Finance

How To Start Your Own Credit Card Company

Modified: March 1, 2024

Learn how to start your own credit card company and enter the lucrative world of finance with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Credit Card Industry

- Conducting Market Research

- Developing a Business Plan

- Obtaining Necessary Licenses and Permits

- Securing Funding for Your Credit Card Company

- Building a Team and Infrastructure

- Creating Credit Card Products

- Partnering with Banks or Payment Processors

- Designing and Printing Credit Cards

- Marketing and Promoting Your Credit Card Company

- Setting Up Customer Service and Support Systems

- Managing Risks and Compliance

- Launching Your Credit Card Company

- Monitoring and Improving Performance

- Conclusion

Introduction

Starting your own credit card company can be an exciting and rewarding venture. With the increasing demand for credit cards and digital payments, there is ample opportunity to tap into this lucrative market. However, it requires careful planning, industry knowledge, and a solid business strategy to succeed.

In this article, we will guide you through the process of starting your own credit card company. We’ll discuss the key steps and considerations involved, from understanding the credit card industry to launching and managing your business. So, whether you’re a financial enthusiast, a tech-savvy entrepreneur, or someone looking to venture into the world of fintech, this article will provide you with valuable insights to get started.

Before diving into the nitty-gritty of creating your credit card company, it’s essential to understand the credit card industry landscape. Credit cards have become an integral part of our lives, providing convenient and secure access to credit for individuals and businesses alike. The industry is highly regulated, and competition is fierce, with established players dominating the market.

However, there are still opportunities for new entrants who can bring innovation, unique offerings, and exceptional customer experiences. By understanding the market dynamics and identifying gaps or niches, you can position your credit card company for success.

Market research plays a crucial role in evaluating the demand and competition in the credit card industry. It involves analyzing consumer behavior, identifying target customer segments, studying competitors, and understanding industry trends. This information will help you make informed decisions and tailor your offerings to meet customer needs and preferences.

Creating a comprehensive business plan is vital for any startup, including a credit card company. It serves as a roadmap for your business, outlining your vision, goals, target market, marketing strategies, financial projections, and operational plans. A well-crafted business plan not only helps you secure funding but also provides direction and guidance as you navigate the challenges of building and growing your credit card company.

Obtaining the necessary licenses and permits is crucial to operate your credit card company legally. Depending on your jurisdiction, you may need to comply with financial regulations, anti-money laundering laws, and consumer protection guidelines. Consulting with legal and regulatory experts can ensure that you adhere to all applicable requirements and maintain regulatory compliance.

Understanding the Credit Card Industry

The credit card industry is a complex and highly regulated sector that facilitates electronic payments and extends credit to consumers. It involves a network of financial institutions, payment processors, merchants, and cardholders.

Credit cards have revolutionized the way we make purchases, allowing us to buy goods and services on credit and repay the amount later. They offer convenience, security, and flexibility, making them a popular choice for consumers and businesses alike.

One of the primary players in the credit card industry is the issuing bank. The issuing bank is responsible for issuing credit cards, setting credit limits, and handling cardholder accounts. They earn revenue through interest charges on outstanding balances and various fees associated with card usage.

Payment processors play a crucial role in the credit card ecosystem. They enable the authorization, settlement, and processing of credit card transactions. Payment processors act as intermediaries between the issuing banks, acquiring banks, and merchants to ensure smooth and secure payment processing.

Acquiring banks are responsible for establishing and maintaining relationships with merchants who accept credit card payments. They facilitate the transfer of funds from cardholders’ accounts to the merchants’ accounts and earn revenue through interchange fees and other transaction-related charges.

The credit card industry is highly regulated to ensure consumer protection, prevent fraud, and maintain the integrity of the financial system. Regulatory bodies, such as the Consumer Financial Protection Bureau (CFPB) in the United States, impose rules and guidelines for credit card issuers and processors to follow.

Understanding the key trends and dynamics in the credit card industry is crucial for success as a credit card company. Some notable industry trends include the shift towards contactless payments, the rise of mobile wallets, and increased security measures to combat fraud. Staying up to date with technological advancements and consumer preferences will help you stay competitive and attract customers.

Furthermore, it is essential to be aware of the competitive landscape. Established credit card companies, such as Visa, Mastercard, and American Express, dominate the market. These companies have built strong brand presence and networks, making competition challenging for new entrants.

However, there are still opportunities for niche credit card companies that offer unique value propositions, cater to specific customer segments, or provide innovative features and rewards programs. Identifying a target market or specific customer need that is underserved by the existing players can give your credit card company a competitive edge.

In the next section, we will delve into the crucial step of conducting market research to identify your target market and assess the competition in the credit card industry.

Conducting Market Research

Conducting thorough market research is a vital step in starting your own credit card company. It allows you to gain valuable insights into the target market, understand customer needs and preferences, and assess the competition. Here are some key aspects to consider when conducting market research for your credit card company:

- Identify target customer segments: Determine the specific customer segments you want to target with your credit card offerings. Consider factors such as age, income level, occupation, and lifestyle preferences. Understanding your target audience will help you tailor your products and marketing strategies to meet their needs.

- Analyze customer behavior: Study the spending habits, payment preferences, and financial behaviors of your target customers. This will help you design credit card features and benefits that are appealing to your target audience.

- Evaluate the competition: Research and analyze the existing credit card companies in the market. Study their product offerings, pricing, rewards programs, and customer service. Identify any gaps or opportunities where your credit card company can differentiate itself and offer unique value to customers.

- Assess market demand: Analyze the market demand for credit cards in your target market. Look for factors such as population size, economic indicators, consumer sentiment, and market trends that indicate the potential growth of the credit card industry in your chosen market.

