Finance

When Were Letters Of Credit First Used

Modified: January 15, 2024

Discover the fascinating history of letters of credit in finance. Learn when this important financial instrument was first used and its impact on global trade.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on the history and importance of letters of credit! In the world of finance, letters of credit play a vital role in facilitating international trade and ensuring secure transactions between buyers and sellers. Understanding the origins and development of this financial instrument is key to comprehending its significance in the modern global economy.

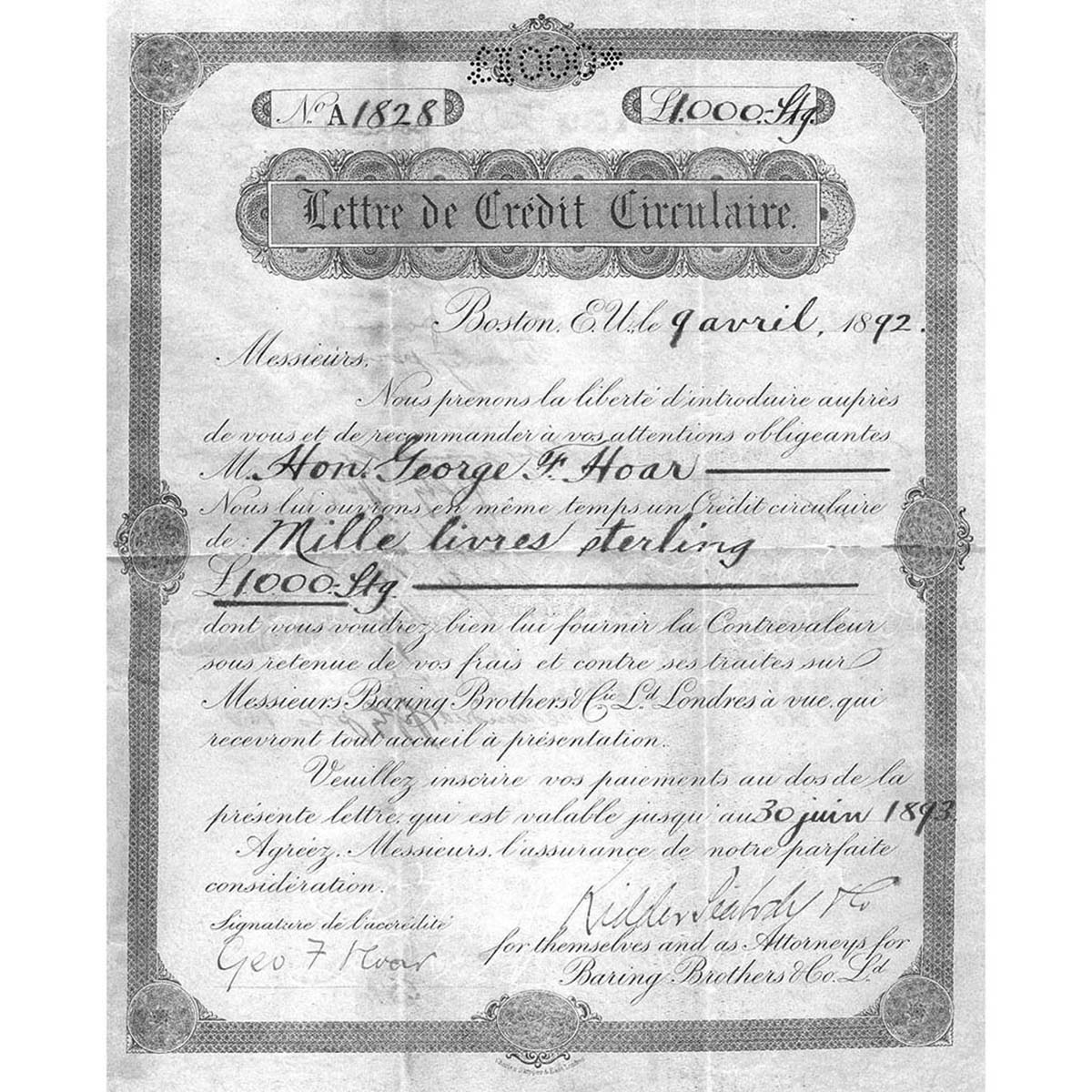

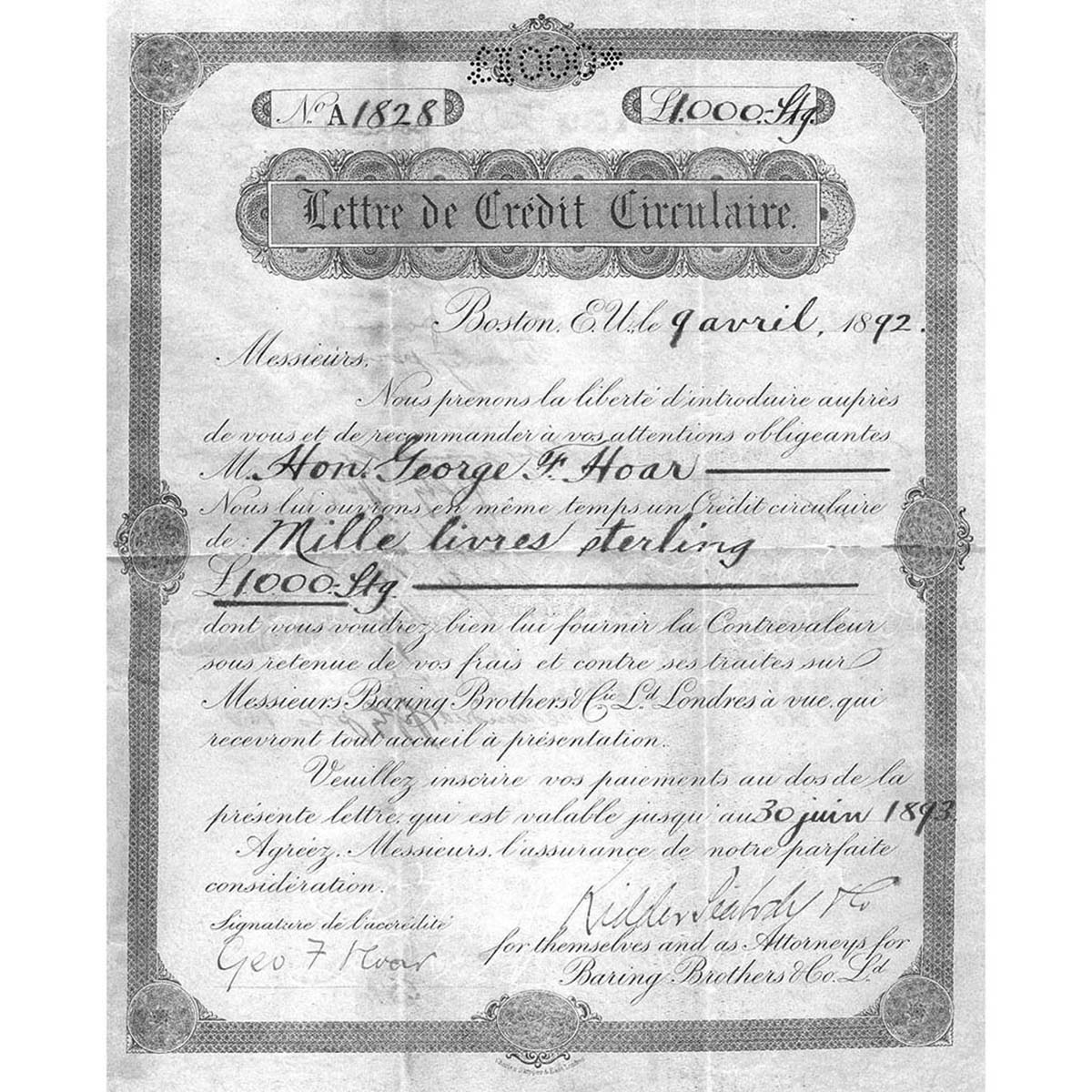

A letter of credit is a financial document issued by a bank on behalf of a buyer, guaranteeing that the seller will be paid the agreed-upon amount once the necessary documentation is presented and all conditions are met. It serves as a binding contract between the buyer, the seller, and the issuing bank, providing reassurance to all parties involved in the transaction.

In this article, we will delve into the historical background of letters of credit, tracing their origins back to ancient times and exploring their development in medieval and Renaissance Europe. We will also examine how letters of credit have evolved to become a crucial component of international trade in the modern era.

By understanding the evolution of letters of credit, we can appreciate the impact they have had on global commerce and the ways in which they contribute to financial stability and trust within the international business community.

Definition of Letters of Credit

Before delving into the historical context, it is essential to establish a clear definition of letters of credit. A letter of credit, often abbreviated as LC, is a financial instrument used in international trade to provide security and assurance to both buyers and sellers.

