Finance

Where To Get A Secured Card With Bad Credit

Published: March 2, 2024

Find the best secured credit cards for bad credit and start rebuilding your finances today. Compare options and apply online. Unlock a brighter financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Secured credit cards can be invaluable tools for individuals with poor or limited credit histories. These financial products offer a pathway to rebuild or establish credit, providing a means to demonstrate responsible financial behavior. Despite their benefits, securing a credit card with bad credit can be a daunting task. However, with the right information and guidance, individuals can find reputable sources for secured cards and embark on a journey toward financial empowerment.

Navigating the world of secured credit cards requires a fundamental understanding of their purpose, benefits, and potential drawbacks. This article aims to demystify the process, offering insights into where to find secured cards with bad credit, how to choose the right option, and tips for utilizing these cards effectively to improve credit scores.

By the end of this article, readers will have a comprehensive understanding of secured credit cards, empowering them to make informed decisions and take proactive steps toward achieving their financial goals. Whether you're looking to rebuild your credit or establish a credit history for the first time, the information presented here will serve as a valuable resource on your journey to financial stability and independence.

Understanding Secured Cards

Secured credit cards are financial tools designed to help individuals establish or rebuild their credit. Unlike traditional credit cards, secured cards require the cardholder to provide a security deposit, which serves as collateral in case of default. This deposit also determines the card’s credit limit, with many issuers offering credit limits equal to the amount of the security deposit. For example, a $500 security deposit would typically result in a $500 credit limit.

One of the primary benefits of secured cards is their accessibility to individuals with poor or limited credit history. Since the security deposit mitigates the risk for the card issuer, these cards are often available to applicants with low credit scores or no credit history. By responsibly using a secured card, cardholders can demonstrate their creditworthiness over time, potentially leading to improved credit scores and increased access to traditional credit products.

It’s important to note that while secured cards function similarly to traditional credit cards, they are not prepaid cards. Cardholders are still required to make monthly payments toward their balances, and these payments are reported to the major credit bureaus. This reporting activity can positively impact the cardholder’s credit history when managed responsibly.

Furthermore, some secured card issuers may offer the opportunity to "graduate" to an unsecured credit card after a period of responsible card usage. This transition typically involves a review of the cardholder’s payment history and overall creditworthiness. If approved, the cardholder may receive their security deposit back and continue using the card as an unsecured credit card.

Understanding the nuances of secured cards is essential for individuals seeking to improve their credit standing. By leveraging the benefits of these cards and using them responsibly, cardholders can lay the foundation for a stronger financial future.

