Finance

How To Remove A Cosigner From A Student Loan

Modified: February 25, 2024

Learn how to remove a cosigner from a student loan and regain financial independence. Expert tips and step-by-step guide for managing your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Cosigned Student Loans

- Why Remove a Cosigner from a Student Loan?

- Assessing Loan Eligibility for Cosigner Release

- Steps to Remove a Cosigner from a Student Loan

- Option 1: Cosigner Release Application

- Option 2: Student Loan Refinancing

- Option 3: Paying off the Loan in Full

- Potential Challenges and Considerations

- Conclusion

Introduction

When it comes to financing higher education, many students rely on the support of a cosigner to secure a student loan. A cosigner is a person who agrees to assume equal responsibility for the loan and to repay it if the borrower is unable to do so. While having a cosigner can be beneficial in obtaining a loan, there may come a time when you want to remove them from the loan agreement.

Removing a cosigner from a student loan can offer several advantages. It provides the borrower with financial independence and the ability to establish their credit history. Additionally, it releases the cosigner from any future liabilities associated with the loan.

However, removing a cosigner from a student loan is not always a straightforward process. Lenders have specific requirements that borrowers must meet in order to be eligible for cosigner release. These requirements often include a good credit history, a solid repayment record, and a steady income.

In this article, we will delve into the steps involved in removing a cosigner from a student loan. We will explore various options available to borrowers, such as applying for a cosigner release, student loan refinancing, or paying off the loan in full. Additionally, we will discuss potential challenges and considerations to keep in mind throughout the process.

Understanding Cosigned Student Loans

A cosigned student loan is a loan that requires the support of a cosigner, usually a parent or guardian, to qualify for the loan. The cosigner provides their creditworthiness and takes on responsibility for repaying the loan if the borrower fails to do so. This added security is often necessary for students who may have limited credit history or income.

When a cosigner signs the loan agreement, they become equally responsible for the debt. This means that any missed payments or default on the loan will affect both the borrower and the cosigner’s credit scores. It is crucial for both parties to understand the financial commitment and potential risks associated with cosigned student loans.

Cosigned student loans are commonly used for private student loans, as federal student loans typically do not require a cosigner. Private lenders may require a cosigner to mitigate the risk of lending to an individual without an established credit history or sufficient income.

It is important to note that cosigners are not just limited to family members; they can be any adult with a strong credit profile who is willing to vouch for the borrower’s ability to repay the loan. Cosigners should carefully consider their decision before entering into a cosigned loan, as it could impact their creditworthiness and financial situation for years to come.

Understanding the dynamics of cosigned loans is vital for both borrowers and cosigners. Openly discussing loan terms, repayment expectations, and any potential challenges can help establish a strong foundation for a successful loan agreement. Additionally, borrowers should keep the lines of communication open with their cosigners to avoid any misunderstandings or surprises during the loan repayment period.

Why Remove a Cosigner from a Student Loan?

Removing a cosigner from a student loan can provide numerous benefits for both the borrower and the cosigner. Here are a few reasons why you might consider removing a cosigner from a student loan:

- Financial Independence: Removing a cosigner allows the borrower to establish their financial independence. They no longer rely on the cosigner’s creditworthiness to secure loans or credit in the future.

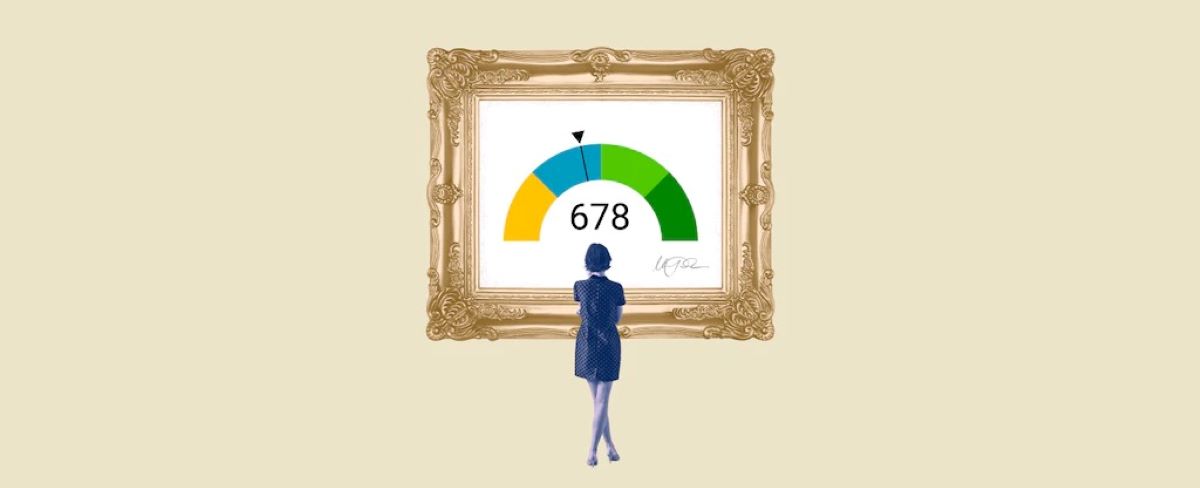

- Improved Credit Score: Successfully managing a student loan without a cosigner can have a positive impact on the borrower’s credit score. Making timely payments and demonstrating responsible financial behavior can help boost their creditworthiness.