At its core, a letter of credit is a written guarantee from a bank or financial institution on behalf of a buyer (known as the applicant) to a seller (known as the beneficiary). The letter of credit ensures that the seller will be paid the agreed-upon amount for goods or services once all specified conditions are met, as stated in the LC terms and conditions.

The letter of credit acts as a binding contract between the buyer, seller, and issuing bank. It includes detailed information about the transaction, such as the amount of the transaction, the timeframe in which the payment should be made, and the necessary documents that must be presented to trigger payment.

Typically, the process starts when the buyer and seller agree on the terms of the transaction, including the use of a letter of credit as a payment method. The buyer then applies to their bank, known as the issuing bank, for the issuance of the LC. Once the issuing bank approves the application, they will issue the letter of credit to the seller’s bank, known as the advising or confirming bank.

The seller, upon receiving the LC, can proceed with shipping the goods or providing the agreed-upon services. They must ensure that they comply with the terms and conditions specified in the letter of credit, including the timing and accuracy of the documentation required for payment.

Once the seller fulfills all the obligations and presents the necessary documentation to their bank, the advising or confirming bank reviews the documents to ensure compliance with the LC terms. If everything is in order, the bank makes payment to the seller on behalf of the buyer.

Letters of credit provide a level of trust and security in international trade by mitigating the risk for both the buyer and seller. The buyer has peace of mind knowing that payment will only be made if the conditions are met, while the seller enjoys assurance that they will receive payment for their goods or services.

Now that we have a clear understanding of the definition and purpose of letters of credit, let’s explore their historical origins.

Historical Background

The history of letters of credit can be traced back centuries, with their origins rooted in the need for secure and reliable means of conducting trade. The concept of credit, or trust extended between buyers and sellers, has existed since ancient times. However, the formalization of letters of credit as a financial instrument took shape over the course of history.

Ancient Origins

Trade routes, such as the Silk Road that connected Europe and Asia, fueled the need for methods to facilitate commerce and mitigate the risks associated with long-distance trade. In ancient Mesopotamia and Egypt, clay tablets dating back to 3000 BCE have been discovered, depicting transactions involving the exchange of goods and a form of credit.

Development in Medieval and Renaissance Europe

The concept of letters of credit gained prominence during medieval and Renaissance Europe when international trade flourished. Merchants began to adopt practical methods to reduce risks and ensure the smooth flow of trade.

During the 12th and 13th centuries, Italian merchant families, such as the Medici, established networks of banking agents in different cities to facilitate trade and provide credit. They pioneered the use of promissory notes, which evolved into early forms of letters of credit. These notes were used to guarantee payment to specific individuals upon the presentation of the note by the payee.

