Finance

How To Report Cash Income To The IRS

Published: October 31, 2023

Learn how to report cash income to the IRS and stay compliant with your finances. Get expert tips and guidance on managing your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to income, most people are aware that they need to report their earnings to the Internal Revenue Service (IRS) to ensure compliance with tax regulations. However, what about cash income? Many individuals receive cash payments for various reasons, such as gig work, side jobs, or tips, and may be unsure of how to properly report this income to the IRS.

Cash income refers to any money received in the form of physical currency, whether it’s in the form of cash, checks, or money orders. Whether you earn cash income regularly or occasionally, it’s essential to understand your obligations and responsibilities when it comes to reporting it to the IRS.

In this article, we will explore the various aspects of reporting cash income to the IRS and provide you with valuable information to help you navigate through this process. Understanding how to report cash income accurately can save you from potential penalties and legal trouble, while also ensuring that you comply with all tax regulations.

So, if you’re ready to learn how to report cash income to the IRS effectively, let’s dive in and explore the necessary steps you need to take.

Understanding Cash Income

Cash income encompasses any money you receive in the form of physical currency, including cash, checks, or money orders. This type of income can come from a variety of sources, such as freelance work, side jobs, tips, or even occasional sales of personal belongings.

It’s important to note that cash income is not limited to traditional employment scenarios. It can also include income from non-traditional work arrangements, such as gig economy platforms like Uber or Airbnb. If you receive funds directly from clients or customers without any taxes withheld, it is considered cash income.

Furthermore, it’s crucial to understand that even if you don’t receive a 1099-MISC form from the payer, you are still legally responsible for reporting all of your cash income to the IRS. The responsibility falls on your shoulders to accurately track and report this income.

When it comes to reporting cash income, it’s important to maintain accurate records. Keeping detailed records of the income you receive is vital for both tax purposes and personal financial management. By documenting your cash income, you can track your earnings, differentiate between taxable and non-taxable income, and ensure you are meeting your tax obligations.

While cash income can seem less formal than other types of income, it must still be reported to the IRS. Failure to report cash income can result in penalties, fines, and potential legal consequences. To avoid these issues, it’s crucial to understand how to report cash income properly.

In the next section, we will discuss the steps involved in reporting cash income to the IRS, ensuring you fulfill your tax obligations and avoid any negative repercussions.

Reporting Cash Income to the IRS

When it comes to reporting cash income to the IRS, it’s essential to be diligent and accurate in your reporting. Here are the key steps you should take:

- Keep detailed records: As mentioned earlier, maintaining thorough records is crucial. Keep track of all cash income you receive, including dates, sources, and amounts. This will help you accurately report your earnings and provide evidence if needed.

- Report all income: Regardless of the amount, it’s crucial to report all your cash income to the IRS. Remember that even if you don’t receive a 1099-MISC form, you are still obligated to report your earnings. The IRS expects you to report all income, whether it is in cash or any other form.

- Use appropriate forms: When it comes to reporting cash income, there are specific forms you need to use. If you are self-employed or earn income from a business, you will likely need to use Schedule C or Schedule C-EZ. If your cash income comes from a non-business source, such as tips or occasional sales, you may need to report it on Schedule 1 of your tax return.

- Record cash income on your tax return: Make sure you accurately record your cash income on the appropriate forms when filing your tax return. Reporting your income correctly will help calculate your tax liability accurately and prevent any potential discrepancies.

- Include all necessary information: When reporting cash income, provide all the information requested on the forms, such as payer details, income amounts, and any relevant expenses. This will help ensure transparency and accuracy in your tax reporting.

It’s important to note that cash income may be subject to self-employment taxes, depending on the source and amount of your earnings. Self-employment taxes include both Social Security and Medicare taxes, which you may need to pay in addition to your regular income tax.

If you have any doubts or questions regarding reporting cash income to the IRS, it’s best to consult with a tax professional or an accountant. They will provide guidance tailored to your specific situation, ensuring compliance with tax laws and regulations.

