Home>Finance>How To Use Zelle With America First Credit Union

Finance

How To Use Zelle With America First Credit Union

Modified: February 21, 2024

Learn how to easily and securely use Zelle with America First Credit Union to simplify your financial transactions. Streamline your finances with Zelle and enjoy hassle-free transfers.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is Zelle?

- What is America First Credit Union?

- How to Sign Up for Zelle with America First Credit Union

- Linking your America First Credit Union Account with Zelle

- Sending Money with Zelle through America First Credit Union

- Receiving Money with Zelle through America First Credit Union

- Zelle Transaction Limits and Fees

- Security Measures when using Zelle with America First Credit Union

- Common Issues and Troubleshooting Tips

- Conclusion

Introduction

Welcome to our comprehensive guide on how to use Zelle with America First Credit Union. In today’s digital age, transferring money has become easier and more convenient than ever before. With the emergence of peer-to-peer payment platforms like Zelle, you can now send and receive money securely and instantly.

So, what exactly is Zelle? Zelle is a popular payment service that allows users to send and receive money directly from their bank accounts. With Zelle, you can split expenses with friends, pay your share of the rent, or simply send money to someone in need – all with just a few taps on your smartphone.

Now, let’s talk about America First Credit Union. Established in 1939, America First Credit Union is one of the largest credit unions in the United States, serving over a million members across Utah, Nevada, Arizona, and Idaho. As a member of America First Credit Union, you have the advantage of utilizing Zelle to transfer money effortlessly.

In this article, we will guide you through the process of signing up for Zelle with America First Credit Union, linking your bank account, and using Zelle to send and receive money. We will also provide you with important information regarding transaction limits, fees, security measures, and troubleshooting tips to ensure a seamless experience.

So, whether you’re a seasoned Zelle user or a newcomer to America First Credit Union, this guide is designed to help you navigate the world of digital payments and make the most out of your banking experience.

