Finance

How To Value Mergers And Acquisitions

Published: February 24, 2024

Learn how to value mergers and acquisitions in the finance industry with expert tips and strategies. Understand the key principles and methods for successful M&A valuation.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Mergers and acquisitions (M&A) are pivotal events in the corporate world, often shaping the landscape of industries and markets. These strategic transactions enable companies to combine resources, expand their operations, and achieve synergies that can enhance their competitive positioning. Understanding the value of M&A deals is essential for both the companies involved and the investors evaluating the potential impact on their portfolios.

The process of valuing mergers and acquisitions involves a comprehensive analysis of various factors, including financial metrics, market conditions, and potential synergies. This article delves into the intricacies of M&A valuation, shedding light on the methods and considerations that underpin this critical aspect of corporate finance.

By gaining insights into the valuation techniques employed in M&A deals, investors, financial analysts, and corporate decision-makers can make informed assessments of the potential outcomes and implications of such transactions. Whether it's assessing the value of a target company or evaluating the impact of a merger on the combined entity, a nuanced understanding of M&A valuation is indispensable.

Throughout this article, we will explore the diverse methodologies used to determine the value of M&A deals, ranging from traditional financial models to more nuanced approaches that account for synergies and market dynamics. By delving into these valuation methods, readers will gain a deeper appreciation for the complexities involved in determining the worth of M&A transactions and the factors that drive their success.

Understanding Mergers and Acquisitions

Mergers and acquisitions (M&A) encompass a spectrum of strategic transactions that involve the consolidation of companies, assets, or business operations. In a merger, two separate entities combine to form a new, single organization, thereby pooling their resources, talents, and market presence. On the other hand, an acquisition involves one company purchasing another, often resulting in the acquired entity becoming a subsidiary of the acquirer.

These transactions can take various forms, such as horizontal mergers, where companies operating in the same industry merge to expand their market share and gain competitive advantages. Vertical mergers involve companies within the same supply chain or distribution channel combining their operations, while conglomerate mergers entail the union of companies that operate in unrelated industries. Additionally, acquisitions can be categorized as friendly or hostile, depending on the willingness of the target company to be acquired.

From a strategic standpoint, M&A activities are driven by diverse objectives, including achieving economies of scale, accessing new markets, diversifying product portfolios, and leveraging synergies to enhance operational efficiencies. Furthermore, M&A transactions can be instrumental in fostering innovation, driving technological advancements, and reshaping industry dynamics through the consolidation of complementary capabilities.

Understanding the nuances of M&A transactions is crucial for stakeholders across the corporate landscape, as these deals have far-reaching implications on market competition, industry structure, and shareholder value. Whether it’s navigating regulatory requirements, integrating organizational cultures, or assessing the financial viability of a proposed transaction, a comprehensive understanding of M&A dynamics is essential for successful execution and value creation.

As we delve into the valuation methods for M&A transactions, it is imperative to recognize the multifaceted nature of these strategic endeavors and the strategic imperatives that drive companies to pursue such transformative initiatives.

Valuation Methods

Valuing mergers and acquisitions involves a rigorous assessment of the target company’s worth, taking into account various financial and strategic factors. Several methodologies are employed to determine the value of M&A transactions, each offering unique insights into the potential synergies, market positioning, and financial implications of the deal.

