Finance

What Is Group Term Life Insurance?

Published: October 16, 2023

Learn about group term life insurance and how it can provide financial security for you and your loved ones. Compare and find the best finance options online.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Group Term Life Insurance

- Key Features of Group Term Life Insurance

- How Group Term Life Insurance Works

- Advantages of Group Term Life Insurance

- Disadvantages of Group Term Life Insurance

- Eligibility Criteria for Group Term Life Insurance

- Types of Group Term Life Insurance Coverage

- How to Apply for Group Term Life Insurance

- Cost and Premiums of Group Term Life Insurance

- Claim Process for Group Term Life Insurance

- Comparison of Group Term Life Insurance with Individual Life Insurance

- Conclusion

Introduction

Welcome to our comprehensive guide on group term life insurance! In this article, we will explore what group term life insurance is, how it works, its advantages and disadvantages, and the process of applying for coverage. Whether you are an employer looking to offer life insurance benefits to your employees or an individual considering enrolling in a group life insurance plan, this article will provide you with the information you need to make informed decisions.

Group term life insurance is a type of life insurance coverage that is typically offered by employers or other organizations to a group of individuals. It provides financial protection to the beneficiaries of the insured individuals in the event of their death. This type of insurance is popular among employers as it allows them to offer a valuable benefit to their employees at a lower cost compared to individual life insurance policies.

Throughout this guide, we will delve into the key features of group term life insurance, such as the eligibility criteria, types of coverage offered, and the cost and premiums associated with it. We will also provide insights into the claim process for group term life insurance and compare it with individual life insurance to help you better understand the benefits and drawbacks of each option.

Whether you are considering enrolling in group term life insurance or want to learn more about this type of coverage, this guide will equip you with the knowledge you need to navigate the world of group term life insurance confidently. Let’s dive in!

Definition of Group Term Life Insurance

Group term life insurance is a type of life insurance coverage that is provided by employers or organizations to a group of individuals, typically employees or members. This insurance coverage is temporary, meaning it is only in effect for a specified period of time, usually one year. Group term life insurance is designed to provide financial protection to the beneficiaries of the insured individuals in the event of their death during the coverage period.

Unlike individual life insurance, which requires the insured person to go through medical underwriting and may have higher premiums based on individual risk factors, group term life insurance is generally offered on a “guaranteed issue” basis. This means that eligible individuals are automatically enrolled in the coverage without the need to provide proof of good health or undergo medical examinations.

Group term life insurance policies typically provide a set amount of coverage, known as the “face value” or “death benefit”. This is the amount that will be paid out to the beneficiaries if the insured individual passes away while the policy is in effect. The face value is often based on a multiple of the individual’s salary or a predetermined amount chosen by the employer.

It’s important to note that group term life insurance is typically a voluntary benefit offered by employers, meaning employees have the option to enroll in the coverage and may be required to contribute towards the premiums. The cost of group term life insurance is often lower than individual life insurance premiums, as the risk is spread among a larger pool of insured individuals.

In summary, group term life insurance is a type of temporary coverage provided by employers or organizations to a group of individuals. It offers financial protection to the beneficiaries of the insured individuals in the event of their death and is typically offered on a guaranteed issue basis. This type of insurance provides a set amount of coverage for a specified period of time and is often more cost-effective compared to individual life insurance policies.

Key Features of Group Term Life Insurance

Group term life insurance offers several key features that make it a popular choice for both employers and individuals seeking life insurance coverage. Understanding these features can help you make an informed decision about whether group term life insurance is the right choice for you. Let’s explore the key features:

- Group Coverage: Group term life insurance is offered to a group of individuals, typically employees of a company or members of an organization. This allows employers to provide life insurance benefits to their employees as a valuable perk. It also means that individuals within the group can benefit from the collective purchasing power, typically resulting in lower premiums compared to individual life insurance policies.

- Automatic Enrollment: Unlike individual life insurance, where you need to apply and undergo medical underwriting, group term life insurance often offers guaranteed issue enrollment. This means that eligible individuals are automatically enrolled in the coverage without having to provide proof of good health or undergo medical examinations. This makes it accessible to a wider range of individuals, including those with pre-existing health conditions.

