Finance

Lifeline Account Definition

Published: December 18, 2023

Get a clear understanding of what a lifeline account is in finance. Discover its definition and how it can benefit your financial situation.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Lifeline Account Definition: An Essential Guide to Financial Stability

When it comes to our personal finances, having a clear understanding of various financial tools and concepts can make a significant difference. One such concept that plays a crucial role in financial stability is a lifeline account. In this blog post, we will delve into Lifeline Account Definition, its benefits, and how it can help you navigate through financial challenges.

Key Takeaways:

- A lifeline account is a financial tool that helps individuals maintain a minimum balance for essential needs.

- It offers a safety net during tough times while promoting financial stability.

So what exactly is a lifeline account? A lifeline account refers to a designated bank account designed to assist individuals in maintaining a minimum balance for essential needs. This type of account aims to provide a financial safety net during difficult times while encouraging financial stability.

Now, let’s dive deeper into the key benefits of having a lifeline account:

- Emergency Fund: A lifeline account acts as a dedicated space where you can accumulate emergency funds. These funds can be used to cover unexpected expenses such as medical bills, car repairs, or urgent home repairs. Having an emergency fund provides peace of mind and protects you from falling into debt during unpredictable circumstances.

- Financial Stability: By maintaining a lifeline account, you establish a financial safety net that can cushion the impact of financial hardships. Whether you face a job loss, a decrease in income, or unexpected expenses, having a lifeline account ensures you have access to funds necessary for basic needs.

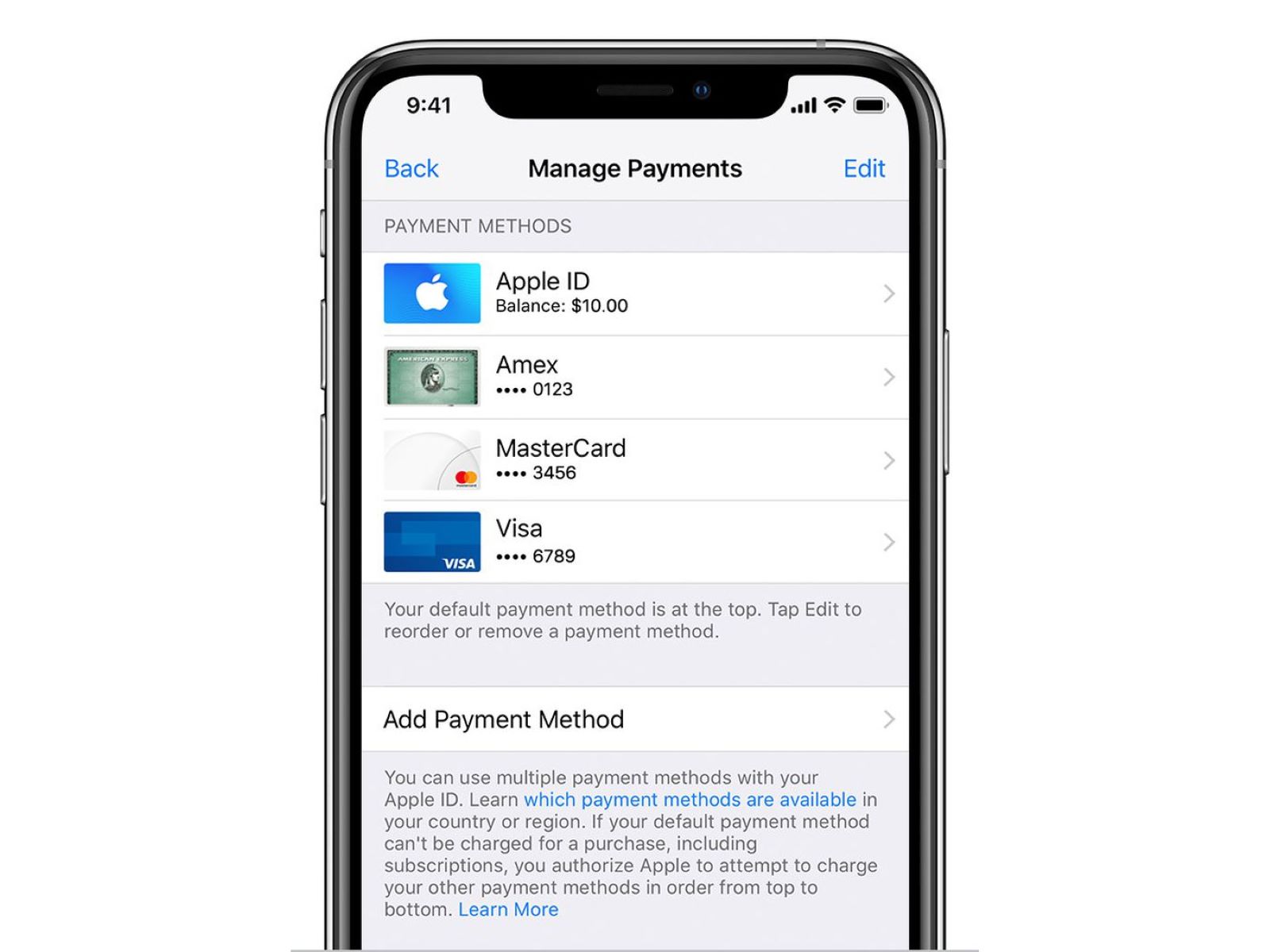

Now that you understand the importance and benefits of a lifeline account, it’s essential to know how to set one up. Follow these simple steps to get started:

- Contact your local bank or credit union and inquire about lifeline account options.

- Gather the necessary documents such as identification proof and proof of income.

- Complete the account opening process by filling out the required forms.

- Deposit the minimum balance required to maintain the account.

Remember, a lifeline account is not just a financial instrument, but an invaluable tool for promoting financial stability. By being proactive and establishing this account, you are taking a significant step towards securing your financial future.

Key Takeaways:

- A lifeline account is a financial tool that helps individuals maintain a minimum balance for essential needs.

- It offers a safety net during tough times while promoting financial stability.

In conclusion, lifeline accounts are a powerful financial tool that provides individuals with a safety net during challenging times. By establishing and maintaining such an account, you are investing in your financial well-being and protecting yourself from unexpected financial setbacks. So why wait? Take the necessary steps to set up a lifeline account today and pave the way for a secure financial future.