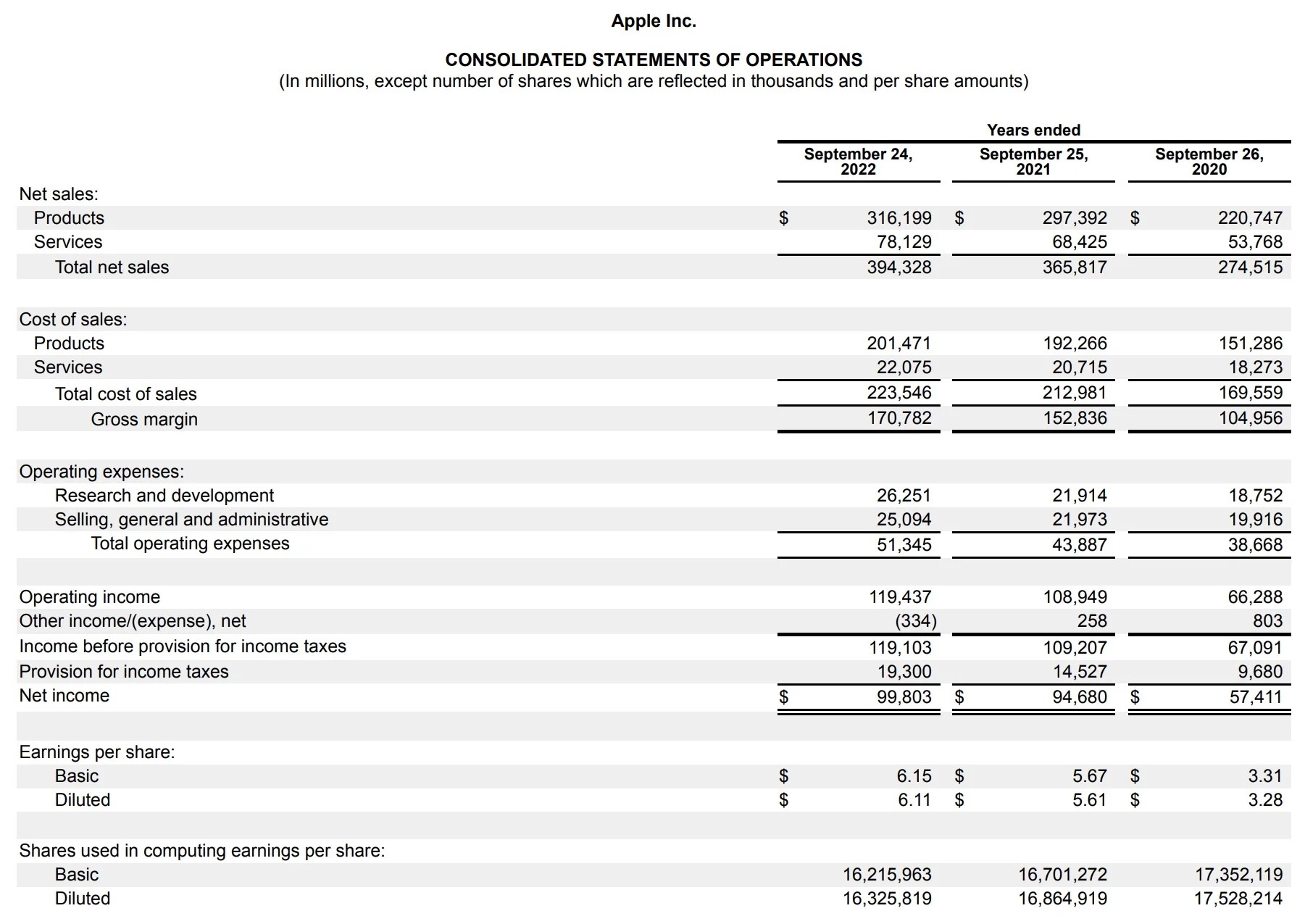

One of the primary valuation methods is the Comparable Company Analysis (CCA), which involves benchmarking the target company’s financial metrics, such as revenue, earnings, and multiples, against those of similar publicly traded companies. By identifying comparable firms within the same industry, analysts can gauge the relative valuation of the target company and assess its competitive standing within the market.

Another widely used approach is the Precedent Transactions Analysis (PTA), which entails evaluating the purchase prices and deal terms of past M&A transactions involving similar companies. By examining historical deals, analysts can glean insights into the valuation multiples and premiums paid, providing a basis for assessing the fairness and competitiveness of the proposed transaction.

Furthermore, the Discounted Cash Flow (DCF) analysis is a fundamental valuation method that involves projecting the target company’s future cash flows and discounting them to their present value. This approach accounts for the time value of money and provides a comprehensive assessment of the company’s intrinsic value based on its future earnings potential.

Additionally, the Adjusted Present Value (APV) analysis is utilized to evaluate M&A transactions by considering the impact of leverage, tax shields, and other financing-related factors on the target company’s value. This method provides a nuanced perspective on the financial structuring and capital allocation aspects of the deal, offering insights into the optimal financing strategies.

Transaction Multiples, such as the price-to-earnings (P/E) ratio and enterprise value-to-EBITDA (EV/EBITDA), are also instrumental in M&A valuation, providing a comparative framework for assessing the target company’s valuation relative to its earnings and operating performance.

