Home>Finance>Financial Responsibility: Optimizing Credit Card Use & Avoiding Overspending

Finance

Financial Responsibility: Optimizing Credit Card Use & Avoiding Overspending

Published: March 4, 2024

Discover strategies for smart credit card use and tips to prevent overspending, ensuring financial health and growth.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

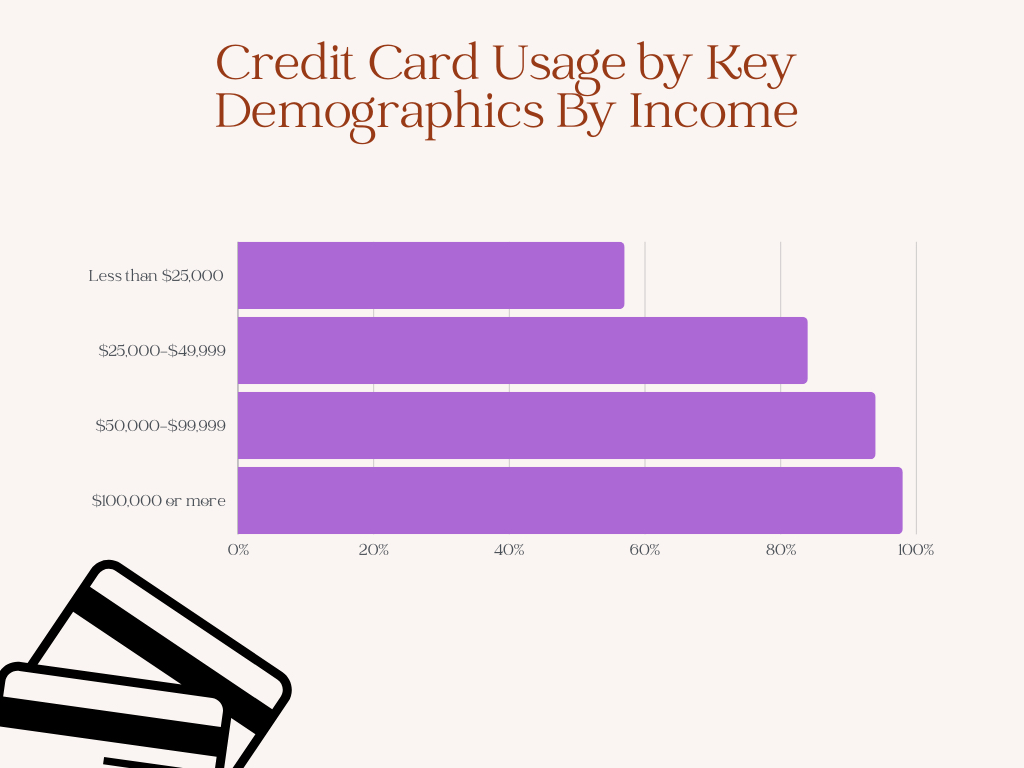

Credit cards can be useful financial tools when used responsibly. However, misusing credit cards can quickly lead to overwhelming debt. With credit card debt in the US reaching record highs, it’s important to understand the factors driving this debt and learn strategies to optimize credit card use while avoiding overspending.

Understanding Credit Card Debt

Credit card debt isn’t a great position to be in. To prevent being in this vulnerable position, it is important to understand how people get into credit card debt. The key factors that contribute to problematic credit card debt include:

Overspending Beyond Means

It’s easy to overestimate affordable spending limits when using credit cards since purchases don’t immediately leave your bank account. Failing to track spending or ignoring credit limits can result in balances that exceed your ability to pay in full each month. Overspending patterns in different states vary, but the general gist is spending beyond your means.

Lack of Emergency Funds

Not having emergency money saved can be hard. Unexpected expenses like doctor bills, car fixes, or losing a job means relying on credit cards. This makes paying off cards each month tough. One study said 57% of credit card debt happens because people can’t cover surprise costs with savings.

Lacking emergency money also stops you from investing or managing cash flow gaps. Experts say save at least 3-6 months of living expenses before other money goals. An emergency fund helps your finances, gives peace of mind, and avoids credit card debt spiraling from surprise costs.

The less you owe on your credit cards as compared to the amount you can borrow, the broader your credit utilization will be. The common rule of thumb is to have at least 70% of your balance available.

