Home>Finance>What Is The Main Reason That Most Mergers And Acquisitions Negatively Affect Shareholder Value

Finance

What Is The Main Reason That Most Mergers And Acquisitions Negatively Affect Shareholder Value

Published: February 24, 2024

Learn why most mergers and acquisitions have a negative impact on shareholder value and the implications for finance. Gain insights into the main reasons behind these effects.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Understanding the Impact of Mergers and Acquisitions on Shareholder Value

- Exploring the Dynamics of Corporate Restructuring

- Unraveling the Determinants of Shareholder Value in Mergers and Acquisitions

- Unveiling the Predominant Factor Undermining Shareholder Wealth in Mergers and Acquisitions

- Illustrating the Real-World Impact of Mergers and Acquisitions on Shareholder Value

- Navigating the Complexities of Mergers and Acquisitions: Implications for Shareholder Value

Introduction

Understanding the Impact of Mergers and Acquisitions on Shareholder Value

Mergers and acquisitions (M&A) have long been a strategic tool for companies seeking growth, market expansion, and increased competitiveness. However, the impact of M&A activities on shareholder value has been a subject of extensive debate and analysis within the finance and business communities. Shareholder value, a key metric of a company's performance, reflects the return that shareholders receive from their investment in the company's stock. Understanding the factors that influence shareholder value in the context of M&A is crucial for investors, executives, and financial professionals.

In this article, we will delve into the complex relationship between mergers and acquisitions and shareholder value. We will explore the various factors that can influence shareholder value in the wake of M&A activities and identify the primary reasons why many M&A transactions result in a negative impact on shareholder value. By examining real-world case studies and examples, we will illustrate the practical implications of M&A transactions on shareholder value, shedding light on the challenges and opportunities associated with these strategic moves. Through this exploration, we aim to provide a comprehensive understanding of the dynamics at play and equip readers with valuable insights into the intricacies of M&A and its implications for shareholder value.

As we embark on this journey, it is important to recognize that the landscape of M&A is multifaceted, with a myriad of variables influencing outcomes. By unraveling the complexities and nuances of M&A transactions, we can gain a deeper appreciation for the interconnectedness of corporate strategy, financial markets, and shareholder interests. Let us now embark on this exploration of M&A and its impact on shareholder value, aiming to demystify this intricate domain and glean actionable insights for investors and industry professionals alike.

Understanding the Impact of Mergers and Acquisitions on Shareholder Value

Overview of Mergers and Acquisitions

Exploring the Dynamics of Corporate Restructuring

Mergers and acquisitions (M&A) represent strategic initiatives undertaken by companies to consolidate their operations, expand their market presence, and achieve synergies that can enhance their competitive position in the industry. Mergers involve the combination of two or more companies to form a new entity, while acquisitions refer to one company purchasing another, resulting in the acquired company becoming a part of the acquiring company. These corporate restructuring activities are driven by various motives, including gaining access to new technologies, entering new markets, achieving cost efficiencies, and leveraging complementary resources and capabilities.

From a strategic standpoint, M&A activities can enable companies to achieve economies of scale, diversify their product or service offerings, and capitalize on strategic alliances that foster growth and innovation. However, the execution of M&A transactions is a complex process that involves meticulous planning, negotiation, and integration to realize the intended benefits. The success of M&A endeavors hinges on the ability to align organizational cultures, optimize operational processes, and deliver value to stakeholders, particularly shareholders.

Throughout the history of corporate finance, M&A has been a prominent feature of the business landscape, shaping industries and reshaping competitive dynamics. The allure of M&A stems from the potential to unlock value through synergies, strategic positioning, and market expansion. Nevertheless, the outcomes of M&A transactions vary widely, with some delivering substantial value creation while others fall short of expectations, leading to adverse effects on shareholder value.

