Finance

How To Secure A Mortgage With Bad Credit

Published: January 6, 2024

Learn how to secure a mortgage even with bad credit. Get expert advice on finance options and improve your chances of loan approval.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Bad Credit

- Factors Affecting Mortgage Approval with Bad Credit

- Steps to Secure a Mortgage with Bad Credit

- Improving Your Credit Score

- Saving for a Larger Down Payment

- Seeking Professional Mortgage Advice

- Employing Co-Signers or Guarantors

- Exploring Alternative Mortgage Options

- Conclusion

Introduction

Securing a mortgage is an important step in fulfilling the dream of owning a home. However, if you have a bad credit history, obtaining a mortgage can seem like a daunting task. Bad credit can result from various factors such as past late payments, bankruptcy, or high levels of debt. It can significantly affect your ability to get approved for a mortgage and may result in higher interest rates or lower loan amounts.

While having bad credit can be a barrier, it doesn’t mean that homeownership is out of reach. With careful planning and strategic steps, it is possible to secure a mortgage even with bad credit. This article will outline the factors that affect mortgage approval with bad credit and provide practical steps to improve your chances of obtaining a mortgage.

It is important to note that each situation is unique, and there is no one-size-fits-all approach. The strategies discussed here are general guidelines that can help increase your likelihood of getting approved for a mortgage. Consulting with a professional mortgage advisor or financial expert is advisable to tailor these strategies to your specific circumstances.

Now, let’s delve deeper into understanding bad credit and explore the factors that can influence mortgage approval with bad credit.

Understanding Bad Credit

Before diving into the process of securing a mortgage with bad credit, it’s essential to understand what bad credit actually means. Bad credit is a term used to describe a low credit score, which is typically a result of a history of missed payments, high credit card balances, or defaulting on loans.

When you apply for a mortgage, lenders will review your credit history and credit score to assess your creditworthiness. A credit score is a numerical representation of your creditworthiness, ranging from 300 to 850. A lower credit score indicates a higher level of risk for the lender.

Some common factors that contribute to bad credit include:

- Missed or late payments on credit cards, loans, or utility bills

- High credit card balances or maxed-out credit cards

- Bankruptcy or foreclosure

- Collection accounts or defaulted loans

Having bad credit can make it challenging to secure a mortgage as lenders may perceive you as a higher risk borrower. However, it’s important to remember that bad credit is not a permanent condition. With time and effort, you can improve your credit score and increase your chances of qualifying for a mortgage.

One way to start understanding and managing your credit is to request a credit report from one of the major credit reporting agencies – Equifax, Experian, or TransUnion. Review your credit report for any errors or inaccuracies that could be negatively impacting your credit score. Dispute any errors and work on resolving any outstanding debts or late payments.

In the next section, we will discuss the factors that can influence mortgage approval with bad credit and provide steps to improve your credit score.

Factors Affecting Mortgage Approval with Bad Credit

When applying for a mortgage with bad credit, it’s important to understand the factors that lenders consider when evaluating your application. While bad credit can present challenges, lenders take into account multiple factors to determine whether to approve your mortgage application.

Here are some key factors that affect mortgage approval with bad credit:

1. Credit Score

Your credit score plays a significant role in mortgage approval. Lenders typically have minimum credit score requirements, and having a higher credit score increases your chances of getting approved. While specific credit score requirements may vary among lenders, a score above 620 is generally considered the threshold for conventional mortgage loans. However, some lenders may offer options for borrowers with lower credit scores.

2. Debt-to-Income Ratio

Your debt-to-income ratio (DTI) is the percentage of your monthly gross income that goes towards paying your debts. Lenders assess your DTI to determine your ability to repay the mortgage. A high DTI ratio can indicate a higher risk for lenders. Generally, a DTI ratio of 43% or lower is preferred for conventional mortgages. However, certain loan programs may allow higher DTI ratios for borrowers with compensating factors.

