Home>Finance>I Need To Use My Credit Card Before Billing Cycle Ends, Who Processes Immediately?

Finance

I Need To Use My Credit Card Before Billing Cycle Ends, Who Processes Immediately?

Published: March 7, 2024

Ensure your credit card payment is processed immediately before the billing cycle ends with expert financial advice. Take control of your finances today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Managing credit card payments is an important aspect of personal finance. It’s not uncommon to find oneself in a situation where a credit card payment needs to be made urgently before the billing cycle ends. Whether it’s to avoid interest charges or to ensure that a large purchase is reflected in the current billing cycle, understanding the options for immediate payment processing is crucial.

In this article, we’ll delve into the intricacies of credit card billing cycles and payment processing. We’ll explore the entities involved in processing credit card payments and the factors that affect immediate processing. Additionally, we’ll discuss alternative methods for making immediate payments and provide valuable insights to help you navigate this aspect of credit card management effectively.

By the end of this article, you’ll have a comprehensive understanding of how credit card payments are processed, the options available for immediate processing, and the factors to consider when making time-sensitive payments. Let’s embark on this insightful journey to unravel the nuances of credit card payment processing and empower ourselves with the knowledge to make informed financial decisions.

Understanding Billing Cycles and Payment Processing

Before delving into the specifics of immediate payment processing, it’s essential to grasp the concept of credit card billing cycles and payment processing timelines. A billing cycle, typically lasting between 28 and 31 days, is the duration during which transactions are recorded and a statement is generated. At the end of this cycle, a statement is issued, detailing the transactions made, the total balance, minimum payment due, and the payment due date.

Payment processing involves the steps taken to settle the outstanding balance on a credit card account. When a payment is made, it undergoes a series of processes before reflecting in the account balance. These processes include authorization, batching, and settlement, each of which contributes to the overall timeline for payment processing.

Understanding the billing cycle and payment processing timeline is crucial for effective credit card management. It enables cardholders to strategize their payments, anticipate the impact of transactions on their billing cycle, and make informed decisions regarding when to make payments to optimize their financial position.

By comprehending the intricacies of billing cycles and payment processing, individuals can gain greater control over their credit card accounts, minimize interest charges, and leverage the nuances of payment timelines to their advantage. This foundational knowledge forms the basis for navigating the realm of immediate payment processing, which we’ll explore in the subsequent sections.