- Relieve Cosigner’s Financial Obligation: Removing a cosigner from the loan releases them from any future liabilities associated with the loan. This can provide peace of mind for the cosigner and allow them to focus on their own financial goals.

- Avoid Strained Relationships: In some cases, cosigning a loan can strain relationships between the borrower and the cosigner. Removing the cosigner from the loan can alleviate any potential tensions or conflicts that may arise from financial obligations.

- Favorable Interest Rates: As borrowers build their credit history and financial stability, they may become eligible for better interest rates. Removing a cosigner and refinancing the loan could potentially allow the borrower to secure a lower interest rate, reducing the overall cost of the loan.

- Flexibility in Financial Decision-making: Removing a cosigner gives the borrower greater flexibility in making financial decisions related to the loan. They can explore options such as loan consolidation, deferment, or repayment plans without seeking the cosigner’s approval.

It’s important to note that removing a cosigner from a student loan is not always a straightforward process. Lenders typically have specific requirements that borrowers must meet in order to be eligible for cosigner release. However, understanding the potential benefits can motivate borrowers to take the necessary steps to remove a cosigner and assume full responsibility for their student loan.

Assessing Loan Eligibility for Cosigner Release

Before you can proceed with removing a cosigner from a student loan, it’s essential to determine whether you meet the eligibility criteria set by your lender. While specific requirements may vary, here are some common factors that lenders consider when assessing loan eligibility for cosigner release:

- Timely Payment History: Lenders typically require a record of on-time payments for a specified period. This demonstrates your ability to handle the loan responsibly and may be a requirement for cosigner release.

- Credit History: Lenders often consider your credit history to assess your financial responsibility. A solid credit history and a good credit score can increase your chances of qualifying for cosigner release.

- Income and Employment: Lenders may evaluate your income and employment stability to ensure that you have the ability to repay the loan on your own. A steady income and a low debt-to-income ratio can strengthen your application.

- Loan Repayment Term: Some lenders require a specific number of on-time payments or completion of a certain percentage of the loan term before considering cosigner release. Review your loan agreement or contact your lender to understand their requirements.

- Borrower’s Age: Certain lenders may have age restrictions for cosigner release. It’s important to verify whether there are any age-related eligibility criteria for removing a cosigner from the loan.

- Lender’s Policies: Each lender has its own policies and guidelines for cosigner release. It’s crucial to review your loan agreement and contact your lender to understand their specific requirements and procedures.

Keep in mind that meeting the basic eligibility criteria does not guarantee cosigner release. Some lenders may have additional requirements or discretionary factors that they consider when evaluating an application for cosigner release. It’s important to communicate with your lender and clarify any doubts or questions you may have regarding the process.

Assessing your loan eligibility for cosigner release is a critical first step in removing a cosigner from a student loan. By understanding and meeting the criteria set by your lender, you can increase your chances of successfully obtaining cosigner release and assuming full responsibility for your loan.

Steps to Remove a Cosigner from a Student Loan

Removing a cosigner from a student loan typically involves a series of steps that vary depending on the lender and loan type. While the exact process may differ, here are some general steps to consider when seeking to remove a cosigner from a student loan:

- Review your loan agreement: Begin by thoroughly reviewing your loan agreement and seeking clarity on the cosigner release requirements set by your lender. Understand the specific criteria and timeline for cosigner release.

- Contact your lender: Reach out to your lender to discuss the process and gather information about their cosigner release program. Ask about the necessary documentation and steps you need to take to initiate the cosigner removal process.

- Evaluate your eligibility: Assess your own eligibility for cosigner release based on the lender’s criteria. Consider factors such as your payment history, credit score, income stability, and employment status.

- Submit an application: If you meet the eligibility requirements, submit a cosigner release application to your lender. This may require providing documentation such as proof of income, employment verification, and payment history.

- Follow up with your lender: Keep in touch with your lender throughout the review process. Stay organized and be prepared to provide any additional information or documentation they may request.

- Continued loan repayment: While waiting for the cosigner release decision, continue making regular, on-time payments on your student loan. This demonstrates your financial responsibility and commitment to repaying the loan.

- Cosigner release approval: If your application is approved, your lender will officially remove the cosigner from the loan agreement. You will now be solely responsible for repayment.

