Finance

Non-Controlling Interest Definition

Published: December 31, 2023

Understand the definition of non-controlling interest, a crucial concept in finance. Learn how it impacts financial statements and investment decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Non-Controlling Interest Definition: A Closer Look at This Finance Term

Welcome to our FINANCE category, where we delve into various aspects of the financial world. In this blog post, we’re going to explore the concept of non-controlling interest, a term that often pops up in financial reports and discussions. What exactly does non-controlling interest mean? How does it affect a company’s financial statements? Join us as we break it down and provide you with a comprehensive understanding of this important finance term.

Key Takeaways:

- Non-controlling interest refers to the ownership stake in a company held by individuals or entities other than the controlling shareholders or parent company.

- Non-controlling interest is reported as a separate line item on a company’s balance sheet and income statement.

Let’s start by addressing the fundamental question: What is non-controlling interest? Non-controlling interest, also known as minority interest, represents the ownership stake in a company that is held by individuals or entities other than the controlling shareholders or parent company. In other words, it refers to the portion of a company’s ownership that does not give the holder control over the company’s operations or decision-making processes.

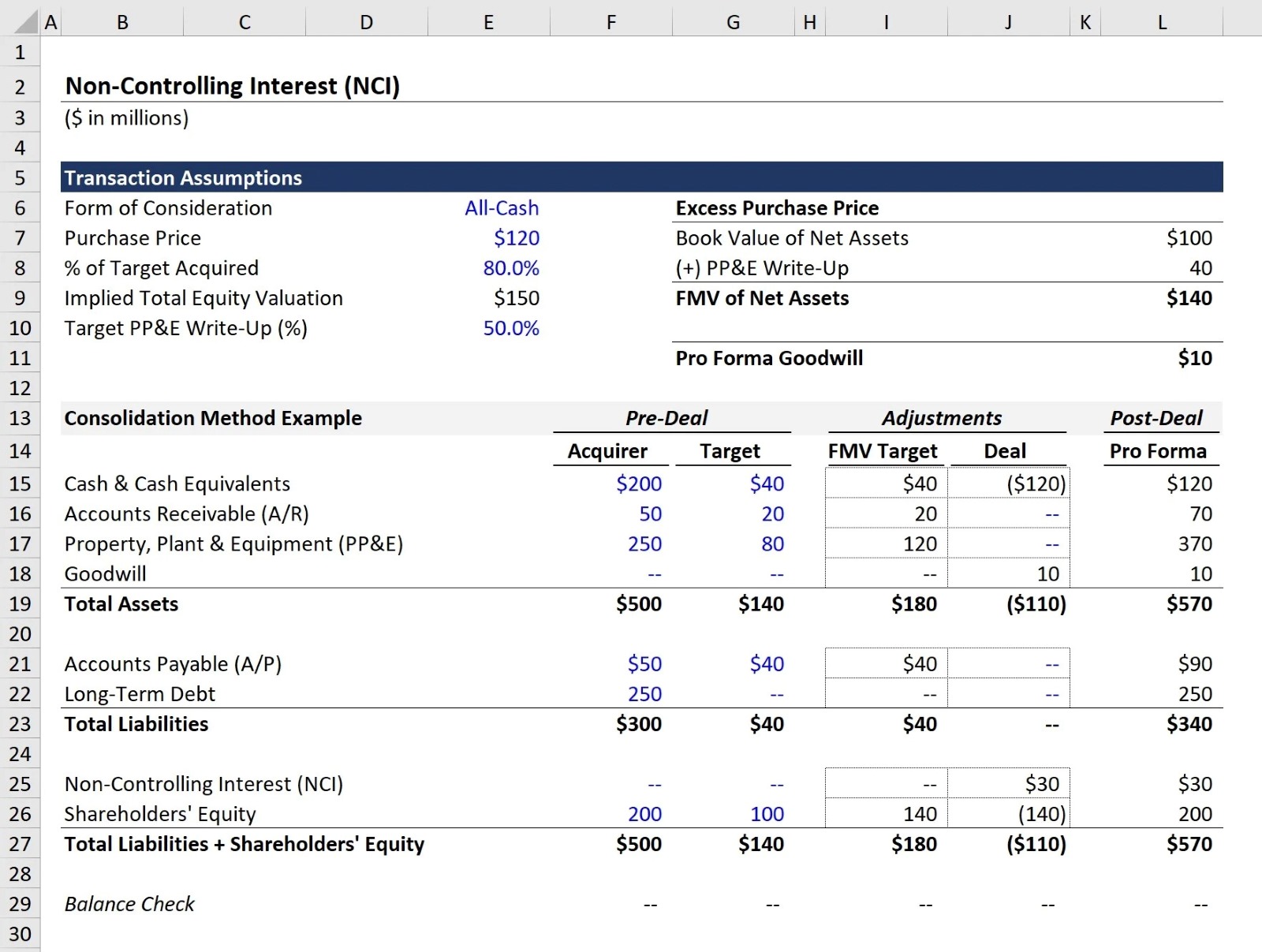

Non-controlling interest arises in situations where a company has subsidiaries or joint ventures. When a parent company holds more than 50% of the voting rights and economic interest in another entity, it typically consolidates the subsidiary’s financial statements. However, the portion of the subsidiary’s equity that is not attributable to the parent company is considered non-controlling interest.

Here are two key takeaways to keep in mind when it comes to non-controlling interest:

- Non-controlling interest is reported as a separate line item on a company’s balance sheet. It represents the value of the minority shareholders’ equity in the company.

- On the income statement, non-controlling interest is reflected as a deduction from the consolidated net income, as it represents the portion of the subsidiary’s profit that belongs to the minority shareholders.

For example, let’s say Company A owns 80% of Company B, while the remaining 20% is held by external shareholders. Company A would consolidate Company B’s financial statements, but the 20% equity held by the external shareholders would be reported as non-controlling interest.

Non-controlling interest has an impact on a company’s financial statements, as it affects the ownership structure and the allocation of profits. It is important for investors and stakeholders to understand the concept of non-controlling interest to accurately analyze a company’s financial health and performance.

In conclusion, non-controlling interest refers to the ownership stake in a company held by individuals or entities other than the controlling shareholders or parent company. It is reported as a separate line item on a company’s balance sheet and income statement and represents the portion of equity and profit attributable to minority shareholders. By understanding non-controlling interest, investors can gain a deeper understanding of a company’s ownership structure and financial performance.