Finance

Re-Entry Term Insurance Definition

Published: January 16, 2024

Looking for a clear explanation of re-entry term insurance? Find out what it means and how it can benefit your financial planning. Explore finance-related articles and resources.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Re-Entry Term Insurance Definition: Protecting Your Financial Future

If you’re looking for a way to secure your future and protect your loved ones financially, re-entry term insurance may be the solution you’ve been searching for. This specialized form of insurance offers individuals the flexibility and peace of mind they need when it comes to planning for the unexpected. But what exactly is re-entry term insurance, and how can it benefit you?

Key Takeaways:

- Re-entry term insurance provides individuals with the flexibility to renew their coverage at the end of each term without having to undergo underwriting again.

- This type of insurance allows policyholders to tailor their coverage to their changing needs over time.

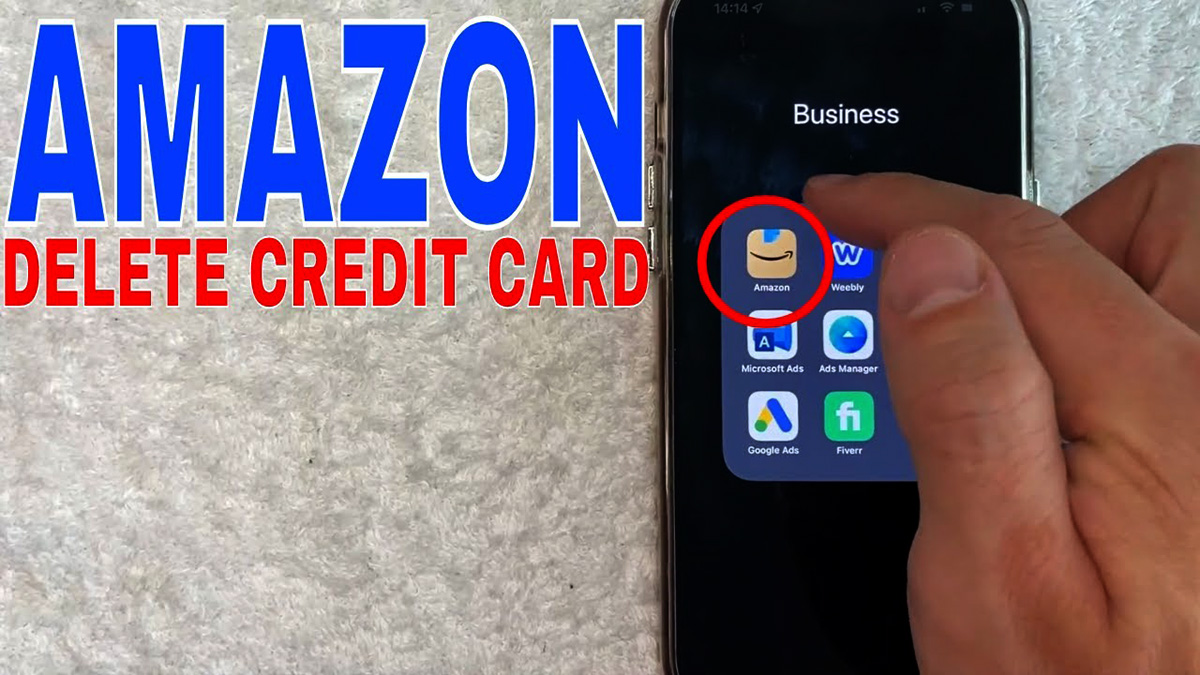

Re-entry term insurance is a type of insurance policy that grants policyholders the ability to renew their coverage at the end of each term without having to go through underwriting again. This means that as you grow older and your financial needs change, you have the option to adjust your policy accordingly with ease. In essence, re-entry term insurance is designed to offer individuals the flexibility they need in managing their insurance coverage throughout various stages of life.

One of the key advantages of re-entry term insurance is its flexibility. As life circumstances change, such as getting married, starting a family, or reaching retirement age, your insurance needs may vary. With re-entry term insurance, you have the freedom to adjust your coverage to match these changing needs without undergoing the time-consuming and sometimes costly underwriting process. This can make it easier for individuals to ensure they have the right level of coverage at each stage of life.

Additionally, re-entry term insurance allows policyholders to maintain coverage even if they have experienced changes in their health or lifestyle. This means that if you were diagnosed with a medical condition during the term of your policy, you can still renew your coverage without facing higher premiums or potential denial of coverage due to the change in your health status.

The Importance of Re-Entry Term Insurance

Life is full of uncertainties, and unexpected events can often catch us off guard. Having adequate insurance coverage is crucial in protecting your loved ones and securing your financial future. Re-entry term insurance provides the following benefits:

- Financial Security: Re-entry term insurance ensures that your loved ones will be financially protected in case of your untimely passing. This coverage can help cover funeral expenses, outstanding debts, and provide ongoing financial support to your dependents.

- Flexibility: With re-entry term insurance, you have the flexibility to adjust your coverage as your needs change. Whether you need more or less coverage, you can easily modify your policy to ensure it aligns with your current situation.

- Peace of Mind: By knowing that you have re-entry term insurance in place, you can have peace of mind knowing that regardless of any changes in your health or lifestyle, you have the option to continue your coverage without hassle.

In conclusion, re-entry term insurance is an excellent option for individuals looking for flexibility and control over their insurance coverage. With the ability to renew your policy at the end of each term without undergoing underwriting again, you can make adjustments to your coverage as your life circumstances change. This ensures that you have the right level of coverage to protect your loved ones and give you peace of mind for the future.