Next, let’s explore the importance of tracking cash income and the methods you can use to keep accurate records.

Tracking Cash Income

In order to accurately report your cash income to the IRS, it’s crucial to keep thorough records and track your earnings. Here are some methods and tips to help you effectively track your cash income:

- Maintain a dedicated record system: Set up a system to keep track of your cash income. This can be done digitally using accounting software, spreadsheets, or even a dedicated app designed for income tracking. Alternatively, you can use a physical ledger or notebook to manually record your earnings.

- Create separate categories: Depending on the sources of your cash income, consider creating separate categories to differentiate and track your earnings. For example, if you work multiple side jobs, you can create separate categories for each job, making it easier to track income from different sources.

- Document all transactions: Whenever you receive cash income, be diligent in recording the date, amount, and source of the payment. If possible, include additional details such as the nature of the work performed or any specific project or client associated with the income.

- Keep supporting documents: In addition to recording the income, it’s important to keep supporting documents such as invoices, receipts, or any other relevant paperwork related to the cash transactions. These documents can serve as evidence if the IRS ever audits your records.

- Regularly reconcile your records: Set aside time on a regular basis to review and reconcile your records. This will help ensure accuracy and identify any discrepancies or errors in your income tracking.

- Utilize digital tools for convenience: There are various digital tools available that can help simplify the process of tracking cash income. These tools can automate certain tasks, provide real-time income reports, and offer convenient features like easy data entry and expense tracking.

By consistently tracking your cash income, you can establish a reliable record-keeping system that not only helps with tax reporting but also allows you to assess your overall financial situation and make well-informed decisions about your income and expenses.

Remember, accurate record-keeping is crucial when it comes to reporting cash income. It not only demonstrates your compliance with tax regulations but also provides you with a clear understanding of your financial health and helps you maintain a strong financial foundation.

Next, let’s delve into the specific forms you may need to use when reporting your cash income to the IRS.