3. Employment History and Income

Lenders also consider your employment history and income stability. A consistent employment history and steady income can help demonstrate your ability to make mortgage payments on time. Lenders typically look for a stable work history and prefer borrowers who have been employed with the same employer for at least two years.

4. Down Payment

The amount of down payment you can provide can significantly impact your mortgage approval. A larger down payment demonstrates your commitment and reduces the loan amount needed. While conventional loans generally require a down payment of 20%, some specialized loan programs may offer options for lower down payments.

5. Loan-to-Value Ratio

The loan-to-value (LTV) ratio is the percentage of the loan amount compared to the appraised value or purchase price of the property. A lower LTV ratio indicates a lower risk for lenders. With bad credit, lenders may require a lower LTV ratio to mitigate the risk associated with the borrower’s credit history.

These are some of the key factors that lenders consider when evaluating mortgage applications from borrowers with bad credit. In the next section, we will discuss practical steps you can take to improve your credit score and increase your chances of securing a mortgage with bad credit.

Steps to Secure a Mortgage with Bad Credit

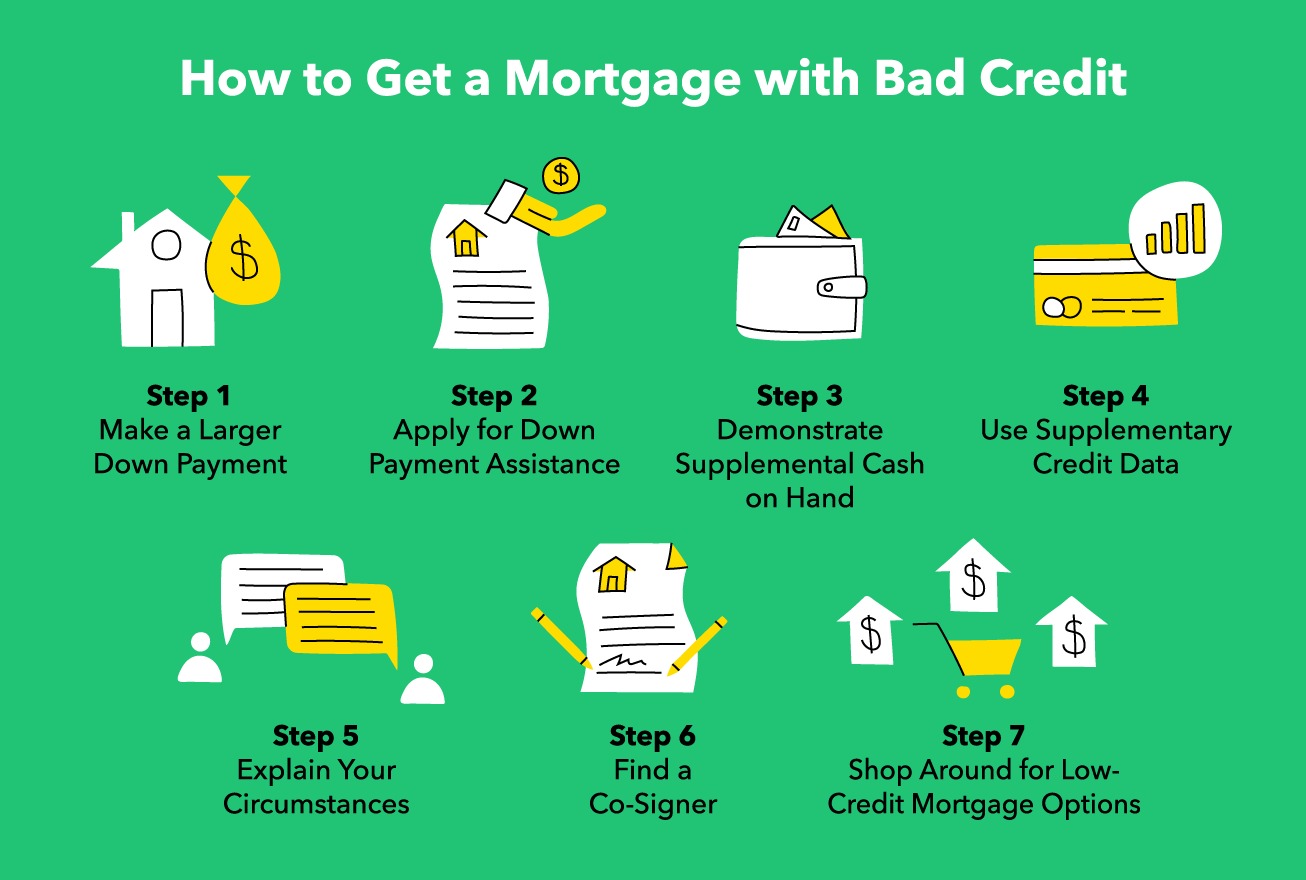

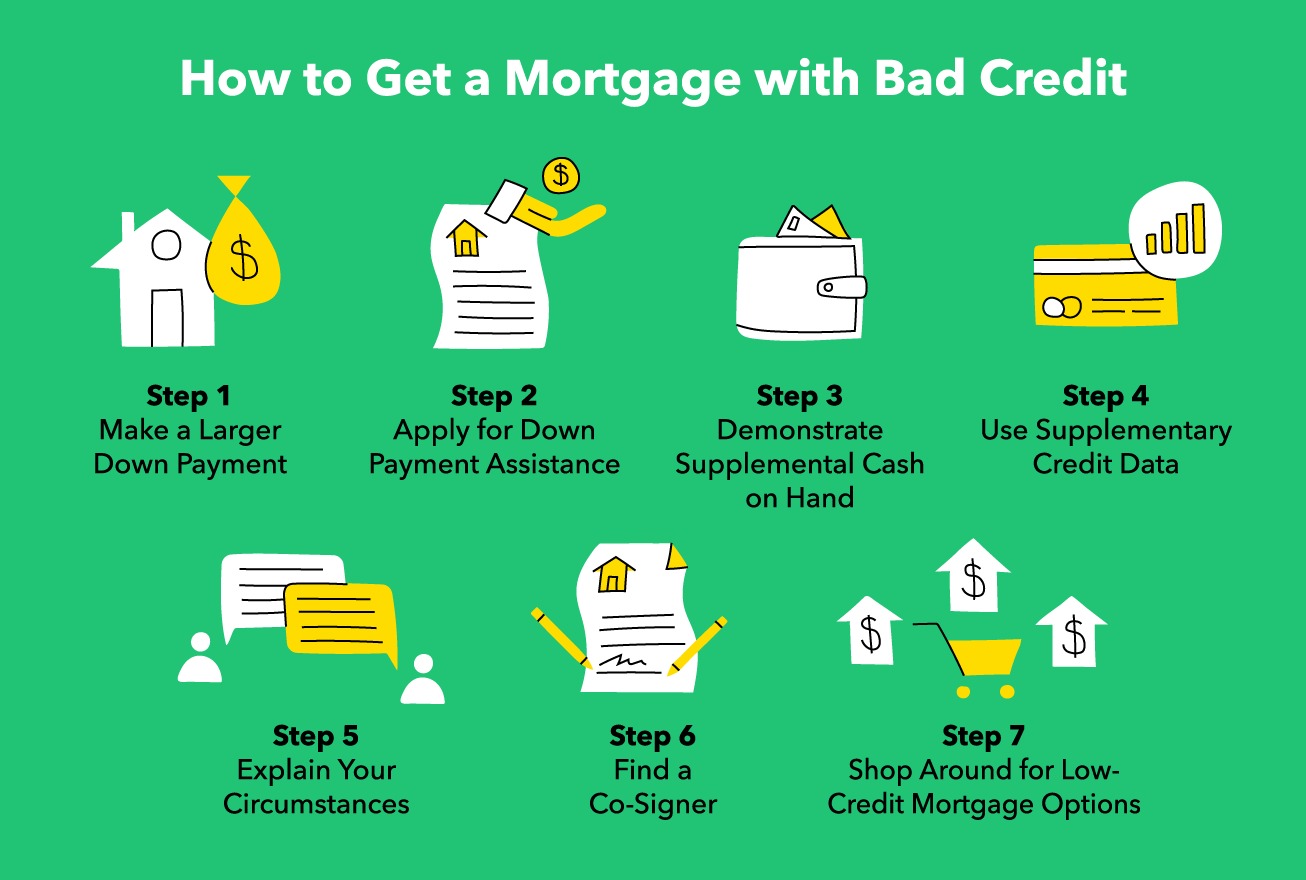

Securing a mortgage with bad credit may require some extra effort and strategic planning. While it may be more challenging, it’s not impossible. By following these steps, you can increase your chances of securing a mortgage even with bad credit:

1. Improve Your Credit Score