- Understand regulatory requirements: Familiarize yourself with the legal and regulatory requirements for offering credit card services in your jurisdiction. Ensure that you comply with all the necessary licensing, privacy, and consumer protection regulations.

To conduct market research effectively, you can utilize a combination of primary and secondary research methods. Primary research involves collecting data directly from potential customers through surveys, interviews, or focus groups. This will provide you with direct insights into their needs and preferences.

Secondary research involves gathering existing data and information from reputable sources such as industry reports, market research firms, government publications, and trade associations. This will give you a broader understanding of the credit card industry and market trends.

By conducting comprehensive market research, you can gain a deep understanding of your target market, validate the demand for your credit card products, and identify opportunities for differentiation. This research will serve as the foundation for developing a solid business strategy and positioning your credit card company for success.

In the next section, we will explore the process of developing a business plan for your credit card company, which will guide your operations and help attract investors and partners.

Developing a Business Plan

Developing a comprehensive business plan is a crucial step in starting your own credit card company. A well-crafted business plan serves as a roadmap for your company, outlining your goals, strategies, target market, financial projections, and operational plans. It helps you showcase the viability of your business to potential investors and partners, and provides guidance as you navigate the challenges of building and growing your credit card company.

Here are the key components to include when developing your business plan:

- Executive Summary: This section provides an overview of your credit card company, highlighting its mission, vision, and key differentiators. It should be concise but compelling, grabbing the reader’s attention and setting the stage for the rest of the business plan.

- Company Description: Describe your credit card company in detail, including its legal structure, ownership, and management team. Explain the unique value proposition of your credit card products and how they address customer needs.

- Market Analysis: Conduct a thorough analysis of the credit card industry and your target market. Identify the market size, growth potential, and key trends. Assess the competitive landscape and highlight any opportunities or gaps that your credit card company can capitalize on.

- Product and Service Offering: Describe the features, benefits, and pricing of your credit card products and services. Explain how they provide value to your target customers and differentiate your company from competitors. Outline any additional services or perks, such as rewards programs, travel benefits, or customer support.

- Marketing and Sales Strategy: Outline your marketing and sales plans to attract and acquire customers. Identify the channels and tactics you will use to promote your credit card company, such as digital marketing, partnerships, advertising, or direct sales. Develop strategies to build brand awareness and attract a loyal customer base.

- Operations and Infrastructure: Detail the operational aspects of your credit card company, including the technology systems, infrastructure, and processes required to support card issuance, payment processing, and customer service. Explain how you will ensure a secure and seamless user experience.

- Financial Projections: Provide realistic financial projections for your credit card company, including revenue, expenses, and net income over a three to five-year period. Include details on the funding required to start and operate your credit card company, as well as your plan for generating revenue and achieving profitability.

- Risk Analysis: Identify potential risks and challenges that may impact the success of your credit card company. Develop strategies to mitigate these risks, whether they are regulatory, operational, financial, or competitive in nature.

It is crucial to ensure that your business plan is well-researched, realistic, and demonstrates a clear understanding of the credit card industry. Consider seeking input and feedback from industry experts or experienced professionals to validate your assumptions and strengthen your plan.

A well-developed business plan not only helps you secure funding from investors or financial institutions but also provides guidance and a framework for decision-making as you launch and grow your credit card company.

In the next section, we will discuss the process of obtaining the necessary licenses and permits to legally operate your credit card company.

Obtaining Necessary Licenses and Permits

Obtaining the necessary licenses and permits is a crucial step in starting your credit card company. Operating without the proper licenses and permits can lead to legal issues and regulatory penalties. The specific requirements may vary depending on your jurisdiction, so it’s essential to research and comply with the regulations applicable to your location.

Here are some key licenses and permits you may need to obtain:

- Financial Institution License: In many jurisdictions, providing credit card services requires obtaining a financial institution license. This license establishes your company as a recognized financial institution and ensures compliance with financial regulations.

- Payment Card Industry Data Security Standard (PCI DSS) Compliance: Compliance with the PCI DSS is necessary for companies involved in processing, transmitting, or storing payment card information. It ensures that your infrastructure and processes adhere to stringent security standards to protect cardholder data.

- Anti-Money Laundering (AML) Compliance: Credit card companies are often subject to AML regulations to prevent illegal activities such as money laundering and terrorist financing. You may need to establish robust AML policies and procedures and register with the appropriate regulatory bodies.

- Consumer Protection Registration: Depending on your jurisdiction, you may need to register your credit card company with consumer protection agencies or regulatory authorities to ensure fair practices and transparency in your operations. This registration helps protect cardholders’ rights and promotes ethical business conduct.

- Privacy Regulations Compliance: Credit card companies handle sensitive customer information, making compliance with privacy regulations critical. Ensure that you have the necessary measures in place to protect and secure customer data in accordance with applicable data protection laws.

It is important to consult with legal experts specializing in financial services or regulatory compliance to ensure that you are aware of all the licenses and permits required for your credit card company. They can guide you through the application processes and help you stay compliant with the applicable regulations.

When applying for licenses and permits, be prepared to provide detailed documentation, such as business plans, financial statements, background checks, and compliance policies. The application process may involve reviews, audits, and inspections to ensure that your credit card company meets the necessary requirements.

Keep in mind that maintaining compliance is an ongoing responsibility. Stay up to date with changes in regulations and continuously review and update your policies and procedures to reflect any new requirements.

By obtaining the necessary licenses and permits, you demonstrate your commitment to operating a legitimate and compliant credit card company. It instills trust in your customers, financial partners, and regulatory authorities and helps establish a solid foundation for your business.

In the next section, we will explore strategies for securing funding to launch and grow your credit card company.

