Finance

Cash Accumulation Method Definition

Published: October 24, 2023

Discover the cash accumulation method's definition and its significance in finance. Learn how it can help you grow wealth and reach your financial goals.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Cash Accumulation Method in Finance: A Guide for Financial Success

When it comes to achieving financial success and security, it’s crucial to have a solid understanding of various financial strategies and methods. One such method that can help you build wealth and accumulate cash is the Cash Accumulation Method. In this blog post, we will delve into the definition of the Cash Accumulation Method, its benefits, and how it can be implemented in your financial journey.

Key Takeaways:

- The Cash Accumulation Method is a financial strategy focused on saving and accumulating cash.

- It emphasizes the importance of maintaining a liquidity reserve for unexpected expenses and investment opportunities.

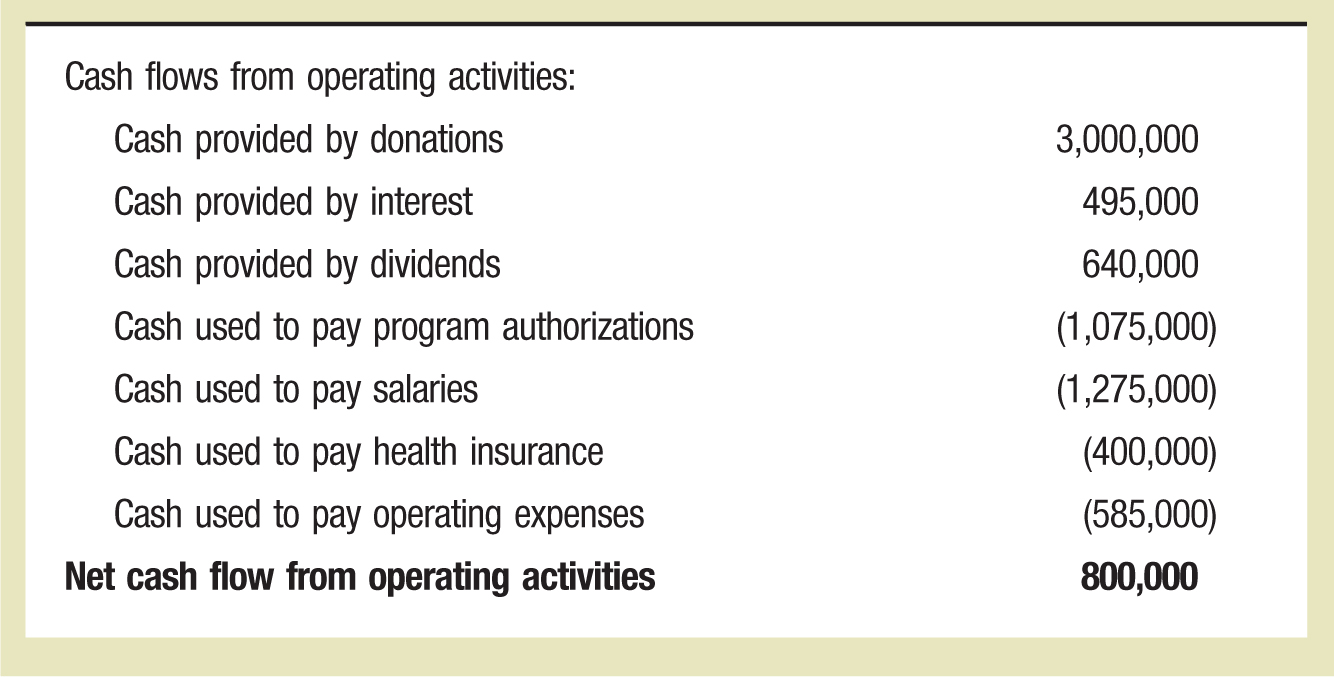

The Cash Accumulation Method is essentially a systematic approach to building cash reserves over time. It involves setting aside a portion of your income or profits from investments on a regular basis to create a financial safety net. By following this method, you ensure that you always have liquid funds readily available for emergencies or investment opportunities, even when unpredictable circumstances arise.

Implementing the Cash Accumulation Method requires discipline and consistency in saving and investing. Here are the steps to get started:

- Assess Your Financial Goals: Begin by setting clear financial goals for yourself. Determine how much cash you want to accumulate and by when.

- Create a Budget: Develop a monthly budget to manage your expenses and identify areas where you can save more.

- Automate Savings: Set up automatic transfers from your checking account to a designated savings account to ensure regular contributions without fail.

- Invest Wisely: Allocate a portion of your accumulated cash into low-risk investments that provide steady returns. This will help your cash grow and maintain its value over time.

- Review and Adjust: Periodically review your progress and make adjustments to your savings and investment strategy as needed. Regularly reassess your financial goals to track your progress effectively.

By following these steps, the Cash Accumulation Method can help you achieve financial stability and flexibility. Here are two key takeaways to remember:

- Regularly setting aside a portion of your income for savings is critical for building a cash reserve.

- Investing a portion of your accumulated cash can help grow your wealth while maintaining liquidity.

Financial security and success are the result of careful planning, wise decisions, and disciplined execution. If you’re looking to strengthen your financial position and protect yourself from unforeseen events, the Cash Accumulation Method can be a valuable tool in your financial arsenal. Start implementing this method today and pave the way for a secure financial future.