By the 15th century, the practice of banking had spread across Europe, and letters of credit became more standardized. Merchant guilds and associations developed rules and regulations to govern the issuance and acceptance of letters of credit, ensuring trust and consistency in trade transactions.

Modern Adoption and International Trade

The 19th and 20th centuries saw significant advancements in global trade and transportation. As the volume and complexity of international trade increased, the demand for reliable and secure methods of payment grew.

With the rise of globalization and the establishment of international banking systems, letters of credit became an integral part of facilitating cross-border trade. The ICC (International Chamber of Commerce) and organizations like SWIFT (Society for Worldwide Interbank Financial Telecommunication) played key roles in standardizing and facilitating the usage of letters of credit in international trade transactions.

Today, letters of credit continue to be widely used in global trade, providing assurance and security to buyers and sellers around the world. They have adapted to the digital era, with electronic letters of credit becoming popular, streamlining the process and reducing paperwork.

The historical development of letters of credit showcases their crucial role in enabling international trade and fostering trust between parties involved in complex transactions. Understanding their evolution allows us to appreciate the importance and impact of letters of credit in the modern global economy.

Now that we have explored the historical background of letters of credit, let’s delve into their impact and importance in international trade.

Ancient Origins

The origins of letters of credit can be traced back to ancient civilizations, where the need for secure and reliable means of conducting trade was essential. In ancient Mesopotamia and Egypt, we can find evidence of early forms of credit that laid the foundation for the development of letters of credit as a financial instrument.

As early as 3000 BCE, clay tablets discovered in Mesopotamia reveal records of trade transactions involving the exchange of goods and a system of credit. These tablets depict agreements made between merchants, documenting the amount of goods exchanged and the promise of payment at a later date.

In ancient Egypt, papyrus scrolls dating back to the Bronze Age provide glimpses into the early practices of trade and credit. These scrolls contain detailed records of business transactions, including the use of credit agreements.

During these times, long-distance trade routes were established, connecting different regions of the ancient world. These trade networks, such as the Silk Road, brought merchants into contact with people from diverse cultures, languages, and currencies. The need for a reliable method of conducting trade, protecting assets, and ensuring payment became apparent.

Merchants and traders in ancient civilizations developed systems of trust and credit to mitigate the risks associated with long-distance trade. They established relationships based on reputation and personal guarantees, which allowed them to conduct business with confidence.

Over time, as trade became more extensive and complex, these informal systems of credit evolved into more formalized methods of conducting business. Written agreements and promissory notes began to emerge to provide a tangible representation of credit transactions.

While the ancient origins of letters of credit were not as structured or standardized as their modern counterparts, they laid the groundwork for the development of a financial instrument that would enhance trade and commerce throughout history.

The practices of ancient Mesopotamia and Egypt influenced the merchants of medieval and Renaissance Europe, who would go on to refine and formalize the concept of letters of credit. These early civilizations set the stage for the evolution and adoption of letters of credit as a crucial component of international trade.

Now that we have explored the ancient origins of letters of credit, let’s delve into their development in medieval and Renaissance Europe.

Development in Medieval and Renaissance Europe

The development of letters of credit reached new heights during the medieval and Renaissance periods in Europe. This era saw a flourishing of international trade and the emergence of powerful merchant families who played a significant role in shaping the financial landscape.

During the 12th and 13th centuries, Italian merchant families, particularly those from cities such as Florence and Genoa, became prominent in European trade. These merchants recognized the need for practical methods to reduce risks and ensure the smooth flow of commerce.

Italian merchants established extensive networks of banking agents in different cities across Europe and the Mediterranean, facilitating trade and providing credit services. This network of agents allowed for the transfer of funds and the issuance of financial guarantees, setting the stage for the development of letters of credit.

Early forms of letters of credit can be traced back to this period. Merchants began to use promissory notes, known as “promissoriae”, as a means of guaranteeing payment to specific individuals upon the presentation of the note by the payee. These notes served as an early form of credit instrument, demonstrating the willingness of the issuer to honor a debt obligation.