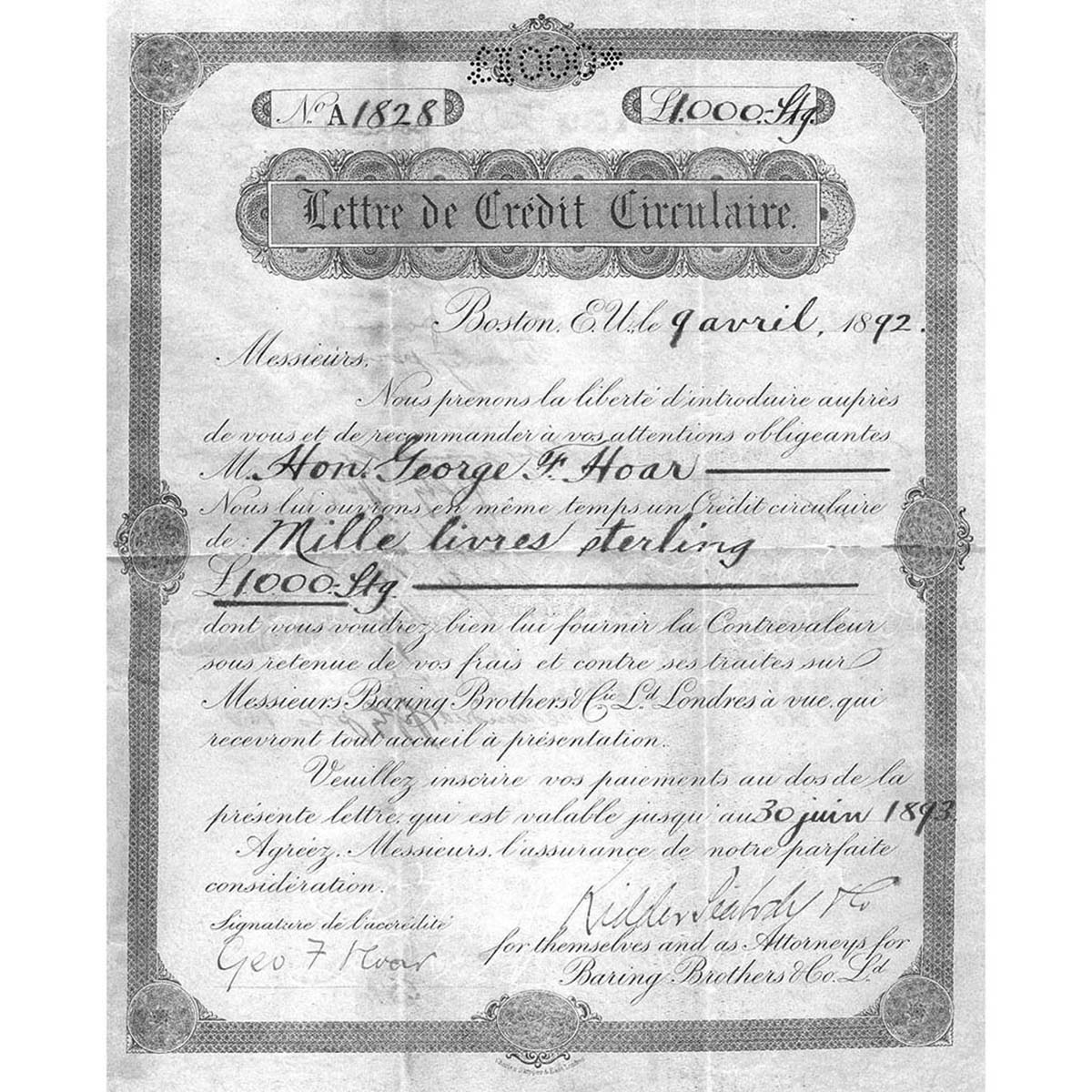

What is Zelle?

Zelle is a popular digital payment platform that enables users to send and receive money directly from their bank accounts. It is a convenient and secure way to transfer funds quickly, eliminating the need for cash or checks. Unlike other peer-to-peer payment services, Zelle is integrated into banking apps, making it easily accessible to millions of users.

With Zelle, you can send money to friends, family, or anyone else who has a bank account in the United States. All you need is the recipient’s email address or phone number linked to their bank account, and you can initiate a payment right from your mobile device or computer.

One of the major advantages of using Zelle is its speed. Transactions made through Zelle are usually completed within minutes, allowing you to send money to someone in need or split expenses with friends in real-time. This makes Zelle an excellent choice for situations that require instant money transfers.

Another key feature of Zelle is its wide network of participating banks and credit unions. Many financial institutions have partnered with Zelle, allowing their customers to take advantage of this seamless payment solution. This means that if your bank supports Zelle, you can easily send and receive money to and from other Zelle users within the same network.

It’s important to note that Zelle operates within the United States and is limited to domestic transactions. If you need to send money internationally, you will need to explore other options or utilize a separate international money transfer service.

Overall, Zelle offers a convenient, fast, and secure way to send and receive money directly from your bank account. Its integration with various banks and credit unions, including America First Credit Union, makes it a popular choice for individuals seeking a hassle-free and reliable digital payment solution.

What is America First Credit Union?

America First Credit Union is a financial institution that operates as a member-owned, not-for-profit cooperative. Established in 1939, America First Credit Union has grown to become one of the largest credit unions in the United States, serving over a million members across Utah, Nevada, Arizona, and Idaho.

As a credit union, America First operates differently from traditional banks. Instead of being owned by shareholders, it is owned by its members, who also have voting rights and the ability to influence the policies and operations of the credit union. This member-centric approach allows America First Credit Union to prioritize the unique needs and interests of its members.

America First Credit Union offers a wide range of financial products and services, including checking and savings accounts, credit cards, home loans, auto loans, personal loans, and investment options. They also provide online and mobile banking services, making it convenient for members to manage their finances from anywhere at any time.

What sets America First Credit Union apart from traditional banks is their commitment to providing competitive rates and low fees for their members. By operating as a not-for-profit organization, they can offer more favorable terms on loans, higher interest rates on savings accounts, and lower fees compared to many banks.

In addition to their financial offerings, America First Credit Union is dedicated to giving back to the communities they serve. They actively engage in various community initiatives, support local organizations, and provide financial literacy programs to help individuals and families achieve their financial goals.

