Home>Finance>Notice Of Assessment (NOA): Definition, Details, Objection Filing

Finance

Notice Of Assessment (NOA): Definition, Details, Objection Filing

Published: January 1, 2024

Learn everything about Notice of Assessment (NOA) in finance, including its definition, details, and how to file an objection.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Notice of Assessment (NOA): Definition, Details, Objection Filing

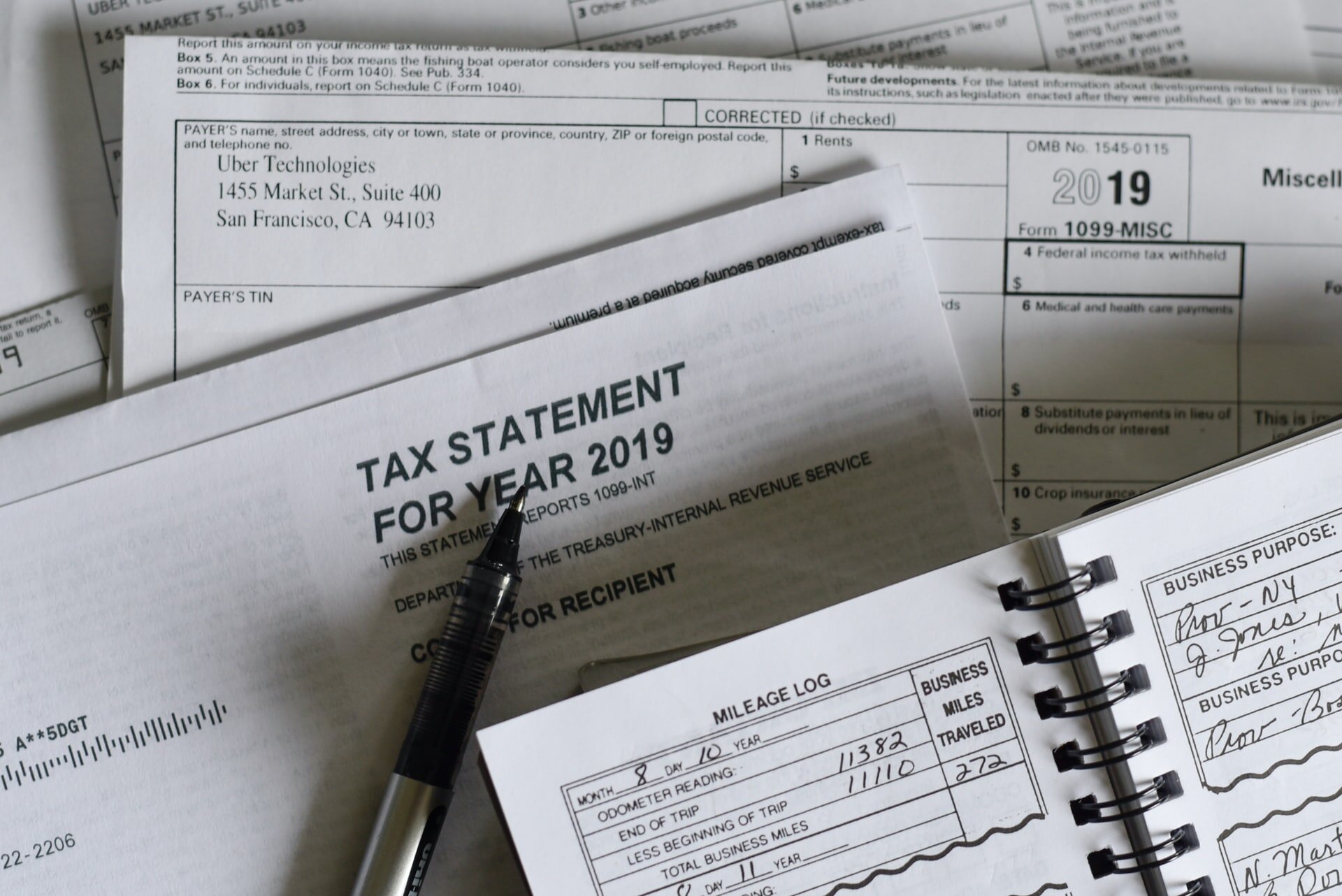

Welcome to our FINANCE blog category, where we discuss all things related to personal finance, taxes, and more. In today’s post, we will shed light on the Notice of Assessment (NOA), an important document that every taxpayer should be familiar with. If you’ve ever wondered what a NOA is, what details it contains, and how to file an objection, you’ve come to the right place.

Key Takeaways:

- A Notice of Assessment (NOA) is a document issued by the tax authorities to inform taxpayers about the amount of tax they owe or their refund after filing their tax return.

- A NOA includes important details such as taxable income, deductions claimed, credits applied, and any amounts owing or refundable.

Understanding Notice of Assessment (NOA)

When you file your tax return, the tax authorities thoroughly review it and calculate your tax liability or refund. Once this assessment is complete, they issue a Notice of Assessment (NOA) to provide you with a clear understanding of your tax situation.

A NOA is a comprehensive document that highlights important information related to your taxes. It includes details such as your taxable income, deductions claimed, credits applied, and any amounts owing or refundable. It serves as confirmation that the tax authorities have assessed your return and determined your tax liability or refund.

But here’s the million-dollar question: What should you do if you disagree with the information provided in your NOA? The answer lies in the process of filing an objection. Let’s dive into the details!

Filing an Objection

If you believe that the information in your NOA is incorrect or incomplete, you have the right to file an objection with the tax authorities. This process allows you to challenge their assessment and provide additional information or explanations for the discrepancies.

Here’s a step-by-step guide to filing an objection:

- Carefully review your NOA to identify the specific areas where you disagree with the tax authorities.

- Gather any supporting documents or evidence that can help strengthen your case. This may include receipts, financial statements, or other relevant records.

- Prepare a clear and concise letter outlining your objections and the reasons behind them. Be sure to include any supporting documents or evidence you have collected.

- Submit your objection, along with the supporting documentation, to the tax authorities within the specified timeframe. This timeframe varies depending on your jurisdiction, so be sure to check the guidelines provided by the tax authorities.

Once your objection is received, the tax authorities will review the information you have provided and reassess your tax return. They will then issue a revised NOA reflecting any changes made as a result of your objection.

Key Takeaways:

- Filing an objection allows taxpayers to challenge the information provided in their Notice of Assessment (NOA) if they believe it to be incorrect or incomplete.

- When filing an objection, it is important to carefully review the NOA, gather supporting documents, prepare a clear letter outlining objections, and submit the objection within the specified timeframe.

In conclusion, understanding the Notice of Assessment (NOA) is crucial for every taxpayer. It provides important details about your tax situation and serves as confirmation of the tax authorities’ assessment. If you ever need to challenge the information in your NOA, filing an objection is the appropriate course of action. Make sure to follow the steps we’ve outlined to increase your chances of a successful objection. Stay tuned for more finance-related content on our blog!