Home>Finance>What Is Non-Controlling Interest On The Balance Sheet?

Finance

What Is Non-Controlling Interest On The Balance Sheet?

Published: December 27, 2023

Learn what non-controlling interest means on a balance sheet in the field of finance. Gain insights into its significance and accounting implications.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Non-Controlling Interest

- Importance of Non-Controlling Interest on the Balance Sheet

- Accounting for Non-Controlling Interest

- Consolidated Financial Statements

- Valuation of Non-Controlling Interest

- Reporting Non-Controlling Interest on the Balance Sheet

- Examples of Non-Controlling Interest

- Conclusion

Introduction

When examining a company’s balance sheet, you may come across a term called non-controlling interest. While it may sound unfamiliar to some, understanding the concept and its implications is crucial for anyone interested in comprehending a company’s financial position.

Non-controlling interest, also known as minority interest, refers to the portion of a company’s equity that is not owned or controlled by the majority shareholders or parent company. It represents the ownership stake held by outside investors or other entities in a subsidiary or affiliated company.

This article aims to delve into the intricacies of non-controlling interest on the balance sheet, exploring its significance in financial reporting, accounting treatment, and valuation. We will also provide examples to illustrate how non-controlling interest is reported.

By gaining a comprehensive understanding of non-controlling interest, investors, analysts, and stakeholders can make informed decisions, evaluate the financial health of a company, and assess its potential risks and rewards.

Understanding Non-Controlling Interest

Non-controlling interest, as the name implies, refers to the ownership stake in a company that is not controlled by the majority shareholders or parent company. It represents the portion of equity held by outside investors or entities in a subsidiary or affiliated company.

Non-controlling interest typically arises when a company owns more than 50% of another company’s shares. In such cases, the subsidiary is consolidated into the parent company’s financial statements. However, the portion of equity not owned by the parent company is classified as non-controlling interest.

Non-controlling interest allows minority shareholders to have a voice and influence on decision-making processes within the subsidiary or affiliated company. While they do not have control, minority shareholders still have economic rights to a share of the subsidiary’s profits and assets.

It’s important to note that non-controlling interest only applies to equity ownership and does not encompass other forms of investment, such as loans or debt securities. The presence of non-controlling interest on the balance sheet indicates that a subsidiary or affiliated company has significant minority shareholders whose interests need to be accounted for.

Non-controlling interest often arises in situations where a company seeks external funding or acquires other companies. By allowing outside investors to hold an ownership stake, the company can raise capital or expand its operations while retaining control over the majority of shares.

It’s also possible for a company to have multiple layers of non-controlling interest. For example, if a subsidiary is itself a parent company of another subsidiary, there can be non-controlling interest at both levels. In such cases, each level of non-controlling interest needs to be accounted for separately on the consolidated balance sheet.

Understanding non-controlling interest is vital for financial analysis and decision-making. It provides insights into the ownership structure of a company and helps in evaluating the influence, rights, and economic share held by minority shareholders.

Importance of Non-Controlling Interest on the Balance Sheet

Non-controlling interest plays a significant role in accurately reflecting the financial position of a company on the balance sheet. Here are a few key reasons why non-controlling interest is important:

1. Equity and Ownership Representation: Non-controlling interest represents the portion of the company’s equity that belongs to minority shareholders. By including it on the balance sheet, companies provide a clear picture of the ownership structure and the rights held by minority shareholders.

2. Transparent Financial Reporting: Including non-controlling interest on the balance sheet ensures transparency and adherence to accounting standards. It demonstrates the company’s commitment to accurately reporting the financial results and obligations of both majority and minority shareholders.

3. Evaluation of Capital Allocation: Non-controlling interest helps in assessing the utilization of capital and the allocation of resources within a company. It allows stakeholders to understand how the business is funding its operations and whether there is a fair distribution of profits among shareholders.