- Temporary Coverage: Group term life insurance is temporary coverage that lasts for a specific period, usually one year. This means that the policy will need to be renewed annually to maintain coverage. The temporary nature of the coverage makes it well-suited for individuals who may only need life insurance for a specific period, such as while they are employed by a particular company.

- Death Benefit: Group term life insurance provides a death benefit to the beneficiaries of the insured individual in the event of their death during the coverage period. The death benefit is the amount of money that is paid out to the beneficiaries and is usually a multiple of the individual’s salary or a predetermined amount chosen by the employer.

- Portability: In some cases, group term life insurance policies are portable, meaning that if an individual leaves the group (e.g., changes jobs or retires), they have the option to convert their group coverage into an individual policy without needing to go through medical underwriting again. This allows individuals to maintain life insurance coverage without interruption.

These key features make group term life insurance an attractive option for both employers and individuals looking for life insurance coverage. The group nature of the coverage provides cost savings, while the automatic enrollment and portability features add convenience and flexibility to the policy. However, it’s important to consider the specific terms and conditions of the group term life insurance policy offered by your employer or organization to determine if it meets your needs and financial goals.

How Group Term Life Insurance Works

Group term life insurance functions differently from individual life insurance, primarily due to its group nature. Understanding how group term life insurance works can help you grasp the mechanics of this type of coverage. Here’s an overview of the process:

- Employer Offers Coverage: Employers typically offer group term life insurance as a part of their employee benefits package. They may work with an insurance provider to secure a policy that covers their employees. In some cases, employees may have the option to select additional coverage or opt-out of the insurance altogether.

- Automatic Enrollment: Eligible employees are automatically enrolled in the group term life insurance policy without undergoing medical underwriting. This means that even individuals with pre-existing health conditions can benefit from this coverage. The employer may establish eligibility criteria, such as requiring a minimum number of hours worked or a certain employment status.

- Premium Contributions: In many cases, employees contribute towards the cost of group term life insurance through payroll deductions. The cost of premiums can vary depending on factors such as the employee’s age, salary, and the coverage amount. The employer may also subsidize a portion of the premiums to make the coverage more affordable for employees.

- Temporary Coverage: Group term life insurance is typically provided for a specific period, often one year. During this coverage period, the insured individuals are protected, and their beneficiaries are eligible to receive the death benefit in the event of their passing.

- Death Benefit Payouts: If an insured individual passes away while the group term life insurance policy is in effect, their designated beneficiaries will receive the death benefit payout. The amount of the death benefit is based on a predetermined formula, such as a multiple of the employee’s salary or a fixed sum chosen by the employer. This payout provides financial support to the beneficiaries and helps them cover expenses or replace lost income.

- Policy Renewal: Group term life insurance policies typically require annual renewal. This means that the employer must review and renew the policy to ensure continued coverage for their employees. Any changes to the policy, such as premium adjustments or coverage amounts, may be made during the renewal process.

It’s important to note that group term life insurance coverage generally ends when an individual leaves the group, such as when they change jobs or retire. However, some policies offer the option to convert the coverage into an individual policy, allowing the insured individual to continue their life insurance protection without undergoing medical underwriting again. This feature is known as portability and can provide a valuable opportunity for maintaining coverage.

Understanding the workings of group term life insurance can help both employers and employees make informed decisions about coverage. It offers a cost-effective way for employers to provide valuable benefits, while employees gain access to life insurance protection without the traditional medical underwriting process. If you are enrolled in a group term life insurance policy, it’s essential to review the terms and conditions of the coverage to ensure you understand its specific features and limitations.

Advantages of Group Term Life Insurance

Group term life insurance offers several advantages that make it an appealing option for both employers and individuals seeking life insurance coverage. Let’s explore some of the key advantages of group term life insurance:

- Cost-Effective: Group term life insurance is often more affordable compared to individual life insurance policies. This is because the risk is spread among a larger pool of insured individuals, which allows insurers to offer coverage at lower premiums.