For members of America First Credit Union, the integration of Zelle into their banking services is a valuable addition. With Zelle, members can seamlessly send and receive money directly from their America First accounts, enhancing the convenience and speed of their financial transactions.

In summary, America First Credit Union is a member-owned financial cooperative that prides itself on providing excellent financial products and services to its members. By combining personalized member service, competitive rates, and the convenience of digital banking, America First Credit Union has become a trusted institution for many individuals and families in the communities they serve.

How to Sign Up for Zelle with America First Credit Union

Signing up for Zelle with America First Credit Union is a straightforward process that can be done through your existing America First online banking account or the America First Mobile Banking app. Here’s a step-by-step guide to help you get started:

- Log in to your America First online banking account or open the America First Mobile Banking app on your smartphone.

- Navigate to the “Payments” or “Transfer” section of your account.

- Select the option to enroll in Zelle.

- Review and accept the terms and conditions for using Zelle.

- Verify your contact information, including your email address and phone number.

- Choose the America First account you want to link with Zelle.

- Set up a Zelle profile by providing your first and last name.

- Create a unique Zelle profile username or “Zelle ID” that will be associated with your America First account. This username will be used by others when sending money to you.

- Review the information you have entered and confirm your enrollment.

- You will receive a confirmation email or notification once your Zelle enrollment is complete.

- Once enrolled, you can now start using Zelle to send and receive money through your America First Credit Union account.

It is important to note that the availability of Zelle may vary depending on your specific America First Credit Union account and the type of account you hold. If you have any questions or encounter any issues during the enrollment process, be sure to reach out to America First Credit Union’s customer service for assistance.

Now that you have successfully signed up for Zelle with America First Credit Union, you can enjoy the convenience of sending and receiving money directly from your bank account with ease.

Linking your America First Credit Union Account with Zelle

Linking your America First Credit Union account with Zelle is a crucial step to ensure seamless money transfers. By connecting your account, you can easily send and receive funds through Zelle within the America First ecosystem. Here’s a step-by-step guide on how to link your America First Credit Union account with Zelle:

- Log in to your America First online banking account or open the America First Mobile Banking app.

- Navigate to the “Payments” or “Transfer” section of your account.

- Look for the option to link your account with Zelle.

- Verify your identity by providing the necessary information, such as your name, account number, and other required details.

- Confirm that the account you want to link with Zelle is eligible for use with the service.

- Once your account eligibility is confirmed, follow the prompts to link your America First Credit Union account with Zelle.

- You may be required to authenticate your account through a verification process. This could involve entering a verification code sent to your registered email address, phone number, or answering security questions.

- Review the information you have entered and complete the account linking process.

- Once your America First Credit Union account is successfully linked with Zelle, you can start using the platform to send and receive money.

It’s important to note that the steps and options for linking your America First Credit Union account with Zelle may vary based on the specific online banking platform or app used by America First Credit Union. If you encounter any difficulties or have any questions, reach out to the customer support team at America First Credit Union for assistance.

By successfully linking your America First Credit Union account with Zelle, you can now enjoy the convenience of transferring funds within the Zelle network directly from your America First Credit Union account.

Sending Money with Zelle through America First Credit Union

Once you have linked your America First Credit Union account with Zelle, sending money to friends, family, or other recipients is quick and effortless. Here’s a step-by-step guide on how to send money with Zelle through America First Credit Union:

- Log in to your America First online banking account or open the America First Mobile Banking app.

- Navigate to the “Payments” or “Transfer” section of your account.

- Select the option to send money with Zelle.

- Choose the recipient from your contact list by selecting their name or enter their email address or phone number.

- Enter the amount you want to send.

- Review the payment details and confirm the transaction.

- Verify the transaction details once more and authorize the payment.

- Upon successful completion, the recipient will be notified of the incoming funds, and the transfer will be initiated. The money will be instantly deducted from your America First Credit Union account.

It’s important to note that when using Zelle to send money through America First Credit Union, the recipient must have a bank account within the Zelle network or be already enrolled with Zelle. If the recipient is not yet enrolled, they will receive a notification with instructions on how to enroll and claim the funds.