Securing Funding for Your Credit Card Company

Securing funding is a crucial step in starting and growing your credit card company. Whether you are looking to fund initial startup costs or expand your operations, having the necessary capital is essential. Here are some strategies to consider when seeking funding:

- Self-Funding: If you have personal savings or assets, self-funding can be a viable option to get your credit card company off the ground. This approach allows you to maintain control and ownership of your business without relying on external investors.

- Friends and Family: Approach friends and family members who believe in your business idea and may be willing to provide financial support. However, it’s important to have clear expectations, terms, and legal agreements in place to protect both parties’ interests.

- Angel Investors: Angel investors are individuals or groups who provide capital to startups in exchange for equity or a return on investment. Seek out angel investors with a background in the financial or fintech industries who may be interested in supporting your credit card venture.

- Venture Capitalists: Venture capitalists (VCs) are professional investors who provide funding to high-growth startups in exchange for equity. Look for VCs with experience in the financial technology (fintech) sector or those who have invested in similar companies.

- Bank Loans: Consider applying for traditional bank loans to secure funding for your credit card company. Prepare a solid business plan, financial statements, and any other necessary documentation to present to the bank. Collateral may be required to secure the loan.

- Crowdfunding: Crowdfunding platforms provide an opportunity to raise funds from a large group of individuals who believe in your vision. Create a compelling campaign highlighting the unique aspects of your credit card company, and offer rewards or equity for those who contribute.

- Strategic Partnerships: Explore potential partnerships or collaborations with banks, financial institutions, or technology companies that can provide financial support in exchange for access to your credit card services or technology solutions. This can also offer valuable expertise, resources, and distribution channels.

When seeking funding, it’s important to develop a comprehensive financial plan and projections that demonstrate the potential return on investment for your credit card company. Investors and lenders will want to see a clear path to profitability and a solid understanding of the market dynamics.

Additionally, networking with industry professionals, attending investment conferences, and joining fintech incubators or accelerators can help you connect with potential investors and gain valuable insights and guidance.

Remember that funding is not just about the money but also about finding investors or partners who align with your values and strategic goals. Choose investors who bring more than just capital to the table, such as industry expertise, connections, and mentorship.

In the next section, we will discuss the process of building a team and infrastructure for your credit card company.

Building a Team and Infrastructure

Building a strong team and establishing a robust infrastructure are critical components of starting and scaling your credit card company. The right team and infrastructure will help you efficiently manage operations, deliver exceptional customer experiences, and drive business growth. Here are some key steps to consider:

- Identify Key Roles: Determine the key roles and positions needed for your credit card company, such as executive leadership, finance, operations, marketing, technology, compliance, and customer service. Define the responsibilities and skillsets required for each position.

- Recruit Talented Professionals: Seek out professionals with experience in the financial services, credit card, or fintech industries. Look for individuals who not only possess the required skills and expertise but also align with your company’s vision and values. Utilize online job boards, professional networks, and recruitment agencies to attract top talent.

- Establish Internal Processes: Develop clear and efficient processes to streamline your credit card operations. This may include procedures for card issuance, payment processing, customer onboarding, fraud prevention, regulatory compliance, and customer support. Document these processes and ensure all team members are trained and equipped to follow them.

- Invest in Technology: Implement robust technology systems and infrastructure to support your credit card operations. This may include payment processing platforms, customer relationship management (CRM) tools, fraud detection systems, data analytics, and security measures. Partner with reputable technology providers to ensure the reliability, security, and scalability of your infrastructure.

- Emphasize Compliance: Compliance with financial regulations and industry standards is crucial for running a credit card company. Ensure that your team has a deep understanding of the regulatory requirements and follows best practices for data security, privacy, and anti-money laundering. Conduct regular training sessions to keep employees updated on compliance policies.

- Cultivate a Positive Work Culture: Foster a positive work environment that encourages collaboration, creativity, and continuous learning. Emphasize transparency, open communication, and a supportive culture that values diversity and inclusion. This will help attract and retain top talent and promote employee satisfaction and engagement.

- Continuous Improvement: Regularly evaluate and assess your team’s performance and identify areas for improvement. Encourage feedback and suggestions from employees and customers to drive innovation and enhance the customer experience. Stay updated with industry trends and emerging technologies to keep your team and infrastructure at the forefront of the credit card industry.

Building a strong team and scalable infrastructure may take time and investment, but it is crucial for the long-term success of your credit card company. Remember, your team and infrastructure will form the foundation for delivering excellent service, building customer trust, and differentiating your company in the market.

In the next section, we will discuss the process of creating credit card products that cater to your target market’s needs and preferences.

Creating Credit Card Products

Creating compelling and attractive credit card products is essential for success in the credit card industry. It involves understanding the needs and preferences of your target market and designing card features, rewards programs, and benefits that differentiate your offerings from competitors. Here are essential steps to consider when creating credit card products:

- Identify Target Customer Segments: Determine the specific customer segments you want to target with your credit card products. Consider factors such as demographics, lifestyle, spending habits, and financial aspirations. This will help tailor your products to meet their unique needs and preferences.

- Define Value Proposition: Clarify the value proposition of your credit card products. Identify the key benefits and features that set your cards apart from the competition. Whether it’s offering competitive interest rates, generous rewards programs, unique perks, or customized card designs, highlight what makes your credit cards desirable and valuable to potential customers.

- Design Card Features: Determine the specific features and functionalities you want to offer with your credit cards. These may include features like contactless payments, mobile wallet integration, balance transfer options, extended warranties, purchase protection, or travel insurance. Prioritize features that align with your target market’s preferences and provide tangible benefits.