4. Assessment of Minority Shareholder Rights: Non-controlling interest reveals the level of influence and control that minority shareholders have within a company. This information is important for minority shareholders and potential investors who want to gauge the extent of their involvement in the decision-making processes and corporate governance structure.

5. Calculation of Consolidated Financial Ratios: Non-controlling interest is integral to calculating financial ratios accurately. Ratios such as return on equity (ROE) and earnings per share (EPS) are influenced by the inclusion of minority shareholders’ economic interest.

6. Strategic and Investment Decision-making: Non-controlling interest provides valuable insights to investors, analysts, and management regarding the impact of minority shareholders on the overall financial health and performance of a company. This information assists in making informed decisions regarding investments, partnerships, and strategic initiatives.

By recognizing the importance of non-controlling interest on the balance sheet, stakeholders can have a more comprehensive understanding of a company’s financial position, equity structure, and the rights and obligations associated with minority shareholders.

Accounting for Non-Controlling Interest

Accounting for non-controlling interest involves properly recognizing and reporting the ownership stake held by minority shareholders in a subsidiary or affiliated company. The accounting treatment for non-controlling interest is guided by accounting standards such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

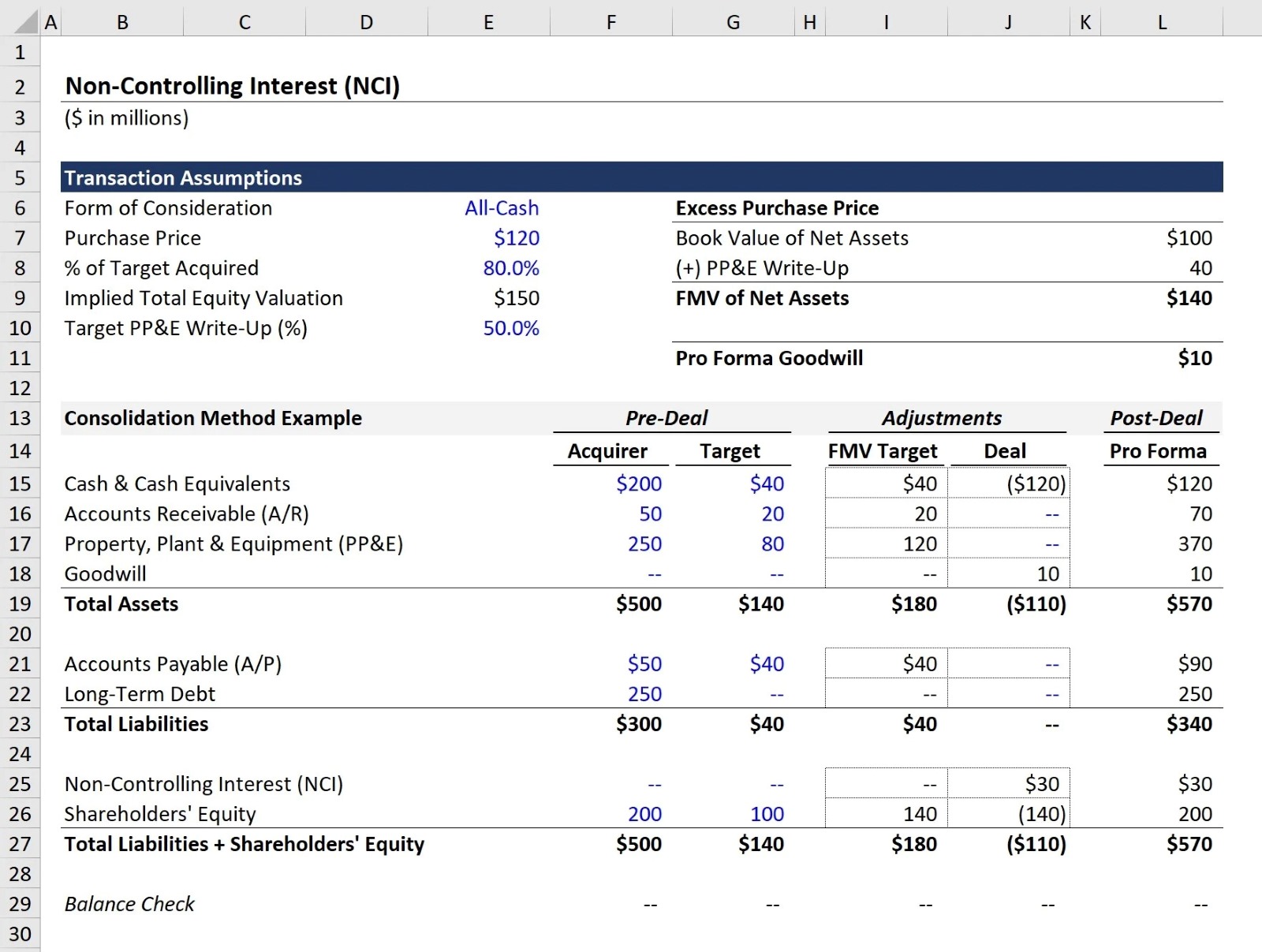

When a company owns more than 50% of another company’s shares, the subsidiary is consolidated into the parent company’s financial statements. The portion of equity owned by the parent company is recorded as the parent’s equity, while the portion owned by minority shareholders is recorded as non-controlling interest on the consolidated balance sheet.

Non-controlling interest is presented as a separate line item on the equity section of the balance sheet. It represents the minority shareholders’ share of the subsidiary’s net assets, including equity, assets, liabilities, and retained earnings.

The accounting treatment for non-controlling interest also extends to the income statement. The subsidiary’s net income or loss is allocated between the parent company and non-controlling interest based on their respective ownership percentages. This allocation is done before calculating the parent company’s net income or loss for the period.