As we navigate the realm of M&A, it is essential to recognize the multifaceted nature of these transactions, encompassing financial, strategic, and operational dimensions. By gaining a holistic understanding of the intricacies involved in M&A, stakeholders can make informed decisions and mitigate the risks associated with these transformative endeavors. In the subsequent sections, we will delve deeper into the factors that influence shareholder value in the context of M&A, shedding light on the key considerations that underpin the outcomes of these pivotal corporate actions.

Factors Affecting Shareholder Value

Unraveling the Determinants of Shareholder Value in Mergers and Acquisitions

When evaluating the impact of mergers and acquisitions (M&A) on shareholder value, it is imperative to consider the diverse array of factors that can influence the outcomes of these strategic transactions. The dynamics of M&A extend beyond financial metrics and encompass a broad spectrum of elements that shape the value proposition for shareholders. Understanding these factors is instrumental in discerning the implications of M&A activities and their ramifications for shareholder wealth.

1. Strategic Fit and Synergies: The strategic rationale behind an M&A transaction plays a pivotal role in determining its impact on shareholder value. Transactions that are driven by a clear strategic fit, such as complementary product portfolios, market synergies, or technological advantages, are more likely to yield positive outcomes for shareholders. Conversely, deals lacking strategic coherence or failing to realize synergistic benefits may erode shareholder value.

2. Integration and Execution: The post-merger integration process is critical in determining the success of an M&A transaction. Efficient integration of operations, systems, and cultures can unlock synergies and create value for shareholders. Conversely, challenges in integration, including cultural clashes, operational disruptions, and leadership transitions, can impede value creation and negatively impact shareholder wealth.

