Finance

Incremental Dividend Definition And Example

Published: December 8, 2023

Learn about the concept of incremental dividends in finance with a comprehensive definition and real-world examples. Gain a deeper understanding of this crucial aspect of dividend payouts.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Incremental Dividend in Finance

Welcome to the world of finance! Today, we are going to dive into the concept of incremental dividend. What exactly is an incremental dividend, and how does it work? In this article, we will provide you with a comprehensive definition and example to help you better understand this financial term.

Key Takeaways:

- An incremental dividend is an additional distribution of profits by a company to its shareholders, paid on top of regular dividends.

- It is usually declared when a company experiences unexpected profits or has excess cash reserves.

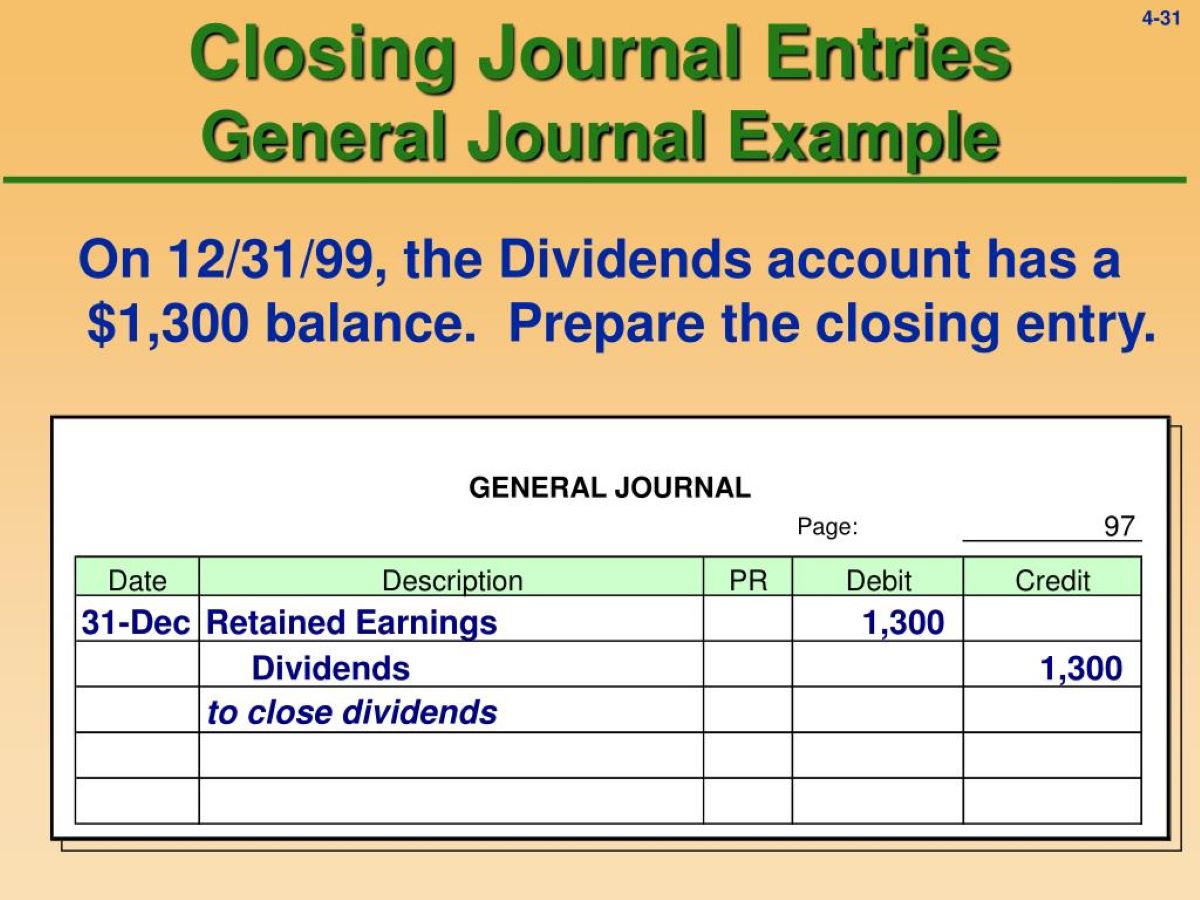

So, what is an incremental dividend? In simple terms, an incremental dividend is an extra dividend paid by a company to its shareholders in addition to the regular dividends. It is declared when a company has excess profits or cash reserves that can be distributed among the shareholders. This additional payout is a way for the company to reward its stakeholders for their investment and loyalty.

Now, let’s dive into an example to help you grasp the concept better. Imagine you own shares in XYZ Company, which usually pays a quarterly dividend of $0.50 per share. However, this quarter, XYZ Company has reported exceptional profits and decides to declare an incremental dividend of $0.10 per share.

Let’s say you own 1000 shares of XYZ Company. In a normal quarter, you would receive $500 as your dividend payout (1000 shares x $0.50). However, with the incremental dividend, you would receive an additional $100 (1000 shares x $0.10). So, your total dividend payout for that quarter would be $600 ($500 + $100).

Incremental dividends can be a pleasant surprise for shareholders as it highlights the financial success of the company. It shows that the company is not only generating regular profits but also has surplus earnings that it can share with its shareholders.

Key Takeaways:

- An incremental dividend is an additional distribution of profits by a company to its shareholders, paid on top of regular dividends.

- It is usually declared when a company experiences unexpected profits or has excess cash reserves.

In conclusion, incremental dividends provide an opportunity for shareholders to benefit from a company’s exceptional financial performance. They serve as a way for companies to reward their shareholders and foster investor confidence. So, the next time you receive an additional dividend payout, remember that it’s an incremental dividend enriching your investment in the company.

Thank you for joining us in exploring the concept of incremental dividends in the world of finance. We hope this article has helped you gain a better understanding of this financial term. If you have any further questions or need clarification, please feel free to reach out to us. Happy investing!