Finance

How To A Report Company To The IRS

Modified: February 21, 2024

Learn how to report a company to the IRS for finance-related issues. Take the necessary steps to ensure compliance and address any concerns you may have.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance! As a business owner or individual taxpayer, it is important to understand the various reporting requirements imposed by the Internal Revenue Service (IRS). Filing reports with the IRS ensures compliance with tax laws and helps maintain transparency in financial activities. One such important report is the submission of company information to the IRS.

Submitting a report to the IRS about your company can be a daunting task, especially if you are unfamiliar with the process. However, with the right knowledge and guidance, you can navigate through the steps involved and submit the required information accurately and timely. This article will provide a comprehensive guide on how to report company information to the IRS.

Before diving into the steps, it is important to emphasize the significance of reporting company information. The IRS relies on this information to enforce tax regulations, track taxpayer activities, and ensure the accuracy of financial data. By reporting your company information, you contribute to the overall integrity of the tax system and help support the economy.

Now, let’s move on to the step-by-step process of reporting company information to the IRS. This guide will walk you through the necessary information to gather, the appropriate forms to use, how to fill out the forms, and the submission process. Following these steps will help streamline the reporting process and avoid any penalties or compliance issues.

Step 1: Gather Necessary Information

Before you begin the process of reporting company information to the IRS, it’s crucial to gather all the necessary information. Having the required details readily available will streamline the process and ensure you provide accurate and complete information. Here are some key pieces of information you need to gather:

- Company Information: Collect all relevant details about your company, including its legal name, address, and contact information. This information will be used to identify your company in the IRS records.

- EIN or SSN: Obtain your company’s Employer Identification Number (EIN) or your Social Security Number (SSN). This unique identifier is crucial for tax purposes and is necessary for reporting your company information to the IRS.

- Financial Records: Gather all financial records, including income statements, balance sheets, cash flow statements, and any other relevant financial documents. These records will be used to accurately report your company’s financial activities.

- Employee Information: If you have employees, collect their information, including names, addresses, and Social Security Numbers. This information is needed for reporting wages, salaries, and other compensation to the IRS.

- Business Structure: Determine the legal structure of your business, such as sole proprietorship, partnership, corporation, or LLC. This information will impact the type of form you need to file with the IRS.

- Industry Codes: Identify the industry code that best represents your business activities. The IRS uses these codes to classify different types of businesses for statistical and reporting purposes.

- Other Relevant Information: Depending on your specific circumstances, gather any additional information that may be required for reporting purposes. This may include information related to foreign assets, international transactions, or specialized tax credits or deductions.

By gathering all the necessary information before you begin the reporting process, you’ll save time and avoid potential errors or omissions. It is always a good practice to keep these records organized and up to date throughout the year, as this will facilitate the reporting process when the time comes.

