Finance

Multiple Column Tariff Definition

Published: December 27, 2023

Learn about the multiple column tariff definition in finance and understand how it affects various industries. Stay ahead of the game with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Multiple Column Tariff: Definition, Benefits, and How It Works

Welcome to the Finance category of our blog! In today’s post, we are going to dive deep into the world of multiple column tariffs. Whether you are a business owner or a curious individual, understanding tariffs is crucial for navigating the complex waters of international trade. So, what exactly is a multiple column tariff, and how does it work? Let’s find out!

Key Takeaways:

- A multiple column tariff is a tariff schedule that categorizes goods based on certain criteria, allowing for different rates of import duties.

- This tariff system offers transparency, flexibility, and the potential for encouraging domestic industries.

What is a Multiple Column Tariff?

A multiple column tariff is a tariff schedule that classifies goods into different categories or columns based on various factors such as the product’s origin, value, or specific attributes. This classification system enables customs authorities to apply different rates of import duties or tariffs to different categories of goods. In simpler terms, it’s like grouping products into different baskets and assigning specific tax rates to each basket.

Now that we have a basic understanding of multiple column tariffs, let’s explore some of its key benefits:

The Benefits of Multiple Column Tariffs:

- Transparency: By categorizing goods into different columns, multiple column tariffs provide a clear structure that outlines the specific duties applicable to each category. This transparency allows businesses to plan their imports or exports more accurately, helping to avoid unnecessary surprises or financial setbacks.

- Flexibility: The use of multiple columns in tariff schedules provides flexibility for policymakers to adjust duty rates based on the needs of different industries or economic considerations. This flexibility allows governments to provide incentives or protection to certain domestic industries, potentially fostering growth and competitiveness.

Now that we have explored the benefits of multiple column tariffs, let’s take a closer look at how this tariff system works:

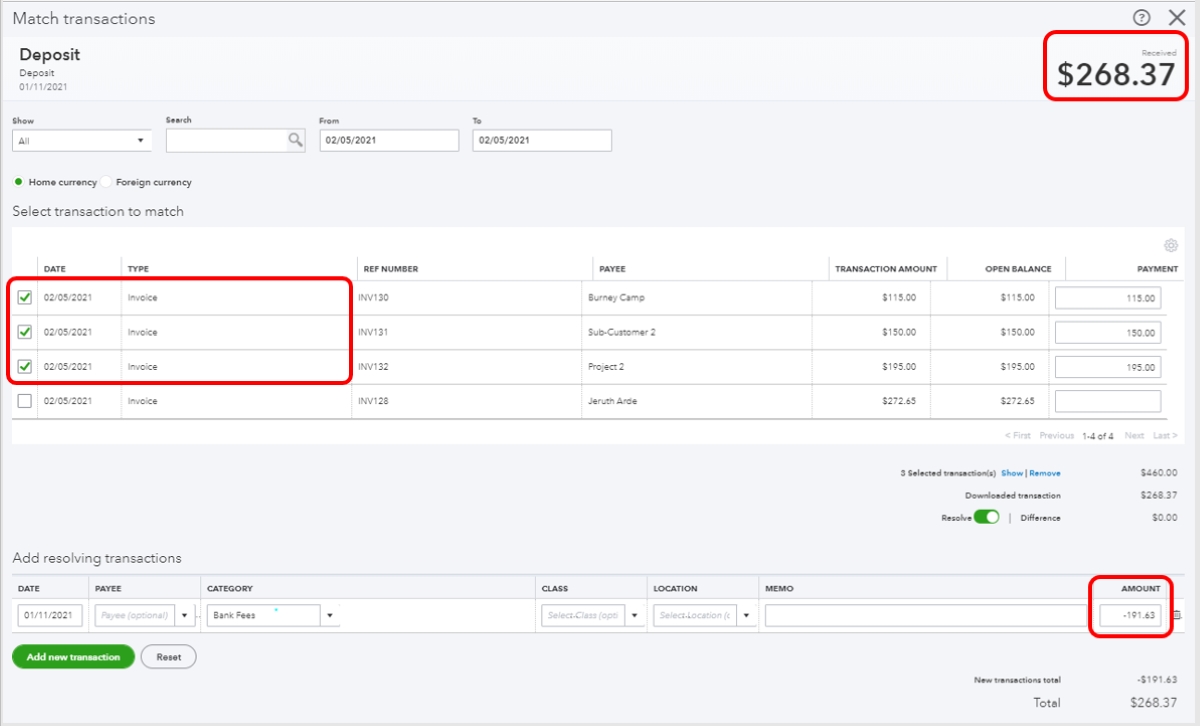

How Does a Multiple Column Tariff Work?

A typical multiple column tariff schedule consists of various columns assigned to different categories of goods. Each column corresponds to a specific set of criteria such as the product’s origin, value, or characteristics. These criteria determine the applicable duty rates for goods falling within each category. The customs authorities apply the relevant duty rate to calculate the import duties owed.

For example, let’s say a country has a multiple column tariff system for imported electronic goods. The tariff schedule may have different columns based on the product’s value range, such as “Under $500,” “Between $500 and $1,000,” and “Over $1,000.” Each column will have a specific duty rate associated with it. When importing electronic goods, the customs authorities will assess the value of the goods and apply the applicable duty rate from the corresponding column.

This system enables the government to incentivize certain industries or align tariffs with specific policy goals. For instance, a country may choose to impose lower duty rates on raw materials to encourage local manufacturing or higher duty rates on luxury items to protect domestic producers.

In conclusion, multiple column tariffs provide a structured approach to applying import duties based on different product categories. This system offers transparency, flexibility, and the potential for encouraging domestic industries. Understanding multiple column tariffs can empower businesses and individuals to make informed decisions in the ever-evolving landscape of international trade.

We hope this blog post has shed some light on the complexities of multiple column tariffs. If you have any questions or want to learn more about the finance world, feel free to explore the other categories on our blog or contact our team of experts!