- Create Rewards Programs: Develop attractive rewards programs that incentivize cardholders and encourage frequent usage. Consider offering cashback rewards, airline miles, loyalty points, or exclusive discounts with partner merchants. Structure the rewards program to align with the spending patterns and interests of your target customer segments.

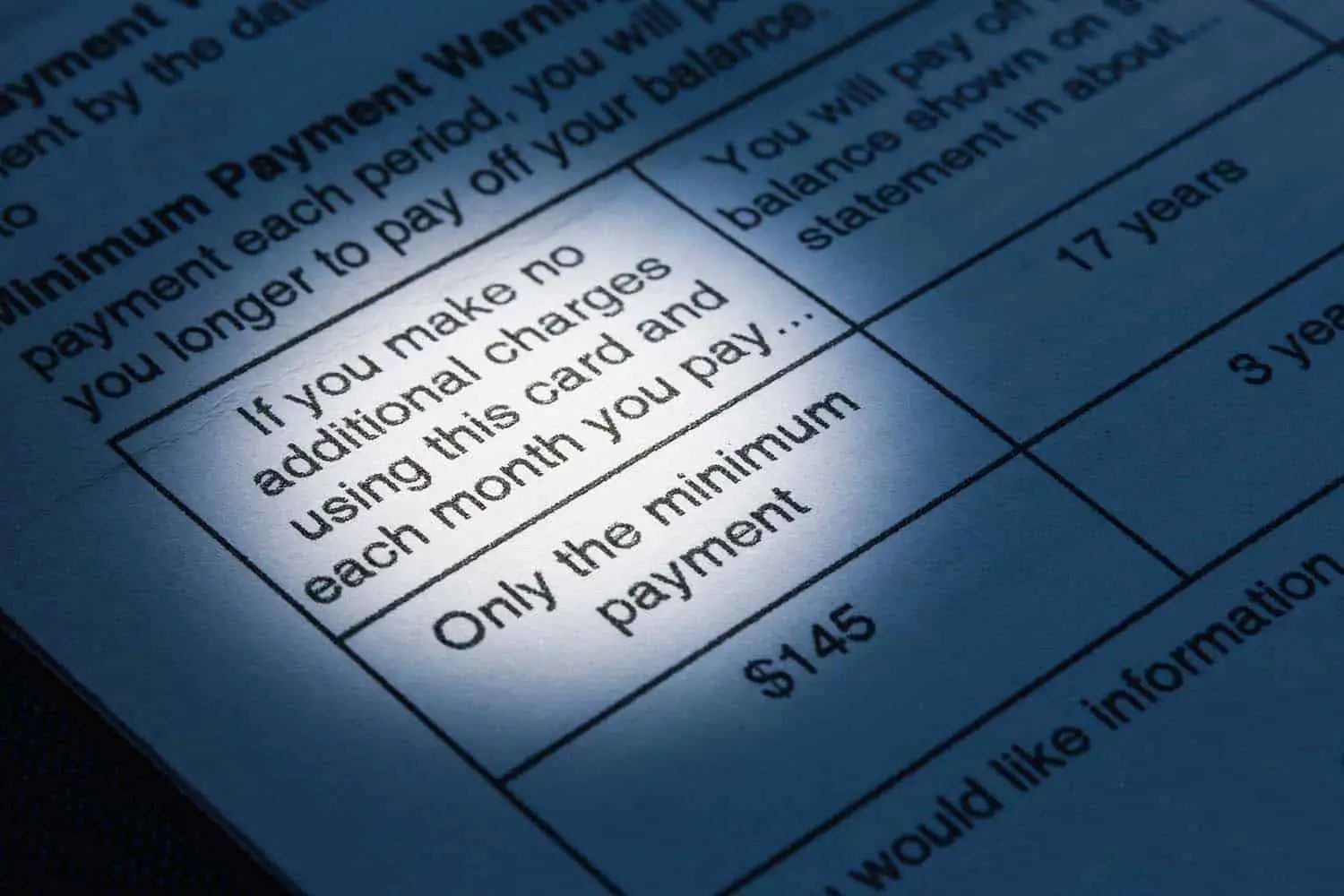

- Set Appropriate Fees and Interest Rates: Establish fees and interest rates that strike a balance between revenue generation and customer attractiveness. Research industry standards and competitive offerings to determine reasonable fee structures. Set interest rates that are competitive but still align with your credit risk assessment and revenue goals.

- Ensure Security and Fraud Protection: Implement robust security measures to protect cardholders’ data and prevent fraud. This may include utilizing encryption technologies, implementing two-factor authentication, and monitoring transactions for suspicious activities. Communicate your commitment to security and provide peace of mind to your customers.

- Provide Customer Support: Establish strong customer support channels to assist cardholders with any inquiries, concerns, or issues. Offer multiple contact options, such as phone, email, and live chat, and ensure timely and responsive assistance. Excellent customer service can differentiate your credit card company and create a positive experience for cardholders.

It is crucial to continuously gather customer feedback and monitor industry trends to refine and enhance your credit card products. Stay updated with market demands, emerging technologies, and competitors’ offerings to ensure your credit card products remain relevant and competitive.

Before launching your credit card products, conduct thorough testing and quality assurance to ensure that they function as intended and provide a seamless user experience. Consider conducting pilot programs or soft launches to gather feedback and make any necessary adjustments before a full-scale release.

By creating credit card products that resonate with your target market, offer unique value, and cater to their needs, you can attract and retain a loyal customer base and position your credit card company for success.

In the next section, we will discuss the importance of partnering with banks or payment processors to strengthen your credit card company’s operations and reach.