Additionally, any dividends declared by the subsidiary are typically allocated between the parent and non-controlling interest based on their ownership percentages. The portion of the dividends attributable to non-controlling interest reduces the parent company’s equity and is reported as a dividend expense.

It’s worth noting that changes in the ownership percentage of non-controlling interest require adjustments to be made in the financial statements. If the parent company acquires or disposes of additional shares of the subsidiary, the impact is reflected in the allocation of equity and net income or loss between the parent and non-controlling interest.

Properly accounting for non-controlling interest is essential for providing accurate and transparent financial reporting. It helps stakeholders understand the ownership structure and the influence of minority shareholders on the consolidated financial statements. By adhering to accounting standards, companies can ensure consistency and comparability in reporting the financial impact of non-controlling interest.

Consolidated Financial Statements

Consolidated financial statements are financial reports that combine the financial information of a parent company and its subsidiaries or affiliated companies into a single set of financial statements. The purpose of preparing consolidated financial statements is to provide a comprehensive view of the financial position, performance, and cash flows of the entire group of companies as if they were a single entity.

Non-controlling interest plays a crucial role in the preparation of consolidated financial statements. When a company owns more than 50% of another company’s shares, the subsidiary’s financial information is consolidated into the parent company’s financial statements.

The consolidation process involves adjusting the subsidiary’s financial statements to eliminate intra-group transactions and balances. In other words, transactions between the parent company and its subsidiary are eliminated to avoid double-counting or overstating the financial position and performance of the consolidated entity.

The equity portion on the consolidated balance sheet includes both the parent company’s equity and the non-controlling interest. Non-controlling interest represents the ownership stake held by minority shareholders in the subsidiary, while the parent company’s equity reflects its own ownership stake.

Consolidated financial statements also include a consolidated income statement, which combines the revenues, expenses, and net income or loss of the parent company and its subsidiaries. The net income or loss is allocated between the parent company and non-controlling interest based on their ownership percentages.