As trade continued to expand, merchants realized the need for a more standardized and reliable method of payment. To address this, merchant guilds and associations developed rules and regulations governing the issuance and acceptance of letters of credit.

These rules ensured that both buyers and sellers had a common understanding of the terms and conditions under which the letter of credit would be honored. This standardization helped build confidence and trust in the use of letters of credit as a viable means of conducting trade.

During the Renaissance period, particularly in the 15th century, banking practices and the use of letters of credit became more sophisticated. Italian banking families such as the Medici took center stage in the European financial landscape.

The Medici family, based in Florence, established a robust banking system and pioneered the use of letters of credit. Their network of banking agents across Europe facilitated international trade and commerce, cementing Florence’s position as a financial hub.

With the rise of trade and banking in Europe, the usage and acceptance of letters of credit spread to other regions and became integral to conducting business. Merchant associations formed cooperative networks, ensuring the smooth flow of goods and payments.

The development of letters of credit in medieval and Renaissance Europe laid the foundation for their modern-day usage. The merchant practices and standardized systems established during this time set the stage for the widespread adoption and acceptance of letters of credit in international trade.

Now that we have explored the development of letters of credit in medieval and Renaissance Europe, let’s continue our journey to examine their modern adoption and importance in international trade.

Modern Adoption and International Trade

The modern adoption of letters of credit has played a pivotal role in facilitating international trade and ensuring secure transactions between buyers and sellers. As globalization and cross-border commerce have expanded, letters of credit have become an integral part of conducting business across different countries and currencies.

In the 19th and 20th centuries, advancements in transportation, communication, and banking systems revolutionized international trade. As trade volume and complexity increased, so did the need for reliable methods of payment that could provide assurance to both buyers and sellers.

The International Chamber of Commerce (ICC), an organization dedicated to promoting and facilitating international trade, played a crucial role in standardizing and regulating the usage of letters of credit. The ICC developed a set of rules known as the Uniform Customs and Practice for Documentary Credits (UCP), which provides a framework for the issuance and utilization of letters of credit in international trade transactions.

The UCP guidelines ensure that the terms and conditions of letters of credit are clearly defined, reducing ambiguity and the potential for disputes. They lay out the responsibilities and obligations of all parties involved, including the issuing bank, the advising or confirming bank, the buyer, and the seller.

Through the services provided by banks, letters of credit offer various facilities such as sight payment, deferred payment, or acceptance credits. These options cater to the different needs and circumstances of buyers and sellers, making international trade transactions more flexible and accessible.

The modern adoption of letters of credit has also seen their digitization. Electronic letters of credit (eLCs) have become increasingly prevalent, streamlining the process and reducing paperwork. Electronic platforms and secure digital systems have made it easier for banks, buyers, and sellers to exchange and verify the necessary documents required for the letter of credit transaction.

One of the key advantages of using letters of credit in international trade is the security and assurance they provide. The issuing bank, in providing the letter of credit, assures the seller that they will receive payment as long as the agreed-upon conditions are met. This mitigates the risk for sellers, particularly when dealing with new or unknown buyers in unfamiliar markets.

For buyers, letters of credit offer protection by providing them with the confidence that they will only release payment once the seller has fulfilled their obligations and provided the required documentation.

Letters of credit play a crucial role in facilitating trust and reducing payment risk in global trade. They serve as a guarantee and an instrument of payment, allowing parties in different countries to engage in mutually beneficial transactions with confidence.

Overall, the modern adoption and usage of letters of credit have transformed international trade by minimizing risks, fostering trust, and increasing the efficiency of transactions. They have become an indispensable tool for businesses engaged in global commerce.

As we conclude our exploration of the modern adoption of letters of credit, it is important to recognize their impact and importance in facilitating secure and seamless international trade transactions.