By leveraging these diverse valuation methods, stakeholders involved in M&A transactions can gain a comprehensive understanding of the target company’s worth, the financial implications of the deal, and the potential synergies that can drive value creation in the post-transaction landscape.

Comparable Company Analysis

Comparable Company Analysis (CCA) is a fundamental valuation method used in mergers and acquisitions to assess the value of a target company by comparing its financial metrics with those of similar publicly traded firms. This approach provides valuable insights into the relative valuation of the target company within its industry and the broader market, offering a basis for evaluating its competitive positioning and growth potential.

The process of conducting a CCA involves identifying comparable companies that operate in the same industry and exhibit similar business characteristics, such as size, market share, growth trajectory, and operational dynamics. Once the peer group of comparable companies is established, key financial metrics, including revenue, earnings, and valuation multiples, are analyzed to gauge the relative performance and valuation of the target company.

By benchmarking the target company against its peers, analysts can assess its strengths, weaknesses, and growth prospects in relation to industry norms and market dynamics. This comparative framework enables a nuanced evaluation of the target company’s financial health, market positioning, and potential for value creation in the context of an M&A transaction.

Furthermore, CCA facilitates the identification of potential outliers and anomalies in the target company’s valuation, shedding light on unique factors that may influence its market value. This comparative analysis also aids in understanding the industry trends, competitive landscape, and market sentiment, providing valuable context for assessing the target company’s strategic fit and growth prospects within its sector.

Moreover, CCA serves as a critical tool for investors, financial analysts, and corporate decision-makers involved in M&A transactions, offering a robust framework for evaluating the target company’s valuation in a broader market context. By leveraging the insights derived from comparable company analysis, stakeholders can make informed assessments of the target company’s intrinsic value, competitive standing, and growth potential, thereby enhancing their decision-making processes in the M&A landscape.

Precedent Transactions Analysis

Precedent Transactions Analysis (PTA) is a pivotal valuation method utilized in mergers and acquisitions to assess the value of a target company by examining the pricing and deal terms of past M&A transactions involving similar companies. This approach offers valuable insights into the valuation multiples, premiums paid, and strategic considerations that underpinned historical deals, providing a basis for evaluating the fairness and competitiveness of the proposed transaction.

The process of conducting a PTA involves identifying and analyzing relevant M&A transactions that share similarities with the proposed deal in terms of industry, business characteristics, and market dynamics. By examining the purchase prices, deal structures, and financial metrics of these precedent transactions, analysts can derive valuable benchmarks for assessing the target company’s valuation and the potential terms of the current deal.

Furthermore, PTA enables stakeholders to gain insights into the strategic motivations, market trends, and competitive dynamics that shaped past M&A transactions within the target company’s industry. This historical perspective offers a nuanced understanding of the prevailing market conditions, valuation trends, and the premiums paid for similar companies, thereby informing the assessment of the proposed deal’s terms and potential synergies.

Moreover, PTA aids in evaluating the potential value creation and synergies that can result from the proposed M&A transaction by drawing parallels with historical deals that yielded strategic advantages and financial benefits for the acquirer. By examining the outcomes and post-transaction performance of precedent transactions, analysts can assess the potential impact of the current deal on the combined entity’s growth prospects, operational efficiencies, and market positioning.

PTA serves as a critical tool for investors, acquirers, and financial advisors involved in M&A transactions, providing a robust framework for evaluating the target company’s valuation in the context of historical deal dynamics and market trends. By leveraging the insights derived from precedent transactions analysis, stakeholders can make informed assessments of the proposed deal’s fairness, strategic rationale, and potential for value creation, thereby enhancing their decision-making processes in the M&A landscape.

Discounted Cash Flow Analysis

Discounted Cash Flow (DCF) analysis is a fundamental valuation method employed in mergers and acquisitions to assess the value of a target company based on its projected future cash flows. This approach involves forecasting the company’s cash flows over a defined period and discounting them to their present value using a suitable discount rate, often the company’s cost of capital. DCF analysis provides a comprehensive and intrinsic assessment of the target company’s value, considering its future earnings potential and the time value of money.

The process of conducting a DCF analysis entails making detailed financial projections, including revenue, expenses, and capital expenditures, to estimate the company’s free cash flows over a specified forecast period. These cash flow projections are then discounted back to their present value using an appropriate discount rate that reflects the company’s risk profile and the opportunity cost of capital.