Furthermore, the consolidated cash flow statement captures the cash flows from operating, investing, and financing activities of the entire group of companies. It provides insights into the consolidated entity’s ability to generate cash, invest in new projects, and meet its financial obligations.

Consolidated financial statements provide a holistic view of the financial performance and position of a company and its subsidiaries. This allows stakeholders to evaluate the overall health and profitability of the group, assess its solvency and liquidity, and make informed investment, lending, and strategic decisions.

By incorporating the financial results of subsidiary companies and non-controlling interest, consolidated financial statements provide a complete and accurate picture of the financial performance and position of a group of companies as a whole.

Valuation of Non-Controlling Interest

Valuing non-controlling interest is a critical aspect of financial reporting and decision-making. It involves determining the fair value of the ownership stake held by minority shareholders in a subsidiary or affiliated company. The valuation process ensures that non-controlling interest is reflected accurately on the balance sheet and provides a basis for assessing the economic worth of the minority shareholders’ stake.

There are several methods used to value non-controlling interest, and the choice of method depends on various factors including the applicable accounting standards and the availability of reliable market data. Some common valuation methods include:

- Market-based Approach: This method relies on the analysis of market prices of publicly traded companies that are comparable to the subsidiary or affiliated company. By comparing key financial metrics and market multiples, such as price-to-earnings (P/E) ratio or price-to-sales (P/S) ratio, the value of non-controlling interest can be estimated.

- Income-based Approach: This approach utilizes financial projections and discounted cash flow (DCF) analysis to determine the present value of expected future cash flows attributable to the non-controlling interest. This method takes into account factors such as revenue growth, profitability, and the cost of capital.

- Asset-based Approach: This approach focuses on the fair value of the subsidiary’s net assets and entails adjusting the carrying value of assets and liabilities to reflect their current market value. The non-controlling interest is then calculated as a percentage of the adjusted net assets.

It’s important to note that the valuation of non-controlling interest should be conducted by qualified professionals, such as appraisers or valuation experts, who have the necessary expertise and knowledge of valuation techniques and principles.

The valuation of non-controlling interest has implications for financial reporting, including the calculation of goodwill and any subsequent impairment testing. It also plays a role in determining the allocation of net income or loss and dividends between the parent company and non-controlling interest.

Accurate valuation of non-controlling interest is crucial for stakeholders, including investors, analysts, and regulators, as it provides insights into the intrinsic value of minority shareholders’ equity stake and allows for better evaluation of the overall worth of the consolidated entity.

It’s important for companies to follow the applicable accounting standards and seek professional expertise to ensure that the valuation of non-controlling interest is carried out in a transparent, reliable, and consistent manner.

Reporting Non-Controlling Interest on the Balance Sheet

Reporting non-controlling interest on the balance sheet is a crucial step in accurately presenting the ownership structure and financial position of a company. Non-controlling interest is reported as a separate line item within the equity section of the balance sheet, distinct from the parent company’s equity.

The non-controlling interest on the balance sheet represents the ownership stake held by minority shareholders in a subsidiary or affiliated company. It reflects their economic interest in the subsidiary’s net assets, including equity, assets, liabilities, and retained earnings.

The specific presentation of non-controlling interest on the balance sheet may vary depending on the applicable accounting standards and reporting requirements. However, it is typically disclosed as a separate line item or included within the equity section, often labeled as “Non-controlling Interest” or “Minority Interest”.

Under the equity section, the parent company’s equity is typically reported first, followed by the non-controlling interest. This provides a clear distinction between the ownership stake of the parent company and the minority shareholders.

The non-controlling interest is calculated as a percentage of the subsidiary’s net assets that belong to the minority shareholders. For example, if the parent company owns 80% of the subsidiary and the remaining 20% is held by non-controlling interest, the balance sheet will reflect these percentages accordingly.

In addition to the balance sheet, non-controlling interest is also disclosed in the notes to the financial statements. These notes provide further details about the nature of the non-controlling interest, the ownership percentage, and any significant transactions or agreements that may impact the economic rights of the minority shareholders.