The first step towards securing a mortgage with bad credit is to work on improving your credit score. This can be done by making timely payments, reducing your credit card balances, and avoiding any new debts or late payments. Additionally, consider working with a credit counselor who can help you develop a plan to improve your credit.

2. Save for a Larger Down Payment

A larger down payment can help offset the impact of bad credit on your mortgage application. By saving up a significant down payment, you can reduce the loan amount required and demonstrate your commitment to the purchase. Aim for a down payment of at least 20% if possible, as it can help you qualify for more favorable loan terms.

3. Seek Professional Mortgage Advice

Consulting with a professional mortgage advisor who has experience working with borrowers with bad credit can be invaluable. They can guide you through the mortgage process, explain your options, and help you understand the requirements and steps needed to secure a mortgage with bad credit. Their expertise can be crucial in finding the right loan program for your situation.

4. Consider Employing Co-Signers or Guarantors

If your bad credit is making it difficult to secure a mortgage on your own, you may consider enlisting a co-signer or guarantor. A co-signer is someone with good credit who agrees to take joint responsibility for the loan. A guarantor, on the other hand, provides a guarantee that the loan will be repaid. Having a co-signer or guarantor can provide additional assurance to lenders and improve your chances of getting approved.

5. Explore Alternative Mortgage Options

If traditional lenders are hesitant to approve your mortgage application, consider exploring alternative mortgage options. There are specialized loan programs designed for borrowers with bad credit, such as FHA loans or VA loans. These programs may have more flexible requirements and lower credit score thresholds, making it easier to secure a mortgage.