- Loan refinancing: If you are unable to meet the requirements for cosigner release, another option is to explore student loan refinancing. Refinancing involves taking out a new loan with a different lender to pay off the existing student loan while removing the cosigner.

- Notify credit bureaus: Once the cosigner is removed or the loan is refinanced, inform the credit bureaus about the change in the loan status. This ensures that your credit report accurately reflects the updated loan arrangement.

It is important to remember that the process of removing a cosigner from a student loan can take time, and each lender may have their own specific procedures. It is crucial to stay in close communication with your lender and follow their instructions closely to increase the likelihood of a successful cosigner release.

Option 1: Cosigner Release Application

One of the primary methods for removing a cosigner from a student loan is through a cosigner release application. Many lenders offer this option to borrowers who meet certain eligibility criteria. Here’s how the cosigner release application process generally works:

- Review the lender’s requirements: Familiarize yourself with the specific cosigner release requirements outlined by your lender. Understand factors such as minimum payment history, credit score, and income criteria that need to be met for cosigner release.

- Gather necessary documentation: Prepare all the documentation required by the lender to support your cosigner release application. This may include proof of income, employment verification, and payment history.

- Initiate the application: Contact your lender or visit their website to initiate the cosigner release application process. Follow their instructions and provide all the requested information accurately and promptly.

- Appraisal of the application: The lender will review your application and assess your eligibility for cosigner release. This may involve evaluating your payment history, creditworthiness, income stability, and other relevant factors.

- Approval or denial: The lender will notify you of their decision regarding your cosigner release application. If approved, the cosigner will be officially removed from the loan agreement, and you will assume full responsibility for repayment.

- Continue loan repayment: Even if your application is approved, it is crucial to continue making timely payments on your student loan. This ensures that you maintain a good payment record and further strengthens your creditworthiness.

- Seek assistance if denied: If your cosigner release application is denied, don’t lose hope. Reach out to your lender to understand the reasons for denial and explore alternative options, such as loan refinancing or addressing any deficiencies in your application.

It is important to note that each lender may have different requirements and processes for cosigner release applications. Some lenders may have strict criteria, while others may have more flexible policies. It is crucial to carefully review your loan agreement and communicate with your lender to ensure you meet all the necessary requirements for a cosigner release.

Remember that patience and persistence are key throughout the cosigner release application process. Stay organized, follow the lender’s instructions, and provide the requested documentation promptly to increase your chances of a successful cosigner release.

Option 2: Student Loan Refinancing

Another option for removing a cosigner from a student loan is through student loan refinancing. Refinancing involves obtaining a new loan with different terms to pay off the existing student loan. Here’s how student loan refinancing can help remove a cosigner from your loan:

- Evaluate your eligibility: Research and compare different lenders to determine if you are eligible for student loan refinancing. Lenders typically consider factors such as credit history, income, employment stability, and debt-to-income ratio when evaluating loan applications.

- Shop for the best rates and terms: Look for lenders offering competitive rates and favorable terms for refinancing. Compare interest rates, repayment options, and any potential fees associated with refinancing to find the best deal.

- Apply for refinancing: Complete the application process with the chosen lender. Provide all the required documentation, including proof of income, identification, and details of your current student loan.

- Get approved and pay off your existing loan: If your refinancing application is approved, the new lender will pay off your existing student loan. This effectively removes the old loan, along with the cosigner, from your financial responsibilities.

- Assume full responsibility: With the new loan, you become solely responsible for repayment. This means the cosigner is released from any financial obligations related to the original loan.

- Enjoy potential cost savings: Refinancing can also result in cost savings if you secure a lower interest rate. This reduces the overall amount you will pay over the life of the loan.

- Review the new loan terms: Carefully review the terms and conditions of the refinanced loan. Understand the repayment schedule, any potential penalties for early repayment, and any changes to the loan agreement.

- Continue making on-time payments: Once you have refinanced your student loan, it is crucial to continue making timely payments. This helps maintain a good credit record and ensures repayment of the new loan on schedule.

Student loan refinancing offers the advantage of removing the cosigner while potentially providing financial benefits such as lower interest rates. However, before refinancing, it’s important to carefully consider the terms and potential risks associated with the new loan. Additionally, keep in mind that refinancing federal student loans with a private lender may result in the loss of certain borrower benefits and federal loan protections.

Consult with multiple lenders, read the fine print, and weigh the pros and cons before deciding whether refinancing is the right option for removing the cosigner from your student loan.

Option 3: Paying off the Loan in Full

If you have the financial means to do so, paying off your student loan in full is another effective way to remove a cosigner. While this option may require a significant sum of money, it offers complete financial independence. Here’s how you can go about paying off your loan in full:

- Assess your financial situation: Evaluate your financial resources and determine if you have sufficient funds to pay off the loan in its entirety. Consider factors such as your savings, income stability, and other financial obligations.