It’s important for companies to accurately report non-controlling interest on the balance sheet in accordance with the relevant accounting standards. This ensures transparency and allows stakeholders to understand the ownership structure, economic rights, and obligations associated with minority shareholders.

Investors, analysts, and regulators consider the reporting of non-controlling interest on the balance sheet as an essential element for evaluating the financial health, ownership structure, and influence of minority shareholders in a company.

Examples of Non-Controlling Interest

Non-controlling interest can arise in various business scenarios and industries. Here are a few examples that illustrate how non-controlling interest is encountered:

1. Subsidiary Ownership: When a company owns a majority stake in another company, the portion of equity not owned by the parent company represents the non-controlling interest. For instance, if Company A owns 70% of Company B’s shares, the remaining 30% is classified as non-controlling interest.

2. Joint Ventures: In joint ventures, two or more companies come together to form a separate entity with shared ownership. Each participating company holds a partial ownership stake, which may be deemed as non-controlling interest. For example, if Company X and Company Y collaborate to establish a joint venture, their ownership percentages would be classified as non-controlling interest.

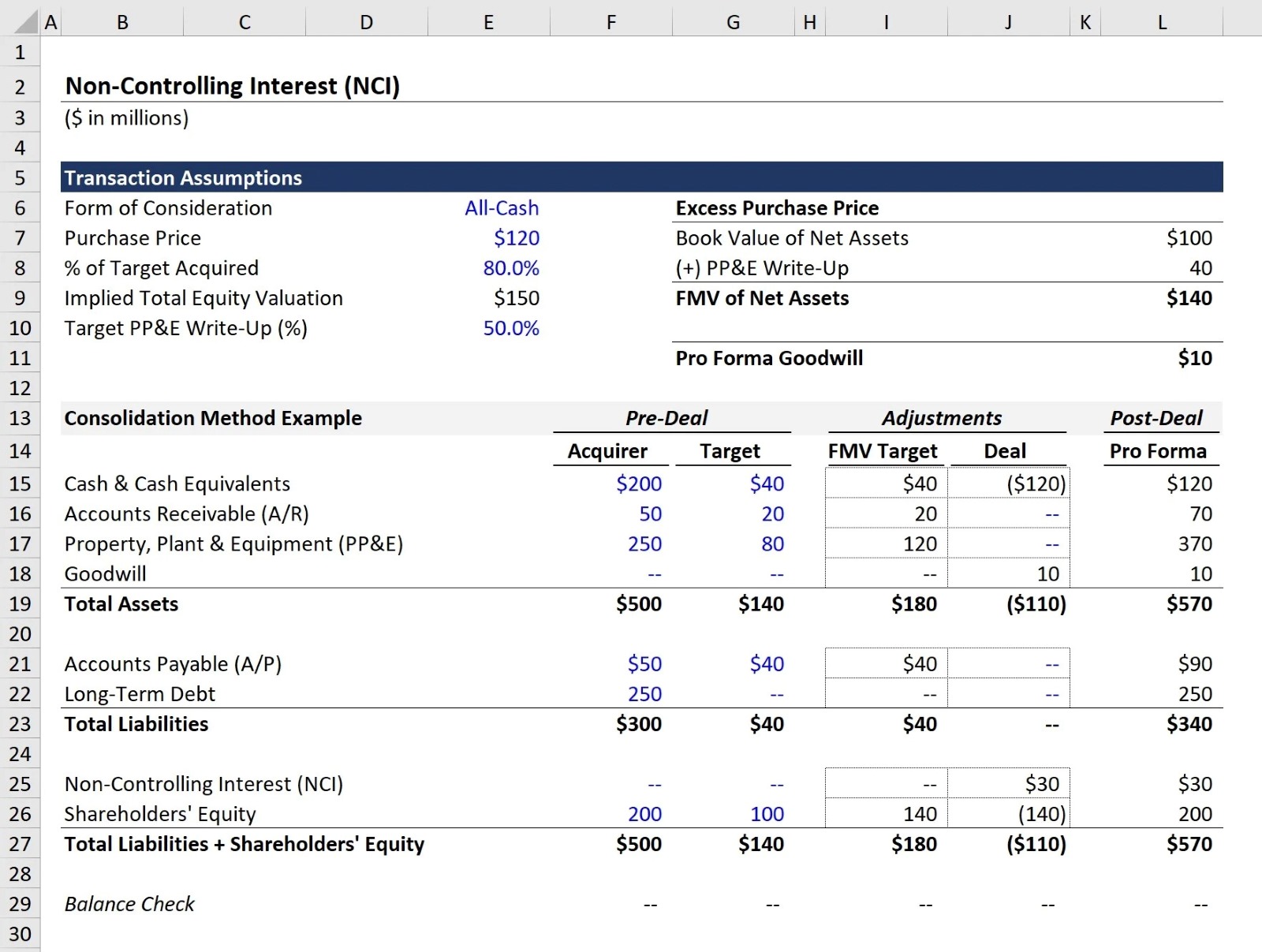

3. Mergers and Acquisitions: When a company acquires another company, the acquired entity’s minority shareholders may retain a portion of equity as non-controlling interest. For instance, if Company A acquires 80% of Company B, the remaining 20% owned by minority shareholders would be classified as non-controlling interest.

4. Publicly Traded Subsidiaries: In some cases, a subsidiary might be publicly traded, meaning that its shares are available for purchase by external investors. The shares held by these external investors would be considered non-controlling interest. This often occurs when the parent company decides to list a subsidiary’s shares on a stock exchange.

5. Multinational Companies: For multinational companies with operations in different countries, there may be non-controlling interest arising from subsidiaries located in foreign jurisdictions. Each subsidiary’s minority shareholders would hold a non-controlling interest in the respective subsidiary.