Remember, each person’s situation is unique, and there is no one-size-fits-all approach when it comes to securing a mortgage with bad credit. By taking these steps, you can increase your chances of obtaining a mortgage and fulfilling your dream of homeownership. With patience, perseverance, and the right guidance, you can overcome the challenge of bad credit and embark on your journey as a homeowner.

Improving Your Credit Score

Improving your credit score is key to securing a mortgage with bad credit. While it may take time and effort, there are practical steps you can take to boost your creditworthiness and increase your chances of approval:

1. Pay Your Bills on Time

One of the most important factors in building a good credit history is making timely payments. This applies to all your bills, including credit cards, loans, and utilities. Set up automatic payments or reminders to ensure you never miss a due date. Consistently making on-time payments can positively impact your credit score over time.

2. Reduce Credit Card Balances

High credit card balances can negatively impact your credit score. Aim to keep your credit card balances below 30% of their credit limits. If possible, pay off your balances in full each month to demonstrate responsible credit usage. Paying down your credit card debt can help improve your credit utilization ratio, which is an important factor in calculating your credit score.

3. Avoid Opening New Credit Accounts

Opening multiple new credit accounts can be seen as a red flag for lenders. It may indicate financial instability or an increased risk of accumulating more debt. Avoid opening unnecessary credit accounts, particularly during the mortgage application process. Focus on managing and improving your existing credit accounts instead.