- Create a repayment plan: Develop a repayment strategy that aligns with your financial capabilities. Calculate the total loan amount, including any accrued interest, and determine a timeline for repayment based on your available funds.

- Contact your lender: Reach out to your lender to inquire about the necessary steps for paying off the loan in full. Obtain the payoff amount, which may differ from the outstanding loan balance due to accrued interest or prepayment penalties.

- Submit the payment: Make the full payment to your lender, paying off the loan balance entirely. Ensure that you follow the specific instructions provided by the lender to ensure the payment is applied correctly.

- Confirm the loan closure: Once the payment is processed, confirm with your lender that the loan has been paid off, and obtain written confirmation that the cosigner has been released from any financial obligations related to the loan.

- Notify credit bureaus: Inform the credit bureaus of the loan closure and make sure your credit report reflects the updated information. This helps ensure accurate reporting and establishes your creditworthiness as an independent borrower.

- Continue building credit: After paying off your student loan, continue practicing responsible financial habits to maintain and improve your credit score. This will help you build a strong credit profile and enhance your future borrowing opportunities.

Paying off your student loan in full allows you to remove the cosigner completely and achieve financial independence. However, before making this decision, carefully evaluate your financial situation and ensure that paying off the loan won’t negatively impact your other financial goals. It’s important to consider the opportunity costs and potential benefits of using those funds for other purposes, such as investments or savings.

If paying off the loan in full is not currently feasible, you can also consider making accelerated payments or increasing your monthly payment amounts to expedite the repayment process and ultimately remove the cosigner from the loan.

Potential Challenges and Considerations

While removing a cosigner from a student loan offers numerous advantages, it’s essential to be aware of potential challenges and considerations that may arise during the process. Here are a few factors to keep in mind:

- Lender Requirements: Each lender has its own set of requirements for cosigner release or loan refinancing. It’s important to review and understand these requirements to ensure you meet the eligibility criteria.

- Financial Stability: To qualify for cosigner release or loan refinancing, you typically need to demonstrate financial stability. This includes a good credit score, a steady income, and a positive repayment history. It’s important to assess your financial situation and determine if you meet these requirements before pursuing either option.

- Cosigner’s Consent: If you wish to remove a cosigner from a loan, they may need to provide consent or follow specific procedures outlined by the lender. It’s crucial to communicate openly with your cosigner and ensure they are willing to release their responsibilities and obligations associated with the loan.

- Impact on Credit Score: Depending on the option you choose, there may be temporary fluctuations in your credit score. For example, refinancing may result in a new loan account being opened, which can impact your credit utilization and average account age. Consider the potential impact on your credit score and plan accordingly.

- Loss of Borrower Benefits: If you refinance federal student loans with a private lender, you may lose certain borrower benefits, such as deferment options, income-driven repayment plans, or loan forgiveness programs. Be sure to evaluate the trade-offs between removing the cosigner and losing any potential benefits associated with your current loan.

- Additional Costs: Depending on the option you choose, there may be additional costs associated with cosigner release or loan refinancing, such as application fees or closing costs. Factor in these costs when making your decision.

- Legal and Financial Advice: It’s always a good idea to consult with legal and financial professionals when making significant financial decisions. They can provide guidance specific to your situation and ensure that you fully understand the implications of removing a cosigner from your student loan.

By considering these potential challenges and taking appropriate steps to address them, you can navigate the process of removing a cosigner from your student loan smoothly and make informed decisions about your financial future.

Conclusion

Removing a cosigner from a student loan is a significant milestone that offers borrowers increased financial independence and the opportunity to take full control of their loan obligations. While the process may have its challenges, understanding the options available and meeting the necessary requirements can lead to successful cosigner removal.

Whether through a cosigner release application, student loan refinancing, or paying off the loan in full, each option has its own considerations, benefits, and potential drawbacks. It is important to carefully evaluate your financial situation, eligibility, and long-term goals before deciding which path to pursue.

Communicating openly with your cosigner and keeping them informed throughout the process is crucial to maintaining positive relationships and ensuring a smooth transition. It is also essential to stay in close contact with your lender, following their instructions, and submitting any required documentation promptly to increase your chances of success.

As you embark on the journey of removing a cosigner from your student loan, remember to stay focused and disciplined in your financial management. Continue making regular, on-time payments, or explore opportunities to pay off your loan more quickly, further establishing your financial independence and growing your creditworthiness.

While removing a cosigner may require effort and careful planning, it provides valuable benefits, such as improved credit scores, financial flexibility, and the opportunity to assume complete responsibility for your student loan. Take the necessary steps, seek guidance from professionals when needed, and enjoy the satisfaction of accomplishing this significant financial milestone.