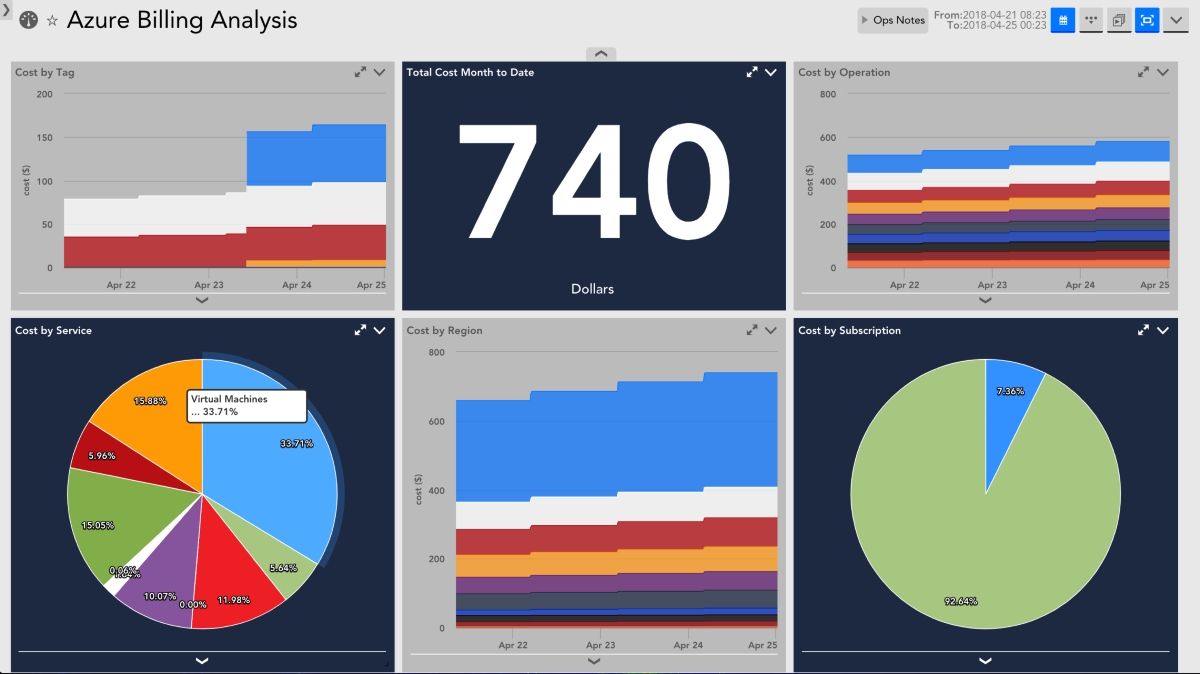

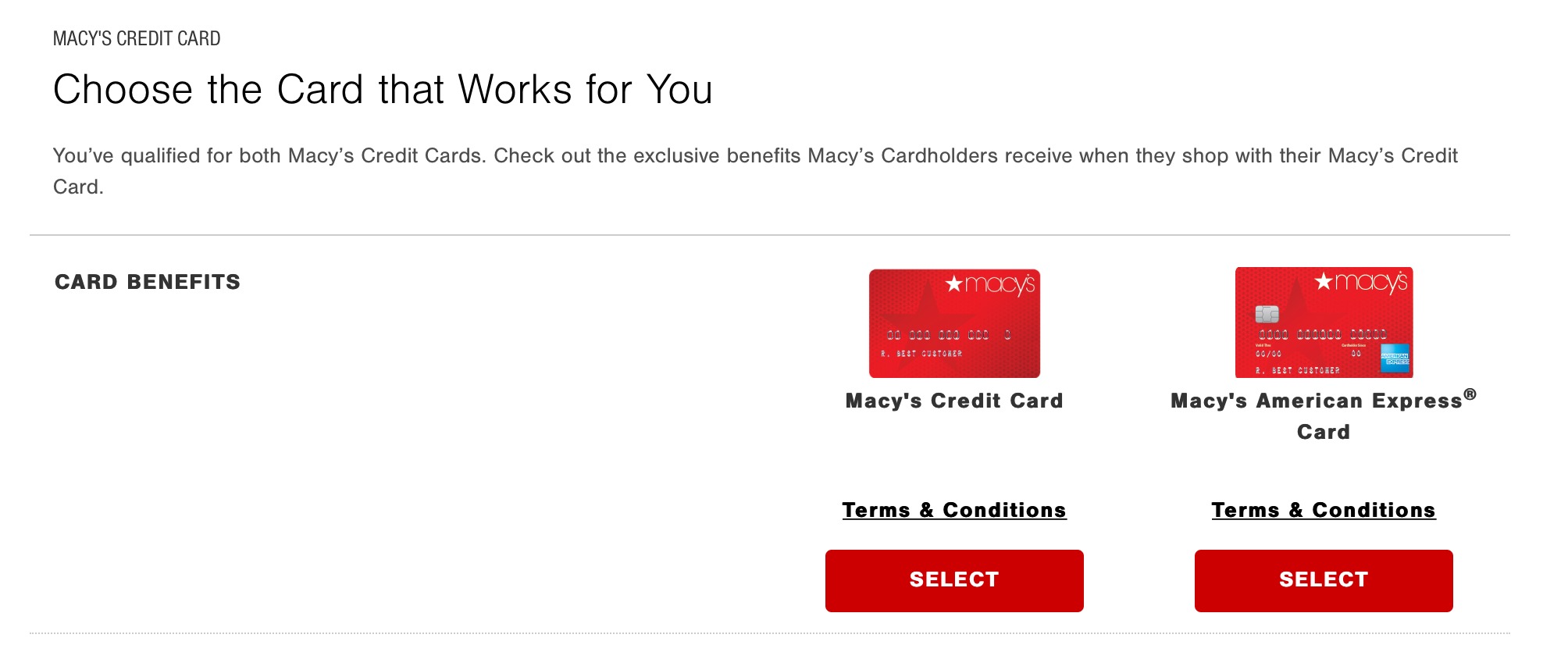

Credit Card Issuers and Their Processing Times

When it comes to credit card payments, understanding the processing times of different issuers is essential for managing payments effectively. Credit card issuers, such as banks and financial institutions, have varying timelines for processing payments, which can significantly impact when the payment reflects on the account balance.

Most credit card issuers offer multiple methods for making payments, including online payments, phone payments, and in-person payments at bank branches. Each of these methods may have different processing times, with online payments often being the quickest due to automated systems and real-time processing capabilities.

It’s important to note that while some issuers may process payments immediately, others may have a delay of one or more business days before the payment is reflected in the account balance. Understanding the specific processing times of your credit card issuer is crucial for making informed decisions when time-sensitive payments are required.

Furthermore, the time at which a payment is made within the billing cycle can also impact its processing time. Payments made closer to the payment due date may take longer to reflect in the account balance, potentially leading to late payment fees or accrued interest if not accounted for strategically.