Forms for Reporting Cash Income

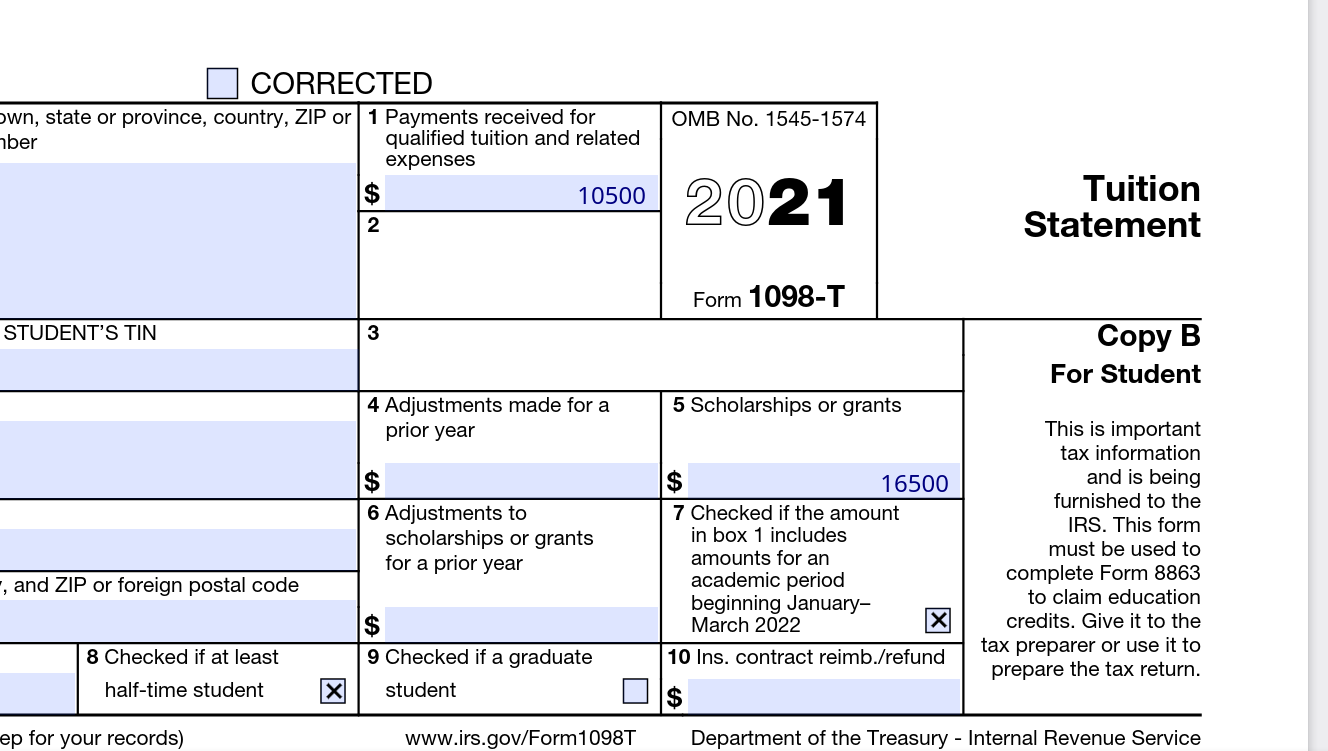

When it comes to reporting your cash income to the IRS, there are specific forms you may need to use, depending on the nature of your earnings. Here are some common forms used for reporting cash income:

- Schedule C: If you are self-employed or have income from a business, you will likely need to use Schedule C or Schedule C-EZ. These forms are used to report income and expenses from a sole proprietorship, including cash income. You will need to provide details about your business, such as its name, industry, and expenses incurred.

- Schedule C-EZ: The Schedule C-EZ is a simplified version of the Schedule C and is used for reporting self-employed income if your business expenses are minimal. It requires fewer details compared to the regular Schedule C but still allows you to report your cash income accurately.

- Schedule 1: If your cash income comes from non-business sources, such as tips, occasional sales, or rental income, you may need to report it on Schedule 1 of your tax return. This form allows you to report additional income that does not fit into other categories, such as wages or salaries.

- Form 1040: Form 1040 is the standard individual income tax return form. It serves as the main form for reporting your income, including any cash income. Depending on your situation, you may need to attach additional schedules, such as Schedule C or Schedule 1, to accurately report your cash income.

- Form 1099-MISC: While this form is typically used by businesses to report income paid to independent contractors, it’s worth mentioning that receiving a Form 1099-MISC is not the only trigger for reporting cash income to the IRS. Even if you don’t receive a 1099-MISC, you are still required to report your cash income.

It’s important to use the appropriate forms when reporting your cash income. Filling out these forms accurately and providing all the necessary information will ensure that your income is reported correctly on your tax return.

If you’re uncertain about which forms to use or how to accurately report your cash income, it’s advisable to consult with a tax professional or an accountant. They can provide guidance tailored to your specific situation and help you navigate the reporting process with confidence.

Next, let’s discuss the deductions and expenses you may be eligible to claim for your cash income.

Deductions and Expenses for Cash Income

When reporting cash income to the IRS, it’s important to understand that you may be eligible to claim deductions and expenses related to your earnings. These deductions can help reduce your taxable income and potentially lower the amount of tax you owe. Here are some common deductions and expenses you may be able to claim:

- Business Expenses: If your cash income comes from a business or self-employment, you may be able to deduct expenses related to running your business. This can include costs such as supplies, advertising, equipment, office space, and professional services. Keep detailed records of these expenses and consult with a tax professional to determine which expenses are eligible for deduction.

- Home Office Deduction: If you use a portion of your home exclusively for your business or self-employment activities, you may be eligible for a home office deduction. This deduction allows you to deduct a portion of your rent or mortgage interest, utilities, and other home-related expenses. However, be aware that there are specific criteria and limitations for claiming this deduction.

- Mileage Deduction: If you use your vehicle for business purposes, you may be able to deduct the mileage related to your business activities. Keep a record of your business-related trips, including the purpose, date, and mileage. The IRS provides standard mileage rates that are updated annually, which you can use to calculate your deduction.