- Easy Enrollment: Group term life insurance typically offers automatic enrollment, meaning eligible individuals are automatically enrolled without the need for medical underwriting. This makes it accessible to a wider range of employees, including those with pre-existing health conditions.

- No Medical Exams: Unlike individual life insurance, group term life insurance doesn’t require employees to undergo medical exams. This simplifies the enrollment process and ensures that coverage is available to all eligible individuals, regardless of their health status.

- Employer Contributions: In many cases, employers subsidize a portion of the group term life insurance premiums. This means that employees can benefit from employer contributions, making the coverage even more affordable.

- Supplemental Coverage: Group term life insurance can serve as supplemental coverage for individuals who already have individual life insurance policies. This additional coverage can provide an extra layer of protection to ensure that loved ones are adequately protected in the event of an untimely death.

- Convenience: Group term life insurance is often offered as a part of an employer’s benefits package. This means that employees only need to deal with one insurance provider and policy, making it more convenient to manage their life insurance coverage.

Group term life insurance offers affordable coverage, simplified enrollment, and the convenience of a single policy. Employers can provide valuable benefits to their employees, while individuals gain access to life insurance protection without the hassle of medical exams or extensive underwriting. However, it’s important to consider the limitations and specific terms of the group term life insurance policy offered by your employer to ensure it meets your needs and financial goals.

Disadvantages of Group Term Life Insurance

While group term life insurance offers many advantages, it’s important to consider the potential disadvantages before making a decision. Understanding the limitations of group term life insurance can help you make an informed choice about whether it is the right type of coverage for you. Here are some the key disadvantages:

- Lack of Customization: Group term life insurance is typically a one-size-fits-all policy offered by employers. This means that you have limited control over the coverage amount and features. The policy may not fully align with your unique needs or financial goals.

- Temporary Coverage: Group term life insurance is typically provided for a specific period, often one year. This means that the coverage is temporary and needs to be renewed annually. If you leave the group, such as changing jobs or retiring, you may lose the coverage.

- Portability Limitations: While some group term life insurance policies offer portability, allowing you to convert the coverage into an individual policy, this option may have limitations. It may come with higher premiums or reduced coverage options compared to individual life insurance policies.

- Limited Flexibility for Beneficiary Designation: Group term life insurance is often subject to restrictions when it comes to designating beneficiaries. The policy may specify that the death benefit will be paid out to specific individuals, such as immediate family members, and may not allow for more customized beneficiary designations.

- Dependence on Employer: Group term life insurance coverage is tied to your employment. If you change jobs or lose your job, you may lose the coverage. This lack of portability can leave you without life insurance protection during periods of transition.

- Insufficient Coverage Amount: The coverage amount provided by a group term life insurance policy may not be sufficient to meet your financial needs. It is often based on a multiple of your salary, which may not adequately factor in your individual circumstances, such as outstanding debts or the needs of your dependents.

It’s important to carefully assess your needs and compare the benefits and drawbacks of group term life insurance. Consider whether the coverage amount and limitations of the policy align with your specific circumstances. If you require more flexibility, customization, or a higher coverage amount, individual life insurance may be a better option for you. Consulting with a qualified insurance advisor can help you evaluate your options and make an informed decision.

Eligibility Criteria for Group Term Life Insurance

Group term life insurance is typically offered by employers or organizations to their employees or members. To be eligible for this type of coverage, you must meet certain criteria established by the employer or the insurance provider. While the specific eligibility requirements may vary, here are some common criteria for group term life insurance:

- Employment Status: Group term life insurance is primarily offered as an employee benefit. Therefore, you typically need to be a full-time or part-time employee of a company that offers this type of coverage. Some employers may also extend eligibility to certain groups or associations, such as union members or professional organizations.

- Minimum Hours Worked: Employers may have a minimum threshold for the number of hours an employee must work to become eligible for group term life insurance. This requirement ensures that employees who work a certain amount of hours receive the benefit, while those who work fewer hours may not be eligible.

- Enrollment Periods: Employers generally provide specific enrollment periods during which employees can enroll in or make changes to their group term life insurance coverage. It is important to be aware of these enrollment periods and take advantage of them to secure the desired coverage.

