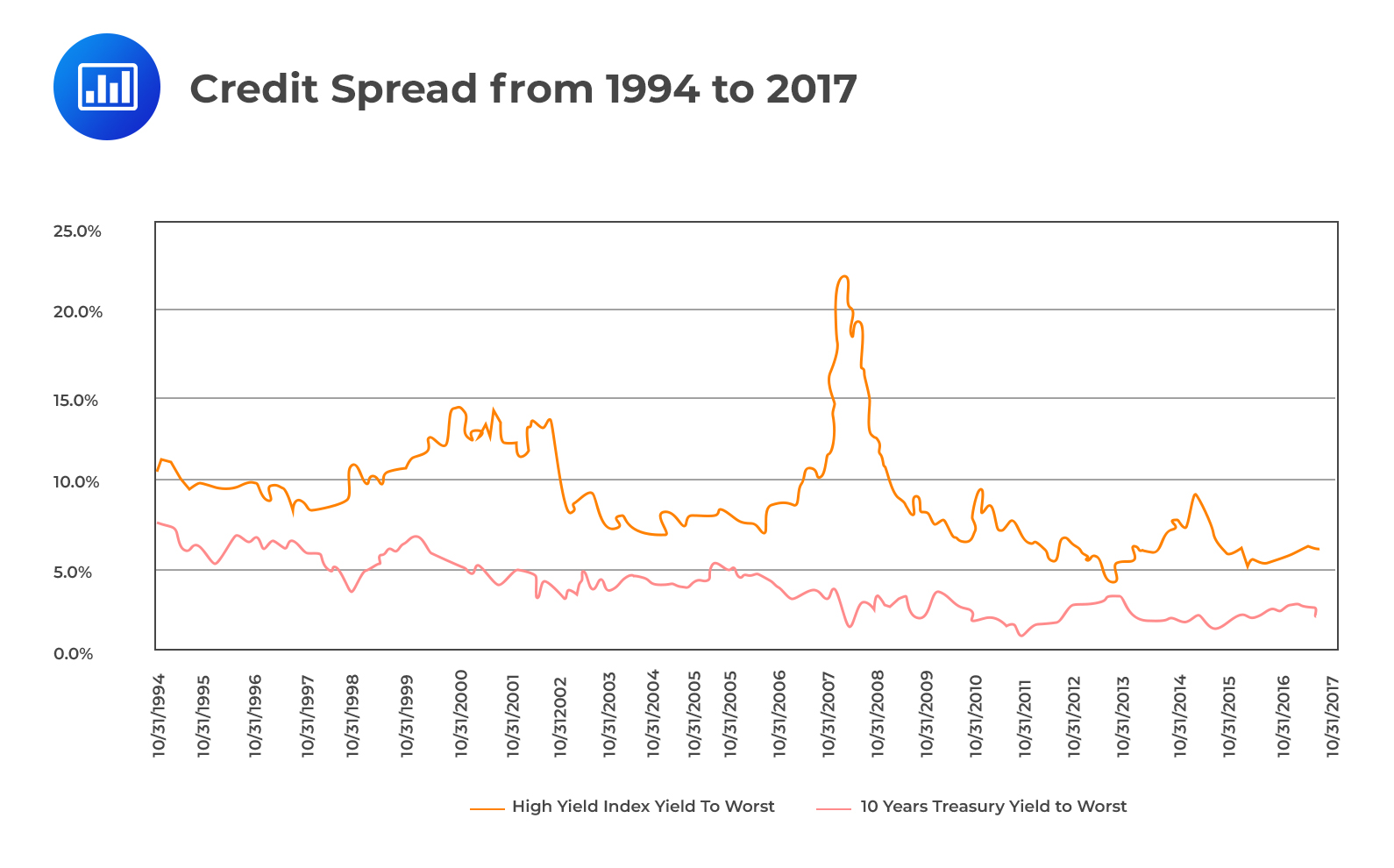

Interest rates for parent student loans can vary depending on the lender and the borrower’s creditworthiness. The rates are often fixed, meaning they remain the same for the entire term of the loan. However, some lenders may also offer variable interest rates, which can fluctuate over time based on market conditions.

