Finance

No Cash-Out Refinance Definition

Published: December 31, 2023

Learn the definition of a no cash-out refinance and how it can benefit your financial situation. Find out how to navigate this finance option and make the most of it.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding No Cash-Out Refinance: A Comprehensive Guide

Welcome to my finance blog, where we dive into various topics related to money management, investment strategies, and financial planning. In this post, we will explore the concept of a no cash-out refinance. Whether you are a new homeowner or looking to refinance your mortgage, this guide will equip you with the knowledge to make informed decisions for your financial future.

Key Takeaways:

- A no cash-out refinance is a type of mortgage refinancing that allows borrowers to replace their existing mortgage with a new one without receiving any cash proceeds.

- This refinancing option is often chosen by homeowners who want to lower their interest rate, change their loan term, or switch from an adjustable-rate mortgage to a fixed-rate mortgage.

What is a No Cash-Out Refinance?

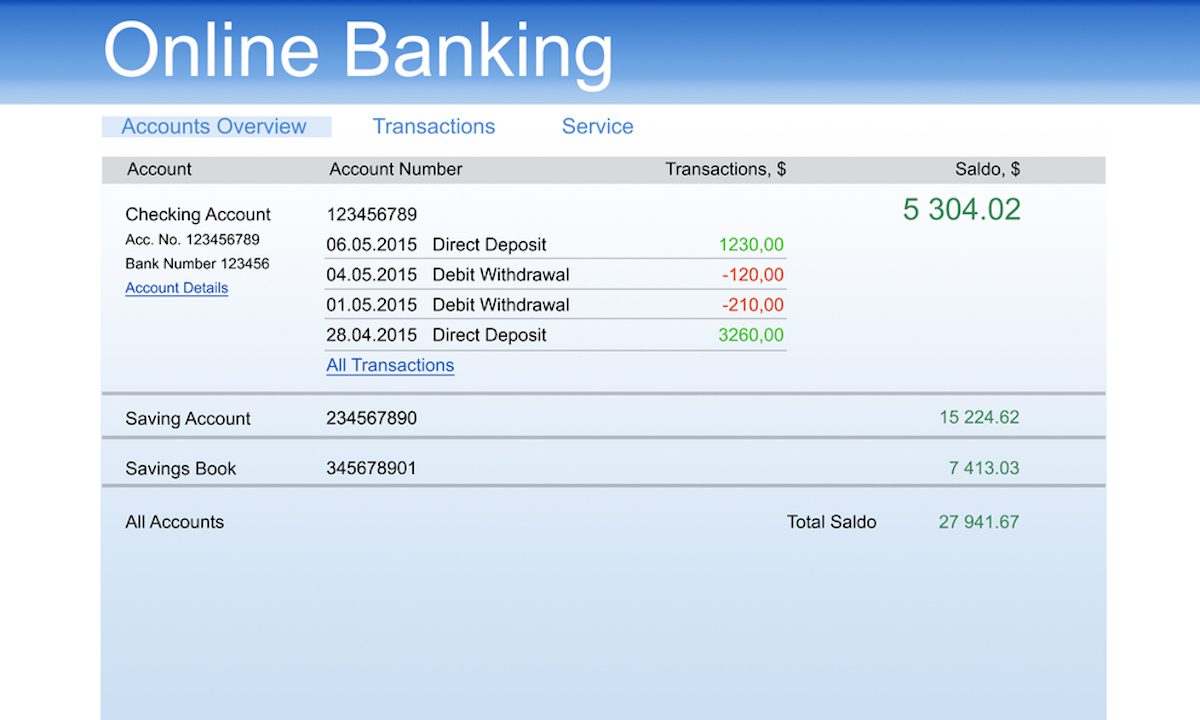

A no cash-out refinance, also known as a rate and term refinance, is a type of mortgage refinancing that allows borrowers to replace their existing mortgage with a new one without receiving any cash proceeds. In simpler terms, it means you are restructuring your mortgage loan but not taking any additional funds out of the equity in your home.

This type of refinancing option is typically chosen by homeowners who want to:

- Lower their interest rate: By refinancing at a lower interest rate, borrowers can reduce their monthly mortgage payments and potentially save thousands of dollars over the life of the loan.

- Change their loan term: Homeowners may choose to refinance to either extend or shorten their loan term. Extending the term can result in lower monthly payments, while shortening it can help borrowers pay off their mortgage sooner and save on interest costs.

- Switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage (FRM): Adjustable-rate mortgages often start with a lower interest rate but can increase over time, causing unpredictable monthly payments. Refinancing to a fixed-rate mortgage provides stability by locking in a consistent interest rate throughout the loan term.

How Does a No Cash-Out Refinance Work?

The process of a no cash-out refinance is similar to securing a new mortgage. Borrowers go through an application and approval process with a lender to qualify for the new loan. Factors like credit score, income, and home value are taken into account during the underwriting process. Once approved, the existing mortgage is paid off, and a new mortgage with revised terms is established.

It’s important to note that a no cash-out refinance does come with certain costs, including closing costs, appraisal fees, and loan origination fees. However, these fees can often be rolled into the new loan or negotiated with the lender. Be sure to consider these costs when evaluating whether a no cash-out refinance is the right option for you.

In Summary

A no cash-out refinance is an attractive option for homeowners who want to optimize their mortgage terms without tapping into their home equity. Whether you aim to lower your interest rate, change your loan term, or switch from an ARM to an FRM, a no cash-out refinance can provide the flexibility and financial benefits you need. Just remember to consider the associated costs, and always consult with a trusted mortgage professional before making any refinancing decisions.

Thank you for reading! Check out the other articles in our finance category for more valuable insights on managing your money, investing wisely, and achieving your financial goals.