Partnering with Banks or Payment Processors

Partnering with banks or payment processors is a strategic move that can significantly strengthen your credit card company’s operations and market reach. By leveraging the infrastructure and expertise of established financial institutions, you can enhance your product offerings, expand your customer base, and improve the overall credibility of your brand. Here are key reasons why partnering with banks or payment processors is advantageous:

- Access to Payment Networks: Banks and payment processors have established connections with payment networks such as Visa, Mastercard, or American Express. Partnering with them can provide you with access to these networks, enabling your credit card company to issue cards that are accepted worldwide.

- Payment Processing Expertise: Banks and payment processors have extensive experience and specialized systems in payment processing. By partnering with them, you can leverage their payment processing infrastructure to handle transactions efficiently and securely. This eliminates the need to build your own payment processing capabilities from scratch.

- Regulatory Compliance: Financial institutions are well-versed in regulatory requirements and compliance standards. Partnering with banks ensures that your credit card company operates within the legal framework and meets regulatory guidelines. They can provide guidance on anti-money laundering (AML) procedures, data protection, and other compliance-related matters.

- Credibility and Trust: Partnering with reputable banks or payment processors enhances your credit card company’s credibility and instills trust in potential customers. Customers are more likely to trust and choose a credit card backed by a well-known financial institution that has a strong track record in the industry.

- Risk Management: Banks have sophisticated risk management systems and processes in place to mitigate fraud and credit risk. By partnering with them, you can leverage their expertise and benefit from their risk assessment and monitoring capabilities. This helps protect your credit card company and customers from potential risks.

- Access to Banking Services: Partnering with banks allows you to offer additional banking services to your customers. This can include options such as savings accounts, online banking, or loans, which further enhance the value proposition of your credit card offerings and attract a broader customer base.

- Distribution Channels: Banks and payment processors have established distribution networks, enabling your credit card products to reach a wider audience. By partnering with them, you can tap into their existing customer bases and benefit from their marketing and distribution channels. This can accelerate your customer acquisition efforts and drive growth.

When seeking partnerships, carefully evaluate potential banking or payment processing partners. Consider factors such as their reputation, reliability, technological capabilities, customer service, and alignment with your business objectives. Thoroughly review partnership agreements and consult legal and financial experts to ensure that the terms and conditions protect your interests.

Collaborating with banks or payment processors can provide your credit card company with the resources, expertise, and market access necessary to compete effectively in the industry. It allows you to focus on core competencies, such as product innovation and customer experience, while leveraging the established infrastructure and credibility of your partners.

In the next section, we will discuss the importance of designing and printing visually appealing and functional credit cards.

Designing and Printing Credit Cards

The design of your credit cards plays a crucial role in attracting customers, promoting brand recognition, and enhancing the overall user experience. Designing visually appealing and functional credit cards requires thoughtful consideration of branding elements, security features, and cardholder convenience. Here are key factors to keep in mind when designing and printing credit cards:

- Branding and Visual Identity: Your credit card design should align with your brand’s visual identity and values. Incorporate your logo, brand colors, and typography to create a cohesive and recognizable look. Consistency in branding helps build trust and reinforces your credit card company’s image.

- Cardholder Information: Ensure that essential cardholder information, such as the cardholder’s name, card number, expiration date, and security code, is prominently displayed and easily readable. Consider using embossing or raised letters for a tactile experience that adds a sense of security to the card.

- Security Features: Incorporate security features into the design of your credit cards to protect against counterfeit or fraudulent activities. This may include holograms, UV inks, microprinting, or unique card patterns. Consult with security experts to determine the most effective measures based on industry standards and best practices.

- Card Technology: Depending on the features you offer, adopt the appropriate card technology to enhance the cardholder experience. This can include contactless payment capabilities, EMV chips for added security, or magnetic stripes for compatibility with older payment terminals. Ensure that the card design accommodates and highlights these technologies effectively.

- Card Features and Benefits: Use visual cues to highlight the features and benefits of your credit cards. This can include icons or symbols that represent rewards programs, cashback offers, or exclusive perks. Engaging visuals can captivate the cardholder and motivate them to actively use the card to take advantage of the benefits.

- Card Design Variation: Consider offering different design options or customization features for your credit cards. This allows customers to personalize their cards and fosters a sense of ownership and individuality. Explore options such as cardholder photos, personalized backgrounds, or limited-edition designs for special events or collaborations.

- Print Quality and Materials: Ensure that your credit cards are printed with high-quality materials and techniques that withstand frequent use and maintain their appearance over time. Choose durable materials, such as PVC or composite materials, and work with reputable printing companies that specialize in card production.

- Legal Requirements: Adhere to legal requirements and regulations related to credit card design, such as displaying required terms and conditions, logos of payment networks, and international card acceptance symbols. Consult legal experts to ensure full compliance with applicable laws and regulations.

Carefully review and approve design proofs before final production to ensure accuracy and make any necessary modifications. Consider obtaining feedback from potential customers or conducting focus groups to gauge their reactions to the design and usability of the credit cards.

Remember that credit card designs should strike a balance between aesthetics, functionality, and security. Keep the cardholder experience at the forefront of your design decisions, aiming to create a visually appealing card that reflects your brand while providing ease of use and peace of mind for cardholders.

In the next section, we will explore effective marketing and promotional strategies for your credit card company.

Marketing and Promoting Your Credit Card Company

Effective marketing and promotion are essential for attracting customers and raising awareness about your credit card company. To successfully market your credit card products, you need to strategically position your brand, communicate your unique value proposition, and engage with your target audience. Here are key strategies for marketing and promoting your credit card company:

- Develop a Solid Marketing Strategy: Start by defining your target market and understanding their needs, preferences, and pain points. Craft a marketing strategy that focuses on reaching and resonating with your target audience. Determine the most effective channels, tactics, and messages to communicate your key selling points.