Step 2: Determine the Correct Form to Use

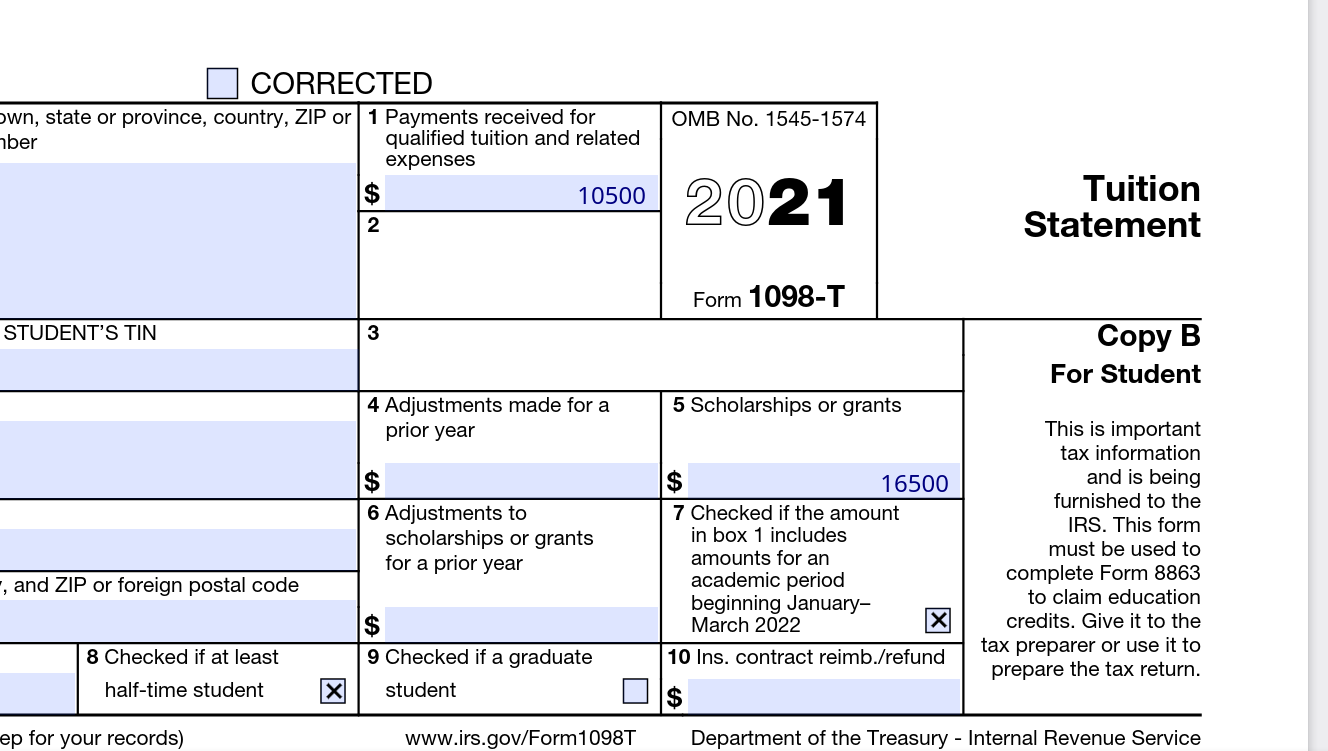

Once you have gathered all the necessary information, the next step is to determine the correct form to use when reporting your company information to the IRS. The specific form you need will depend on the type of business entity you have and the purpose of the report. Here are some common forms you may need to consider:

- Form 1040: If you are a sole proprietor or a single-member LLC, you will use Form 1040, Schedule C to report your business income and expenses.

- Form 1065: If you are in a partnership, you will need to file Form 1065, U.S. Return of Partnership Income. This form reports the partnership’s income, deductions, and distributes the profits or losses to partners.

- Form 1120: If your business is a corporation, you will need to file Form 1120, U.S. Corporation Income Tax Return. This form reports the corporation’s income, deductions, and credits.

- Form 1120S: If your business is an S corporation, you will file Form 1120S, U.S. Income Tax Return for an S Corporation. This form reports the corporation’s income, deductions, and credits, and passes the income or loss to the shareholders.

- Form 990: If your company is a tax-exempt organization, such as a non-profit or charity, you will need to file Form 990, Return of Organization Exempt from Income Tax. This form reports the organization’s financial activities and ensures compliance with tax-exempt status requirements.

It is important to carefully review the instructions for each form to ensure you choose the appropriate one that corresponds to your business entity. Using the wrong form can result in errors, delays, or even penalties from the IRS. Additionally, be aware that there may be specific additional forms or schedules that need to be filed along with the main form, depending on your business activities and circumstances.

If you are unsure of which form to use, it is advisable to consult with a tax professional or accountant who can provide guidance based on your specific situation. They will have the expertise to navigate the complexities of the tax code and ensure accurate reporting.

Once you have determined the correct form to use, you can proceed to the next step of filling out the form with the gathered information.

Step 3: Fill Out the Form

After determining the correct form to use for reporting your company information to the IRS, it’s time to fill out the form with the gathered information. The process of filling out the form will vary depending on the specific form and your business entity. Here are some general guidelines to follow:

- Read the Instructions: Start by carefully reading the instructions provided with the form. The instructions will provide detailed guidance on how to fill out the form and any specific requirements or additional forms that may be needed.

- Enter Company Information: Begin by entering your company’s legal name, address, and other identifying information as requested on the form. Ensure that the information is accurate and matches the records you have gathered.

- Provide Financial Information: Depending on the form, you will need to report various financial information such as income, expenses, assets, liabilities, and any credits or deductions. Follow the instructions on the form to fill in the financial details accurately.

- Include Employee Information: If you have employees, you may need to report their wages, salaries, and any other compensation. Enter the employee information as required, including their names, addresses, and Social Security Numbers.

- Attach Additional Schedules or Forms: Depending on your business activities, you may need to attach additional schedules or forms to provide more detailed information. Be sure to review the instructions to determine if any additional documentation is required.

- Double-Check and Review: Before submitting the form, carefully review all the information entered for accuracy. Check for any missing or incomplete information and make any necessary corrections.

- Sign and Date: Once you have completed filling out the form, don’t forget to sign and date it. Failure to sign the form may result in it being considered incomplete.

It’s worth noting that some businesses may have more complex reporting requirements or may need to complete additional forms or schedules. In such cases, it is advisable to consult with a tax professional or accountant to ensure compliance with all the necessary reporting obligations.

Additionally, consider keeping a copy of the filled-out form and any supporting documentation for your records. This will help you maintain proper documentation and provide you with a reference point in the event of an audit or future inquiries.

With the form filled out, you’re ready to move on to the next step of submitting the report to the IRS.