By being aware of the processing times of different credit card issuers and the factors that can influence payment timelines, individuals can proactively plan their payments to ensure timely processing and minimize the risk of incurring additional charges.

Factors Affecting Immediate Processing

Several factors can influence the immediate processing of credit card payments, impacting the speed at which a payment reflects in the account balance. Understanding these factors is crucial for effectively navigating time-sensitive payment scenarios.

- Payment Method: The method used to make a credit card payment can significantly affect processing times. Online payments and electronic transfers often result in immediate or same-day processing, while payments made through alternative methods, such as checks or in-person transactions, may involve longer processing times.

- Time of Day: The time at which a payment is initiated can impact its processing time. Payments made during the business hours of the credit card issuer are more likely to be processed on the same day, while payments made outside of these hours may be queued for the next business day’s processing.

- Weekends and Holidays: Payments made on weekends or public holidays may experience delays in processing, as many financial institutions have limited or no processing activities during these periods. It’s important to consider the impact of weekends and holidays when requiring immediate payment processing.

- Account Status: The status of the credit card account, including factors such as current balance, available credit, and payment history, can influence processing times. Accounts with delinquencies or restrictions may undergo additional scrutiny, potentially leading to longer processing times for payments.

- Payment Amount: Larger payments, particularly those exceeding the usual spending patterns of the cardholder, may undergo additional verification processes, leading to longer processing times. Understanding the thresholds for such verifications can help in planning time-sensitive payments effectively.

By considering these factors when requiring immediate payment processing, individuals can make informed decisions regarding the timing and method of their credit card payments, ensuring that payments are processed promptly to align with their financial needs and obligations.

Alternatives for Immediate Payments

When immediate credit card payments are necessary, several alternatives can be explored to expedite the processing and ensure timely reflection in the account balance. Understanding these alternatives empowers individuals to make informed choices based on their specific financial circumstances and urgency of the payment.

- Online Payments: Utilizing the online banking or payment portal offered by the credit card issuer allows for immediate processing of payments in many cases. This method leverages automated systems and real-time processing capabilities to ensure that the payment reflects in the account balance without delays.

- Electronic Funds Transfer (EFT): Initiating an electronic funds transfer from a linked bank account to the credit card can expedite payment processing. EFT payments often result in immediate or same-day processing, making them a viable option for urgent payments.

- Over-the-Phone Payments: Some credit card issuers offer over-the-phone payment services that can facilitate immediate processing of payments. This option is particularly beneficial when online access is unavailable, providing a convenient alternative for time-sensitive payments.

- Same-Day Wire Transfers: In situations where immediate payment processing is imperative, opting for a same-day wire transfer from a bank account to the credit card issuer can ensure rapid settlement of the payment. While wire transfers may involve additional fees, they offer expedited processing times.

- Payment at a Local Branch: Visiting a local branch of the credit card issuer and making a payment in person can provide immediate processing, especially if the payment is made during business hours. This option offers a tangible and prompt solution for urgent payment needs.

When exploring these alternatives, it’s essential to consider any associated fees, processing times, and the availability of the chosen method based on the specific circumstances. By leveraging these alternatives strategically, individuals can navigate time-sensitive payment scenarios with confidence, ensuring that their credit card payments are processed promptly to align with their financial objectives.

Conclusion

Understanding the dynamics of credit card billing cycles, payment processing timelines, and the factors influencing immediate payment processing is fundamental to effective financial management. By gaining insight into these intricacies, individuals can navigate time-sensitive payment scenarios with confidence, ensuring that their credit card payments are processed promptly to align with their financial needs and obligations.

It’s evident that credit card issuers play a pivotal role in the processing of payments, with varying timelines and methods that can impact the speed at which payments reflect in the account balance. By being aware of the processing times of different issuers and the alternatives available for immediate payments, individuals can make informed decisions tailored to their specific circumstances.

Moreover, considering the factors that affect immediate processing, such as payment methods, time of day, weekends and holidays, account status, and payment amount, provides a comprehensive perspective for planning time-sensitive payments effectively. This understanding empowers individuals to strategize their payments and leverage the available alternatives to expedite processing when necessary.

In conclusion, the ability to navigate immediate credit card payments is rooted in knowledge, foresight, and informed decision-making. By integrating these insights into their financial approach, individuals can optimize their credit card management, minimize the risk of additional charges, and maintain greater control over their financial well-being. The journey to mastering the nuances of credit card payment processing equips individuals with the tools to make timely and strategic financial decisions, ultimately contributing to their overall financial stability and peace of mind.