- Establish a Strong Brand Identity: Create a compelling brand identity that reflects your credit card company’s values and resonates with your target audience. This includes designing a memorable logo, developing consistent brand messaging, and leveraging your unique value proposition to differentiate yourself in the market.

- Build a Responsive Website: Develop a user-friendly and informative website that showcases your credit card products, features, benefits, and application process. Optimize the website for search engines to improve visibility and ensure it is mobile responsive for seamless access across devices.

- Content Marketing: Create relevant and valuable content to engage your target audience and establish your credit card company as a trusted authority. Share informative blog posts, educational videos, or infographics that provide tips, insights, and guidance on financial management, credit card usage, and personal finance topics.

- Digital Advertising: Utilize digital advertising channels, such as search engine marketing (SEM), social media advertising, and display ads, to raise awareness of your credit card products. Target specific demographics, interests, or behaviors to reach your ideal customers and drive traffic to your website or application page.

- Social Media Engagement: Leverage social media platforms to engage with your audience, share updates, and foster a sense of community around your credit card brand. Run contests, share customer testimonials, and respond promptly to customer queries or feedback to strengthen your brand reputation.

- Partnerships and Sponsorships: Collaborate with relevant brands, influencers, or organizations to expand your reach and credibility. Seek partnerships that align with your target audience and brand values, allowing you to tap into their existing customer base and benefit from their marketing channels.

- Referral Programs: Encourage your existing cardholders to refer family and friends to your credit card company. Develop referral programs that reward both the referrer and the new customer, such as bonus rewards or cash incentives. This can help drive customer acquisition and foster loyalty among your existing cardholders.

- Customer Testimonials and Reviews: Highlight positive customer experiences through testimonials and reviews. Share success stories, customer testimonials, and ratings on your website, social media platforms, and review sites to build trust and credibility in your credit card company.

- Educational Seminars and Webinars: Host educational seminars or webinars to provide valuable insights and guidance on financial management, credit building, or personal finance topics. Position your credit card company as a trusted resource that helps customers make informed financial decisions.

Remember to monitor and analyze the effectiveness of your marketing efforts through data tracking and analytics. This will allow you to refine your strategies, optimize campaigns, and allocate resources more effectively.

Compliance with applicable laws and regulations, including those related to advertising, data privacy, and consumer protection, is crucial when marketing your credit card products. Ensure that all marketing materials adhere to these legal requirements and clearly communicate terms, conditions, and disclosures.

By implementing these marketing and promotional strategies, you can create visibility for your credit card company, attract the right audience, and drive customer acquisition. As you grow and gain market share, continue to innovate and adapt your marketing strategies to stay ahead of competitors and maintain customer loyalty.

In the next section, we will discuss the importance of setting up robust customer service and support systems for your credit card company.

Setting Up Customer Service and Support Systems

Providing excellent customer service and support is crucial for building trust, retaining customers, and ensuring a positive experience with your credit card company. Setting up robust customer service and support systems will help you address inquiries, resolve issues, and maintain high levels of customer satisfaction. Here are key considerations when establishing customer service and support for your credit card company:

- Multi-channel Support: Offer multiple channels for customer support to cater to varying customer preferences. This may include phone support, email, live chat, or social media channels. Provide prompt and knowledgeable assistance across all channels to ensure a seamless customer experience.

- Well-trained Support Team: Hire and train a team of customer support representatives who are knowledgeable about your credit card products, policies, and processes. Equip them with the necessary tools and resources to quickly and effectively address customer inquiries and resolve issues in a professional and friendly manner.

- 24/7 Availability: Consider offering 24/7 customer support to cater to customers in different time zones or those who require immediate assistance outside of regular working hours. This includes providing access to online self-help resources, FAQs, or automated chatbots to handle common customer inquiries.

- Personalized Assistance: Tailor your customer service approach based on individual customer needs. Treat each customer interaction as an opportunity to build rapport and provide personalized solutions. Collect and analyze customer data to anticipate their needs and offer proactive support.

- Complaint Resolution Process: Establish a well-defined process for addressing and resolving customer complaints. Provide clear guidelines and escalation paths to ensure that complaints are handled promptly, fairly, and to the customer’s satisfaction. Monitor complaint trends to identify areas for improvement in your products or processes.

- Education and Onboarding Materials: Develop educational materials, such as user guides, tutorials, and FAQ sections, to assist customers in understanding the features, benefits, and proper usage of your credit cards. Consider offering online onboarding sessions or webinars to help new cardholders navigate their credit card journey.

- Continuous Training and Improvement: Invest in ongoing training and development programs for your customer support team. This ensures that they stay updated on product updates, regulatory changes, and industry trends. Encourage feedback from both customers and team members to identify areas for improvement and enhance the overall customer support experience.

- Data Security and Privacy: Prioritize data security and privacy when handling customer information. Implement robust security measures to protect sensitive customer data and comply with data protection regulations. Clearly communicate your privacy policy and data handling practices to build trust with your customers.

- Customer Feedback and Surveys: Regularly seek customer feedback through surveys, post-interaction surveys, or feedback forms on your website. Gain insights into customer satisfaction, identify areas for improvement, and use the feedback to enhance your products, processes, and customer support practices.

- Proactive Communication: Keep customers informed about important updates, new features, or changes in policies through proactive communication. This can be done through email newsletters, SMS notifications, or regular updates on your website or social media platforms.

Remember, providing exceptional customer service is an ongoing commitment. Continuously listen to your customers, adapt to their evolving needs, and strive for continuous improvement in your customer service and support systems. By doing so, you can foster loyalty, drive customer retention, and build a positive reputation for your credit card company.

In the next section, we will discuss the importance of managing risks and compliance in your credit card company.