Repayment terms for parent student loans can range from 5 to 25 years, with the specific term depending on the lender and the amount borrowed. Monthly payments typically begin immediately, although there may be the option for a deferment or forbearance in certain circumstances.

One important consideration for parent student loans is that they are the responsibility of the borrowing parent. This means that if the parent becomes unable to make the payments, the burden does not transfer to the student. It’s crucial for parents to carefully evaluate their financial situation and ability to repay the loan before taking on this responsibility.

Unlike federal student loans, which offer borrower protections such as income-driven repayment plans and loan forgiveness options, parent student loans do not offer the same flexibility. Repayment options for parent student loans are generally more limited, with standard repayment being the most common option.

It’s important for parents to carefully review the terms and conditions of their parent student loans and understand their rights and responsibilities as a borrower. This includes understanding the interest rate, repayment term, and any fees associated with the loan.

Now that we have a clearer understanding of parent student loans, the next step is to explore the reasons why refinancing these loans may be a viable option to reduce financial strain and improve long-term financial well-being.

Why Refinance Parent Student Loans

Refinancing parent student loans can provide numerous benefits and financial relief. Here are the key reasons why parents might consider refinancing their parent student loans:

- Lower interest rates: One of the primary motivations for refinancing is to secure a lower interest rate. When parents originally took out their parent student loans, they may have been charged higher interest rates. By refinancing, they have the opportunity to qualify for lower rates, which can significantly reduce the overall cost of the loan.

- Lower monthly payments: Refinancing can also result in lower monthly payments. With a lower interest rate, the amount of interest being charged each month decreases, leading to a reduced payment amount. This can provide much-needed relief and free up more funds in the monthly budget.

- Opportunity for savings: By refinancing parent student loans, parents have the chance to save money over the life of the loan. With a lower interest rate, more of their monthly payments go towards reducing the principal balance, resulting in substantial savings. These savings can be used for other financial goals or to pay off the loan faster.

- Consolidation of multiple loans: Many parents have multiple parent student loans, each with its own interest rate and repayment terms. Refinancing allows them to combine all their loans into a single loan, simplifying the repayment process. Managing just one loan instead of multiple separate loans can make it much easier to keep track of payments and stay organized.

- Flexible repayment options: Refinancing parent student loans can also provide access to more flexible repayment options. Some lenders offer options such as graduated repayment, where the monthly payments start lower and increase over time, or income-driven repayment plans, which adjust the payment amount based on a borrower’s income. These options can provide more manageable repayment terms based on individual financial circumstances.

While there are several advantages to refinancing, it’s important to consider the potential risks and drawbacks as well. For example, refinancing parent student loans may result in the loss of certain borrower protections offered by federal student loans, such as income-driven repayment plans and loan forgiveness options. It’s crucial to carefully weigh the benefits against any potential loss of benefits before proceeding with refinancing.

Now that we understand the motivations behind refinancing parent student loans, the next step is to explore the eligibility criteria for refinancing and finding the right lender.

Eligibility for Refinancing Parent Student Loans

Refinancing parent student loans is an attractive option for many parents looking to improve their financial situation. However, not all borrowers may be eligible for refinancing. Here are some key eligibility criteria to consider:

- Creditworthiness: Lenders typically evaluate the creditworthiness of borrowers before approving them for loan refinancing. A good credit score is essential, as it demonstrates a borrower’s ability to manage debt responsibly. Lenders will also assess factors such as debt-to-income ratio and payment history. Those with a strong credit profile are more likely to qualify for refinancing at favorable rates.

- Income stability: Lenders may require borrowers to demonstrate a stable income to ensure they can comfortably meet their loan obligations. This is particularly important for parents who have retired or are close to retirement age. They may need to provide proof of income, such as pay stubs or tax returns, to support their refinancing application.

