Finance

Market-With-Protection Order Definition

Published: December 23, 2023

Find finance market-with-protection order definition, benefits, and how it can safeguard your investments. Stay informed about financial security with us.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Market-With-Protection Order Definition: Understanding How it Works

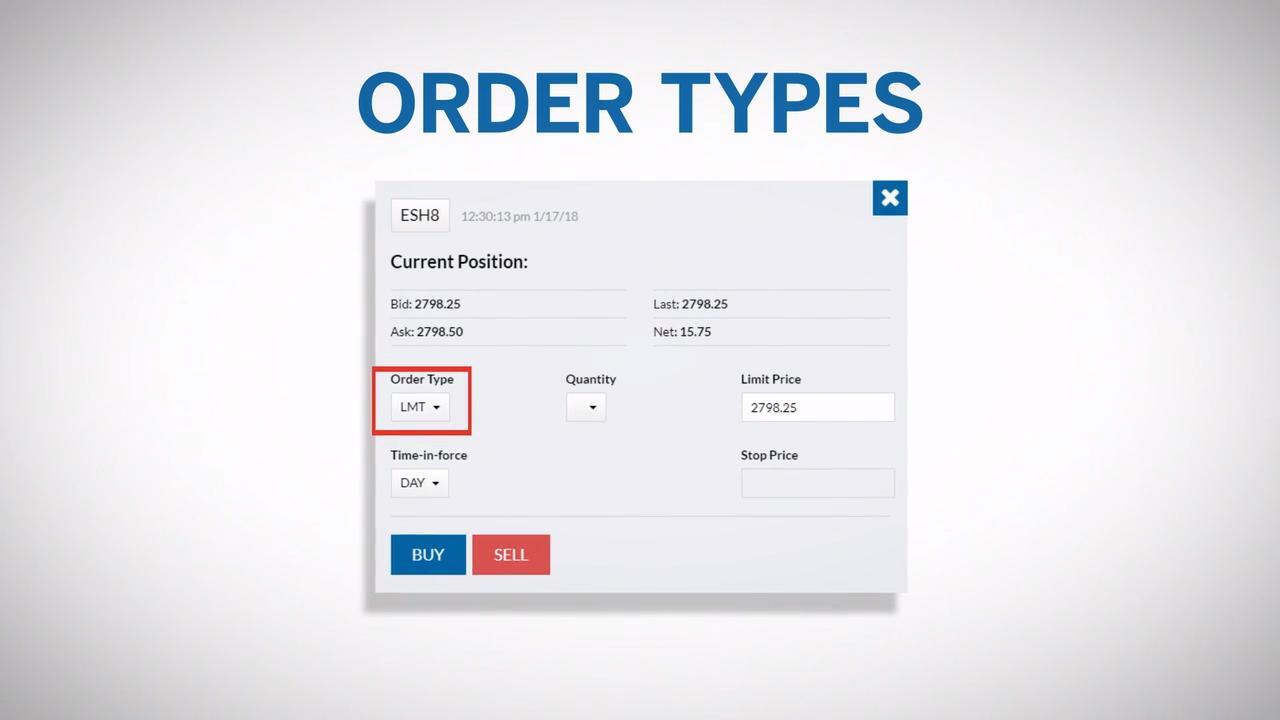

When it comes to financial markets, there are various order types that traders can use to execute their trades. One of these order types is the Market-With-Protection order, also known as MWP. But what exactly is a Market-With-Protection order, and how does it work? In this blog post, we will delve into the details of MWP orders, their definition, and their benefits. By the end of this article, you’ll have a solid understanding of how Market-With-Protection orders can enhance your trading strategy and protect your investments.

Key Takeaways:

- A Market-With-Protection order is an order type used in financial markets to execute trades at the best market price while protecting against excessive slippage.

- It combines the advantages of market orders and limit orders, ensuring optimal execution while setting a maximum acceptable price.

Now, let’s dive in and explore the Market-With-Protection order in more detail.

What is a Market-With-Protection Order?

A Market-With-Protection order is a type of order that allows traders to buy or sell a security at the best available market price while protecting against excessive slippage. Slippage refers to the difference between the expected price of a trade and the actual execution price. It can occur when the market is experiencing high volatility or low liquidity.

With a Market-With-Protection order, traders can set a maximum acceptable price, known as the protection level, at which they are willing to execute their trade. If the market price reaches or exceeds the protection level, the trade will be canceled, ensuring that the order is not executed at an unfavorable price.

The Market-With-Protection order combines the advantages of market orders and limit orders. Market orders provide quick execution at the best available price, but without any price protection. On the other hand, limit orders offer price protection but may not get executed if the market price does not reach the specified limit. MWP orders strike a balance between these two, allowing for optimal execution while setting a maximum acceptable price.

Benefits of Market-With-Protection Orders

Market-With-Protection orders offer several benefits for traders, including:

- Protection against slippage: By setting a protection level, traders can safeguard themselves against excessive slippage, ensuring that their orders are executed at desirable prices.

- Improved trade execution: MWP orders aim to achieve the best execution possible by taking advantage of market liquidity. They ensure quick execution while considering price limitations.

- Flexibility: Traders can adjust the protection level of their Market-With-Protection orders according to their risk tolerance and market conditions.

- Efficient risk management: With MWP orders, traders can effectively manage risk by controlling the maximum price at which they are willing to execute their trades.

Market-With-Protection orders are commonly used by traders who want to balance the need for quick execution with price protection. They are particularly useful in fast-moving markets or during periods of heightened volatility, where slippage risks are higher.

In Conclusion

A Market-With-Protection order is a valuable tool for traders in the financial markets. It combines the advantages of market orders and limit orders, providing quick execution while protecting against excessive slippage. By setting a maximum acceptable price, traders can enhance their trading strategies and safeguard their investments. Whether you are a beginner or an experienced trader, understanding the Market-With-Protection order can help you make informed decisions and navigate the complexities of financial markets with confidence.