- Age Limitations: Some group term life insurance policies may have age restrictions for enrollment. For example, the policy may only be available to employees within specific age ranges, such as 18 to 65 years old. Age restrictions may impact eligibility for both new enrollment and the renewal of coverage.

- Participation Requirements: Employers may require a minimum number of employees to enroll in the group term life insurance policy for it to remain in effect. This ensures that there is enough participation to sustain the policy and keep the premiums affordable.

- Health Conditions: Unlike individual life insurance, group term life insurance typically does not require individuals to undergo medical underwriting or provide evidence of good health. Therefore, pre-existing health conditions usually do not disqualify individuals from eligibility for this type of coverage.

It’s important to note that while group term life insurance offers automatic enrollment without medical underwriting, certain circumstances may impact an individual’s ability to enroll in the coverage. For example, if an individual has a terminal illness or is already insured under another group term life insurance policy, they may be ineligible for enrollment.

To determine your eligibility for group term life insurance, it is best to consult your employer’s benefits department or human resources representative. They can provide you with specific information regarding the eligibility criteria, enrollment periods, and any other requirements that may apply to your particular group term life insurance policy.

Types of Group Term Life Insurance Coverage

Group term life insurance coverage can come in different forms, offering varying levels of protection and flexibility. Understanding the types of group term life insurance coverage can help you choose the option that best suits your needs and financial goals. Here are some common types:

- Basic Group Term Life Insurance: Basic group term life insurance is the most common type of coverage offered by employers. It often provides a death benefit equal to a multiple of an employee’s salary. This coverage is typically provided at no cost to the employee, with the employer paying the premiums. While the coverage amount may be limited, it still offers financial protection to the employee’s beneficiaries.

- Supplemental Group Term Life Insurance: Supplemental group term life insurance is optional coverage that employees can choose to add on top of their basic group term life insurance. This coverage allows employees to increase their death benefit to better suit their needs. It typically requires employees to pay an additional premium based on their selected coverage amount.

- Dependent Group Term Life Insurance: Dependent group term life insurance provides coverage for an employee’s spouse and dependent children. This type of coverage offers a death benefit in the event of the covered dependent’s death. The premium for dependent coverage is generally paid by the employee. It can provide financial support for funeral expenses, outstanding medical bills, and other related costs.

- Accelerated Death Benefit: Some group term life insurance policies include an accelerated death benefit rider. This rider allows terminally ill policyholders to access a portion of their death benefit while they are still alive. This benefit can be used to cover medical expenses or other financial needs during the individual’s final stages of life.

- Conversion Option: Some group term life insurance policies include a conversion option. This allows employees who are leaving the group, such as due to retirement or changing jobs, to convert their group term life insurance coverage into an individual policy without the need for medical underwriting. This conversion option provides individuals with the opportunity to maintain life insurance coverage even when they are no longer part of the group.

It’s important to review the specific group term life insurance coverage options offered by your employer to determine which types of coverage are available to you. Consider your personal circumstances, financial goals, and the needs of your dependents when choosing the appropriate coverage level.

Understanding the various types of group term life insurance coverage can help you make an informed decision about the right level of protection for you and your loved ones. Consult with your employer’s benefits department or human resources representative to gain a clear understanding of the coverage options available and how they align with your needs.

How to Apply for Group Term Life Insurance

Applying for group term life insurance is a relatively straightforward process, typically facilitated by your employer or the organization offering the coverage. Here is a general overview of the steps involved in applying for group term life insurance:

- Eligibility Check: Verify your eligibility for the group term life insurance coverage. Ensure that you meet the requirements set by your employer or organization, such as being a full-time or part-time employee or a member of the eligible group.

- Enrollment Period: Be aware of the specific enrollment period during which you can apply for or make changes to your group term life insurance coverage. This enrollment period is typically communicated by your employer and may occur annually or during specific times of the year.

- Review Coverage Options: Review the available coverage options provided by your employer. These may include different coverage amounts, supplemental insurance options, and dependent coverage. Consider your financial needs and the needs of your beneficiaries when evaluating the available options.