Additionally, it’s crucial to double-check the recipient’s information before making a payment to avoid any potential mistakes or sending money to the wrong person. Once a payment is sent through Zelle, it cannot be canceled or reversed.

By following these simple steps, you can easily send money to anyone within the Zelle network through your America First Credit Union account. Enjoy the convenience of instant money transfers with Zelle!

Receiving Money with Zelle through America First Credit Union

Receiving money through Zelle with your America First Credit Union account is a seamless and convenient process. Whether you’re splitting expenses with friends or receiving funds from family members, here’s a step-by-step guide on how to receive money with Zelle through America First Credit Union:

- Ensure that your America First Credit Union account is linked with Zelle. If you haven’t done so already, follow the steps outlined earlier in this guide to link your account.

- Inform the person who wants to send you money that they can use Zelle to send the funds directly to your America First Credit Union account. Provide them with your Zelle profile username or “Zelle ID.”

- Await the incoming payment. Once the sender initiates the payment through their Zelle account, you will receive a notification through email or text message.

- Check your America First online banking account or the America First Mobile Banking app for the incoming payment notification.

- Follow the prompts to accept the incoming funds. You may need to confirm your identity or authenticate the transaction through various security measures, such as entering a verification code or answering security questions.

- Once you have verified and accepted the incoming funds, the money will be deposited directly into your America First Credit Union account, ready for you to use.

It’s important to note that when receiving money with Zelle through America First Credit Union, there are typically no fees associated with the transaction. However, it’s advisable to review your account terms and conditions or consult with America First Credit Union for any specific details regarding fees or limitations.

By following these simple steps, you can easily receive money from others who use Zelle, making it a convenient way to handle payments and fund transfers with your America First Credit Union account.

Zelle Transaction Limits and Fees

When using Zelle through America First Credit Union, it’s important to understand the transaction limits and potential fees associated with the service. Here’s what you need to know:

Transaction Limits:

While the specific transaction limits may vary depending on your America First Credit Union account type and other factors, Zelle typically imposes certain limits on the amount of money you can send and receive. These limits aim to ensure security and prevent unauthorized or excessive transactions.

Generally, Zelle sets a daily and weekly transaction limit for both sending and receiving money. These limits can range from a few hundred dollars up to several thousand dollars, depending on various factors such as your account history, relationship with the credit union, and other risk considerations.

It’s important to check with America First Credit Union or review your account terms and conditions to determine the specific transaction limits that apply to your account.

Fees:

Using Zelle through America First Credit Union typically does not incur any additional fees. However, it’s crucial to review your account terms and conditions or consult with America First Credit Union to ensure you have accurate and up-to-date information regarding potential fees.

While America First Credit Union does not charge fees for Zelle transactions, it’s essential to consider any potential fees that may be associated with your account, such as monthly maintenance fees or charges for non-sufficient funds (NSF) if you don’t have enough funds in your account to cover a transaction.

Keep in mind that while America First Credit Union may not charge fees for Zelle transactions, the recipient’s bank or financial institution may have their own fee structure. It’s advisable to inform the recipient to check with their own bank or financial institution if they have any questions or concerns regarding fees.

Remember, transaction limits and fees can vary, so it’s crucial to review your specific account details or contact America First Credit Union directly for the most accurate and up-to-date information. By understanding the transaction limits and fees associated with Zelle, you can make informed decisions when sending and receiving money through your America First Credit Union account.

Security Measures when using Zelle with America First Credit Union

Security is a top priority when it comes to digital transactions, and America First Credit Union takes the necessary steps to ensure the safety of its members when using Zelle. Here are some of the security measures in place:

Encryption and Secure Network:

When using Zelle through America First Credit Union, all communication and transactions are encrypted to protect sensitive data. This ensures that your personal and financial information is secure during transmission over the network.

Authentication and Verification:

America First Credit Union employs various authentication and verification methods to ensure that you are the authorized user of your account. This may include multifactor authentication, where you are required to provide additional verification information or enter a one-time verification code sent to your registered email address or phone number.

Fraud Monitoring:

America First Credit Union has sophisticated fraud detection and monitoring systems in place to detect and prevent unauthorized activity. These systems continuously monitor account activity for any suspicious transactions or behavior, helping to protect your account and funds.