6. Family-owned Businesses: In family-owned businesses, where ownership and control are often tightly held, non-controlling interest may occur when family members or external investors hold a minority stake in the company. These minority shareholders would have non-controlling interest in the business.

These examples demonstrate the various scenarios in which non-controlling interest can arise. Understanding these situations is essential for evaluating the ownership structure, economic rights, and influence of minority shareholders in a company.

Conclusion

Non-controlling interest plays a significant role in the financial reporting and analysis of a company. It represents the ownership stake held by minority shareholders in a subsidiary or affiliated company. Understanding non-controlling interest is crucial for evaluating the ownership structure, economic rights, and influence of minority shareholders.

Non-controlling interest is reported as a separate line item on the balance sheet, providing transparency and accuracy in reflecting the minority shareholders’ equity stake. It is important for stakeholders to recognize the importance of non-controlling interest in assessing a company’s financial health, performance, and decision-making processes.

The accounting treatment for non-controlling interest involves consolidating the financial statements of the parent company and its subsidiaries, while properly allocating net income or loss, dividends, and equity between the parent company and non-controlling interest.

Valuation of non-controlling interest ensures that its fair value is reflected in the financial statements, allowing for a more accurate representation of the consolidated entity’s worth. Different valuation methods, such as market-based, income-based, or asset-based approaches, can be utilized based on the specific circumstances and availability of market data.

By reporting non-controlling interest in a transparent and consistent manner, companies provide stakeholders with a comprehensive view of the ownership structure, economic rights, and obligations associated with minority shareholders. This information aids in making informed investment decisions, understanding the consolidation impact on financial ratios, and assessing the overall financial position and influence of a company.

In conclusion, non-controlling interest holds a crucial place within the financial landscape of a company. Recognizing its significance allows stakeholders to gain a deeper understanding of a company’s ownership structure, while facilitating transparency, compliance with accounting standards, and informed decision-making.