- Complete the Application: Obtain and complete the group term life insurance application form provided by your employer or insurance provider. This form will require basic personal information, such as your name, date of birth, and contact details. Additionally, you may need to provide beneficiary information, such as names and contact details.

- Submit the Application: Submit the completed application form to the designated contact person or department at your workplace. Ensure that you meet the submission deadline to be considered for coverage during the enrollment period.

- Designate Beneficiaries: Along with your application, you will need to designate one or more beneficiaries who will receive the death benefit in the event of your passing. Consider selecting individuals who are financially dependent on you or who would be significantly impacted by your loss.

- Elect Premium Contributions: Some group term life insurance policies require employees to contribute a portion of the premium. If applicable, indicate your election for premium contributions, such as payroll deductions, and provide any necessary payment information.

It’s crucial to carefully review the group term life insurance policy document and any related materials provided by your employer or insurance provider. Familiarize yourself with the coverage details, exclusions, and any limitations associated with the policy.

If you have questions or need assistance with the application process, reach out to your employer’s benefits department or human resources representative. They can provide guidance, answer your questions, and assist you throughout the application process.

By following these steps and providing the necessary information, you can successfully apply for group term life insurance and gain the peace of mind that comes with knowing your loved ones will be financially protected in the event of your passing.

Cost and Premiums of Group Term Life Insurance

The cost and premiums associated with group term life insurance can vary depending on several factors, including the coverage amount, the age of the insured individuals, and the overall risk profile of the group. Understanding the cost structure of group term life insurance can help you budget for the coverage and make informed decisions. Here are some key aspects to consider:

- Employer Contributions: In many cases, employers subsidize a portion of the group term life insurance premiums, reducing the cost for employees. The amount of this contribution can vary significantly among employers, with some offering full coverage at no cost to the employee.

- Employee Premiums: While some employers cover the entire cost of group term life insurance, others require employees to contribute towards the premiums. Employee contributions are typically deducted from their paycheck on a regular basis, such as monthly or bi-weekly. The amount of the employee premium can depend on factors such as age, coverage amount, and the risk profile of the group.

- Coverage Amount: The amount of coverage selected for group term life insurance directly impacts the cost. Higher coverage amounts will typically result in higher premiums. Employers often provide a pre-determined amount of basic coverage for all employees, while supplemental coverage options may require additional premium contributions from employees.

- Age of Insured Individuals: Age is a significant factor in determining the premiums for group term life insurance. Premiums tend to increase as individuals get older, as the risk of death or health issues generally increases with age. Therefore, younger individuals may generally have lower premiums compared to older individuals within the same group.

- Group Risk Profile: The risk profile of the group as a whole can impact the premiums for group term life insurance. Factors such as the industry in which the employer operates, the size of the group, and the historical claims experience can influence the pricing. Groups with higher perceived risk may have higher premiums compared to groups with lower risk profiles.

It’s important to note that the cost of group term life insurance is generally lower compared to individual life insurance premiums. This is because the risk is spread among a larger pool of insured individuals, allowing insurers to offer coverage at more affordable rates.

To get a clear understanding of the cost and premiums associated with your group term life insurance coverage, consult the benefit information provided by your employer or speak to your employer’s benefits department. They can provide specific details about the premiums, including any employee contribution requirements and the coverage options available to you.

By considering the cost and premiums of group term life insurance, you can make informed decisions that align with your budget and financial needs while ensuring the financial protection of your loved ones in the event of your passing.

Claim Process for Group Term Life Insurance

When a covered individual passes away, it is important for the beneficiaries to understand the claim process for group term life insurance. This process ensures that the death benefit is disbursed smoothly and efficiently. While the specific procedures can vary among insurance providers and employers, here is a general overview of the claim process:

- Notify the Insurance Provider: The first step in initiating a claim for group term life insurance is to notify the insurance provider. This can usually be done by contacting the designated claims department or the customer service hotline. The insurance provider will guide you through the necessary documentation and inform you of the next steps.

- Complete Claim Forms: The insurance provider will require certain documentation to process the claim. This may include completing claim forms, providing a death certificate, and possibly other supporting documents. The claim forms typically request information such as details of the insured individual, beneficiaries, and the cause of death.