- Loan balance: Each lender will have its own minimum and maximum loan balance requirements. Parents looking to refinance their parent student loans will need to ensure that their loan balance falls within the lender’s specified range.

- Loan status: In order to refinance, the parent student loans should be in good standing, with no defaulted or delinquent payments. Lenders will typically require borrowers to provide proof of current loan status as part of the refinancing application process.

- Employment status: Some lenders may require borrowers to be employed or have a steady source of income. However, there are lenders that offer refinancing options for self-employed individuals or those with non-traditional sources of income.

It’s important to note that eligibility criteria may vary between lenders. Some lenders may have stricter requirements, while others may be more flexible. It’s crucial to research and compare different lenders to find one that aligns with your financial circumstances and offers favorable terms.

Parents who may not meet the eligibility criteria for refinancing parent student loans have other options to consider. For example, they can explore loan consolidation options, which can simplify repayment by combining multiple loans into one. Additionally, they can work on improving their credit score and overall financial profile to increase their chances of qualifying for refinancing in the future.

Now that we understand the eligibility criteria for refinancing, the next step is to explore how to find the right lender for refinancing parent student loans.

Finding the Right Lender

When it comes to refinancing parent student loans, finding the right lender is crucial. The right lender can offer competitive interest rates, flexible repayment terms, and excellent customer service. Here are some factors to consider when searching for the right lender:

- Interest rates: Compare interest rates from different lenders to find the most competitive options. A lower interest rate can result in significant savings over the life of the loan. However, it’s important to consider both fixed and variable rate options and evaluate the potential risks and benefits of each.

- Repayment terms: Look for lenders that offer flexible repayment terms that align with your financial goals. This includes options for different loan terms (e.g., 5, 10, 15 years), as well as any special repayment plans or options, such as graduated repayment or income-driven repayment.

- Fees and costs: Consider any fees associated with refinancing, such as origination fees or prepayment penalties. These costs can vary between lenders, so it’s important to understand and factor them into your decision-making process.

- Customer service: Research the reputation of the lender and read reviews to get a sense of their customer service. It’s important to choose a lender that has a responsive and helpful customer service team who can address any questions or concerns you may have throughout the refinancing process.

- Additional benefits: Some lenders offer additional perks or benefits, such as interest rate reductions for automatic payments or forbearance options in case of financial hardship. These additional benefits can add value to your refinancing experience and make it more attractive.

Additionally, it’s important to consider whether you want to refinance with a traditional bank, credit union, or online lender. Online lenders often offer a streamlined application process and quicker approval times, while traditional banks and credit unions may provide more personalized service and in-person support. Evaluate your preferences and priorities to determine which type of lender is the best fit for you.

As you research potential lenders, don’t be afraid to ask questions and seek clarification on any terms or conditions you don’t understand. The more informed you are, the better equipped you’ll be to make an informed decision about your refinancing options.

Some online resources and comparison websites can help simplify the process of finding the right lender for refinancing parent student loans. These platforms allow you to input your information and receive personalized rate quotes from multiple lenders, making it easier to compare your options and make an informed choice.

Now that we know how to find the right lender for refinancing parent student loans, let’s move on to the application process.

Application Process for Refinancing Parent Student Loans

The application process for refinancing parent student loans involves several steps, but with the right preparation and organization, it can be a straightforward and relatively quick process. Here’s an overview of the typical steps involved:

- Gather necessary documents: Before applying for refinancing, gather all the necessary documents. This may include proof of income, such as tax returns or pay stubs, as well as documentation of existing parent student loans, such as account statements or loan agreements.

- Research and select a lender: Based on your eligibility and the factors that are important to you, research and select a lender that offers the most favorable terms and conditions. Consider their interest rates, repayment options, and additional benefits.