Where to Find Secured Cards with Bad Credit

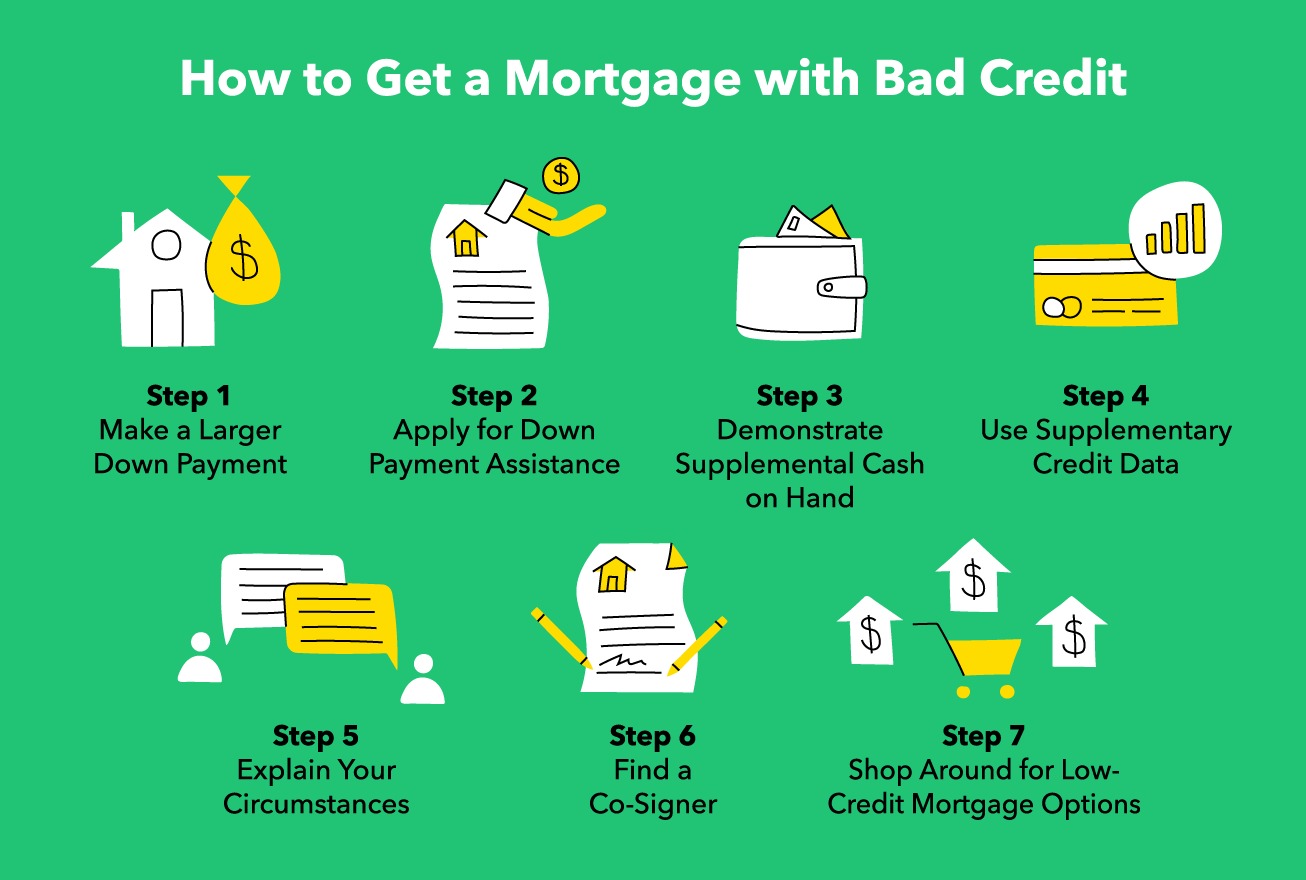

Finding a reputable source for secured credit cards when dealing with bad credit requires careful consideration and research. While many traditional financial institutions offer secured cards, individuals with poor credit may encounter challenges in obtaining approval. Fortunately, several avenues exist for finding secured cards tailored to those with less-than-ideal credit histories.

1. Credit Unions: Credit unions are member-owned financial cooperatives that often have more flexible lending criteria compared to traditional banks. Many credit unions offer secured credit cards with favorable terms, making them a viable option for individuals with bad credit.

2. Online Lenders: In recent years, numerous online lenders and financial technology companies have entered the secured credit card market. These entities may be more willing to work with individuals who have bad credit, providing an opportunity to secure a secured card through a streamlined online application process.

3. Secured Card Issuers: Some financial institutions specialize in offering secured credit cards to individuals with poor credit. These issuers understand the unique needs of this demographic and may be more accommodating when it comes to approval requirements.

4. Credit-Building Programs: Certain organizations and financial service providers offer credit-building programs that include access to secured credit cards. These programs are designed to help individuals improve their credit profiles and may be particularly beneficial for those with bad credit.

5. Prepaid Card Companies: While not traditional secured credit cards, some prepaid card companies offer products that function similarly to secured cards. These cards may report payment activity to the credit bureaus, potentially contributing to the cardholder’s credit history over time.

When exploring these options, it’s crucial to assess the terms and conditions of each secured card offer. Pay close attention to factors such as annual fees, interest rates, and the reporting of payment activity to the major credit bureaus. Additionally, be wary of predatory lenders or issuers that may take advantage of individuals with bad credit. Researching consumer reviews and seeking recommendations from reputable financial sources can help in identifying trustworthy secured card providers.

By exploring these avenues and conducting thorough due diligence, individuals with bad credit can find secured credit card options that align with their financial needs and goals.

How to Choose the Right Secured Card

When selecting a secured credit card, individuals with bad credit should carefully evaluate various factors to ensure they choose a product that aligns with their financial circumstances and goals. The following considerations can help guide the decision-making process:

1. Fees and Interest Rates: Compare the annual fees, application fees, and ongoing interest rates associated with different secured card offers. While individuals with bad credit may encounter higher fees and interest rates, it’s important to seek out options with reasonable and transparent pricing structures.

2. Credit Reporting: Verify that the secured card issuer reports payment activity to all three major credit bureaus: Equifax, Experian, and TransUnion. The primary objective of using a secured card is to build or rebuild credit, so this reporting feature is essential for achieving that goal.

3. Security Deposit Requirements: Understand the minimum and maximum security deposit amounts required by each secured card issuer. Additionally, inquire about the potential for increasing the credit limit over time without an additional deposit, as this can be beneficial for credit utilization ratios.