- Submit Required Documents: Gather the required documents outlined by the insurance provider and submit them as instructed. This may involve providing certified copies of the death certificate, identification documents of the beneficiaries, and any additional documentation requested by the insurance provider.

- Review and Verification: The insurance provider will review the submitted documents to verify the claim. This may involve conducting their own investigation and assessing the eligibility of the claim according to the terms and conditions of the group term life insurance policy.

- Processing and Disbursement: Once the claim has been reviewed, approved, and verified, the insurance provider will proceed with processing the claim. They will disburse the death benefit to the designated beneficiaries as per the instructions provided on the claim forms.

- Beneficiaries Receive the Benefit: The beneficiaries will receive the death benefit in a lump sum or in accordance with the payment option chosen at the time of claim submission. This provides financial support to the beneficiaries to help cover expenses, such as funeral costs, outstanding debts, and ongoing living expenses.

It is important to initiate the claim process promptly after the death of the insured individual. Any delays in notifying the insurance provider or submitting the required documentation may result in a delay in receiving the death benefit.

If you have any questions or need guidance throughout the claim process, contact the claims department of the insurance provider or your employer’s benefits department. They can provide assistance, clarify any doubts, and guide you through the necessary steps to ensure a smooth and timely claims settlement.

By following the necessary procedures and submitting the required documentation, the beneficiaries of a group term life insurance policy can receive the financial support they need during a difficult time.

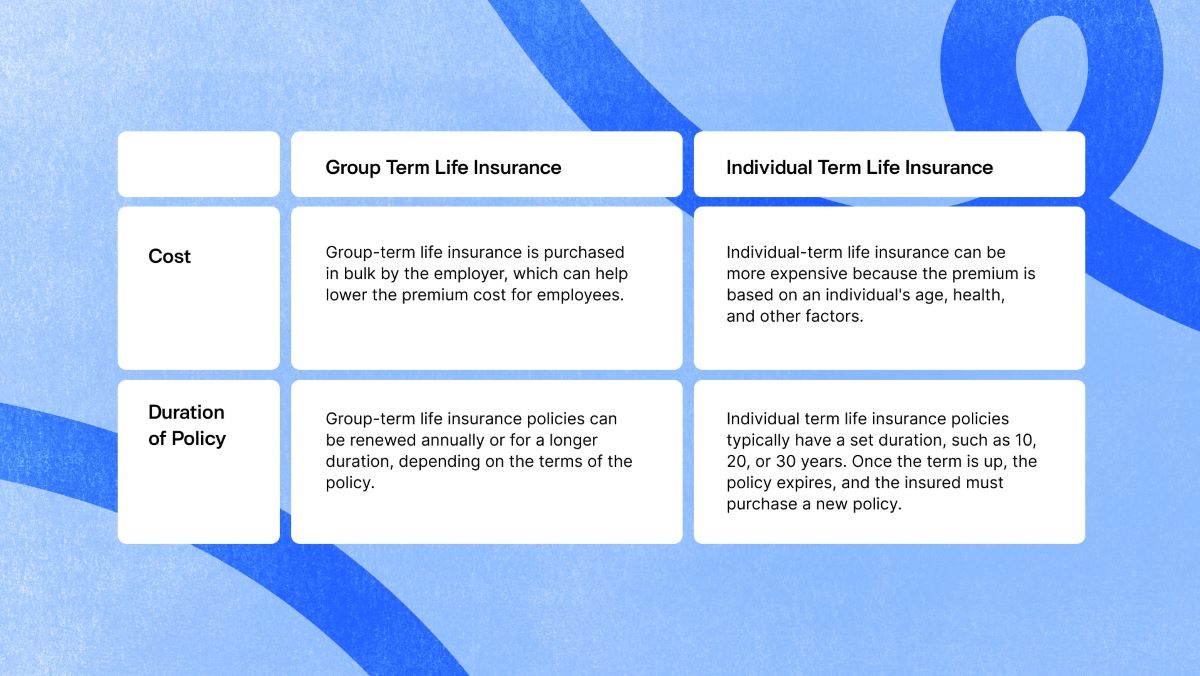

Comparison of Group Term Life Insurance with Individual Life Insurance

When considering life insurance options, it’s essential to understand the differences between group term life insurance and individual life insurance. Each type of coverage has its own advantages and considerations. Here is a comparison between the two:

1. Underwriting Process: Group term life insurance generally does not require individual underwriting. Eligible individuals are automatically enrolled without the need for medical exams or extensive health assessments. In contrast, individual life insurance typically involves a thorough underwriting process, including medical examinations, to assess an individual’s health and determine premiums.

