Home>Finance>New York Stock Exchange (NYSE): Definition, How It Works, History

Finance

New York Stock Exchange (NYSE): Definition, How It Works, History

Published: December 30, 2023

Discover the definition, working principles, and historical significance of the New York Stock Exchange (NYSE) in the world of finance. Uncover its rich history and understand how it operates.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The New York Stock Exchange (NYSE): A Historical Pillar of Finance

Welcome to our Finance category, where we dive into the fascinating world of money, investments, and markets. In this post, we will explore the New York Stock Exchange (NYSE), its definition, how it works, and its rich history. Whether you are a seasoned investor or someone just starting their financial journey, understanding the NYSE is essential to grasp the foundations of modern finance.

Key Takeaways on the New York Stock Exchange (NYSE):

- The NYSE is the largest stock exchange in the world, representing a significant portion of the global economy.

- It provides a platform for buying and selling stocks in publicly-traded companies, making it a crucial hub for investors.

The Definition and Purpose:

The New York Stock Exchange, also known as the NYSE or the Big Board, is a marketplace where investors can buy and sell shares of publicly-traded companies. It is the largest stock exchange globally, with over 2,400 companies listed and a market capitalization of trillions of dollars. The NYSE’s primary purpose is to facilitate the smooth trading of stocks, allowing individuals and institutions to invest their capital and own a share of the world’s leading companies.

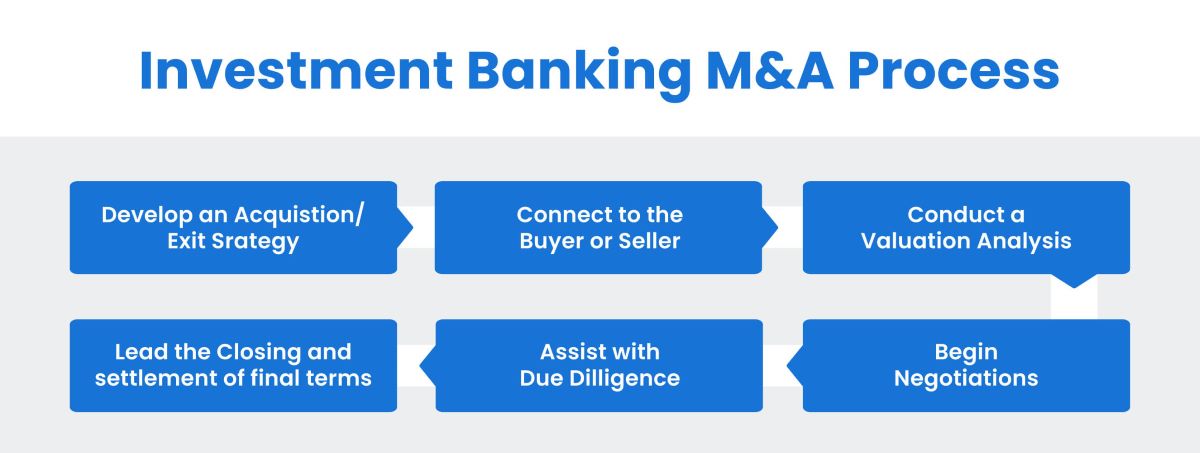

How the NYSE Works:

The NYSE operates as an auction-based market, where buyers and sellers come together to determine the price of a stock. Here’s a step-by-step overview of how the NYSE works:

- Listing: A company decides to go public and lists its shares on the NYSE. This process involves meeting stringent requirements set by the exchange.

- Trading Floor: Historically, the NYSE had an iconic trading floor, bustling with traders. Today, much of the trading occurs electronically, but the trading floor still plays a symbolic role.

- Brokers and Market Makers: Brokers act on behalf of investors to buy or sell stocks in the NYSE. Market makers facilitate liquidity by continuously buying and selling stocks.

- Bidding Process: Buyers submit bids and sellers submit offers to the market. The highest bid and the lowest offer meet at the “bid-ask spread,” determining the stock price.

- Matching: When a bid and offer meet, a trade occurs, and the transaction is recorded on the centralized system.

- Market Regulation: The NYSE has a robust regulatory framework in place to ensure fair trading practices and protect investors.

A Brief History of the NYSE:

The NYSE has a long and storied history that dates back to 1792 when a group of merchants signed the Buttonwood Agreement, establishing the foundations of organized trading in New York City. Here are some notable milestones:

- 1817: The formation of the New York Stock & Exchange Board, the precursor to the NYSE.

- 1863: The creation of the U.S. Securities and Exchange Commission (SEC) to regulate the stock market.

- 1903: The construction of the iconic Wall Street building that housed the NYSE until 1978.

- 1971: The adoption of electronic trading, revolutionizing the way stocks are bought and sold.

- 2007: The NYSE merges with Euronext, forming the first transatlantic stock exchange.

Today, the NYSE continues to play a pivotal role in global finance, shaping the landscape of Wall Street and serving as a symbol of capitalism and economic activity.

Conclusion:

The New York Stock Exchange is the epitome of the stock market, representing the heart of global finance. Understanding how the NYSE works and its rich history can empower both seasoned investors and newcomers to navigate the world of investments with confidence and insight.

So, whether you dream of shouting orders on the bustling trading floor or prefer the comfort of trading from your smartphone, the NYSE remains an essential institution driving the world’s economy forward.