4. Check Your Credit Report for Errors

Regularly review your credit report to ensure its accuracy. Look for any errors, such as accounts that don’t belong to you or incorrect payment information. Dispute any inaccuracies and work with the credit reporting agencies to resolve them. Cleaning up errors on your credit report can have a positive impact on your credit score.

5. Build Positive Credit History

Building a positive credit history can help counteract the negative impact of past credit issues. Consider obtaining a secured credit card or becoming an authorized user on someone else’s credit card to establish positive credit history. Make small purchases and consistently pay them off to demonstrate responsible credit behavior.

6. Be Patient and Persistent

Improving your credit score takes time and consistent effort. Don’t expect overnight results. Stay committed to responsible credit management and be patient as you work towards your goal. Persistent efforts to improve your credit will pay off in the long run when it comes to securing a mortgage.

Remember, every little improvement in your credit score can make a difference when applying for a mortgage. By following these steps and maintaining healthy credit habits, you can steadily improve your creditworthiness and enhance your chances of securing a mortgage with bad credit.

Saving for a Larger Down Payment

Saving for a larger down payment can be a smart strategy when securing a mortgage with bad credit. A larger down payment offers several benefits and can increase your chances of getting approved for a mortgage:

1. Lower Loan-to-Value Ratio

By providing a larger down payment, you reduce the loan amount needed to purchase a home. This results in a lower loan-to-value (LTV) ratio, which is calculated by dividing the loan amount by the appraised value of the property. Lenders typically prefer lower LTV ratios, as they perceive them as less risky. With a lower LTV ratio, you may have a better chance of obtaining mortgage approval, despite having bad credit.

2. Demonstrates Financial Stability

A larger down payment demonstrates your financial stability and commitment to the home purchase. It shows that you have the ability to save a significant amount of money and are willing to invest it in your property. This can help alleviate concerns that lenders may have about your bad credit history, as it indicates your dedication to fulfilling loan obligations.

3. Potential for Lower Interest Rates

Providing a larger down payment can also lead to lower interest rates on your mortgage. This is because a higher down payment reduces the lender’s risk, making you a more attractive borrower. In turn, lenders may offer you more favorable interest rates, which can save you money over the life of the loan.

4. Avoidance of Private Mortgage Insurance (PMI)

If your down payment is less than 20% of the purchase price, lenders may require you to pay for private mortgage insurance (PMI). PMI is an additional cost that protects the lender in case you default on your loan. By saving for a larger down payment and reaching the 20% threshold, you can avoid the extra expense of PMI and reduce your overall monthly mortgage payment.

5. Increased Equity and Flexibility

A larger down payment means you’ll have more equity in the property right from the start. Equity is the difference between the appraised value of your home and the outstanding balance on your mortgage. With a higher equity position, you may have more flexibility in the future, such as the ability to refinance or access home equity loans for home improvements or other financial needs.

While saving for a larger down payment may require discipline and time, the benefits it brings when securing a mortgage with bad credit are worth it. Consider implementing a budgeting plan, cutting unnecessary expenses, and exploring saving strategies to reach your down payment goal. By doing so, you’ll be one step closer to fulfilling your homeownership dreams.

Seeking Professional Mortgage Advice

When navigating the process of securing a mortgage with bad credit, seeking professional mortgage advice can be immensely beneficial. A mortgage advisor is a qualified professional who specializes in helping individuals find the right mortgage options based on their unique financial situations, including those with bad credit.

Why Seek Professional Mortgage Advice?

1. Expert Knowledge: Mortgage advisors are well-versed in the mortgage industry and have a deep understanding of the various loan programs available. They can evaluate your financial situation, including your credit history, and provide personalized guidance to help you identify the most suitable mortgage options.

2. Tailored Guidance: Each person’s financial circumstances are unique, and what works for one individual with bad credit may not work for another. A mortgage advisor can consider your specific situation and provide tailored guidance based on your needs. They can help you understand the requirements and criteria of different loan programs, increasing your chances of securing a mortgage.