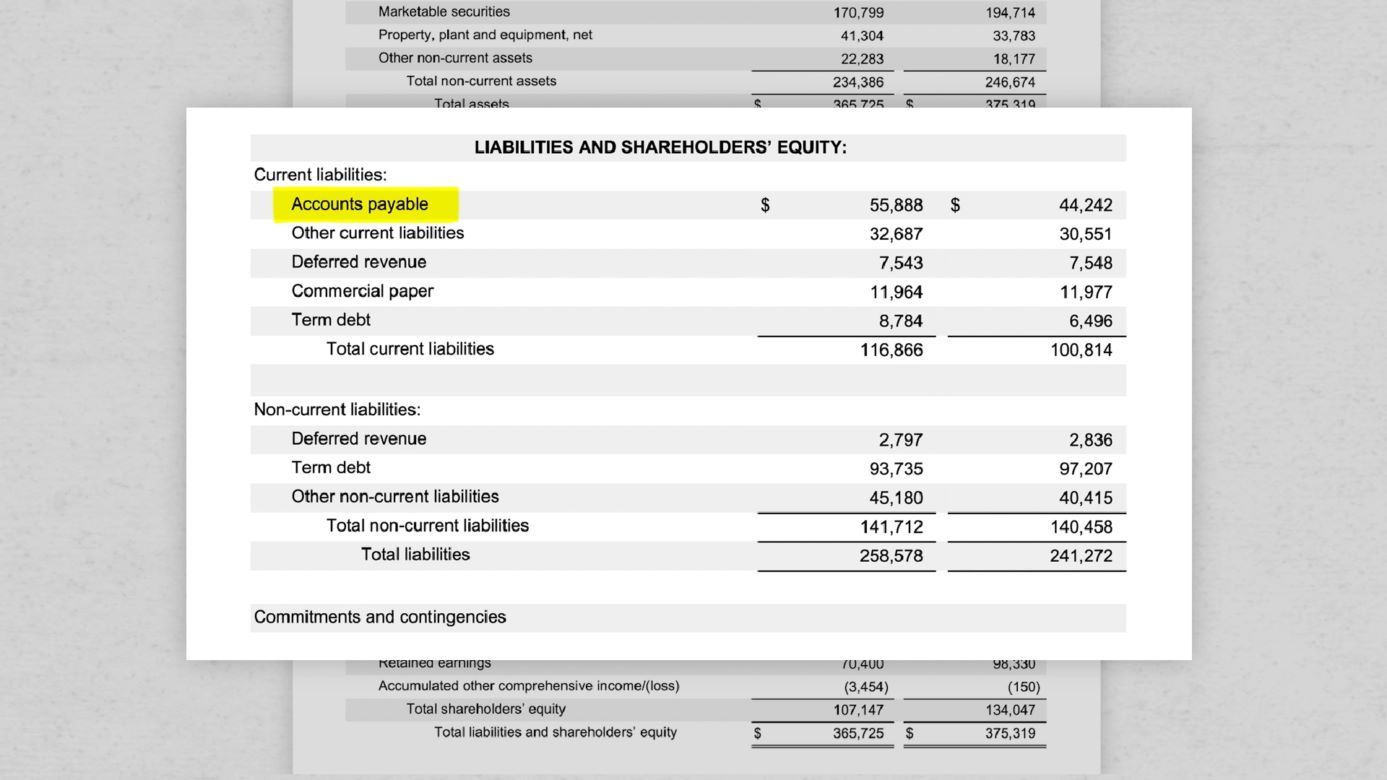

3. Financial Performance and Cost Efficiencies: The financial implications of M&A, including revenue growth, cost savings, and capital allocation, directly influence shareholder value. Successful M&A initiatives that deliver improved financial performance and cost efficiencies can bolster shareholder wealth, while underperforming transactions may lead to value erosion.

4. Market Sentiment and Investor Perception: The reaction of the market and investors to an M&A announcement can significantly affect shareholder value. Positive market sentiment, driven by confidence in the strategic rationale and potential synergies, can enhance shareholder wealth. Conversely, skepticism, uncertainty, or negative perceptions surrounding the M&A deal can exert downward pressure on shareholder value.

5. Regulatory and Legal Considerations: Compliance with regulatory requirements, antitrust laws, and legal frameworks is essential in safeguarding shareholder interests. M&A transactions that encounter regulatory hurdles or legal challenges can disrupt value creation and introduce uncertainties that impact shareholder value.

By comprehensively analyzing these factors, stakeholders can gain insights into the intricate web of influences that shape the outcomes of M&A transactions and their implications for shareholder value. In the subsequent section, we will delve into the primary reason behind the negative impact of M&A on shareholder value, shedding light on a critical aspect that warrants attention in the realm of corporate restructuring.

The Main Reason for Negative Impact on Shareholder Value

Unveiling the Predominant Factor Undermining Shareholder Wealth in Mergers and Acquisitions

While mergers and acquisitions (M&A) hold the promise of value creation and strategic growth, it is essential to acknowledge the predominant factor that often leads to a negative impact on shareholder value in the aftermath of these transactions. One of the primary reasons for the erosion of shareholder wealth in M&A activities is the failure to realize anticipated synergies and integration challenges.

Lack of Synergistic Benefits: The pursuit of synergies, which underpins many M&A transactions, is often predicated on the expectation of combined entities achieving greater value together than they could as standalone entities. However, the actualization of synergistic benefits is contingent on effective integration, harmonization of processes, and alignment of strategic objectives. In instances where the anticipated synergies fail to materialize or are not fully captured, the anticipated value creation may not materialize, resulting in a negative impact on shareholder value.

Integration Challenges: The integration of disparate organizational cultures, operational systems, and human capital is a complex undertaking in the context of M&A. Challenges in integration, such as cultural clashes, leadership transitions, and operational disruptions, can impede the realization of synergies and value creation. Moreover, the diversion of managerial attention and resources toward integration efforts may detract from core business operations, affecting financial performance and shareholder returns.

Communication and Expectation Management: Inadequate communication and transparency regarding the integration process and the expected benefits can contribute to uncertainty and apprehension among shareholders. When the post-merger reality deviates from the communicated expectations, it can lead to disillusionment and a subsequent decline in shareholder value.