Managing Risks and Compliance

Managing risks and compliance is a critical aspect of running a successful credit card company. The financial industry is heavily regulated, and failure to comply with applicable laws and regulations can lead to severe consequences. It’s crucial to proactively identify and mitigate risks while ensuring compliance with relevant requirements. Here are key considerations for managing risks and compliance:

- Risk Assessment: Conduct a comprehensive risk assessment to identify and evaluate potential risks associated with your credit card operations. This includes assessing credit risk, fraud risk, operational risk, regulatory risk, and reputational risk. Determine the impact and likelihood of each risk and develop strategies to mitigate them effectively.

- Compliance Framework: Establish a robust compliance framework that incorporates policies, procedures, and controls to ensure adherence to legal and regulatory requirements. Develop a compliance manual that clearly outlines roles, responsibilities, and processes for maintaining compliance. Regularly review and update compliance practices to stay aligned with changing regulations.

- Data Security and Privacy Protection: Implement stringent data security measures and protocols to protect cardholder data from breaches or unauthorized access. This includes encryption, secure network infrastructure, access controls, and regular security audits. Comply with data protection laws and clearly communicate your privacy practices to build trust with customers.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Processes: Develop robust AML and KYC processes to prevent money laundering, terrorist financing, and other illicit activities. Conduct thorough due diligence on customers, establish transaction monitoring procedures, and report any suspicious activities in accordance with regulatory requirements.

- Regulatory Compliance Monitoring: Regularly monitor changes in applicable laws, regulations, and industry standards to ensure ongoing compliance. Stay informed about updates from regulatory bodies and adjust your practices and policies accordingly. Conduct periodic internal audits and external assessments to assess compliance effectiveness.

- Employee Training and Awareness: Provide comprehensive training programs to employees to ensure they have a clear understanding of regulatory requirements, compliance policies, and best practices. Foster a culture of compliance through ongoing education, awareness campaigns, and regular updates on regulatory changes. Encourage employees to report any compliance concerns or violations they observe.

- Vendor and Third-Party Risk Management: Assess the risks associated with third-party vendors and partners that provide services to your credit card company. Ensure they meet regulatory requirements, maintain adequate security measures, and align with your risk management objectives. Regularly review vendor contracts and conduct due diligence to mitigate potential risks.

- Disaster Recovery and Business Continuity Planning: Develop a robust disaster recovery and business continuity plan to ensure the continuity of credit card operations during unexpected events or disruptions. Implement backup systems, data recovery processes, and contingency plans to minimize downtime and maintain customer service during emergencies.

- Documentation and Recordkeeping: Maintain comprehensive documentation and records of compliance activities, risk assessments, employee training, and incident responses. These records serve as evidence of your commitment to compliance and can assist during regulatory audits or investigations.

- Regular Monitoring and Reporting: Establish a system for ongoing monitoring of compliance and risk management activities. Implement mechanisms to detect, investigate, and report any compliance breaches or incidents. Regularly assess and report on the effectiveness of risk management and compliance programs to senior management and regulatory authorities.

Engaging legal and regulatory experts can provide valuable guidance in navigating the complex landscape of risks and compliance. They can assist in interpreting regulations, staying updated on compliance obligations, and ensuring that your credit card company operates within legal boundaries.

By effectively managing risks and maintaining compliance, you can protect your credit card company, mitigate potential losses, and build trust with customers and regulatory authorities. It’s a continuous process that requires vigilance, adaptability, and a commitment to maintaining a culture of compliance throughout your organization.

In the next section, we will discuss the process of launching your credit card company and bringing your products and services to the market.

Launching Your Credit Card Company

Launching your credit card company is an exciting milestone that marks the culmination of your hard work and preparation. It’s a pivotal moment where you bring your credit card products and services to the market, attract customers, and start generating revenue. Here are key steps to consider when launching your credit card company:

- Finalize Product Offerings: Ensure that your credit card products are fully developed, tested, and aligned with your target market’s needs and preferences. Confirm that all features, benefits, and terms and conditions are accurately reflected in your product offerings.

- Prepare Marketing and Promotional Materials: Develop captivating marketing materials, including brochures, website content, and social media campaigns, to raise awareness about your credit card company. Clearly communicate the unique value propositions, benefits, and rewards associated with your credit cards.

- Launch Marketing Campaigns: Execute your marketing strategy and initiate targeted marketing campaigns to reach your intended audience. Utilize digital advertising, social media, and partnerships to promote your credit card company. Monitor the performance of your campaigns and make adjustments as needed based on customer response and feedback.

- Establish Application and Onboarding Processes: Have a streamlined, user-friendly application process for customers to apply for your credit cards. Ensure that your online application forms are secure, easily accessible, and mobile-friendly. Develop an onboarding process to welcome new cardholders and provide them with information on card activation, usage, and benefits.

- Secure Partnerships: Strengthen your credit card company by securing partnerships with banks, payment processors, or financial institutions. Leverage their expertise, infrastructure, and networks to enhance your product offerings and increase your reach in the market.

- Monitor Performance and Metrics: Track performance metrics, such as customer acquisition, activation rates, transaction volumes, and customer satisfaction scores, to assess the success of your credit card company. Regularly analyze data and reports to identify areas of improvement and refine your strategies for optimal results.

- Provide Excellent Customer Service: Prioritize delivering exceptional customer service from day one. Ensure your customer support team is well-trained, responsive, and equipped to handle customer inquiries, issues, and feedback. Continuously evaluate and improve your customer service processes based on customer feedback and market trends.

- Comply with Regulations: Adopt a rigorous approach to regulatory compliance by adhering to all relevant laws and regulations governing credit card operations. Regularly review and update compliance procedures, maintain accurate records, and promptly address any compliance issues that may arise.