3. Access to Multiple Lenders: Mortgage advisors typically have access to a wide range of lenders, including those who specialize in lending to borrowers with bad credit. They can help you explore different options, compare rates and terms, and connect you with lenders who may be more willing to consider your application.

4. Negotiation Assistance: Navigating the mortgage process can be complex, especially for borrowers with bad credit. A mortgage advisor can negotiate on your behalf with lenders to secure the most favorable terms and conditions. They can help you understand the intricacies of mortgage contracts and ensure that you are making informed decisions.

5. Supportive Guidance: Applying for a mortgage can be an overwhelming experience, particularly if you have bad credit. A mortgage advisor can offer emotional support and guidance throughout the process. They can help you stay focused, answer your questions, and provide reassurance during what can sometimes be a stressful journey.

Choosing the Right Mortgage Advisor

When seeking professional mortgage advice, it’s important to choose a knowledgeable and reputable mortgage advisor. Consider the following factors when selecting a mortgage advisor:

– Experience: Look for a mortgage advisor with a proven track record and experience working with borrowers with bad credit.

– Credentials: Seek an advisor who is licensed, certified, and a member of a reputable professional mortgage organization.

– References: Ask for references or testimonials from previous clients to ensure the advisor has a history of providing excellent service.

– Communication: Choose an advisor who communicates clearly, listens to your needs, and is readily available to answer your questions.

By seeking professional mortgage advice, you can navigate the complexities of securing a mortgage with bad credit more effectively. Working with a qualified mortgage advisor can increase your chances of finding the right loan program, obtaining favorable terms, and ultimately achieving your goal of homeownership.

Employing Co-Signers or Guarantors

When faced with bad credit, one option to enhance your prospects of securing a mortgage is to employ a co-signer or guarantor. These individuals can provide an extra layer of financial assurance to lenders, increasing your chances of approval.

Co-Signers

A co-signer is someone who agrees to share the responsibility of the mortgage with you. They have good credit and a strong financial standing, which can help offset your bad credit history in the eyes of lenders. By co-signing the loan, the co-signer is legally obligated to repay the mortgage if you are unable to do so.

Guarantors

A guarantor, similar to a co-signer, provides a guarantee that the loan will be repaid. While they may not be directly responsible for making the monthly mortgage payments, they commit to fulfilling the financial obligations should you default on the loan. A guarantor typically has a good credit history and a stable financial situation, providing lenders with the reassurance they need to approve the mortgage.

The Benefits of Co-Signers or Guarantors

1. Increased Creditworthiness: Co-signers or guarantors with good credit significantly improve your creditworthiness in the eyes of lenders. They demonstrate a lower risk associated with the loan, making it more likely for you to secure a mortgage despite your bad credit history.

2. Access to Better Loan Terms: With a co-signer or guarantor, you may qualify for more favorable loan terms, such as lower interest rates or higher loan amounts. This can greatly benefit you financially and make homeownership more affordable.

3. Potential for Larger Loan Amounts: The financial strength of a co-signer or guarantor may allow you to qualify for a larger loan amount, giving you a greater choice of properties and ensuring that your mortgage aligns with your home buying aspirations.

Choosing the Right Co-Signer or Guarantor

When considering employing a co-signer or guarantor, it’s essential to be thoughtful and selective. Here are some factors to consider:

– Good Credit and Financial Stability: Look for someone with a strong credit history and a stable financial situation. Lenders will closely evaluate the creditworthiness of the co-signer or guarantor, so their financial stability is crucial.

– Trust and Communication: Choose someone you trust and have a strong relationship with, as this is a significant financial commitment. Effective communication is key to ensure all parties are on the same page and understand their responsibilities throughout the mortgage process.