By addressing these pivotal factors, companies engaging in M&A can mitigate the risks associated with value erosion and enhance the prospects of delivering sustainable value to shareholders. In the subsequent section, we will delve into real-world case studies and examples to illustrate the practical implications of these challenges on shareholder value, offering valuable insights into the complexities of M&A and its impact on investor interests.

Case Studies and Examples

Illustrating the Real-World Impact of Mergers and Acquisitions on Shareholder Value

Examining real-world case studies and examples provides valuable insights into the tangible effects of mergers and acquisitions (M&A) on shareholder value, shedding light on the complexities and challenges inherent in these strategic transactions. Let’s explore two illustrative cases that underscore the impact of M&A on shareholder wealth.

Case Study 1: AOL-Time Warner Merger

In 2000, the merger of AOL and Time Warner, heralded as a transformative combination of media and technology, was anticipated to create substantial synergies and redefine the landscape of content distribution. However, the integration challenges and divergent corporate cultures impeded the realization of synergistic benefits. The failure to align strategic objectives and harness synergies led to a significant decline in shareholder value, with the combined entity witnessing a substantial erosion in market capitalization in the years following the merger.

Case Study 2: Hewlett-Packard’s Acquisition of Autonomy

Hewlett-Packard’s acquisition of Autonomy, a UK-based software company, exemplifies the impact of integration and performance discrepancies on shareholder value. Following the acquisition in 2011, Hewlett-Packard alleged accounting irregularities at Autonomy, leading to a substantial write-down of the acquisition value. The ensuing legal disputes and financial setbacks not only eroded shareholder value but also underscored the significance of due diligence and post-acquisition integration in safeguarding shareholder interests.

These case studies underscore the multifaceted nature of M&A and highlight the critical role of integration, synergies, and strategic alignment in shaping the outcomes for shareholders. By learning from these real-world examples, stakeholders can glean valuable lessons and insights into the complexities of M&A and the imperative of safeguarding shareholder value amidst transformative corporate actions.

As we conclude our exploration, it is evident that the impact of M&A on shareholder value is contingent on a myriad of factors, including strategic alignment, integration efficacy, and communication transparency. By navigating these complexities with diligence and foresight, companies can strive to deliver sustainable value creation and uphold the interests of their shareholders in the dynamic landscape of corporate restructuring.

Conclusion

Navigating the Complexities of Mergers and Acquisitions: Implications for Shareholder Value

In conclusion, the realm of mergers and acquisitions (M&A) presents a dynamic landscape fraught with opportunities and challenges, particularly concerning its impact on shareholder value. Through our exploration, we have unraveled the intricate web of factors that influence shareholder value in the context of M&A, shedding light on the multifaceted dynamics that underpin the outcomes of these transformative transactions.

From the strategic fit and integration challenges to the communication transparency and market sentiment, the determinants of shareholder value in M&A transactions are diverse and interwoven. The failure to realize anticipated synergies and integration challenges emerge as predominant reasons for the negative impact on shareholder value, underscoring the critical importance of strategic alignment and post-merger integration in delivering value to shareholders.

Real-world case studies, such as the AOL-Time Warner merger and Hewlett-Packard’s acquisition of Autonomy, have provided tangible illustrations of the complexities and implications of M&A on shareholder wealth. These examples emphasize the significance of due diligence, integration efficacy, and strategic coherence in safeguarding shareholder interests amidst transformative corporate actions.

As companies navigate the complexities of M&A, it is imperative to prioritize the alignment of strategic objectives, meticulous integration planning, and transparent communication to mitigate the risks of value erosion and enhance the prospects of sustainable value creation. By doing so, companies can uphold the interests of their shareholders, foster confidence in the market, and navigate the transformative landscape of corporate restructuring with prudence and foresight.

Ultimately, the impact of M&A on shareholder value underscores the pivotal role of comprehensive analysis, strategic foresight, and diligent execution in shaping the outcomes for stakeholders. By embracing a holistic approach to M&A and prioritizing the creation and preservation of shareholder value, companies can navigate the complexities of corporate restructuring and strive to deliver enduring value to their investors and industry stakeholders.