- Engage in Continuous Improvement: As you launch your credit card company, embrace a mindset of continuous improvement. Collect customer feedback, monitor market trends, analyze competitor strategies, and seek opportunities for innovation and enhancement. Continuously refine your products, services, and operations to stay ahead of the curve and meet evolving customer needs.

- Celebrate Milestones and Successes: Take the time to celebrate your achievements and milestones, whether it’s reaching a certain number of cardholders, achieving a specific revenue target, or receiving positive customer feedback. Recognize and reward your team’s efforts and appreciate your customers’ trust and support.

Launching your credit card company is just the beginning of an ongoing journey. Stay focused, adaptable, and responsive to market demands, customer needs, and industry trends. Continuously evolve your offerings, marketing strategies, and customer experiences to build a thriving credit card company that stands out in the highly competitive financial industry.

In the next section, we will discuss the importance of monitoring and improving the performance of your credit card company.

Monitoring and Improving Performance

Monitoring and improving the performance of your credit card company is essential for long-term success and growth. By regularly assessing key metrics, optimizing processes, and making strategic adjustments, you can ensure that your company remains competitive and aligned with customer expectations. Here are key steps to consider for monitoring and improving the performance of your credit card company:

- Establish Key Performance Indicators (KPIs): Define the KPIs that align with your business goals and track relevant metrics. These may include customer acquisition rates, activation rates, customer retention, average transaction value, credit quality, and profitability. Use these KPIs to measure and evaluate the performance of your credit card company.

- Analyze Customer Data and Feedback: Utilize customer data and feedback to gain insights into their preferences, behavior, and satisfaction levels. Analyze patterns and trends to identify areas for improvement and growth opportunities. Implement surveys or feedback mechanisms to capture customer input on their experiences with your credit cards and services.

- Assess Marketing and Acquisition Strategies: Review the effectiveness of your marketing and customer acquisition strategies. Analyze the return on investment (ROI) of your marketing campaigns, assess customer acquisition cost, and evaluate the performance of different acquisition channels. Optimize your marketing efforts by focusing on channels and strategies that yield the best results.

- Optimize Customer Onboarding: Evaluate your customer onboarding processes to ensure they are efficient, user-friendly, and designed to encourage card activation and usage. Look for ways to streamline the onboarding journey, improve self-service capabilities, and provide clear instructions to help customers navigate the activation process seamlessly.

- Improve Customer Experience: Regularly assess the customer experience at every touchpoint, from application to customer support interactions. Identify areas where you can enhance user experience, simplify processes, and reduce friction points. Respond promptly to customer inquiries and feedback, ensuring that their needs are met and their concerns addressed.

- Review Product Offerings: Continuously monitor and review your credit card products to ensure they remain competitive and meet customer demands. Identify customer preferences and market trends to develop new features, benefits, or rewards programs that differentiate your products. Regularly assess your credit card fees, interest rates, and terms to ensure they remain attractive and reasonable.

- Strengthen Risk Management: Continually evaluate and enhance your risk management practices to mitigate potential risks and effectively address emerging threats. Stay updated on industry trends, potential fraud patterns, and new security technologies. Regularly reassess your risk assessment processes and collaborate with experts to ensure you have robust risk management strategies in place.

- Invest in Employee Development: Empower and develop your team by investing in training programs, fostering a culture of continuous learning, and recognizing employee contributions. Provide opportunities for employee growth and development to ensure they have the skills and knowledge necessary to support your credit card operations and provide excellent customer service.

- Stay Competitive: Regularly monitor the competitive landscape to identify emerging trends, new players, and changes in customer preferences. Benchmark your credit card offerings, features, and benefits against your competitors’ offerings. Identify areas where you can differentiate your products and services to maintain a competitive edge.

- Embrace Innovation and Technology: Stay at the forefront of technological advancements and innovation in the credit card industry. Explore new technologies, such as mobile payments, biometrics, or blockchain, to enhance security, improve user experience, and meet evolving customer expectations. Adopt technology-driven solutions to optimize processes and streamline operations.

Continuous monitoring, analysis, and improvement are key to the success of your credit card company. Regularly review your performance against your goals, seek opportunities to optimize processes, and adapt to changing customer needs and market dynamics. By staying proactive and embracing a mindset of continuous improvement, you can position your credit card company for long-term success.

In the concluding section, we will summarize the key points discussed throughout this article.

Conclusion

Starting your own credit card company is an exciting and challenging endeavor. Throughout this article, we have explored the essential steps involved in setting up and growing a successful credit card company. From understanding the credit card industry landscape and conducting thorough market research to obtaining the necessary licenses and securing funding, each step is crucial for success.

We discussed the importance of building a strong team and infrastructure, creating compelling credit card products, and establishing partnerships with banks or payment processors. We explored the significance of designing visually appealing and secure credit cards and outlined effective marketing strategies to reach and attract customers. We emphasized the importance of setting up robust customer service and support systems, managing risks and compliance, and continuously monitoring and improving performance.

Launching a credit card company requires dedication, industry knowledge, and a customer-centric approach. It is crucial to continuously evaluate market trends, customer feedback, and regulatory changes to adapt and evolve your offerings. By providing exceptional customer experiences, maintaining compliance, and fostering innovation, you can compete in the credit card industry and differentiate your company.

Remember, success in the credit card industry is not achieved overnight. It requires persistence, adaptability, and continuous improvement. By integrating the insights and recommendations shared throughout this article, you can navigate the complexities of the industry and build a thriving credit card company that meets the needs of customers while achieving your business goals.

Now, armed with the knowledge and understanding gained from this article, you can confidently embark on your journey to start your own credit card company. Best of luck!