– Legal Implications: It’s important for both parties involved to fully comprehend the legal implications of co-signing or providing a guarantee. Consult with a mortgage advisor or attorney to understand the legal obligations and potential consequences.

Utilizing a co-signer or guarantor is a strategy that can help you overcome the challenges of bad credit when trying to secure a mortgage. However, it’s crucial to approach this option with caution and fully understand the responsibilities and implications involved.

Exploring Alternative Mortgage Options

When you have bad credit, it’s important to explore alternative mortgage options that are specifically designed to cater to borrowers in similar situations. These options can provide more flexibility and increased chances of securing a mortgage:

FHA Loans

The Federal Housing Administration (FHA) offers mortgage loans specifically for borrowers with lower credit scores. FHA loans have more lenient credit requirements, allowing individuals with bad credit to qualify. These loans are insured by the government, which reduces the risk for lenders. With an FHA loan, you can often secure a mortgage with a lower down payment requirement and more favorable terms.

VA Loans

VA loans are available to eligible veterans, active-duty service members, and their spouses. These loans are guaranteed by the Department of Veterans Affairs (VA) and have less stringent credit requirements compared to conventional mortgages. VA loans often provide favorable terms, including low or no down payment options and competitive interest rates.

USDA Loans

The United States Department of Agriculture (USDA) offers mortgage loans for eligible individuals in rural areas. USDA loans provide flexible credit requirements and low down payment options. These loans aim to promote homeownership in rural communities and provide opportunities for borrowers with bad credit to secure a mortgage.

Non-Qualified Mortgage (Non-QM) Loans

Non-Qualified Mortgage loans are designed for borrowers who may not meet the strict criteria of traditional mortgage programs. These loans take into account factors beyond credit scores, such as your ability to repay the loan. Non-QM loans often have more flexible credit requirements and alternative documentation options, making them a viable option for borrowers with bad credit.

Private Lenders and Hard Money Loans

Private lenders and hard money lenders are alternative financing options for borrowers with bad credit. These lenders focus more on the value of the property you wish to purchase and are willing to take on higher-risk borrowers. Private lenders may offer short-term loans with higher interest rates, while hard money loans are typically used for investment properties or quick transactions.

When exploring these alternative mortgage options, it’s important to carefully consider the terms and conditions. While these loans may offer more flexibility for borrowers with bad credit, they often come with higher interest rates and additional fees. Conduct thorough research, compare terms from different lenders, and consult with a mortgage advisor to ensure you understand the details before making a decision.

By exploring these alternative mortgage options, you can broaden your possibilities and increase your chances of securing a mortgage, even with bad credit. These options offer alternative paths to homeownership and provide opportunities for individuals to achieve their dreams of owning a home.

Conclusion

Securing a mortgage with bad credit may present challenges, but it’s not an insurmountable task. By understanding the factors that lenders consider, taking steps to improve your credit score, exploring alternative mortgage options, and seeking professional mortgage advice, you can increase your chances of obtaining a mortgage and achieving your dream of homeownership.

It’s important to remember that patience, perseverance, and careful planning are key throughout the process. Improving your credit score by making timely payments, reducing debt, and building positive credit history can significantly enhance your creditworthiness. Additionally, saving for a larger down payment, employing co-signers or guarantors, and considering alternative mortgage options can provide you with more options and flexibility.

Seeking professional mortgage advice is also crucial. Mortgage advisors can guide you through the process, help you understand the requirements, and provide personalized guidance based on your unique situation. Their expertise and access to various lenders can make a significant difference in finding the right mortgage for you.

Remember to consider alternative mortgage options such as FHA loans, VA loans, USDA loans, non-qualified mortgage loans, and private lenders. These options cater to borrowers with bad credit and offer more flexibility compared to traditional mortgages.

While securing a mortgage with bad credit may require more effort and consideration, it’s important to stay focused on your goal of homeownership. With determination, responsible financial practices, and the right guidance, you can increase your chances of obtaining a mortgage and starting a new chapter as a homeowner.