Step 4: Submit the Report to the IRS

Once you have completed filling out the form with your company’s information, it’s time to submit the report to the Internal Revenue Service (IRS). The submission process can vary depending on the form and your preferred method of filing. Here are the common methods for submitting your report:

- Electronic Filing: The IRS encourages taxpayers to file their reports electronically, as it is faster, more secure, and reduces processing errors. Depending on the form you are filing, you may have the option to e-file directly through the IRS website or by using authorized tax software.

- Mail-In Paper Filing: If you prefer to file a paper form, you can print a copy of the completed form and mail it to the appropriate IRS address. Ensure that you use the correct mailing address provided in the instructions for the specific form you are filing.

- Private Delivery Service: If you are using a private delivery service to send your report, make sure to use a service that the IRS recognizes. Check the IRS website or consult the instructions for a list of approved private delivery services and the correct address to use.

It is important to note that different forms may have different filing deadlines. Make sure you are aware of the specific due dates for the form you are filing to avoid any late filing penalties or interest charges.

When submitting your report, consider sending it by certified mail or using a tracking service. This will provide proof of delivery and ensure that you have a record of the submission should any issues arise in the future.

After you have submitted the report, it is a good practice to retain a copy of the submitted form and any supporting documentation for your records. This will help you in case you need to reference the information in the future or respond to any IRS inquiries or audits.

Lastly, remember that the IRS may require additional documentation or request further information after you have filed your report. Stay organized and promptly respond to any requests to ensure compliance with their requirements.

Now that you have successfully submitted your report to the IRS, let’s move on to the final step of following up and maintaining documentation.

Step 5: Follow Up and Maintain Documentation

After submitting your report to the IRS, it’s important to follow up and maintain proper documentation for future reference and audit purposes. Here are some key steps to take:

- Confirmation of Receipt: If you filed electronically, you may receive a confirmation email or receipt from the IRS acknowledging the receipt of your report. Keep this confirmation in a safe place as proof of filing.

- Record Retention: Maintain a copy of the submitted report, along with any supporting documentation, for a minimum of three to seven years. This is the recommended period for retaining business records as per IRS guidelines.

- Organize Your Records: Develop a system to organize the filed reports and associated documents. This will make it easier to locate specific information when needed, especially during tax audits or if you need to refer back to the report in the future.

- Track Deadlines: Stay updated on the filing deadlines for future reporting requirements. Maintaining a calendar or reminders will help you stay compliant and avoid penalties for late filing.

- Review for Errors: Periodically review the filed reports and documentation to ensure accuracy. If you identify any errors or discrepancies, take the necessary steps to amend the report or contact the IRS for guidance.

- Stay Informed: Keep up with any changes or updates in tax laws, forms, or reporting requirements that may impact your future filings. This can be done through IRS publications, newsletters, or by consulting with a tax professional.

Properly maintaining your records provides you with a sense of security and ensures that you can readily access the information needed to address any IRS inquiries or audits. Having well-organized and easily retrievable documentation will give you peace of mind and help streamline future reporting processes.

Remember, it is crucial to consult with a tax professional or accountant when dealing with complex reporting requirements or if you have any specific questions or concerns. They can provide expert advice tailored to your unique situation, ensuring compliance with tax regulations and minimizing any potential issues.

By following these steps and diligently maintaining your documentation, you can navigate the process of reporting company information to the IRS smoothly and accurately.

Finally, congratulations on completing the process of reporting company information to the IRS! Your commitment to accurate reporting and compliance contributes to maintaining the integrity of the tax system and helps support a fair financial environment for all.

Conclusion

Reporting company information to the IRS is an essential responsibility for every business owner or individual taxpayer. By following the step-by-step guide outlined in this article, you can navigate through the process with confidence and ensure compliance with tax regulations.

Starting with gathering all the necessary information, such as company details, EIN/SSN, financial records, and employee information, you are well-prepared to move on to determining the correct form to use. Carefully reviewing the instructions and filling out the form accurately is crucial in providing the IRS with the required information.

Submitting the report to the IRS can be done electronically or through mail-in paper filing, depending on your preference and the form requirements. Following up by retaining a copy of the submitted report and maintaining proper documentation will establish a well-organized record-keeping system for future reference and audit purposes.

By diligently following these steps and staying informed about any changes in tax laws or reporting requirements, you can remain compliant and avoid potential penalties or issues with the IRS.

Remember, when in doubt, seek the guidance of a tax professional or accountant who can provide expert advice tailored to your specific circumstances. They can help ensure accurate reporting, minimize risks, and maximize tax benefits.

Reporting company information to the IRS is an essential part of responsible financial management. Your cooperation in this process plays a vital role in maintaining the integrity of the tax system and supporting a fair and transparent financial environment for all.

So, embrace the task of reporting company information to the IRS with confidence and take pride in your commitment to compliance and financial transparency.