Influence of Credit Card Penalty Policies

Many consumers struggle with credit card debt due to penalty policies by card issuers:

- Late Fees – The average late fee is around $30. But it can be as high as $40 for some issuers. Just one late payment per year can cost you $300-400 in fees over a decade.

- Over Limit Fees – Exceeding your credit limit triggers over limit fees averaging $35. This discourages card issuers from approving over-limit transactions.

- Elevated Interest Rates – Issuers can increase your interest rate up to the penalty APR for reasons like one late payment or over limit transaction. This penalizes consumers already struggling with debt.

- Inactivity Fees – To encourage card use, issuers charge inactivity fees if you don’t use their card over an extended period. This prompts unnecessary spending.

Understanding these punitive policies provides insights into avoiding credit card debt traps. Consumers should push for more transparency and fairer fee structures from card issuers.

Optimizing Credit Card Use

Make and Follow a Budget

- Track what you spend each month. Figure out a credit limit that works with money left after needs.

- Use budget apps or spreadsheets to split up spending. For example, on groceries, eating out, fun, etc.

- Set card alerts to warn you if spending goes over budget in any area that month. This helps adjust behavior before overspending becomes too much.

- Budget less than you think for dining out, entertainment, clothing, and other flexible areas where extra costs can sneak in.

Pay Off Each Month

- To use a credit card right, always pay the full bill on time monthly. That way you avoid interest fees.

- If you can’t pay in full, pay as much as possible above the minimum. That will save on interest.

- Don’t spend more just because you have open credit. Keep to your budgeted limit.

Consider Balance Transfers

If you already have card balances with high interest, you can transfer them to an intro 0% card. That saves on interest as you pay down the balance.

Watch for Overspending Warning Signs

Look out for these signs you may be overspending with credit cards:

- Using Cards for Needs: If you put basic expenses like food and utilities on credit cards, it could mean relying too much on credit for normal costs. This flags potential overspending.

- Minimum Payments Increase: If your monthly card payments keep getting bigger, you may be gathering more debt than you can manage. This trend can strain finances.

- Balances Above 30% of Limit: Carrying balances over 30% of your total credit limit can hurt your credit score. It says you’re using too much of available credit.

- Opening New Cards to Pay Old Ones: Using new cards to pay old debt might help short-term but often leads to more total debt. This can cause money issues.

Curb Overspending

Here are some tips to avoid overspending:

- Make Buying Lists and Skip Impulse Buys: Plan purchases ahead and avoid spontaneous buys to stick to a budget. Make a priority list of needs over wants.

- Wait 24 Hours on Big Buys: Take a day to rethink expenses over $100 before buying. This can stop unnecessary splurges.

- Seek Lower Interest Cards if Carrying Debt: If you already have card debt, find balance transfer cards with lower rates to make repayment easier.

- Consider Credit Counseling: If overspending has led to money struggles, credit counseling can help get back on track with budgeting and planning.

Staying alert to warning signs and using these tips can help avoid overusing credit cards and keep your finances healthy.

Frequently Asked Questions (FAQs)

How can I manage multiple credit cards effectively?

Managing more than one credit card can be tricky. But there are some good ways to stay on top of things. Using budget apps can help divide up charges across different cards. This way you won’t lose track and go over your spending limits. Setting up automatic payments makes sure bills always get paid on time too. That prevents late fees or other penalties that cost you more money.

What are smart strategies to use credit card rewards?

When using credit card reward points, it’s smart to save them for basic purchases. Things like groceries, gas, or power bills happen all the time. Focusing rewards on necessities like these means your points add up faster. And when you go to use points, pick options that give real value back. Statement credits off your balance or practical items are better than crazy things you don’t need.

What are the potential long-term impacts of credit card debt?

Carrying a lot of credit card debt can spell trouble in both the short and long term. All that interest builds up quickly, making balances even harder to pay off. It can also drag down your credit score if debt gets too high. A bad credit history can then make bigger loans and mortgages harder to get later. And if the debts hang around unpaid for over 6 months, the credit card company can take legal action. This can mean court orders, garnished wages, and other tough outcomes.

In Summary

In short, credit cards work best when their use sticks to responsible limits. Out-of-control spending can pile up debt before you know it. Keeping close tabs on card habits, buying only what you can realistically afford, and resisting temptation to overspend are key. Use the tips here to make credit cards work for you while building solid money skills.