- Educational Expenses: If you spent money on education or training related to your cash income activities, you may be able to deduct these expenses. These can include courses, workshops, conferences, and professional development materials that enhance your skills and knowledge for your business or self-employment.

- Health Insurance Premiums: If you are self-employed or a small business owner, you may be eligible to deduct the premiums you pay for health insurance coverage for yourself, your spouse, and your dependents. This deduction can help reduce your taxable income and potentially lower your overall tax liability.

It’s worth noting that deducting expenses requires proper documentation and adherence to IRS regulations. Keep thorough records of your expenses, including receipts, invoices, and any other relevant documentation that supports your claims.

Consulting with a tax professional or accountant is recommended to ensure that you are accurately claiming deductions and expenses for your cash income. They can provide guidance specific to your situation and help you optimize your tax deductions while staying in compliance with tax laws.

Now, let’s explore the potential penalties you may face for underreporting your cash income to the IRS.

Penalties for Underreporting Cash Income

Underreporting cash income to the IRS can have serious consequences. It’s crucial to accurately report your earnings to avoid potential penalties and legal issues. Here are some penalties you may face for underreporting your cash income:

- Accuracy-Related Penalties: If the IRS determines that you intentionally underreported your cash income or provided false information on your tax return, you may be subject to accuracy-related penalties. These penalties can range from 20% to 40% of the underreported amount, depending on the circumstances.

- Interest on Underpaid Taxes: If you underreport your cash income and as a result, underpay your taxes, the IRS will charge interest on the outstanding balance. The interest rate is determined by the IRS and is compounded daily, so the longer you wait to resolve the underpayment, the higher the interest amount will be.

- Civil Fraud Penalties: If the IRS finds evidence of intentional fraud or willful evasion of taxes, you may face civil fraud penalties. These penalties can be as high as 75% of the underreported tax liability and can result in additional legal consequences.

- Criminal Charges: In severe cases of deliberate tax evasion or fraud, criminal charges may be brought against individuals who underreport their cash income. This can lead to fines, penalties, and even imprisonment, depending on the severity of the offense.

- Loss of Future Tax Benefits: Underreporting cash income can also result in the loss of certain tax benefits or opportunities in the future. For example, if you apply for a loan or mortgage, your underreported income may be discovered during the financial institution’s review process, leading to potential negative consequences.

It’s essential to understand that the IRS has various methods for detecting underreported income, such as comparing reported income to industry averages, conducting audits, and utilizing sophisticated data analysis techniques.

To avoid these penalties, it’s best to accurately report all your cash income to the IRS. Keep thorough records, consult with tax professionals, and maintain transparency in your tax reporting. By being proactive and diligent, you can ensure compliance with tax regulations and protect yourself from potential penalties and legal troubles.

Let’s wrap up the article with a summary of the key points.

Conclusion

Reporting cash income to the IRS is a vital responsibility for individuals across various industries and work arrangements. Understanding how to accurately report and track your cash income ensures compliance with tax regulations and helps you avoid potential penalties.

In this article, we discussed the importance of understanding cash income and the need to report it to the IRS. We also explored the key steps involved in reporting cash income, such as keeping detailed records, using appropriate forms, and accurately recording income on your tax return. Furthermore, we highlighted the deductions and expenses you may be eligible to claim and the potential penalties for underreporting cash income.

To report your cash income effectively, it’s crucial to establish a reliable record-keeping system, track your earnings, and consult with professionals when needed. By maintaining accurate records and reporting your income correctly, you can ensure compliance, optimize your deductions, and have peace of mind knowing that you have fulfilled your tax obligations.

Remember that financial responsibility and transparency are key when it comes to cash income reporting. Be diligent in tracking your income, keep detailed records, and consult with experts whenever necessary. By doing so, you can navigate the tax reporting process with confidence and avoid any negative consequences associated with underreporting cash income.

Disclaimer: The information provided in this article is for educational purposes only and does not constitute legal or financial advice. Consult with a tax professional for personalized guidance related to your specific situation.