Furthermore, DCF analysis allows for the incorporation of terminal value, representing the value of the company beyond the explicit forecast period. This terminal value is determined using a suitable valuation multiple or perpetuity growth model, providing a holistic assessment of the company’s ongoing cash flow generation potential.

Moreover, DCF analysis offers a forward-looking perspective on the target company’s intrinsic value, considering its growth prospects, operational efficiencies, and capital investment requirements. By capturing the company’s expected cash flows and discounting them to their present value, this method provides a robust framework for assessing the company’s worth based on its fundamental financial performance and future earnings potential.

DCF analysis is instrumental in M&A transactions, as it offers a comprehensive assessment of the target company’s value that accounts for its growth trajectory, risk profile, and long-term earnings capacity. This method enables stakeholders to evaluate the financial viability of the proposed deal, assess the potential returns on investment, and make informed decisions regarding the valuation and strategic implications of the transaction.

By leveraging the insights derived from DCF analysis, investors, acquirers, and financial advisors can gain a nuanced understanding of the target company’s intrinsic value, growth prospects, and the financial considerations that underpin the M&A transaction, thereby enhancing their decision-making processes in the dynamic landscape of mergers and acquisitions.

Adjusted Present Value Analysis

Adjusted Present Value (APV) analysis is a sophisticated valuation method utilized in mergers and acquisitions to assess the value of a target company by considering the impact of financing-related factors, such as leverage, tax shields, and the cost of debt and equity. This approach provides a comprehensive perspective on the target company’s value, accounting for the effects of capital structure and financing decisions on its overall worth.

The process of conducting an APV analysis involves assessing the target company’s unlevered free cash flows, which represent the cash flows generated by the company before accounting for the effects of debt financing. These unlevered cash flows are then discounted at the company’s cost of capital to determine the present value of the company without considering the impact of debt and related tax shields.

Additionally, APV analysis incorporates the tax shields resulting from the tax-deductible interest payments on the target company’s debt. By quantifying the tax benefits associated with debt financing, analysts can adjust the company’s unlevered value to reflect the tax shield derived from its debt obligations, providing a more comprehensive assessment of its overall value.

Moreover, APV analysis accounts for the impact of additional financing factors, such as the costs of debt and equity, and their implications for the target company’s value. By considering the effects of leverage, the cost of debt, and the required return on equity, this method offers insights into the optimal financing structure and the value implications of various capital allocation strategies.

Furthermore, APV analysis enables stakeholders to evaluate the potential impact of capital structure decisions, financing strategies, and tax considerations on the target company’s value in the context of an M&A transaction. By incorporating the effects of leverage, tax shields, and financing-related factors, this method provides a nuanced perspective on the target company’s intrinsic value and the value creation opportunities associated with optimal capital structuring.

APV analysis serves as a critical tool for investors, financial analysts, and corporate decision-makers involved in M&A transactions, offering a robust framework for evaluating the target company’s value while accounting for the impact of financing decisions and tax considerations. By leveraging the insights derived from Adjusted Present Value analysis, stakeholders can make informed assessments of the target company’s intrinsic value, optimal capital structure, and the financial implications of the proposed transaction, thereby enhancing their decision-making processes in the complex landscape of mergers and acquisitions.

Transaction Multiples

Transaction multiples play a pivotal role in the valuation of mergers and acquisitions, providing a comparative framework for assessing the value of a target company relative to its earnings, cash flows, and enterprise value. These multiples, such as the price-to-earnings (P/E) ratio and the enterprise value-to-EBITDA (EV/EBITDA) ratio, offer valuable insights into the target company’s valuation and its relative performance within the market.

The price-to-earnings (P/E) ratio, a widely utilized transaction multiple, compares the target company’s market price per share to its earnings per share, providing a measure of the market’s valuation of the company’s earnings potential. A higher P/E ratio indicates a relatively higher valuation placed on the company’s earnings, reflecting positive market sentiment and growth expectations.

Likewise, the enterprise value-to-EBITDA (EV/EBITDA) ratio assesses the target company’s enterprise value in relation to its earnings before interest, taxes, depreciation, and amortization (EBITDA). This multiple offers insights into the company’s operating performance and its value relative to its cash flow generation capacity, serving as a key metric in M&A valuation.