2. Cost: Group term life insurance is often more cost-effective than individual life insurance. Group policies are typically offered at lower premiums as the risk is spread among a larger group. In contrast, individual life insurance is tailored to the specific individual and may have higher premiums based on factors such as age, health, and lifestyle habits.

3. Customization and Coverage Amount: Individual life insurance policies offer greater flexibility and customization options. You can select the coverage amount and features that suit your specific needs. Group term life insurance, on the other hand, generally provides a predetermined coverage amount, often based on salary multiples. There is limited room for customization with group policies.

4. Portability: Individual life insurance policies are portable, meaning they can be maintained even if you change jobs or leave a specific group. However, group term life insurance coverage typically ends when you leave the group. Some group policies may offer a conversion option, allowing you to convert the coverage to an individual policy, but this may come with limitations or higher premiums.

5. Additional Benefits: Individual life insurance policies often provide additional benefits, such as cash value accumulation and the potential for dividends. These policies can serve as investment vehicles or provide supplemental income during retirement. Group term life insurance generally does not offer these additional benefits.

6. Coverage Duration: Group term life insurance provides coverage for a specified period, usually one year. The coverage needs to be renewed annually, and the premiums may increase with age. Individual life insurance policies can provide coverage for the entire lifetime of the insured, as long as premiums are paid accordingly.

7. Eligibility Criteria: Group term life insurance eligibility is often tied to employment or membership in a specific group. Individual life insurance policies are available to anyone who meets the underwriting criteria set by the insurance company.

Ultimately, the choice between group term life insurance and individual life insurance depends on your specific needs, budget, and circumstances. Group term life insurance can provide affordable coverage with minimal underwriting requirements, making it a suitable option for many individuals. However, if you require more customization, portable coverage, or additional policy features, individual life insurance may be a better choice.

It is advisable to consult with a licensed insurance professional who can assess your situation and recommend the most appropriate type of coverage for your individual needs and financial goals.

Conclusion

Group term life insurance is a popular option for employers and individuals seeking life insurance coverage. It offers several advantages, including affordability, ease of enrollment, and the ability to provide financial protection to employees or group members. Understanding the key features, advantages, and disadvantages of group term life insurance can help you make an informed decision about whether it is the right choice for you.

Group term life insurance provides temporary coverage for a specified period of time, typically one year. It offers a death benefit to the beneficiaries of the insured individuals, providing financial security in the event of their passing. This type of coverage is often offered as part of an employer’s benefits package, with automatic enrollment and the potential for employer contributions towards premiums.

When considering group term life insurance, it is important to review the available coverage options, the eligibility criteria, and the cost and premiums associated with the policy. The claim process for group term life insurance is straightforward, and beneficiaries can receive the death benefit to help cover expenses and support their financial well-being during a challenging time.

It is worth noting that group term life insurance may not provide the same level of customization and long-term flexibility as individual life insurance. Individual policies offer more control over coverage amounts, additional benefits, and portability. However, individual life insurance policies generally come with higher premiums and require a more thorough underwriting process.

In conclusion, group term life insurance offers an affordable and accessible option for individuals seeking life insurance coverage. It provides valuable protection to beneficiaries and can serve as a financial safety net during challenging times. Meanwhile, individuals who require more flexibility, customization, and long-term coverage may find individual life insurance policies better suited to their needs.

When making a decision, consider your specific needs, budget, and circumstances. Assess the benefits and limitations of group term life insurance, and consult with an insurance professional to determine the most appropriate coverage option for you and your loved ones. With the right choice of coverage, you can gain peace of mind knowing that you have taken a significant step towards protecting the financial future of those who depend on you.