Zero Liability Protection:

With Zelle and America First Credit Union, you are protected under their Zero Liability policy. This means that if unauthorized transactions occur on your account without your knowledge or consent, you will not be held liable for those transactions as long as you report them in a timely manner.

Secure Online and Mobile Banking:

America First Credit Union provides secure online and mobile banking platforms for its members. These platforms employ industry-standard security measures, such as secure login procedures, account activity notifications, and the ability to monitor your transactions and account balance in real-time.

While America First Credit Union implements these security measures, it’s also important for individual users to take precautions to protect their personal and financial information. This includes using strong, unique passwords for your online banking accounts and being cautious of phishing attempts or suspicious links or emails.

By working together with America First Credit Union and following their recommended security practices, you can enjoy the convenience of using Zelle while ensuring the safety and security of your financial transactions.

Common Issues and Troubleshooting Tips

While using Zelle with America First Credit Union is generally a smooth experience, you may encounter some common issues along the way. Here are a few common problems that users may face and some troubleshooting tips to help resolve them:

Issue: Unable to link America First Credit Union account with Zelle.

Troubleshooting Tip: Double-check that you have entered the correct account information and that your America First Credit Union account is eligible for Zelle. If the issue persists, reach out to America First Credit Union’s customer service for further assistance.

Issue: Payment not received by the intended recipient.

Troubleshooting Tip: Ensure that you have entered the correct phone number or email address of the recipient. Confirm with the recipient that they are enrolled and set up to receive Zelle payments. If the problem continues, contact America First Credit Union for support.

Issue: Slow or delayed transaction.

Troubleshooting Tip: Zelle transactions are typically instant, but in some cases, there may be delays due to network issues or security verifications. If the transaction takes longer than expected, check your account activity and reach out to America First Credit Union for assistance if necessary.

Issue: Error messages during Zelle transactions.

Troubleshooting Tip: If you encounter error messages during a Zelle transaction, double-check your account balance, internet connection, and verify that you have entered the payment information correctly. If the issue persists, contact America First Credit Union’s customer service for guidance.

Issue: Fraudulent activity or unauthorized transactions.

Troubleshooting Tip: If you suspect any fraudulent activity or unauthorized transactions on your America First Credit Union account, immediately contact the credit union’s customer service to report the issue and secure your account. They will guide you through the necessary steps to address the situation and protect your funds.

Remember, it’s always a good idea to stay updated on the latest security practices, keep your account information confidential, and regularly monitor your transactions for any suspicious activity. By maintaining open communication with America First Credit Union and taking necessary precautions, you can navigate and troubleshoot any potential issues that may arise while using Zelle.

Conclusion

Using Zelle with America First Credit Union provides a convenient and secure way to send and receive money directly from your bank account. By following the steps outlined in this guide, you can easily sign up for Zelle with America First Credit Union, link your account, and start enjoying the benefits of instant digital payments.

Zelle allows you to send money to friends, family, or anyone else with a bank account in the United States. With just a few taps on your smartphone or clicks on your computer, you can split expenses, pay your share of the bills, or send money to someone in need.

America First Credit Union, as one of the largest credit unions in the United States, offers the added advantage of integrating Zelle into its online banking and mobile app platforms. This seamless integration provides you with a hassle-free experience when transferring funds, whether you’re using Zelle to send or receive money.

Throughout this guide, we have discussed the process of signing up for Zelle, linking your America First Credit Union account, and utilizing Zelle to send and receive money. We have also covered important information about transaction limits, fees, security measures, and common troubleshooting tips to ensure a smooth experience.

Remember to stay vigilant when it comes to security, always double-check recipient information, and report any suspicious activity immediately to America First Credit Union to protect your account and funds.

Now that you have a comprehensive understanding of how to use Zelle with America First Credit Union, you can take advantage of this convenient payment service to simplify your financial transactions and enjoy the benefits of instant, secure money transfers.

Whether you are splitting bills, paying back a friend, or managing your finances, Zelle and America First Credit Union make it easier than ever to send and receive money quickly, efficiently, and securely.