Moreover, transaction multiples provide a comparative basis for evaluating the target company’s valuation relative to industry peers and historical M&A transactions. By benchmarking the company’s multiples against those of similar firms and past deals, analysts can gauge its relative performance, market positioning, and potential for value creation in the context of the proposed transaction.

Furthermore, transaction multiples aid in assessing the potential synergies and strategic advantages that can result from the M&A transaction, offering a quantitative basis for evaluating the fairness and competitiveness of the proposed deal. By comparing the target company’s multiples with those of acquirers and industry benchmarks, stakeholders can gain insights into the value implications and growth prospects associated with the transaction.

Transaction multiples serve as critical valuation metrics in M&A transactions, offering a comparative framework for assessing the target company’s valuation, market positioning, and growth potential. By leveraging the insights derived from transaction multiples, investors, acquirers, and financial advisors can make informed assessments of the target company’s relative valuation, strategic fit, and the value creation opportunities associated with the proposed transaction, thereby enhancing their decision-making processes in the dynamic landscape of mergers and acquisitions.

Synergy Analysis

Synergy analysis is a critical component of the valuation process in mergers and acquisitions, focusing on the potential value creation that can result from the combination of two entities. Synergies encompass the strategic benefits, cost savings, revenue enhancements, and operational efficiencies that can be realized when two companies merge or when one company acquires another.

There are several types of synergies that are commonly evaluated in M&A transactions. Operational synergies, for example, involve the potential for streamlining processes, eliminating duplicative functions, and optimizing the combined entity’s operational efficiency. This can lead to cost savings and improved productivity, contributing to the overall value of the merged or acquired company.

Strategic synergies focus on the complementary strengths and capabilities of the merging entities, such as accessing new markets, diversifying product offerings, or leveraging technology and intellectual property. By combining resources and expertise, the merged entity can gain a competitive edge and capitalize on new growth opportunities, enhancing its market positioning and value.

Financial synergies, including tax benefits, improved capital structure, and enhanced financial performance, are also integral to synergy analysis. These synergies can lead to improved cash flows, reduced costs of capital, and enhanced financial stability, contributing to the overall value creation potential of the M&A transaction.

Moreover, synergy analysis involves quantifying the potential synergies and assessing their financial impact on the combined entity. By conducting detailed assessments of the synergies’ expected value, timing, and implementation costs, stakeholders can gauge the incremental value that can be generated from the M&A transaction, informing the overall valuation and strategic rationale of the deal.

Furthermore, synergy analysis serves as a critical tool for investors, acquirers, and financial advisors involved in M&A transactions, offering insights into the value creation opportunities and strategic imperatives that underpin the proposed deal. By leveraging the insights derived from synergy analysis, stakeholders can make informed assessments of the potential synergies’ impact on the combined entity’s growth prospects, operational efficiencies, and market positioning, thereby enhancing their decision-making processes in the dynamic landscape of mergers and acquisitions.

Conclusion

In conclusion, the valuation of mergers and acquisitions is a multifaceted process that encompasses a range of methodologies and considerations, each playing a crucial role in assessing the value and potential synergies of the target company. From the comparative frameworks of Comparable Company Analysis and Precedent Transactions Analysis to the intrinsic assessments of Discounted Cash Flow and Adjusted Present Value analyses, the diverse valuation methods offer comprehensive insights into the financial, strategic, and operational dimensions of M&A transactions.

Transaction multiples further enrich the valuation process by providing a comparative basis for assessing the target company’s market positioning and growth potential, while synergy analysis sheds light on the potential value creation opportunities that can result from the combined entity’s operational, strategic, and financial synergies.

By delving into the intricacies of M&A valuation, stakeholders gain a deeper understanding of the factors that underpin the worth and strategic implications of these transformative transactions. Whether it’s evaluating the target company’s competitive standing, assessing the fairness of the proposed deal, or quantifying the potential synergies, a nuanced understanding of M&A valuation is indispensable for informed decision-making and value creation.

As M&A transactions continue to shape the corporate landscape, the integration of robust valuation methods and synergy analysis is essential for unlocking the full potential of these strategic endeavors. By leveraging the insights derived from diverse valuation approaches and synergy assessments, stakeholders can navigate the complexities of M&A transactions with confidence, driving value creation and strategic growth in the dynamic landscape of mergers and acquisitions.