Impact and Importance of Letters of Credit

Letters of credit have a significant impact on international trade, playing a crucial role in ensuring secure and reliable transactions between buyers and sellers. Their importance lies in the numerous benefits they offer to businesses engaged in global commerce.

One of the key impacts of letters of credit is the reduction of payment risks for both buyers and sellers. Buyers are assured that payment will only be made once the seller has fulfilled all the agreed-upon obligations and presented the necessary documentation. This provides them with confidence and protection against potential fraud or non-compliance by the seller.

For sellers, letters of credit provide a guaranteed method of payment, eliminating concerns about non-payment or late payment by the buyer. This assurance enables sellers to confidently engage in trade with buyers from different countries and mitigate the risks associated with conducting business across borders.

Furthermore, letters of credit help promote trust and establish credibility between parties involved in international trade. By providing a reliable mechanism for payment, they enhance the reputation and integrity of both buyers and sellers. This fosters long-term business relationships and encourages future trade opportunities.

Letters of credit also facilitate trade finance by allowing businesses to obtain financing from banks or financial institutions based on the security of the letter of credit. This enables companies to access capital and fund their operations, particularly in situations where upfront payment is required to procure goods or fulfill contractual obligations.

Additionally, letters of credit contribute to the stability of the global financial system by providing a standardized and regulated method of conducting international trade. The rules and guidelines set forth by the International Chamber of Commerce (ICC) ensure uniformity and consistency in the usage of letters of credit, reducing uncertainties and disputes between parties.

Letters of credit have also played a significant role in bridging cultural and language barriers in international trade. The standardized documentation and procedures associated with letters of credit provide a common framework that transcends linguistic and cultural differences. This facilitates smooth communication and understanding between buyers, sellers, and banks involved in the transaction.

Overall, the impact and importance of letters of credit cannot be overstated. They contribute to the growth and stability of the global economy by facilitating trade, mitigating risks, promoting trust, and providing financial assurance to businesses engaged in international transactions.

As international trade continues to expand and evolve, letters of credit remain an essential tool for businesses seeking secure and reliable methods of conducting cross-border commerce.

Conclusion

In conclusion, letters of credit have a rich history that spans centuries and have evolved into a vital financial instrument in international trade. From their ancient origins to their modern adoption, letters of credit have played a significant role in facilitating secure and reliable transactions between buyers and sellers worldwide.

Throughout history, the development of letters of credit has been driven by the need to mitigate risks associated with long-distance trade. From early credit agreements in ancient Mesopotamia and Egypt to the sophisticated systems established by Italian merchants during the medieval and Renaissance periods, the concept of providing financial guarantees has evolved into the standardized and regulated processes we see today.

The modern adoption of letters of credit, facilitated by organizations like the International Chamber of Commerce (ICC), has had a transformative impact on international trade. Letters of credit provide assurance and security to both buyers and sellers by reducing payment risks, fostering trust, and establishing a framework for secure transactions.

Letters of credit are essential in enabling businesses to engage in global commerce with confidence. By mitigating risks associated with cross-border transactions, they encourage trade, promote stable financial systems, and facilitate access to trade finance.

Furthermore, letters of credit transcend cultural and language barriers, providing a standardized framework that facilitates communication and understanding between parties from different regions and backgrounds. This contributes to the growth and stability of the global economy, fostering cooperation and long-term business relationships.

In the fast-paced and interconnected world of international trade, letters of credit continue to be a fundamental mechanism for ensuring trust, reducing risks, and facilitating seamless transactions. Their importance cannot be overstated, as they contribute to the smooth functioning of global commerce and provide businesses with the necessary confidence to engage in cross-border transactions.

In conclusion, understanding the historical background, definition, and significance of letters of credit allows us to appreciate their impact on global trade and the role they play in promoting stability and trust in the international business community.

As international trade continues to evolve, letters of credit will remain a cornerstone of secure and reliable transactions, facilitating economic growth and fostering collaboration between businesses worldwide.