- Complete the application: Begin the application process by filling out the necessary forms provided by the selected lender. This will typically require personal information, income details, and loan information. Be as accurate and thorough as possible to avoid any potential issues or delays.

- Provide supporting documentation: Along with the application, you will need to provide supporting documentation, such as income verification and loan statements. Make sure these documents are organized and readily available for submission.

- Wait for approval: Once you have submitted your application and supporting documents, the lender will review your information and assess your eligibility. This process may take a few days to a few weeks, depending on the lender. Be patient and prepared to answer any follow-up questions or provide additional documents if requested.

- Review and sign loan documents: If your application is approved, the lender will provide you with the loan documents. Carefully review the terms and conditions, including the interest rate, repayment terms, and any fees or costs associated with the loan. If everything meets your satisfaction, sign the loan documents and return them to the lender.

- Loan payoff and loan consolidation: Once the loan documents are signed and returned, the new lender will pay off your existing parent student loans. Your loans will then be consolidated into the new refinanced loan under the terms agreed upon.

- Make timely payments: Once the refinancing process is complete, it’s important to make timely payments on your new loan. Set up automatic payments, if available, to ensure you never miss a payment and to potentially qualify for any interest rate reductions offered by the lender.

Remember to keep copies of all the documents and correspondence related to your refinancing application for your records.

If you encounter any difficulties or have questions during the application process, reach out to the lender’s customer service for assistance. They are there to help and provide guidance throughout the process.

Now that we understand the application process, let’s explore the benefits and risks of refinancing parent student loans.

Benefits and Risks of Refinancing Parent Student Loans

Refinancing parent student loans offers several potential benefits for borrowers, but it’s important to also consider the associated risks. Understanding both the advantages and the potential drawbacks will help you make an informed decision. Here are the benefits and risks of refinancing parent student loans:

Benefits:

- Lower interest rates: Refinancing can potentially lower the interest rates on parent student loans, leading to significant savings over the life of the loan.

- Lower monthly payments: With a lower interest rate, refinancing can result in reduced monthly payments, providing immediate financial relief for parents.

- Simplified loan management: Consolidating multiple parent student loans into a single loan through refinancing can make loan management easier and more convenient.

- Flexible repayment options: Refinancing can offer more flexible repayment options, such as longer or shorter loan terms, graduated repayment plans, or even income-driven repayment plans.

- Potential savings: By reducing interest rates and lowering monthly payments, refinancing can save parents a significant amount of money over the life of the loan.

- Access to additional benefits: Some refinancing lenders offer additional benefits, such as interest rate discounts, unemployment protection, or the option to release a cosigner.

Risks:

- Loss of federal loan benefits: By refinancing parent student loans with a private lender, borrowers may lose access to certain federal loan benefits, such as income-driven repayment plans, forgiveness programs, or deferment and forbearance options. Consider whether the potential savings outweigh the loss of these benefits.

- Variable interest rates: Opting for a variable interest rate on a refinanced loan can be risky as rates can increase over time, potentially resulting in higher monthly payments in the future. Consider your risk tolerance and financial stability before choosing a variable rate option.

- Extended loan terms: While extending the loan term through refinancing can lower monthly payments, it can also result in paying more interest over the life of the loan. Assess your financial goals and determine if the long-term cost is worth the short-term relief.

- Creditworthiness requirements: Refinancing requires meeting certain creditworthiness criteria, including a good credit score and stable income. If your financial situation has changed or you have a poor credit history, you may not qualify for favorable refinancing terms.

- Origination fees and costs: Some refinancing lenders charge origination fees or other costs, which can add to the overall cost of refinancing. Take these fees into account when evaluating the potential savings of refinancing.

It’s crucial to carefully assess your individual financial circumstances and goals before deciding whether to refinance parent student loans. Consider the potential benefits and risks, and weigh them against each other to make the best decision for your situation.

Now, let’s explore some tips for a successful loan refinancing process.