4. Opportunities for Graduation: Inquire about the issuer’s policy regarding graduating from a secured card to an unsecured card. Knowing whether there is a pathway to potentially reclaim the security deposit and transition to an unsecured card can be a significant factor in the decision-making process.

5. Additional Benefits and Features: Some secured cards offer perks such as cashback rewards, credit education resources, and account management tools. While these features should not be the primary focus when choosing a secured card, they can provide added value and convenience.

6. Issuer Reputation: Research the reputation and track record of each secured card issuer. Look for customer reviews, ratings from independent financial organizations, and any history of regulatory actions or consumer complaints. A reputable issuer is more likely to provide a positive and transparent cardholder experience.

7. Customer Support and Accessibility: Consider the quality of customer service offered by the secured card issuer. Access to responsive and helpful customer support can make a significant difference in addressing any concerns or issues that may arise during the cardholder’s journey.

By carefully weighing these factors and conducting thorough research, individuals can make an informed decision when choosing a secured credit card. Selecting the right card sets the stage for leveraging it effectively to improve credit standing and achieve long-term financial stability.

Tips for Using a Secured Card to Improve Your Credit

Effectively leveraging a secured credit card can significantly contribute to improving one’s credit standing over time. By implementing the following tips, individuals with bad credit can maximize the impact of their secured card usage:

1. Responsible Payment Management: Consistently making on-time payments is crucial for building a positive credit history. Set up automatic payments or reminders to ensure that monthly payments are submitted by the due date, thereby demonstrating responsible financial behavior to creditors and credit bureaus.

2. Credit Utilization Monitoring: Keep credit utilization in check by maintaining a low balance relative to the credit limit. Ideally, aim to utilize no more than 30% of the available credit, as lower credit utilization ratios can positively influence credit scores.

3. Avoiding Overspending: While a secured card provides access to a line of credit, it’s important to use it judiciously. Avoid overspending and strive to keep balances well below the credit limit, as excessive debt relative to the credit line can negatively impact credit scores.

4. Regular Credit Score Monitoring: Stay informed about changes in credit scores by utilizing free credit monitoring services. Monitoring credit scores allows for tracking progress and identifying areas for improvement, empowering individuals to make informed financial decisions.

5. Building a Positive Payment History: Beyond making timely payments on the secured card, aim to build a positive payment history across all credit accounts. Responsible payment behavior across various credit products can enhance overall creditworthiness.

6. Avoiding Opening Multiple Accounts Simultaneously: While it may be tempting to apply for multiple credit accounts, particularly as credit scores improve, opening too many accounts within a short timeframe can raise red flags to creditors and potentially lower credit scores.

7. Regularly Reviewing Credit Reports: Periodically review credit reports from all three major bureaus to ensure accuracy and identify any discrepancies or potential errors. Addressing inaccuracies promptly can prevent negative impacts on credit scores.

8. Patience and Persistence: Building or rebuilding credit with a secured card is a gradual process. It’s essential to remain patient and persistent, as consistent and responsible credit management over time yields positive results.

By incorporating these tips into their financial habits, individuals can harness the full potential of a secured credit card to improve their credit profiles. With dedication and strategic credit management, the path to achieving stronger creditworthiness becomes attainable.

Conclusion

Secured credit cards offer a valuable opportunity for individuals with bad credit to embark on a journey toward credit improvement and financial stability. By understanding the nuances of secured cards and making informed decisions, individuals can leverage these financial tools to build or rebuild their credit profiles effectively.

When seeking secured cards with bad credit, exploring options from credit unions, online lenders, specialized card issuers, credit-building programs, and select prepaid card companies can open doors to accessible and reputable sources. Conducting thorough research and assessing factors such as fees, credit reporting practices, security deposit requirements, and issuer reputation is essential for choosing the right secured card.

Once equipped with a secured card, individuals can employ various strategies to optimize its impact on their credit standing. Responsible payment management, credit utilization monitoring, and regular credit score monitoring are among the key practices that can yield positive results over time. Additionally, maintaining patience, persistence, and a focus on building a positive credit history contribute to the long-term success of using a secured card for credit improvement.

Ultimately, the journey toward credit improvement with a secured card requires dedication and a proactive approach to financial management. By adhering to sound credit practices and leveraging the opportunities presented by secured cards, individuals can lay a solid foundation for enhanced creditworthiness and improved financial well-being. As credit scores rise and credit histories strengthen, doors to broader financial opportunities and increased access to traditional credit products may begin to open, marking a significant milestone in the pursuit of long-term financial success.

Through careful consideration, responsible usage, and a commitment to financial empowerment, individuals can harness the potential of secured credit cards to achieve their credit goals and pave the way for a brighter financial future.