Home>Finance>Deduction Definition And Standard Deductions For 2022

Finance

Deduction Definition And Standard Deductions For 2022

Published: November 9, 2023

Learn about deduction definition and standard deductions for 2022 in the world of finance. Make the most of your financial planning with expert advice and tips.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Deduction Definition and Standard Deductions for 2022

Welcome to our Finance blog! In this post, we will dive into the realm of tax deductions, specifically discussing the deduction definition and the standard deductions for the year 2022. If you’ve ever wondered what deductions are and how they can potentially impact your finances, then this article is for you! So, let’s get started.

Key Takeaways:

- Deductions are expenses that can be subtracted from your total income, reducing the amount of taxable income you need to report to the government.

- Standard deductions are predetermined amounts set by the IRS that you can claim if you choose not to itemize your deductions.

Understanding Deductions

In simple terms, deductions are specific expenses that you are allowed to subtract from your total income, ultimately reducing the amount of income that is subject to taxation. By taking advantage of deductions, you can potentially lower your overall tax liability, keeping more money in your pocket.

The Internal Revenue Service (IRS) allows individuals and businesses to claim deductions under various categories, such as education, health care, home ownership, and charitable contributions. These deductions are meant to incentivize certain behaviors and promote economic growth.

While there are numerous types of deductions that individuals can claim, they generally fall into two categories: itemized deductions and standard deductions. We will focus on the standard deductions for 2022 in this post.

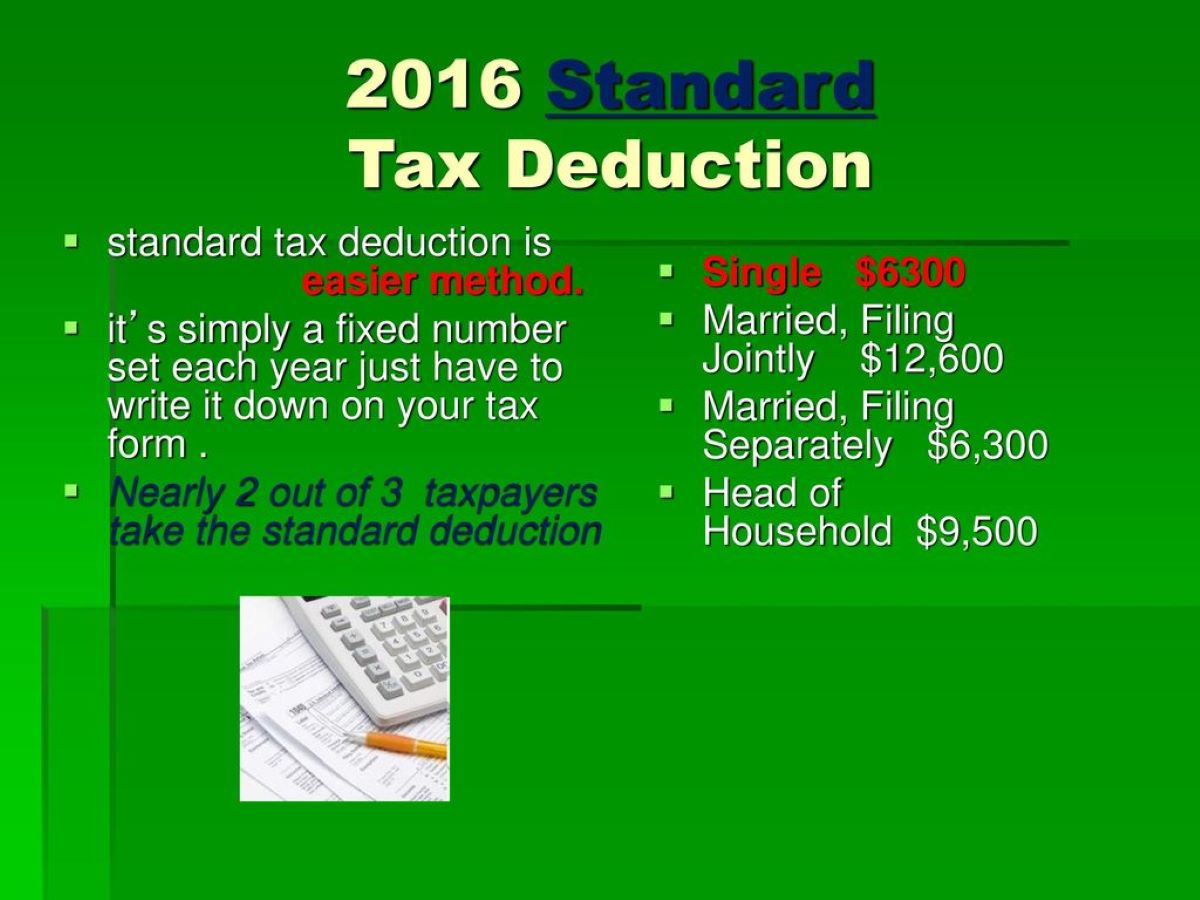

Standard Deductions for 2022

The standard deduction is a predetermined amount that you can claim if you choose not to itemize your deductions. It simplifies the tax filing process for many individuals by providing a basic, no-questions-asked deduction.

For the tax year 2022, the standard deductions are as follows:

- Single filers: $12,550

- Married individuals filing jointly: $25,100

- Married individuals filing separately: $12,550

- Heads of households: $18,800

It’s important to note that if your total itemized deductions exceed the standard deduction amount, it might be more beneficial for you to itemize your deductions instead.

By understanding the standard deductions for 2022, you can better plan your finances and optimize your tax situation. Remember, tax laws can change, so it’s always a good idea to consult with a tax professional or refer to the official IRS guidelines for the most up-to-date information.

In Conclusion

Now that you have a better understanding of what deductions are and how they can impact your finances, you can approach tax planning with more confidence. Keep in mind that the standard deductions for 2022 provide a simple option for reducing your taxable income, but itemizing deductions may be beneficial in certain situations. Consider consulting a tax professional to determine the best strategy for your specific circumstances.

At Finance XYZ, we strive to provide valuable financial information to help you make informed decisions. Stay tuned for more informative posts, and feel free to explore our other finance-related categories for additional helpful content.