Tips for a Successful Loan Refinancing

Refinancing parent student loans can provide significant financial benefits, but it’s important to approach the process with caution to ensure a successful outcome. Here are some tips to help make your loan refinancing experience a success:

- Check your credit score: Before applying for refinancing, review your credit history and credit score. A good credit score will increase your chances of qualifying for better interest rates and terms. If your credit score is lower than desired, take steps to improve it before applying.

- Compare multiple lenders: Don’t settle for the first lender that comes along. It’s important to compare multiple lenders and their offers to find the best fit for your financial needs. Consider interest rates, repayment terms, fees, and customer service reputation.

- Calculate potential savings: Use online calculators or consult financial experts to estimate the potential savings from refinancing. Understand how much you could save in terms of monthly payments and the overall cost of the loan over its lifespan.

- Consider fixed vs. variable interest rates: Understand the pros and cons of both fixed and variable interest rates. Fixed rates provide stability and predictable payments, while variable rates may offer lower initial rates but can fluctuate over time. Choose the option that aligns with your risk tolerance and long-term financial goals.

- Read and understand the terms: Carefully review all the terms and conditions of the refinancing offer, including interest rates, repayment terms, fees, and any potential penalties. Ensure that you fully understand all aspects of the loan and ask questions if anything is unclear.

- Prepare documentation: Be organized and gather all necessary documents in advance. This may include income verification, loan statements, and other financial documents. Having everything ready will expedite the application process and reduce the likelihood of delays or missing information.

- Consider a cosigner: If you have a less-than-ideal credit score or income, consider finding a cosigner with a strong credit history and stable income. A cosigner can help you secure better interest rates and increase your chances of loan approval.

- Review your budget: Before refinancing, assess your budget and ensure that you can comfortably make the monthly payments on the new loan. Consider your current and future financial obligations and make sure refinancing fits within your overall financial plan.

- Continue making payments: Until your refinancing application is approved and finalized, continue making payments on your existing loans. Missing payments or falling into delinquency can negatively impact your credit score and hinder your refinancing efforts.

- Stay informed: Stay updated on changes in the interest rate landscape and new refinancing opportunities. Rates and terms can vary over time, so it’s important to monitor the market and be open to refinancing again if it aligns with your financial goals.

By following these tips, you can increase your chances of a successful loan refinancing experience and take advantage of the potential benefits that come with it.

Now, let’s wrap up our discussion on refinancing parent student loans.

Conclusion

Refinancing parent student loans can be a game-changer for parents seeking to manage their finances more effectively and save money in the process. By securing a lower interest rate and better repayment terms, parents can reduce their monthly payments, decrease their overall debt burden, and potentially save thousands of dollars over the life of the loan.

Understanding the intricacies of parent student loans, the motivations for refinancing, and the eligibility criteria are essential steps in the refinancing process. It’s important to carefully consider the potential benefits and risks, weighing them against your financial goals and circumstances.

When embarking on the refinancing journey, take the time to research and compare multiple lenders. Look for competitive interest rates, flexible repayment options, and superior customer service. Additionally, pay close attention to the terms and conditions of the refinanced loan, ensuring you fully understand the implications and any associated costs.

Successful loan refinancing relies on being proactive and organized. Check your credit score, gather the necessary documentation, and calculate the potential savings to make an informed decision. It’s crucial to review your budget and ensure that the refinanced loan aligns with your financial goals and current and future obligations.

Remember, refinancing parent student loans is not suitable for everyone. Some borrowers may benefit more from federal loan protections or may not meet the creditworthiness requirements for refinancing. In such cases, loan consolidation or other financial strategies may be more appropriate.

In conclusion, refinancing parent student loans can provide significant financial relief and improved management of personal finances. By understanding the process, evaluating the factors involved, and taking the necessary steps for a successful refinancing experience, parents can regain control of their financial future and pave the way for a more secure financial well-being.

Now armed with the knowledge and insights gained from this article, you can confidently explore the option of refinancing your parent student loans and make a decision that suits your unique financial circumstances.